Market Definition

The market comprises software and system solutions that utilize image recognition, analysis, and interpretation technologies within medical settings. It includes applications such as diagnostics, surgical planning, patient monitoring, and workflow optimization across hospitals, clinics, and research facilities.

The market covers vendors that provide tools for medical imaging analysis, real-time video processing, and clinical decision support. The report explores key drivers of market development, offering a detailed regional analysis and a comprehensive overview of the competitive landscape.

Computer Vision in Healthcare Market Overview

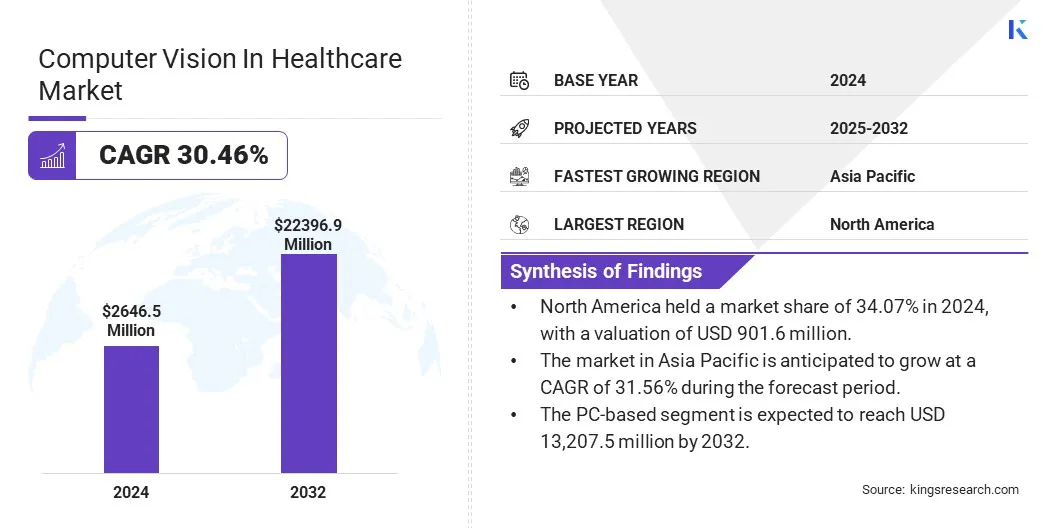

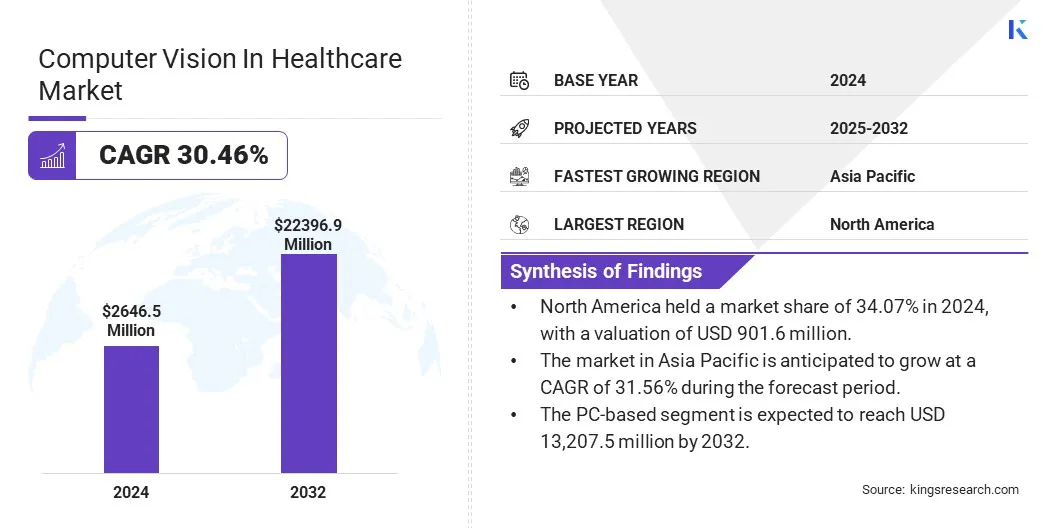

The global computer vision in healthcare market size was valued at USD 2,646.5 million in 2024 and is projected to grow from USD 3,436.0 million in 2025 to USD 22,396.9 million by 2032, exhibiting a CAGR of 30.46% during the forecast period.

