Connected Worker Market Size

Connected Worker Market Size

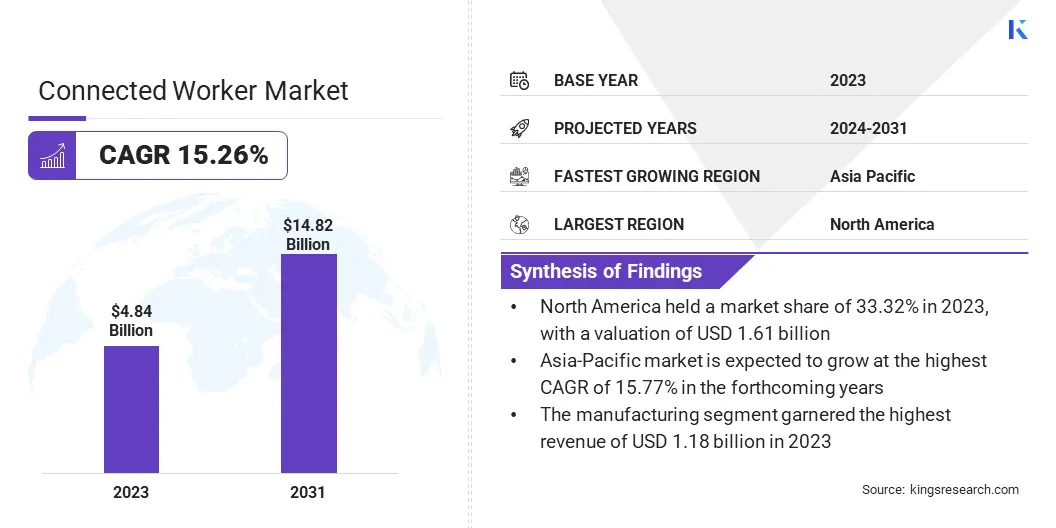

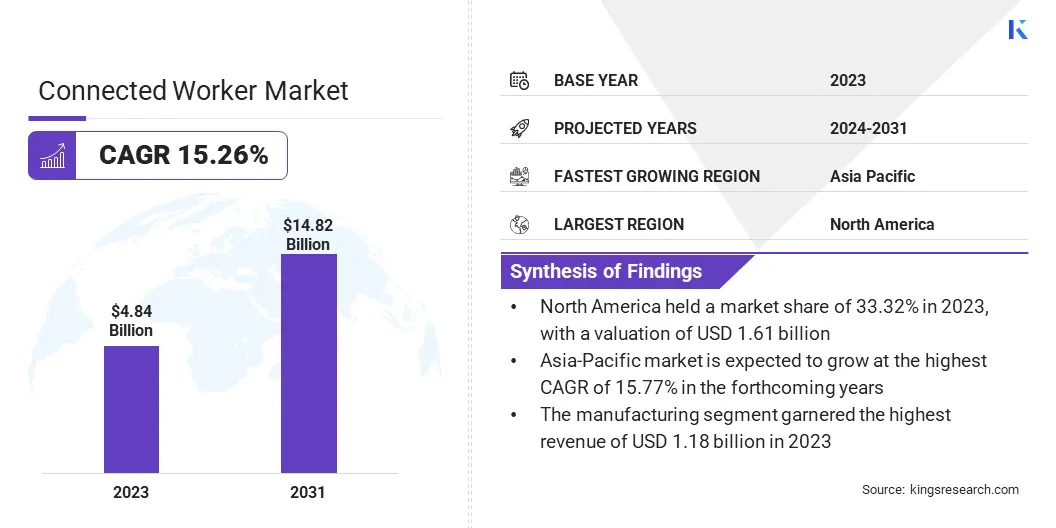

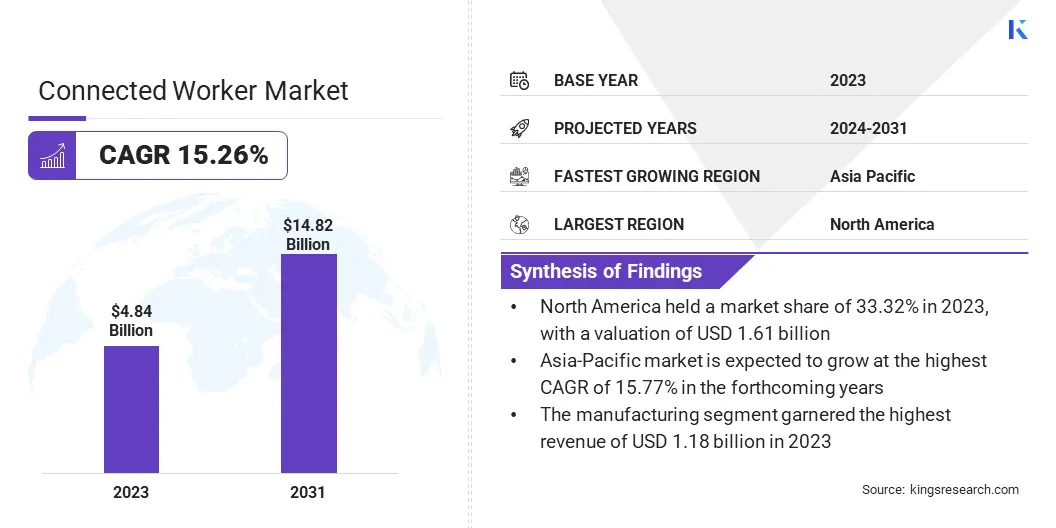

The global connected worker market size was valued at USD 4.84 billion in 2023 and is projected to grow from USD 5.49 billion in 2024 to USD 14.82 billion by 2031, exhibiting a CAGR of 15.26% during the forecast period.

Rising demand for operational efficiency in manufacturing and advancements in AI and machine learning for predictive maintenance are driving the growth of the market. In the scope of work, the report includes services offered by companies such as PTC, Accenture, Nokia, ABB, SAP SE, Augmentir, Inc., Fujitsu, 3M, Rockwell Automation, Wipro, and others.

The expansion of 5G networks is creating significant opportunities for the connected worker market, particularly in enhancing connectivity and data transmission. With the ultra-low latency and high bandwidth offered by 5G, connected worker solutions can deliver faster and more reliable communication between workers, devices, and central management systems.

This advancement ensures real-time data collection, enabling immediate decision-making in critical situations. In industries, including manufacturing, logistics, and construction, where efficiency and safety are paramount, 5G networks offer the infrastructure for advanced connected worker technologies such as augmented reality (AR) for remote assistance, wearable devices for health monitoring, and IoT-enabled sensors for productivity tracking.

- In May 2024, Ericsson partnered with RealWear and OverIT to provide immersive connected worker solutions for hazardous environments. Through its Imagine Live Roadshow, Ericsson showcased 5G connectivity and a new software toolkit, strengthening 5G Standalone capabilities to meet rising network demands and provide premium services with enhanced device handling and real-time access to complex data.

As 5G expands globally, companies are anticipated to implement more sophisticated solutions that enhance operational efficiency and reduce downtime through continuous connectivity. This trend creates opportunities for connected worker platforms to expand into rural or remote locations, overcoming connectivity challenges.

A connected worker is an employee who leverages advanced technologies and digital tools to enhance productivity, safety, and communication in their work environment. Connected worker solutions typically involve wearable devices such as smart helmets, AR glasses, and sensors, which gather real-time data on worker health, location, and performance.

