Market Definition

Construction sealants are specialized materials used to block the passage of fluids through openings or joints in building structures. They provide essential sealing, waterproofing, and insulating functions, ensuring structural integrity and durability.

The market covers a range of product types, including silicone, polyurethane, and polysulfide sealants, catering to both residential and commercial construction. These products are widely applied in flooring, roofing, glazing, and façade systems to enhance performance, prevent leaks, and improve energy efficiency across diverse building projects.

Construction Sealants Market Overview

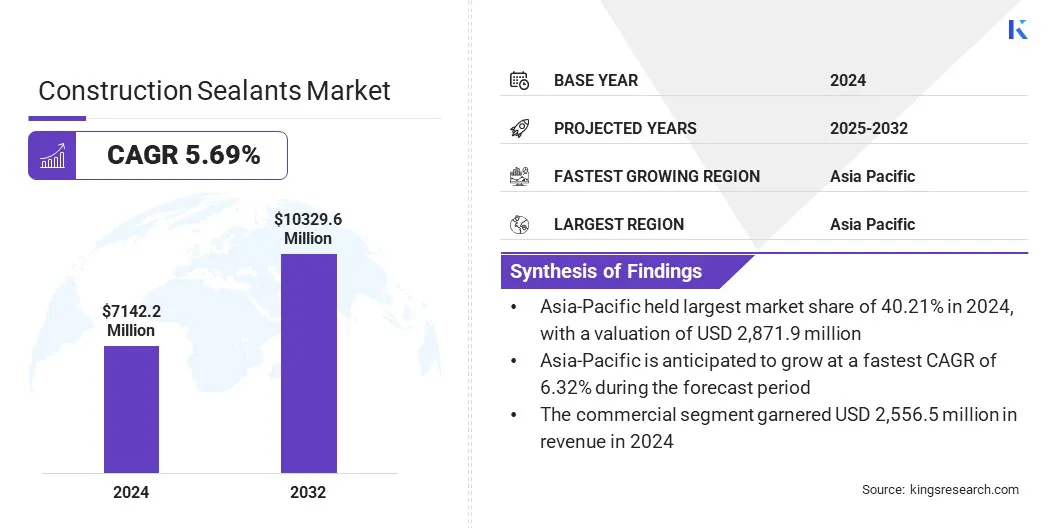

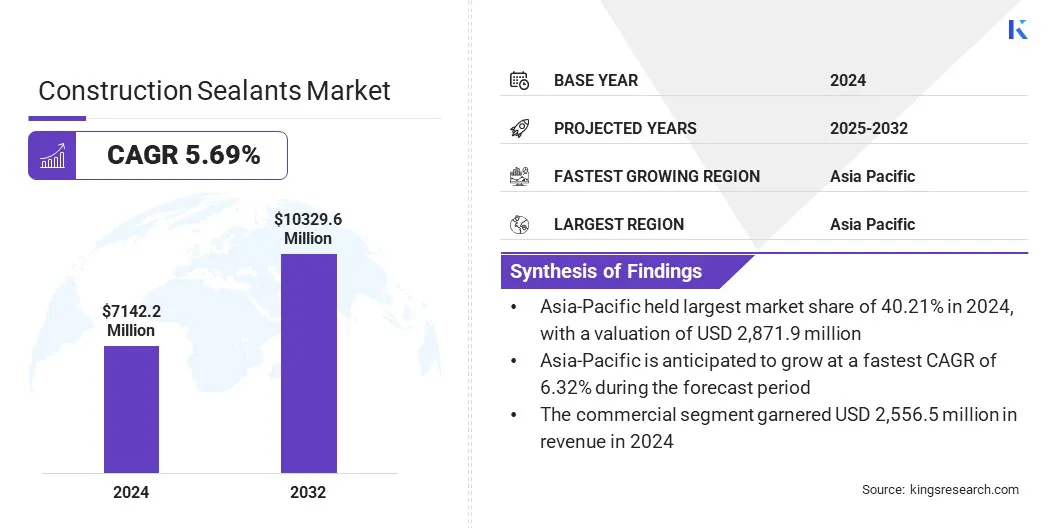

The global construction sealants market size was valued at USD 7,142.2 Million in 2024 and is projected to grow from USD 7,011.1 Million in 2025 to USD 10,329.6 Million by 2032, exhibiting a CAGR of 5.69% during the forecast period. The market is further driven by the rising adoption of eco-friendly and low-VOC formulations to enhance energy efficiency, durability, and performance in modern, sustainable construction projects.

Major companies operating in the construction sealants industry are Sika AG, Henkel AG & Co. KGaA, 3M, Arkema S.A. (Bostik), Dow Inc. (DOWSIL), Wacker Chemie AG, H.B. Fuller Company, Tremco Incorporated, Soudal Group, BASF SE (Master Builders), Mapei S.p.A., Pidilite Industries Ltd., ITW Performance Polymers, Asian Paints Ltd., and Momentive.

