Construction Chemicals Market Size

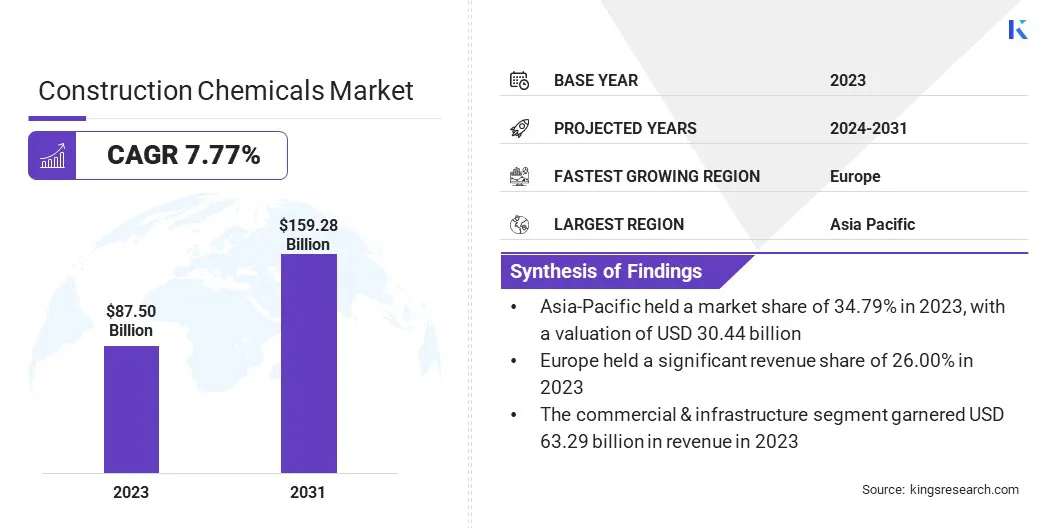

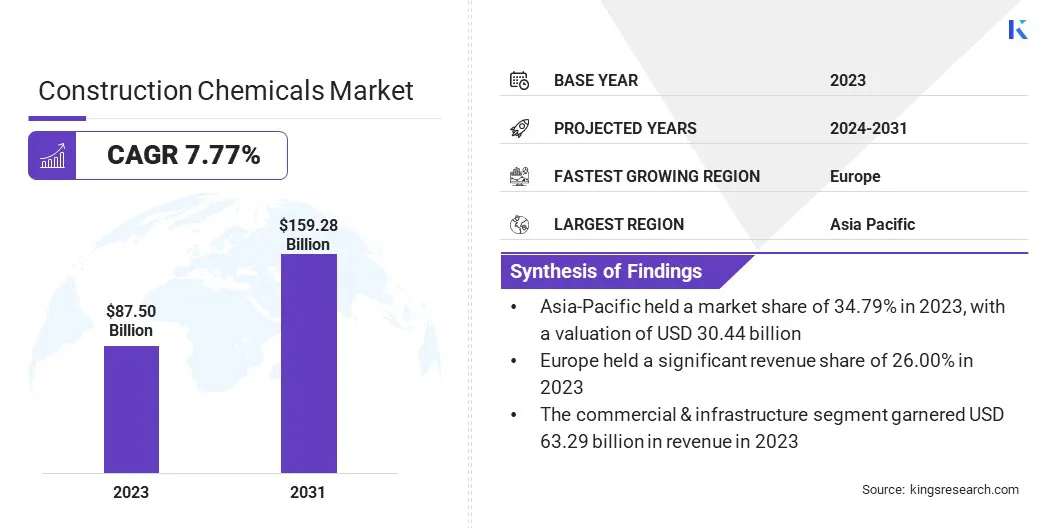

According to Kings Research, the Construction Chemicals Market size was valued at USD 87.50 billion in 2023 and is projected to reach USD 159.28 billion by 2031, growing at a CAGR of 7.77% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Sika AG, BASF SE, Dow, RPM International Inc., Saint-Gobain, MAPEI Corporation, Ardex Group, Fosroc, Inc., B. FULLER COMPANY, Bostik and Others.

Urbanization, infrastructure development projects, and an increasing emphasis on sustainable construction practices are fostering market growth. The construction chemicals market is poised to witness significant growth over the forecast period, driven by population growth, and expansion of large cities due to urban migration, mainly in emerging economies. These chemicals play a crucial role in enhancing the durability, strength, and performance of construction materials, thereby extending the lifespan of infrastructure.