These components are often integrated into a centralized platform that allows employers to monitor and manage their workforce remotely, optimizing operations and improving safety protocols. Connected worker technologies rely heavily on IoT, AI, and cloud-based platforms to provide seamless communication and data flow across different devices.

Deployment options for these solutions range from on-premise systems for large manufacturing facilities to cloud-based platforms for more flexible, remote applications.

Connected worker solutions are used in several industries, including manufacturing, oil and gas, construction, logistics, and healthcare, where real-time monitoring, safety compliance, and productivity enhancements are crucial.

These technologies help companies create smarter, safer, and more agile work environments, transforming traditional labor-intensive operations into tech-enabled, data-driven processes.

Analyst’s Review

The market is witnessing robust growth, with key players focusing on strategic investments in advanced technologies such as AI, IoT, and wearable devices to solidify their positions.

Companies are increasingly integrating cloud-based platforms and leveraging 5G infrastructure to enhance connectivity and real-time data analytics, which are critical for optimizing worker performance and safety. A key market strategy is the expansion of product portfolios to include augmented reality (AR) and virtual reality (VR) tools for training and remote assistance.

- In September 2024, Rockwell Automation launched a connected worker solution via Plex, aimed at optimizing shop floor operations. This solution enhances productivity, safety, and quality, offering advanced capabilities to help users streamline processes and improve overall operational outcomes in industrial environments.

Additionally, companies are forging partnerships with technology providers and telecommunications firms to enhance their solution offerings and improve user experience. The growth of the connected worker market is largely fueled by rising demand for workplace safety, particularly in high-risk industries such as oil and gas, manufacturing, and construction.

Key imperatives for these companies include staying ahead of technological advancements and responding to the evolving needs of connected workforce solutions. Prominent industry players are expected to actively invest in R&D, expand their global reach, and focus on developing user-centric, scalable solutions that address both productivity and safety concerns.

