Market Definition

Computed tomography (CT) is an advanced medical imaging technique that uses X-rays and computer processing to generate detailed cross-sectional images of internal body structures. It provides a clear visualization of bones, blood vessels, and soft tissues, supporting early and accurate diagnosis.

The market includes applications in neurology, cardiology, oncology, orthopedics, and emergency medicine across hospitals, diagnostic centers, and research institutions. These systems are widely used for disease detection, treatment planning, trauma evaluation, and image-guided procedures, making them integral to modern diagnostic healthcare and advancements in clinical outcomes.

Computed Tomography Market Overview

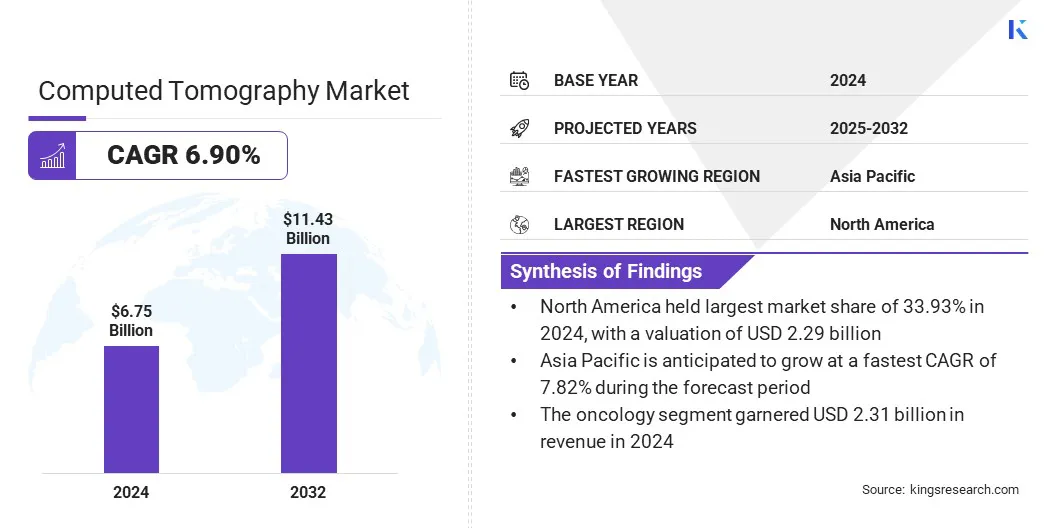

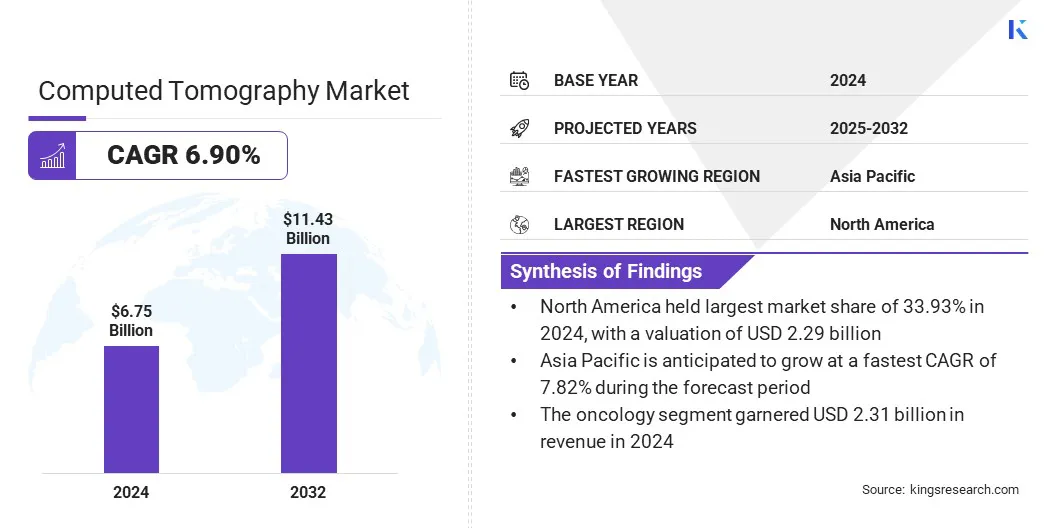

According to Kings Research, the global computed tomography market size was valued at USD 6.75 billion in 2024 and is projected to grow from USD 7.16 billion in 2025 to USD 11.43 billion by 2032, exhibiting a CAGR of 6.90% during the forecast period.

