Market Definition

Consent management refers to software solutions that help organizations collect, manage, and document user permissions regarding data processing activities in compliance with privacy regulations. This market includes consent management platforms (CMPs), preference management tools, and related integration services, covering web, mobile, and connected devices.

It serves sectors handling personal data such as media, healthcare, finance, and retail, with applications in user privacy control, regulatory compliance, and personalized data handling across digital environments.

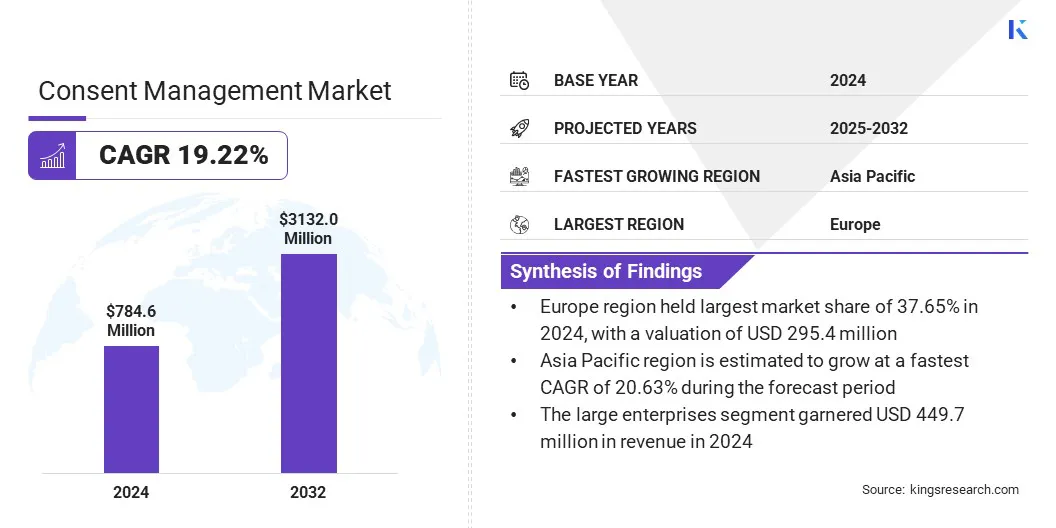

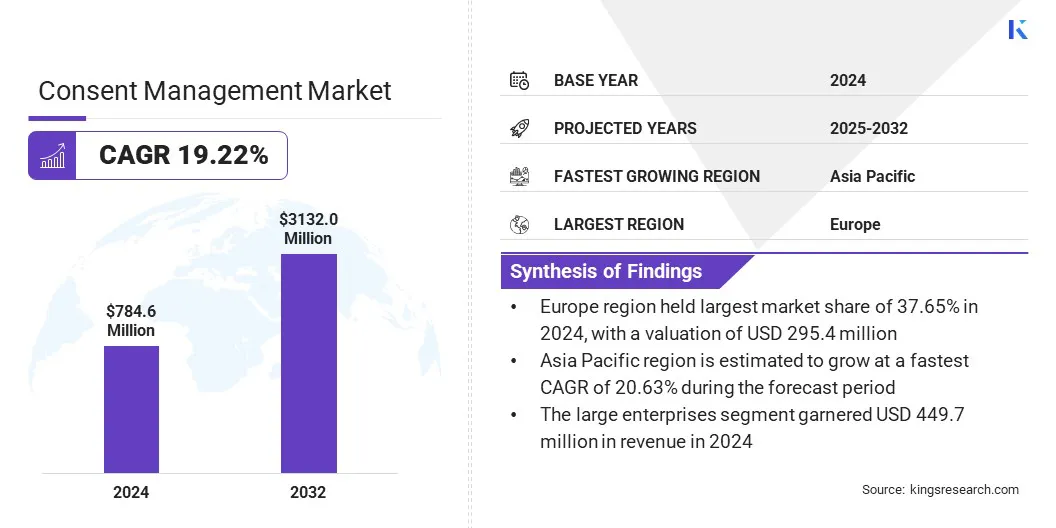

The global consent management market size was valued at USD 784.6 million in 2024 and is projected to grow from USD 915.1 million in 2025 to USD 3,132.0 million by 2032, exhibiting a CAGR of 19.22% during the forecast period.