Key Highlights:

- The construction sealants market was recorded at USD 7,142.2 Million in 2024.

- The market is projected to grow at a CAGR of 5.69% from 2025 to 2032.

- Asia Pacific held a share of 40.21% in 2024, valued at USD 2,871.9 Million.

- The silicone segment garnered USD 2,666.7 Million in revenue in 2024.

- The commercial segment is expected to reach USD 4,157.7 Million by 2032.

- The glazing segment is anticipated to witness a CAGR of 5.90% over the forecast period.

- Europe is anticipated to grow at a CAGR of 5.80% through the projection period.

The growing adoption of prefabricated and modular construction methods is creating significant opportunities for the market. These building approaches require high-quality sealants to ensure airtightness, moisture protection, and structural stability during transportation and on-site assembly.

The precision-driven nature of modular construction increases the need for sealants with consistent performance and quick curing times. Rising investments by the companies in sustainable, cost-effective, and time-efficient building solutions are boosting the use of sealants in factory-fabricated components.

Manufacturers are developing advanced sealant formulations to meet stringent quality standards and offer long-term durability in diverse environmental conditions.

- In March 2025, Avient Corporation announced a successful partnership with Resia, a leading fabricator of bathroom and kitchen pods for modular construction in the U.S. It utilizes Resia’s production system and patented panel technology to deliver high-quality, fully assembled, and ready-to-install components for residential construction.

Market Driver

Growing Demand for Durable and Weather-Resistant Construction Materials

The demand for durable and weather-resistant construction materials is steadily increasing due to the need for long-lasting infrastructure and reduced maintenance costs. Construction sealants play a vital role in protecting structures from water infiltration, UV exposure, extreme temperatures, and chemical degradation.

In regions prone to severe weather conditions, the use of high-performance sealants ensures the structural integrity of buildings and infrastructure. Increasing adoption of energy-efficient construction further drives the use of sealants that enhance insulation and minimize air leakage.

Moreover, the rapid urbanization, coupled with stricter building regulations, is prompting developers to prioritize high-quality sealant solutions. The market is witnessing continuous product innovations aimed at delivering enhanced bonding strength, elasticity, and weather resistance to meet evolving performance requirements.

- In 2024, the Government of India allocated approximately USD 439 billion for green investments, focusing on eco-friendly construction materials. The company pioneered the use of steel slag in road construction, reducing waste while enhancing road strength and durability.

Market Challenge

Fluctuating Raw Material Prices Impacting Production Costs

Fluctuating raw material prices, particularly for petrochemical-based ingredients, present a significant challenge for the construction sealants market. Variations in crude oil prices, supply chain disruptions, and geopolitical uncertainties leads to unpredictable cost increases, affecting profitability for manufacturers.

These fluctuations also create difficulties in long-term pricing strategies and contract commitments, impacting market stability. Volatility in raw material costs also limits the ability of smaller manufacturers to compete, forcing them to absorb additional expenses or pass them on to end-users.

Manufacturers are addressing this challenge through strategic sourcing, supplier diversification, long-term procurement contracts, and greater reliance on bio-based or recycled raw materials.

Market Trend

Increasing Integration of Sealants with Advanced Building Technologies

The integration of sealants with advanced building technologies is a significant trend in modern construction practices. Smart building systems and energy-efficient designs require sealants that perform beyond traditional sealing functions, contributing to thermal performance, sound insulation, and structural adaptability.

Innovative sealants are being engineered to work seamlessly with materials such as high-performance glass, insulated panels, and energy-saving façades. The growing adoption of building information modeling (BIM) is also enabling precise specification and placement of sealants during the design phase, ensuring optimal performance.

- In August 2024, Master Wall Inc. introduced its SuperiorShield SMP Sealants, a new product line engineered to deliver enhanced protection and long-lasting durability, catering to the performance requirements of both residential and commercial construction projects.

Construction Sealants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Resin

|

Silicone, Polyurethane (PU), Acrylic, Polysulfide, Butyl, Others

|

|

By Application

|

Glazing, Flooring & Expansion Joints, Sanitary & Kitchen, Insulation & Roofing, Others

|

|

By End-Use

|

Commercial, Residential, Infrastructure, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Resin (Silicone, Polyurethane (PU), Acrylic, Polysulfide, Butyl, and Others): The silicone segment held 37.34% of the market in 2024, due to its superior flexibility, UV resistance, and long service life, making it ideal for a wide range of construction applications, including façades, glazing, and weatherproofing.

- By Application (Glazing, Flooring & Expansion Joints, Sanitary & Kitchen, and Insulation & Roofing, and Others): The glazing segment is anticipated to grow at a CAGR of 5.90% over the forecast period owing to rising demand for energy-efficient buildings, increased adoption of high-performance glass systems, and the need for sealants that provide airtight, moisture-resistant, and thermally insulated window and façade installations.