The market is experiencing strong growth, driven by the increasing demand for automation in medical imaging and the rising adoption of digital health technologies across clinical settings. Enhanced capabilities in image-based diagnostics and real-time video analysis are enabling faster and more accurate clinical decisions.

Major companies operating in the computer vision in healthcare industry are Siemens AG, GE HealthCare, Koninklijke Philips N.V., Canon Inc., IBM, NVIDIA Corporation, Intel Corporation, Agfa-Gevaert Group, Fujifilm Group, Aidoc, Tempus AI, Inc., Butterfly Network, inc., Voxel51, Qure.ai, and Beijing SenseTime Technology Development Co., Ltd.

AI-integrated medical imaging systems are transforming diagnostics with real-time analysis, improved image quality, and automated workflows. These advancements are enabling faster and more accurate decisions in radiology and oncology, improving efficiency and patient throughput.

Healthcare providers are prioritizing the reduction of diagnostic delays and the enhancement of care delivery, in turn, driving the global adoption of intelligent imaging solutions.

- In December 2024, United Imaging introduced AI-powered medical imaging innovations at Radiological Society of North America 2024, which included the uMR Ultra 3T MRI with live motion imaging and the uMI Panvivo PET/CT platform. The company focused on its “Born with AI” approach and showcased integrated AI solutions to enhance diagnostics and workflow across multiple specialties.

Key Highlights

- The computer vision in healthcare market size was valued at USD 2,646.5 million in 2024.

- The market is projected to grow at a CAGR of 30.46% from 2025 to 2032.