The market growth is driven by the increasing volume of multichannel digital interactions as organizations engage users across websites, mobile apps, and connected devices. Businesses are implementing unified consent and preference management platforms to ensure regulatory compliance and enhance user trust. These systems support the effective collection and use of first-party data and help ensure alignment with evolving data protection regulations.

Key Highlights:

- The consent management industry size was recorded at USD 784.6 million in 2024.

- The market is projected to grow at a CAGR of 19.22% from 2025 to 2032.

- Europe held a market share of 37.65% in 2024, with a valuation of USD 295.4 million.

- The software segment garnered USD 426.4 million in revenue in 2024.

- The cloud-based segment is expected to reach USD 1,994.0 million by 2032.

- The large enterprises segment secured the largest revenue share of 57.32% in 2024.

- The mobile apps segment is poised for a robust CAGR of 21.48% through the forecast period.

- The retail & e-commerce segment garnered USD 286.7 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 20.63% during the forecast period.

Major companies operating in the Consent Management industry are OneTrust, LLC., Quantcast, iubenda, TrustArc Inc., Crownpeak Technolog, Inc., Piwik PRO, BigID, CIVIC, SAP SE, Sourcepoint, HIPAAT International Inc., Didomi, Osano, Inc., PossibleNOW, and Usercentrics GmbH.

Consent Management Market Report Scope

|

Segmentation

|

Details

|

|

By Component

|

Software, Services

|

|

By Deployment Mode

|

Cloud-Based, On-Premise

|

|

By Enterprise Size

|

Large Enterprises, Small & Medium Enterprises (SMEs)

|

|

By Module

|

Web-Based, Mobile App

|

|

By End-Use Industry

|

Retail & E-commerce, Healthcare & Life Sciences, BFSI,IT & Telecommunications

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Consent Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Europe consent management market share stood at 37.65% in 2024 in the global market, with a valuation of USD 295.4 million. This dominance is attributed to Europe’s mature digital infrastructure, which enables efficient deployment of consent management platforms across various industries.

Moreover, a well-established digital ecosystem in sectors such as healthcare, and finance support the seamless integration of CMPs into existing IT environments. This foundation allows organizations to implement privacy controls aligned with strict regulatory requirements. The region’s advanced data governance practices and high compliance awareness continue to strengthen its leading position in the market.

Asia Pacific consent management industry is poised for a significant CAGR of 20.63% over the forecast period. The growth is driven by the rapid expansion of e-commerce and programmatic advertising across Asia Pacific, which increases the need for compliant and transparent data collection practices.

Rising digital transactions and targeted marketing activities demand consent mechanisms that align with evolving privacy regulations. Moreover, businesses are deploying consent solutions to manage user data responsibly across high-traffic digital channels. This accelerating digital shift continues to position Asia Pacific as the fastest growing region in the market.

Consent Management Market Overview

Cross-border data transfer compliance is a primary driver fueling the market expansion, as organizations must align with diverse legal frameworks governing data localization and international transfers. This involves securing valid user consent for processing and storing personal data across jurisdictions with distinct privacy regulations.

Consent management platforms address these obligations by standardizing consent collection, enabling lawful cross-border data exchange, and ensuring compliance with laws such as the General Data Protection Regulation (GDPR), and the Personal Data Protection Act (PDPA).

Market Driver

Expansion of Multichannel Digital Interactions

The rapid expansion of digital customer touchpoints across websites, mobile apps, connected devices, and social platforms is driving demand for robust consent management solutions. Enterprises face increasing regulatory pressure to capture, store, and manage user permissions at every interaction point, especially as consumers engage with brands across multiple digital environments.

This requires scalable tools such as consent management platforms (CMPs), preference management solutions, and application programming interfaces (APIs) that ensure consistent compliance and personalized user experiences across all platforms and jurisdictions. As a result, the consent management market is experiencing consistent growth.

- In January 2025, Whale TV selected OneTrust’s consent management platform to replace its fragmented consent tools and centralize user preferences across its Whale TV OS and streaming apps such as Whale TV+. This exhibits the growing complexity of customer engagement ecosystems, where scalable and compliant consent management is essential for personalized and privacy-first digital services.

Market Challenge

Integration Limitations with Existing IT Systems

A significant challenge in the consent management market is the integration of consent tools with legacy IT systems. Many enterprises operate outdated infrastructure that lacks compatibility with modern consent management platforms, creating data silos and limiting automation.