Connected Worker Market Growth Factors

The manufacturing industry is experiencing a growing demand for operational efficiency, propelled by the need to enhance productivity, reduce costs, and maintain a competitive edge in the connected worker market. Manufacturers are adopting connected worker solutions to optimize workflows, minimize human errors, and ensure seamless coordination between workers and machines.

Connected worker technologies such as wearable devices, IoT-enabled sensors, and AI-driven platforms provide real-time data on machine performance, worker productivity, and inventory levels, enabling managers to make informed decisions and respond proactively to potential disruptions.

- In March 2024, ServiceNow expanded its connected worker solutions by acquiring 4Industry and Smart Daily Management. These acquisitions bolster ServiceNow’s operational technology (OT) management, enhancing its expertise in manufacturing, energy, and logistics.

This digital transformation in manufacturing has become essential for reducing downtime, improving product quality, and meeting stringent delivery timelines. In response to this, many manufacturing companies are investing in connected worker platforms to streamline processes and boost efficiency.

By leveraging these technologies, companies can monitor equipment health, predict maintenance needs, and allocate resources more effectively. As manufacturers strive for leaner operations, connected worker solutions are likely to be essential for enhancing production capabilities, fostering innovation, and sustaining profitability in a highly competitive market.

Data privacy and security concerns present a significant challenge to the development of the market, particularly as more organizations implement technologies that collect sensitive worker data through wearable devices, IoT sensors, and centralized platforms.

These systems gather extensive data on workers’ health, location, productivity, and even biometric data, raising concerns about personal data protection and compliance with regulations such as GDPR. Data breaches or unauthorized access to sensitive worker data may lead to significant financial penalties, reputational damage, and loss of trust among employees.

To mitigate this challenge, companies must adopt stringent cybersecurity measures, including robust encryption protocols, multi-factor authentication, and regular audits to ensure compliance with evolving privacy standards. Data anonymization techniques and limiting access to sensitive information based on roles can further enhance data security.

Additionally, companies need to build transparent communication with their workforce regarding the use and protection of data to foster trust in connected worker solutions and ensure legal compliance.

Connected Worker Industry Trends

The increased emphasis on workforce safety and compliance is a key trend shaping the connected worker market. Amid stricter regulations and growing awareness of workplace hazards, companies are adopting connected worker solutions to enhance safety and ensure compliance.

Wearable devices, sensors, and real-time monitoring systems enable organizations to track worker health, detect potential hazards, and respond quickly to emergency situations, reducing the risk of workplace accidents and injuries. These technologies ensure worker compliance with safety guidelines, such as wearing protective equipment and maintaining proper distances in hazardous environments.

- For instance, in February 2024, ABB introduced an upgraded ABB Ability Connected Worker solution, improving real-time visibility and connectivity for field operators. The new features reduce human error, and minimize downtime, supporting a more sustainable and resilient business model while provifing greater control and flexibility in digitalized work environments.

This focus on safety and compliance is particularly critical in high-risk industries such as construction, oil and gas, and manufacturing, where workplace accidents carry significant risks. By leveraging connected worker solutions, companies aim to reduce their liability and create safer, more productive work environments.

This trend is further fueled by the increasing demand for real-time data and analytics, enabling organizations to proactively identify and mitigate risks before they escalate into serious incidents.

Segmentation Analysis

The global market has been segmented on the basis of component, deployment, technology, end use, and geography.

By Component

Based on component, the market has been segmented into hardware, software, and services. The hardware segment secured the largest share of 47.67% in 2023, primarily due to the growing adoption of wearable devices and IoT-enabled sensors in various industries.

Connected worker hardware, including smart helmets, AR glasses, body-worn sensors, and ruggedized mobile devices, is essential for real-time data collection and communication. These devices allow organizations to monitor worker performance, ensure safety compliance, and improve operational efficiency, particularly in high-risk environments such as manufacturing, oil and gas, and construction.

The demand for such hardware has surged as companies increasingly invest in technologies that enhance workforce safety and productivity. Additionally, advancements in wearable technology and the integration of IoT are increasing demand for connected worker hardware.

These devices track worker location and activity while providing data analytics that allows employers to make informed decisions and take proactive measures to avoid downtime or safety incidents. With increasing reliance on real-time data and the growing need to enhance safety and operational efficiency, the hardware segment anticipated to dominate the market in the forthcoming years.

By Deployment

Based on deployment, the market has been divided into cloud-based and on-premises. The cloud-based segment is expected to grow at a remarkable CAGR of 14.99% through the forecast period.