This growth is driven by technological advancements in imaging systems, which enhance image quality and reduce radiation exposure, improving diagnostic accuracy. Integration of AI-driven imaging and workflow automation streamlines scanning, analysis, and reporting, increasing efficiency and supporting timely clinical decision-making.

Key Highlights

- The computed tomography industry size was USD 6.75 billion in 2024.

- The market is projected to grow at a CAGR of 6.90% from 2025 to 2032.

- North America held a share of 33.93% in 2024, valued at USD 2.29 billion.

- The high-slice CT segment garnered USD 2.69 billion in revenue in 2024.

- The oncology segment is expected to reach USD 4.19 billion by 2032.

- The hospitals segment secured the largest revenue share of 61.40% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.82% over the forecast period.

Major companies operating in the computed tomography market are Siemens, General Electric Company, Canon Inc., Koninklijke Philips N.V, Hitachi High-Tech Corporation, Neusoft Medical Systems Co., Ltd., United Imaging Healthcare Co., Ltd., Samsung, FUJIFILM, Carestream Health, Koning Health, Shimadzu Corporation, Analogic Corporation, CURVEBEAMAI.COM, and Bruker.

Growing cases of cancer, cardiovascular disorders, and respiratory illnesses are boosting the demand for advanced imaging, propelling market expansion. The World Health Organization highlights that Cardiovascular diseases (CVDs) are the top cause of death worldwide, responsible for approximately 17.9 million fatalities annually. CT scans are essential for early detection, accurate diagnosis, and effective monitoring of such conditions.

Increasing reliance on CT imaging enables clinicians to evaluate disease progression and plan timely interventions. Rising patient loads in hospitals and diagnostic centers are creating a greater need for high-throughput and precise imaging systems. Meanwhile, technological advancements are facilitating the development of faster and more detailed CT scanners, improving diagnostic outcomes.

- In December 2023, Siemens Healthineers obtained FDA clearance for the SOMATOM Pro. Pulse Dual-Source CT Scanner. This system incorporates two X-ray tubes and detectors, delivering high temporal resolution and faster scan speeds, beneficial for cardiac CT imaging where motion artifacts are critical. It features embedded AI tools such as myExam Companion for tailored scan protocols and an optional FAST 3D camera for automatic patient positioning.

Market Driver

Technological Advancements in Imaging Systems

Innovations such as spectral CT, iterative reconstruction, and AI-enabled image processing are fueling the growth of the computed tomography market. These advancements are improving diagnostic accuracy by enabling clearer visualization of tissues and lesions. Dual-energy CT provides enhanced insights into material composition, which supports more precise disease characterization.

AI integration streamlines image analysis, reduces interpretation time, and assists clinicians in making informed decisions. Hospitals and diagnostic centers are increasingly investing in advanced CT systems to improve patient outcomes and operational efficiency.

- In February 2024, Philips launched the CT 5300 system at the European Congress of Radiology (ECR). This AI-enabled CT scanner leverages advanced image reconstruction algorithms and workflow automation to enhance diagnostic accuracy, improve efficiency, and support high-throughput clinical environments.

Market Challenge

Rising Radiation Exposure Concerns

A key challenge impeding the computed tomography market is rising concerns over patient safety from ionizing radiation. Frequent or repeated scans increase cumulative radiation dose, which raises long-term health risks and heightens regulatory oversight. Clinicians are facing pressure to balance diagnostic accuracy with minimizing exposure, particularly for children and chronically ill patients.