- By End-Use (Commercial, Residential, Infrastructure, and Industrial): The commercial segment is projected to reach USD 4,157.7 Million by 2032, owing to expanding infrastructure investments, rapid urbanization, and the growing use of advanced sealants in offices, retail spaces, and institutional buildings to ensure durability, aesthetics, and compliance with stringent building codes.

Construction Sealants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia-Pacific held the largest share in the construction sealants market in 2024, accounting for 40.21% and valued at USD 2,871.9 million. This dominance is driven by rapid urbanization, large-scale infrastructure projects, and the expansion of residential and commercial construction activities across major economies such as China, India, and Southeast Asian countries.

Government initiatives to improve transportation networks, smart cities, and green buildings have further stimulated demand for high-performance sealants. The region’s booming real estate sector, coupled with rising investments in industrial facilities, is also fueling market growth.

Additionally, the presence of a strong manufacturing base, lower production costs, and technological advancements in sealant formulations are enabling Asia-Pacific to maintain its dominance in the global market.

- In 2024, India’s Smart Cities Mission aimed to enhance urban living through sustainable, technology-driven solutions, focusing on infrastructure, governance, and social development, alongwith 100 cities under development, it has completed 7,380 of 8,075 projects, representing an investment of approximately USD 17.70 billion.

Europe is projected to record the highest CAGR of 5.80% in the construction sealants market during the forecast period, driven by strong regulatory frameworks supporting energy efficiency, sustainability, and low-emission construction materials.

The region’s focus on retrofitting existing buildings to meet stringent energy performance standards is boosting demand for advanced sealing solutions in insulation, glazing, and façade systems. Rising investments in green infrastructure, along with increased adoption of prefabricated and modular construction, are further contributing to the market growth.

The European construction industry’s focus on innovation and quality, supported by advancements in sealant technology, is enhancing performance and durability across applications. The growing influence of circular economy principles is also prompting manufacturers to develop eco-friendly and recyclable sealant products.

Regulatory Frameworks

- In the European Union, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulates chemical substances used in sealant formulations. It ensures that products meet strict safety, environmental, and health standards, driving the development of low-VOC and eco-friendly construction sealants.

- In the U.S., the Clean Air Act regulates emissions from chemical products, including construction sealants. It sets limits on volatile organic compound (VOC) content to reduce air pollution, influencing manufacturers to develop compliant and sustainable sealant solutions.

- In China, GB 18583-2008 (Indoor Decorating and Refurbishing Materials – Limit of Harmful Substances of Adhesives) regulates harmful substances in adhesive and sealant products. It promotes safer, non-toxic formulations to protect indoor air quality in construction projects.

- In Canada, the Canadian Environmental Protection Act (CEPA) regulates the use and release of toxic substances in sealant manufacturing. It aims to protect environmental and public health, encouraging the use of safer raw materials in construction sealants.

- In Australia, the National Pollutant Inventory (NPI) regulates the reporting of VOC emissions from sealant production. It supports transparency and environmental responsibility, pushing the industry toward low-emission sealant alternatives.

Competitive Landscape

Leading companies in the construction sealants market are focusing on expanding their product portfolios through continuous research and development, targeting enhanced performance, sustainability, and compliance with global building standards. Market players are also pursuing geographic expansion, establishing production facilities and distribution networks in high-growth regions to meet rising demand.

Moreover, they are adopting strategies such as collaborations with construction firms, architects, and infrastructure developers to enhance market penetration and drive long-term partnerships. The integration of digital tools for product selection, performance simulation, and customer engagement is becoming a key differentiator.

To sustain growth, companies are prioritizing environmentally responsible manufacturing, innovation in eco-friendly formulations, and alignment with evolving industry regulations.

- In June 2024, Sika acquired Chema, a leading Peruvian tile-setting materials producer with nationwide operations. This acquisition is expected to strengthen Sika’s Building Finishing portfolio and offer cross-selling opportunities with its complementary range, including sealants, adhesives, liquid-applied membranes, and waterproofing solutions.

Key Companies in Construction Sealants Market:

- Sika AG

- Henkel AG & Co. KGaA

- 3M

- Arkema S.A. (Bostik)

- Dow Inc. (DOWSIL)

- Wacker Chemie AG

- B. Fuller Company

- Tremco Incorporated

- Soudal Group

- BASF SE (Master Builders)

- Mapei S.p.A.

- Pidilite Industries Ltd.

- ITW Performance Polymers

- Asian Paints Ltd.

- Momentive

Recent Developments (Expansion)

- In June 2025, Sika advanced its local-for-local strategy in the market through new manufacturing investments in China, Brazil, and Morocco. The expanded China facility specializes in high-viscosity polyurethane technologies, enhancing bonding and sealing performance for urban infrastructure, thereby supporting durability, efficiency, and sustainable development across critical construction applications.

- In November 2023, Henkel relaunched its bonding and sealing portfolio in Europe with a new packaging concept that reduces virgin plastic use by up to 95%, incorporating recycled post-consumer plastic. This covers a wide range of construction adhesives and sealants under brands like Pattex, Rubson, and Ceresit.