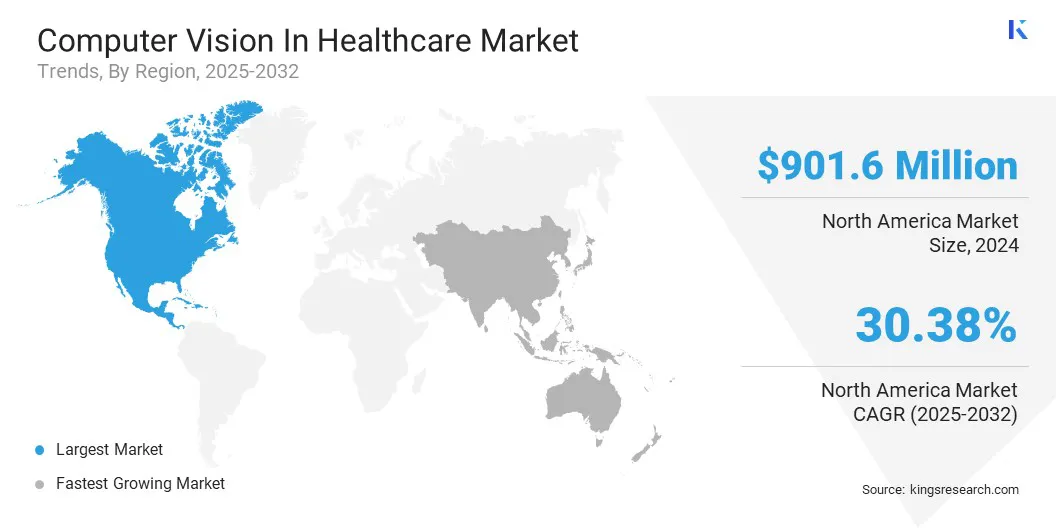

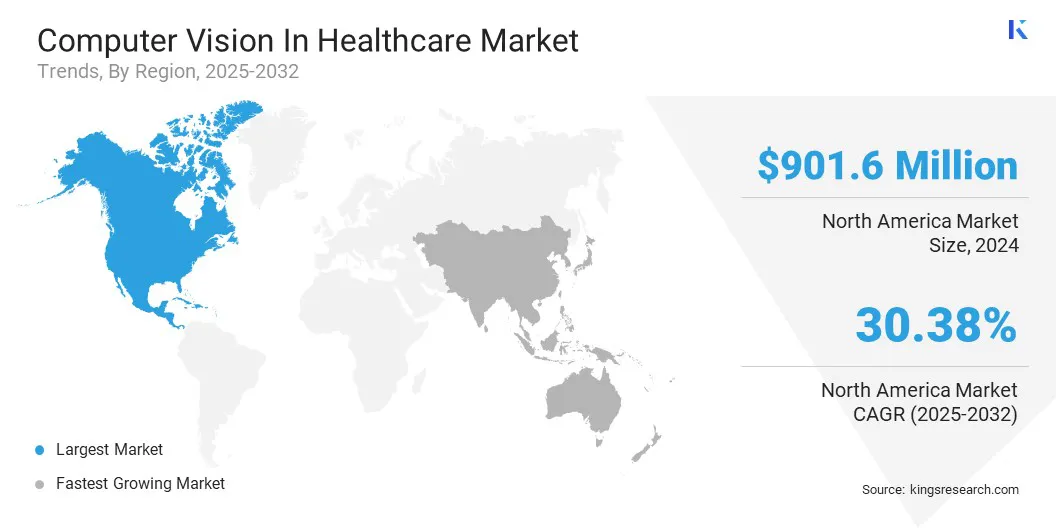

- North America held a market share of 34.07% in 2024, with a valuation of USD 901.6 million.

- The hardware segment garnered USD 1,017.8 million in revenue in 2024.

- The PC-based segment is expected to reach USD 13,207.5 million by 2032.

- The medical imaging & diagnosis segment is expected to reach USD 6,296.1 million by 2032.

- The hospitals & clinics segment is expected to reach USD 8,091.1 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 31.56% during the forecast period.

Market Driver

Advancements in Foundational AI and Multi-Modal Vision Models Driving Healthcare Imaging Innovation

A key driver of the market is the accelerated advancement of foundational artificial intelligence research and the emergence of multi-modal vision models specifically engineered for clinical applications. These models are trained on extensive, heterogeneous medical imaging datasets and function as robust platforms for the development of sophisticated diagnostic solutions.

Their ability to interpret a broad spectrum of imaging modalities such as X-rays, magnetic resonance imaging (MRI), and histopathological slides with enhanced contextual comprehension facilitates higher diagnostic precision and enables workflow automation.

By moving beyond narrowly focused, task-specific algorithms, foundational models establish a scalable and adaptable AI infrastructure, thereby enabling healthcare providers and medical technology companies to implement more efficient and accurate imaging solutions across various clinical settings.

- In October 2024, GE HealthCare launched an AI Innovation Lab to accelerate early-stage AI projects, including agentic AI for clinical decision support, AI models for predicting triple negative breast cancer recurrence, generative AI for maternal and neonatal care, a multi-modal X-ray foundation model, and AI tools to improve mammography screening efficiency.

Market Challenge

Challenges in Reliability and Accuracy of AI-Powered Medical Imaging

A key challenge in the computer vision in healthcare market is ensuring consistent and reliable performance of AI algorithms across diverse medical imaging data. Variations in imaging equipment, patient demographics, and clinical workflows can significantly affect algorithm accuracy, potentially leading to diagnostic errors or omissions.

To address this, key players are actively investing in large-scale, high-quality, and diverse training datasets, along with rigorous real-world validation protocols. Companies are also implementing robust monitoring systems to ensure their solutions maintain accuracy, safety, and clinical relevance over time.

Market Trend

AI-Powered Medical Image Analysis

A key trend in the market is the increasing integration of AI into routine imaging workflows. AI-powered tools are being adopted to automate tasks such as segmentation, classification, and anomaly detection, enhancing diagnostic accuracy and efficiency.

These solutions help prioritize urgent cases, streamline radiologist workflows, and address workforce shortages. Hospitals are embedding AI into PACS and RIS systems for seamless clinical adoption, supporting standardized reporting and reducing variability.

As AI continues to evolve, its operational integration is transforming diagnostic imaging into a faster, more consistent, and data-driven component of modern healthcare delivery.

- In April 2025, AZmed launched AZboneage, a CE-marked AI software that assists healthcare professionals in estimating skeletal maturity in pediatric patients by analyzing hand radiographs using the Greulich and Pyle method. The system produces structured outputs for diagnostic consistency and supports radiologists by streamlining pediatric imaging workflows.

Computer Vision in Healthcare Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Product

|

Smart Cameras-based, PC-based

|

|

By Application

|

Medical imaging & diagnosis, Surgical assistance, Patient identification, Remote patient monitoring, Others

|

|

By End User

|

Hospitals & Clinics, Diagnostic centers, Academic research institutes, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 1,017.8 million in 2024, owing to the increasing deployment of advanced imaging equipment and edge devices for real-time medical data processing.

- By Product (Smart Cameras-based, and PC-based): The PC-based segment held 59.85% of the market in 2024, due to its widespread use in diagnostic imaging systems and compatibility with existing hospital IT infrastructure.