Cloud-based connected worker solutions offer greater flexibility, scalability, and cost-efficiency compared to on-premise systems, making them ideal for organizations seeking to optimize their workforce operations without significant upfront investments.

The cloud enables real-time data access from any location, allowing companies to monitor their employees remotely and ensure business continuity, even in decentralized or remote work environments.

This growth is further supported by the rising demand for centralized platforms that integrate multiple data streams, such as wearables, sensors, and mobile devices, enabled by cloud accessibility. Additionally, cloud solutions provide continuous software updates, ensuring organizations have access to the latest features and security patches.

The scalability of cloud infrastructure makes it ideal for organizations of all sizes, especially those looking to expand their connected worker operations. The acceleration of digital transformation is leading to increased adoption of cloud-based solutions, boosting the growth of the segment.

By End Use

Based on end use, the market has been classified into manufacturing, construction, mining, healthcare, oil & gas, and others. The manufacturing segment led the connected worker market in 2023, reaching a valuation of USD 1.18 billion, fueled by the increasing need for operational efficiency, worker safety, and automation.

Manufacturing, a labor-intensive sector, has widely adopted connected worker technologies to streamline operations, enhance productivity, and mitigate risks associated with human error. IoT-enabled devices and wearable technology allow manufacturers to monitor real-time worker activity, track machine performance, and optimize workflows, thereby reducing downtime and ensuring compliance with stringent safety regulations.

Moreover, the growth of the sector is propelled by the rising trend of Industry 4.0, which emphasizes the integration of advanced technologies such as robotics, AI, and machine learning into manufacturing processes. Connected worker solutions provide necessary data and communication channels, allowing manufacturers to create smarter, more agile operations.

Furthermore, as the manufacturing sector continues to face challenges related to labor shortages and rising costs, connected worker technologies enhance workforce productivity, thus supporting segmental expansion.

Connected Worker Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America connected worker market accounted for a substantial share of 33.32% and was valued at USD 1.61 billion in 2023, reflecting the rising adoption of advanced digital technologies. This dominance is largely attributed to the surging adoption of IoT, wearables, and cloud-based solutions across industries such as manufacturing, oil and gas, and construction.

Companies in North America are increasingly prioritizing workforce safety, operational efficiency, and real-time data insights, making connected worker solutions essential for optimizing processes and reducing workplace incidents.

The region's well-established technological infrastructure and strong regulatory environment facilitate the deployment of these solutions, ensuring compliance with increasingly stringent safety and operational standards.

Moreover, significant investments in research and development by major U.S. and Canadian firms have accelerated innovation in connected worker platforms. The region's focus on digital transformation, coupled with the adoption of AI, AR, and predictive analytics, has further contributed to its considerable market share.

With major industries focusing on worker productivity and automation, North America is poised to maintain its leading position in the connected worker market.

Asia-Pacific market is expected to grow at the highest CAGR of 15.77% in the forthcoming years, bolstered by rapid industrialization, digital transformation, and the rising need for workforce safety.

Industries in Asia-Pacific, particularly in China, India, and Japan, are expanding their manufacturing and construction operations, leading to an increasing demand for connected worker solutions to enhance productivity and ensure safety compliance. The rise of smart factories and Industry 4.0 initiatives in the region is fostering the adoption of IoT, AI, and wearable technologies, crucial components of connected worker platforms.

Additionally, the growing investments in infrastructure projects and the expansion of the oil and gas sector are fueling demand for real-time monitoring and communication tools that ensure worker safety and operational efficiency. As Asia-Pacific economies prioritize digital transformation, the need for scalable, cloud-based connected worker solutions is expected to rise, creating significant growth opportunities.

The increasing focus on worker well-being and regulatory compliance, coupled with government support for technology adoption, positions the regional market for rapid growth in the coming years.

Competitive Landscape

The global connected worker market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Connected Worker Market

Key Industry Developments

- March 2024 (Collaboration): Augmentir joined the Zebra PartnerConnect program, partnering with Zebra Technologies. This integration aligns Augmentir’s AI-driven connected worker solutions with Zebra's enterprise mobile devices, improving productivity and safety. This collaboration helps manufacturing, warehouse, and logistics sectors tackle supply chain challenges, skilled labor shortages, and economic volatility by enhancing operational efficiency and meeting growing demands for speed and accuracy.

The global connected worker market has been segmented:

By Component

- Hardware

- Software

- Services

By Deployment

By Technology

- RFID

- Wi-Fi

- Cellular

- Bluetooth

- Low-Power Wide-Area Network (LPWAN)

- Wireless Field Area Network (WFAN)

- Zigbee

By End Use

- Manufacturing

- Construction

- Mining

- Healthcare

- Oil & Gas

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America