To address this, providers are offering flexible APIs and middleware solutions that bridge new consent systems with existing architectures. This approach supports gradual digital transformation while enabling consistent compliance across all data environments.

Market Trend

Unified Consent and Preference Management for First-Party Data

A key trend supporting the global consent management market is the evolving use of first-party data. Enterprises are aligning consent workflows with individual data permissions to deliver tailored experiences within privacy-compliant boundaries. This integrated approach allows personalization, supports privacy obligations, and builds long-term user trust. Businesses are leveraging this trend to improve the utility of first-party data and increase engagement efficiency.

- In August 2024, Sourcepoint launched its Universal Consent and Preferences solution. This advanced platform integrates with Sourcepoint’s established consent management platform (CMP) to support enterprises in managing complex data privacy requirements while enhancing the effectiveness of their first-party data strategies.

Market Segmentation:

- By Component (Software and Services): The software segment earned USD 426.4 million in 2024 due to its critical role in automating consent collection, ensuring regulatory compliance, and enabling scalable data privacy operations across digital platforms.

- By Deployment Mode (Cloud-Based and On-Premise): The cloud-based segment held 449.7 of the market in 2024, due to its ability to offer scalable deployment, real-time compliance updates, and seamless integration across distributed digital environments.

- By Enterprise Size (Large Enterprises, and Small & Medium Enterprises (SMEs)): The large enterprises segment is projected to reach USD 1,599.3 million by 2032, owing to the high volume of user data they handle, which requires robust compliance frameworks and advanced consent management capabilities.

- By Module (Web-Based, and Mobile App): The web-based segment earned USD 358.3 million in 2024 due to the widespread use of websites as primary data collection channels, driving demand for consent solutions that ensure compliance across web environments.

- By End-Use Industry (Retail & E-commerce, Healthcare & Life Sciences, BFSI, and IT & Telecommunications): The retail & e-commerce segment held 36.54% of the market in 2024, due to its extensive reliance on customer data for targeted marketing, which necessitates strict compliance with data privacy regulations.

Regulatory Frameworks

- In Europe, the European Data Protection Board (EDPB) ensures uniform enforcement of the GDPR across member states by issuing regulatory guidance on lawful consent practices to maintain compliance and accountability.

- In Singapore, the Personal Data Protection Commission (PDPC) enforces the Personal Data Protection Act (PDPA) and provides regulatory guidance on securing valid user consent for data collection and usage.

Competitive Landscape

The competitive landscape of the consent management industry is characterized by targeted acquisitions that enable firms to expand compliance capabilities and accelerate geographic growth. Key players are acquiring niche privacy and ethics platforms to integrate advanced consent, preference, and data governance functionalities.

Vendors are also enhancing platform interoperability, strengthening support for region-specific regulations such as GDPR, CPRA, and LGPD, and embedding real-time consent orchestration into enterprise systems.

Leading players are offering modular, API-first architectures and integrating their solutions with customer data platforms (CDPs) to meet enterprise demand for scalable, unified privacy management. They are actively enabling real-time consent orchestration and ensuring compliance across diverse digital channels and regulatory environments.

- In December 2024, EQS Group acquired the compliance and ethics division of OneTrust, a provider of privacy and security software, including the Convercent by OneTrust platform. This acquisition enhances EQS Group’s global presence and reinforces its market position in the United States.

Key Companies in Consent Management Market:

- OneTrust, LLC.

- Quantcast

- iubenda

- TrustArc Inc.

- Crownpeak Technology, Inc.

- Piwik PRO

- BigID

- CIVIC

- SAP SE

- Sourcepoint

- HIPAAT International Inc.

- Didomi

- Osano, Inc.

- PossibleNOW

- Usercentrics GmbH

Recent Developments (Launch)

- In September 2024, Sourcepoint expanded its Connected TV (CTV) Consent Management Platform (CMP) by integrating HbbTV (Hybrid Broadcast Broadband TV) support. The company now allows broadcasters and content providers to deliver consistent, user-driven consent experiences across a wider range of OTT and CTV platforms.

These strategic moves exhibit a broader industry shift toward end-to-end privacy solutions. Market consolidation is intensifying as vendors seek to gain competitive advantage and accelerate global market penetration.