- By Application (Medical imaging & diagnosis, Surgical assistance, Patient identification, Remote patient monitoring, and Others): The medical imaging & diagnosis segment is projected to reach USD 6,296.1 million by 2032, owing to the growing reliance on image-guided diagnostics and the rising prevalence of chronic diseases.

- By End User (Hospitals & Clinics, Diagnostic centers, Academic research institutes, and Others): The hospitals & clinics segment is projected to reach USD 8,091.1 million by 2032, due to the large-scale integration of computer vision technologies for improved clinical workflows and patient care delivery.

Computer Vision in Healthcare Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.07% share of the computer vision in healthcare market in 2024, with a valuation of USD 901.6 million. This dominance is attributed to the region’s well-established healthcare infrastructure, strong reimbursement frameworks, and the presence of leading players such as GE Healthcare, IBM, Watson Health, and Microsoft.

The early adoption of AI-powered diagnostic platforms and advanced imaging systems in the U.S. has facilitated the integration of computer vision in areas such as radiology, oncology, pathology, and surgical robotics. Additionally, favorable regulatory support from government bodies like the FDA is fueling innovation and commercialization of computer vision technologies across the region.

- In June 2024, Qure.ai collaborated with Strategic Radiology to enhance radiology workflows through AI-powered medical imaging solutions. The collaboration focuses on implementing computer vision algorithms for early lung nodule detection, emergency head CT triage, and streamlined chest X-ray reporting to support clinical accuracy and operational efficiency.

The computer vision in healthcare industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 31.56% over the forecast period. This growth is driven by increasing healthcare digitization, rising demand for efficient diagnostic imaging, and the expansion of medical infrastructure across key markets such as China, India, and Southeast Asia.

In countries like China and India, rising healthcare expenditures and large patient volumes are encouraging hospitals to opt for automated imaging tools to improve diagnostic efficiency. The growing number of medical AI startups and strategic collaborations between regional healthcare providers and technology firms are further contributing to the adoption of computer vision technologies.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates computer vision technologies in healthcare by reviewing and approving medical devices and software to ensure their safety and effectiveness. Additionally, the Health Insurance Portability and Accountability Act (HIPAA) governs data privacy and security and sets strict standards for handling patient information.

- In Europe, the European Medicines Agency (EMA) oversees the evaluation and authorization of medical devices, including AI-powered imaging tools, under the Medical Device Regulation (MDR). The General Data Protection Regulation (GDPR) enforces stringent data protection requirements, which impact the development and use of computer vision solutions in healthcare.

Competitive Landscape

The computer vision in healthcare market is characterized by key players focusing on continuous innovations and the rapid development of new imaging technologies. Companies pursue strategic partnerships with healthcare providers and technology firms to expand their solution portfolios.

Mergers and acquisitions are frequently used to acquire advanced technologies and enter new regions. Players also prioritize obtaining regulatory clearances to speed up product launches and gain market access.

Additionally, firms are investing in cloud-based platforms and enhancing interoperability with existing healthcare IT systems. They also emphasize customized service offerings and flexible deployment models to cater to diverse customer requirements.

- In February 2024, AZmed secured USD 16 million in Series A funding from investors including Maison Worms, Techstars, and Teampact Ventures. This investment will support AZmed’s global expansion and accelerate the research and development of AI-driven medical imaging solutions, which are designed to streamline radiology workflows and meet growing diagnostic demands.

List of Key Companies in Computer Vision in Healthcare Market:

- Siemens AG

- GE HealthCare

- Koninklijke Philips N.V.

- Canon Inc.

- IBM

- NVIDIA Corporation

- Intel Corporation

- Agfa-Gevaert Group

- Fujifilm Group

- Aidoc

- Tempus AI, Inc.

- Butterfly Network, inc

- Voxel51

- Qure.ai

- Beijing SenseTime Technology Development Co., Ltd.

Recent Developments (Collaboration/Product Launch)

- In March 2025, NVIDIA collaborated with GE HealthCare to advance autonomous diagnostic imaging using physical AI. Through this collaboration, GE HealthCare will utilize the new NVIDIA Isaac platform for healthcare simulation to develop and validate autonomous imaging systems, including X-ray and ultrasound technologies. The platform enables the simulation of sensors, anatomy, and environments, allowing for rapid prototyping and development of robotic imaging systems.

- In December 2024, Philips launched the CT 5300 system in North America, featuring AI-driven workflow tools to improve accuracy and efficiency in scanning. The company partnered with Annalise.ai to evaluate AI-powered triage support for prioritizing urgent cases in emergency departments.

which