Moreover, a notable shift toward eco-friendly and sustainable construction chemicals due to increasing emphasis on environmental concerns and stringent regulations pertaining to emissions and waste disposal is prompting construction companies to adopt greener alternatives. Due to this trend, manufacturers are investing heavily in research and development activities to introduce innovative solutions that minimize environmental impact with enhanced quality of the products.

Despite the promising growth prospects, the market faces major challenges such as volatility in raw material prices, intense competition, and regulatory hurdles. However, strategic partnerships, mergers and acquisitions, and product differentiation strategies are expected to help companies navigate these challenges and capitalize on emerging opportunities in the market.

The global market encompasses a wide range of specialty chemicals utilized in the construction industry to enhance the performance, durability, and sustainability of building materials and structures. These chemicals include admixtures, adhesives, sealants, protective coatings, waterproofing agents, and repair products. They are employed across various applications across the residential, commercial, and industrial settings.

Analyst’s Review

The construction chemicals market is anticipated to experience significant growth in the forthcoming years, mainly fueled by infrastructural development in emerging countries. Additionally, the redevelopment of old infrastructures is supporting the growth of the market. Sustainability concerns are driving the demand for eco-friendly solutions, while extreme weather events necessitate high-performance materials.

Emerging markets and repair & rehabilitation projects offer lucrative opportunities for market expansion. Companies that adopt digitalization, prioritize worker safety, and cater to regional needs are likely to be well-positioned to thrive in this dynamic market landscape.

Construction Chemicals Market Growth Factors

Rapid urbanization and substantial investments in infrastructure projects worldwide, including roads, bridges, and dams, are driving the demand for construction chemicals. Products such as concrete admixtures, waterproofing solutions, and anchoring systems play a crucial role in enhancing the performance and durability of infrastructure. This surge in infrastructure development activities is fueling the demand for construction chemicals, thereby contributing to the construction chemicals market growth.

Moreover, growing environmental concerns and regulatory pressures are compelling industry players to adopt sustainable practices. This growing shift toward sustainability is creating potential opportunities for eco-friendly construction chemicals such as bio-based adhesives, recycled content admixtures, and low VOC coatings.

Furthermore, increasing occurrences of extreme weather events underscore the importance of constructing buildings capable of withstanding such challenges. There is a rising demand for high-performance construction chemicals that enhance the durability and resilience of structures. Products such as corrosion inhibitors, fire retardants, and seismic-resistant materials are witnessing increasing demand as key players seek to fortify buildings against adverse environmental conditions.

This growing emphasis on durability and resilience is expected to drive the adoption of high-performance construction chemicals, thereby stimulating market growth. However, the market faces major challenges due to volatility in raw material prices. Fluctuations in the prices of key raw materials such as petroleum derivatives, cement, and specialty chemicals significantly impact production costs for manufacturers.

These fluctuations arise from geopolitical tensions, supply chain disruptions, or changes in global demand-supply dynamics. The implementation of robust supply chain management strategies, including diversification of suppliers, forward contracts, and continuous monitoring of market trends, to mitigate such challenges, is projected to aid market growth.

Construction Chemicals Market Trends

The growing adoption of digital technologies, such as building information modeling (BIM), which are implemented to streamline and optimize various construction processes, is projected to bolster market growth. Construction chemical companies are capitalizing on this digitalization trend by integrating with BIM platforms, allowing for the provision of data-driven solutions and customized product recommendations tailored to the specific requirements of construction projects.

- For instance, through BIM integration, chemical companies aim to provide real-time insights into the compatibility of their products with existing construction materials, facilitating efficient decision-making and enhancing project outcomes.

Moreover, increasing stringency of regulations pertaining to worker safety within the construction industry is driving the demand for construction chemicals with low toxicity levels and specialized personal protective equipment designed specially for handling these chemicals. By prioritizing worker safety through the utilization of less harmful chemical formulations and appropriate protective gear, construction sites are mitigating risks and creating safer working environments conducive to productivity and employee welfare.

Construction chemical manufacturers are increasingly recognizing the importance of tailoring their product offerings to meet the specific requirements and climatic conditions prevalent in different regions. This is reflecting a strategic shift towards regional specialization, ensuring that the chemicals utilized in construction projects deliver optimal performance and durability.