To address this challenge, market players are developing low-dose CT technologies, integrating advanced image reconstruction algorithms, and enhancing scanner efficiency to deliver clearer images at reduced radiation levels. These advancements are improving patient safety while supporting wider clinical acceptance of CT imaging.

- In May 2024, Neusoft Medical Systems introduced the Odose Automatic Tube Current Modulation (ATCM) technology in its CT scanners. This feature dynamically adjusts the tube current based on patient size and anatomical characteristics, achieving up to a 43% reduction in radiation dose while maintaining image quality comparable to standard-dose scans.

Market Trend

Integration of AI-Driven Imaging & Workflow Automation

The computed tomography market is witnessing a notable trend toward the integration of artificial intelligence into imaging and clinical workflows. AI algorithms enable faster image reconstruction, producing high-quality results with reduced noise and lower radiation doses. These tools also support automated anomaly detection, assisting radiologists in identifying subtle patterns that improve diagnostic accuracy.

Workflow automation streamlines reporting, prioritization, and data management, allowing healthcare providers to handle increasing imaging volumes more efficiently. The adoption of AI is enhancing precision, speed, and productivity, positioning computed tomography as a more effective diagnostic tool in modern healthcare systems.

- In December 2024, Canon Medical Systems USA expanded its suite of AI-powered solutions for end-to-end workflow automation in CT imaging. The new offerings include Vina Analytics for protocol management, remote scan support, and automated processing of CT neuro and chest studies. These tools aim to enhance operational efficiencies and deliver faster, accurate results to improve patient care.

Computed Tomography Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

High-slice CT, Mid-slice CT, Low-slice CT, Cone-Beam CT (CBCT)

|

|

By Application

|

Oncology, Neurology, Cardiology, Others

|

|

By End User

|

Hospitals, Diagnostic Imaging Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (High-slice CT, Mid-slice CT, Low-slice CT, and Cone-Beam CT (CBCT)): The high-slice CT segment earned USD 2.69 billion in 2024, mainly due to its ability to provide faster scanning, higher image resolution, and enhanced diagnostic accuracy for complex clinical applications.

- By Application (Oncology, Neurology, Cardiology, and Others): The oncology segment held a share of 34.20% in 2024, fueled by the high demand for precise imaging in cancer diagnosis, treatment planning, and monitoring.

- By End User (Hospitals, Diagnostic Imaging Centers, and Others): The hospitals segment is projected to reach USD 6.91 billion by 2032, propelled by high patient volumes, advanced diagnostic requirements, and the availability of sophisticated imaging infrastructure that supports the extensive use of CT scanners.

Computed Tomography Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America computed tomography market share stood at 33.93% in 2024, valued at USD 2.29 billion. This dominance is reinforced by the region's robust healthcare infrastructure, which supports widespread adoption of advanced medical imaging technologies. Healthcare facilities equipped with state-of-the-art CT scanners are enabling efficient and accurate diagnostics, contributing to this notable growth.

- In December 2024, Philips introduced the CT 5300 system in North America at the Radiological Society of North America (RSNA) 2024 conference. This system features an end-to-end AI-driven smart workflow, aiming to optimize CT procedures and enhance diagnostic accuracy.

Additionally, the integration of electronic health records (EHR) systems streamlines patient data management, improving workflow efficiency. The combination of advanced technology and efficient data systems supports regional market growth.

The Asia-Pacific computed tomography industry is estimated to grow at a CAGR of 7.82% over the forecast period. This growth is propelled by the rising incidence of chronic diseases such as cardiovascular disorders, cancer, and respiratory illnesses. These conditions require precise and timely diagnostic tools for effective management and treatment.

- In November 2024, the OECD's "Health at a Glance: Asia/Pacific 2024" report highlighted that non-communicable diseases (NCDs) such as cardiovascular diseases, cancers, and chronic respiratory diseases account for more than 80% of mortality in ASEAN Member States, underscoring the need for precise diagnostic tools such as CT imaging.