- For instance, in regions prone to high humidity or extreme temperatures, companies may develop specialized formulations of waterproofing solutions or concrete admixtures tailored to withstand such environmental challenges effectively. By catering to the unique demands of each market, chemical companies are aiming to enhance customer satisfaction and gain a competitive edge in the increasingly diverse and dynamic global construction chemicals landscape.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is classified into adhesives, concrete protective coatings, bonding agents, admixtures, waterproofing, and anchoring materials. The waterproofing segment accounted for the largest construction chemicals market share of 33.39% in 2023. The increasing focus on flood resilience, driven by extreme weather events such as floods in North America and Europe, is among the prominent factors driving the demand for efficient waterproofing chemicals. This has led to stricter building regulations and increased demand for high-performance waterproofing membranes and coatings to mitigate water damage risks.

Additionally, the growing popularity of green roofs for their environmental benefits has propelled the demand for specialized waterproofing solutions to safeguard against leaks and structural damage. Furthermore, with the aging infrastructure, the prevalence of leaks and cracks has necessitated extensive repairs and renovations, thereby fueling the demand for waterproofing materials such as sealants and membranes. Moreover, the surge in underground construction projects underscores the need for reliable waterproofing solutions to protect underground structures from water ingress and soil pressure.

By Application

Based on application, the construction chemicals market is bifurcated into commercial & infrastructure and residential. The commercial & infrastructure segment generated the highest revenue of USD 63.29 billion in 2023. The surge in global infrastructure development, driven by substantial government investments in projects such as high-speed rail networks, airports, and renewable energy facilities, underscores the imperative need for extensive utilization of construction chemicals, to ensure structural integrity and longevity.

Moreover, the surge in commercial construction propelled by the rise of e-commerce and the growing demand for office spaces in emerging economies has led to the construction of warehouses, logistics centers, and commercial buildings, all of which require high-performance construction chemicals for durability and energy efficiency.

Additionally, the increasing focus on sustainability in construction practices has fostered the adoption of green building materials and solutions, including eco-friendly waterproofing solutions, to meet stringent environmental standards.

Construction Chemicals Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Construction Chemicals Market share stood around 34.79% in 2023 in the global market, with a valuation of USD 30.44 billion. Rapid urbanization across megacities, including Shanghai, Tokyo, and Delhi, among others, is fueling consistent demand for construction chemicals, driven by the construction of high-rise buildings, extensive infrastructure projects, and urban expansions.

Additionally, government initiatives, such as China's Belt and Road Initiative (BRI), are driving substantial investments in infrastructure across multiple countries within the region. This is leading to the growing demand for significant volumes of construction chemicals.

Furthermore, the region's growing focus on sustainability, evidenced by stricter environmental regulations, is driving the adoption of eco-friendly construction chemicals. Companies such as Nippon Paint in Japan and JSW in India are actively innovating sustainable solutions to meet this burgeoning demand, further solidifying Asia-Pacific's leading position in the construction chemicals market.

Europe held a significant revenue share of 26.00% in 2023. The European Union's renovation wave initiative targets enhancing the energy efficiency of existing buildings, thereby spurring the demand for construction chemicals in upgrading building envelopes, improving insulation, and installing energy-efficient windows. Additionally, as Europe aims for post-pandemic recovery, government stimulus packages prioritize infrastructure projects, thereby fueling product demand for multiple construction chemical applications.

Furthermore, the region boasts stringent building regulations concerning safety, durability, and energy efficiency, which is driving the need for high-performance construction chemicals such as fire retardants and low VOC products. Moreover, the region's green building nitiative is impelling the usage of eco-friendly construction chemicals such as bio-based adhesives and low-carbon concrete, thereby propelling the regional market growth.

Competitive Landscape

The construction chemicals market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in Construction Chemicals Market

- Sika AG

- BASF SE

- Dow

- RPM International Inc.

- Saint-Gobain

- MAPEI Corporation

- Ardex Group

- Fosroc, Inc.

- B. FULLER COMPANY

- Bostik

Key Industry Developments

June 2023 (Partnership): Fosroc, a prominent global producer of top-quality chemicals tailored for the construction sector, and ChemTech, a renowned construction chemicals firm based in Cairo, Egypt, forged a collaborative partnership. This joint venture aimed to produce and distribute Fosroc's comprehensive lineup of construction chemical materials.

The Global Construction Chemicals Market is Segmented as:

By Type

- Adhesives

- Concrete Protective Coatings

- Bonding agents

- Admixtures

- Waterproofing

- Anchoring materials

By Application

- Commercial & Infrastructure

- Residential

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America