Moreover, regional market expansion is fueled by continuous innovations in CT imaging technology, enhancing both image quality and patient safety. Developments such as iterative reconstruction techniques and photon-counting detectors have improved diagnostic accuracy while reducing radiation exposure.

In September 2025, the IEEE Nuclear and Plasma Sciences Society highlighted that iterative and deep-learning-based CT image reconstruction algorithms, along with photon-counting CT, are key areas of research, indicating ongoing advancements in CT imaging technology. These technological improvements enable healthcare providers to offer more precise and safer imaging services.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates CT scanners under two primary statutes: The Radiation Control for Health and Safety Act of 1968 and the Medical Device Amendments to the Federal Food, Drug, and Cosmetic Act. These regulations classify CT imaging systems as both radiation-emitting electronic products and medical devices. Manufacturers must comply with performance standards and radiation safety requirements set forth by the FDA.

- In the European Union, CT scanners are governed by Regulation (EU) 2017/745 on medical devices (MDR), which provides a comprehensive framework for the regulation of medical devices. Under the MDR, CT scanners are classified based on their intended use and risk profile, typically falling under Class IIb. Manufacturers must undergo a conformity assessment process, which includes clinical evaluations and obtaining a CE mark to demonstrate compliance with the regulation. The MDR also mandates post-market surveillance, vigilance reporting, and the maintenance of a European Authorized Representative for non-EU manufacturers.

- In China, the National Medical Products Administration (NMPA) regulates CT scanners under the Medical Device Supervision and Administration Regulations. CT scanners are classified as Class II medical devices, requiring manufacturers to obtain a registration certificate before marketing. The registration process involves submitting technical documentation, clinical evaluation data, and undergoing inspections. The NMPA also enforces post-market surveillance, including adverse event reporting and inspections, to ensure ongoing device safety and performance.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), under the Ministry of Health, Labour and Welfare (MHLW), regulates CT scanners under the Pharmaceutical and Medical Device Act. CT scanners are classified as Class II medical devices, requiring manufacturers to submit a premarket notification (Shonin) or application for certification (Ninsho) depending on the device's risk classification. The approval process includes technical documentation, clinical data, and compliance with Japanese Industrial Standards (JIS).

Competitive Landscape

Major players in the computed tomography industry are adopting strategies such as research and development, technological advancements, and strategic partnerships to maintain competitiveness.

Companies are developing mobile and compact CT solutions that cater to diverse clinical environments, enhancing accessibility and workflow efficiency. Expanding product portfolios to include versatile and portable CT systems helps meet the growing demand in hospitals and critical care units. These strategies enable market players to strengthen their position and address evolving healthcare needs effectively.

- In August 2025, Samsung, in collaboration with its subsidiary NeuroLogica, launched a new range of mobile CT products in India. The portfolio includes the CereTom Elite, OmniTom Elite, OmniTom Elite PCD, and BodyTom 32/64, designed to provide advanced diagnostic imaging across various medical environments such as ICUs, operating rooms, and emergency departments.

Key Companies in Computed Tomography Market:

- Siemens

- General Electric Company

- Canon Inc.

- Koninklijke Philips N.V

- Hitachi High-Tech Corporation

- Neusoft Medical Systems Co., Ltd.

- United Imaging Healthcare Co., Ltd.

- Samsung

- FUJIFILM

- Carestream Health

- Koning Health

- Shimadzu Corporation

- Analogic Corporation

- CURVEBEAMAI.COM

- Bruker

Recent Developments (Collaboration/Approval)

- In November 2024, Canon Medical Systems entered a research collaboration with Penn Medicine to advance photon-counting CT (PCCT) technology, focusing on chest, cardiac, and musculoskeletal imaging. This collaboration aims to accelerate PCCT development and clinical adoption.

- In July 2024, NeuroLogica Corp., a subsidiary of Samsung Electronics, received U.S. FDA 510(k) clearance for its OmniTom Elite mobile computed tomography (CT) scanner, equipped with ultra-high-resolution Photon Counting Detector (PCD) technology.