Companion Diagnostics Market Size

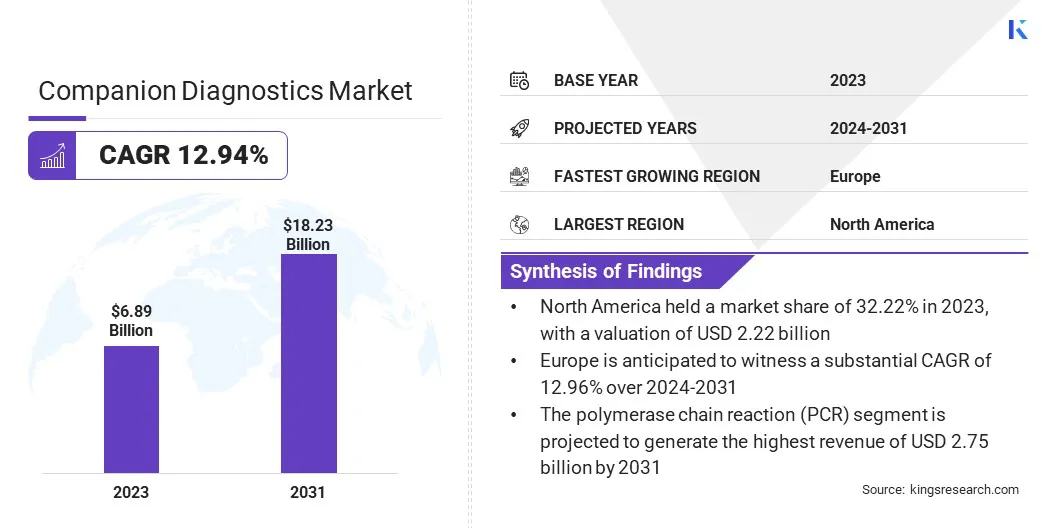

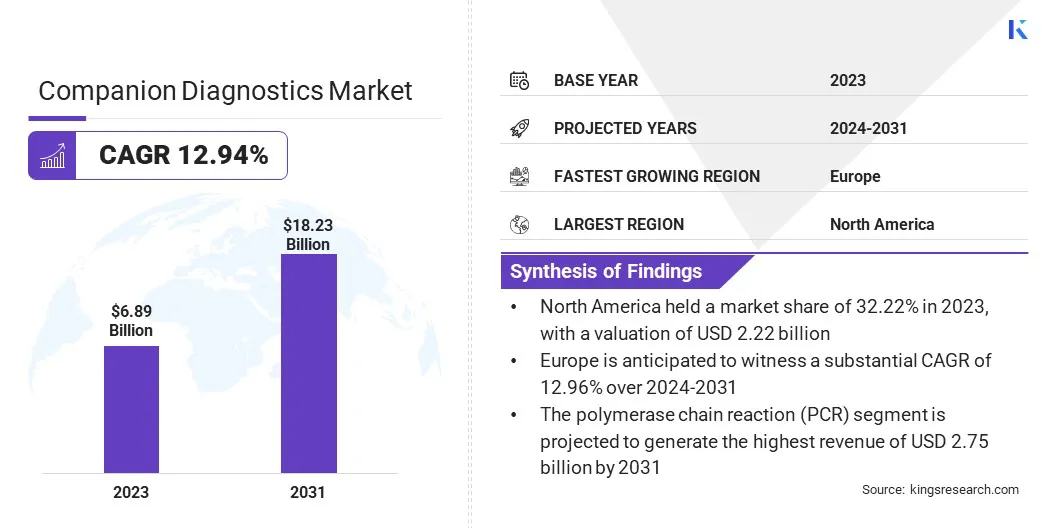

The Global Companion Diagnostics Market was valued at USD 6.89 billion in 2023 and is projected to reach USD 18.23 billion by 2031, growing at a CAGR of 12.94% from 2024 to 2031.

In the scope of work, the report includes products offered by companies such as Hoffmann-La Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific Inc., Abbott, Agilent Technologies, Inc., QIAGEN, BIOMÉRIEUX, Illumina, Inc., ARUP Laboratories, Myriad Genetics and Others. With an increasing emphasis on personalized medicine, fueled by advancements in genomics and molecular diagnostics, companion diagnostics have emerged as vital tools in tailoring treatment regimens to suit individual patients.

The companion diagnostics market is poised to experience substantial growth, driven by a notable shift toward precision healthcare and the rising prevalence of chronic diseases, particularly cancer, which necessitates more targeted and efficacious therapeutic interventions. Moreover, regulatory support and reimbursement policies are providing a favorable environment for market expansion, facilitating timely market access for innovative companion diagnostic products.

Strategic collaborations and partnerships between pharmaceutical companies, diagnostic manufacturers, and research institutions are further supporting market expansion, thereby fostering innovation and commercialization efforts. However, several challenges such as regulatory complexities and data privacy concerns persist, requiring concerted efforts to overcome these obstacles.

The global market encompasses the development, production, and commercialization of diagnostic tests that are closely linked to specific therapeutic drugs or treatments. These tests aid healthcare providers in identifying patients who are most likely to benefit from a particular therapy, by detecting biomarkers or genetic mutations indicative of treatment response or disease progression.

Companion diagnostics play a pivotal role in personalized medicine, by tailoring treatment regimens according to individual patient characteristics, thereby optimizing therapeutic outcomes.

Key components of the market include assay development, biomarker identification, regulatory approval processes, and integration into clinical practice. With a rising focus on precision healthcare and targeted therapies, the companion diagnostics market is characterized by ongoing innovation, strategic collaborations, and evolving regulatory frameworks to meet the demands of a rapidly advancing healthcare landscape.

Analyst’s Review

The market is projected to expand significantly over the forecast period, driven by the imperative to improve patient outcomes, increasing demand for personalized medicine and targeted therapies, and the optimization of healthcare resource allocation in an increasingly personalized and data-driven healthcare ecosystem.

Moreover, continued investment in research and development, coupled with a focus on regulatory compliance, is estimated to drive market expansion and deliver enhanced patient care.

Companion Diagnostics Market Growth Factors

Increasing focus on personalized medicine is propelling the growth of the companion diagnostics market. This paradigm shift toward personalized medicine is enhancing treatment outcomes. According to the American Association for Cancer Research (AACR) survey, 83% of oncologists stated its pivotal role in improving cancer care.

Widespread recognition among healthcare professionals is reflecting the growing acceptance and adoption of companion diagnostics as indispensable tools in tailoring treatment procedures to individual patient characteristics.

Furthermore, the growing prevalence of cancer worldwide is increasing the demand for advanced diagnostic tools, thereby contributing significantly to the widespread adoption of companion diagnostics. As the global burden of cancer is expected to surge in the coming years, there is an increasing demand for more precise and effective diagnostic solutions.

Companion diagnostics, which are designed to identify biomarkers indicative of treatment response or disease progression, are emerging as critical components in the treatment of cancer. As healthcare systems strive to address the challenges posed by the rising cancer burden, the integration of companion diagnostics into clinical practice is crucial, thereby driving market growth and innovation.

However, the market faces several challenges, including regulatory hurdles and a shortage of skilled professionals. The approval process for companion diagnostics is often complex and lengthy, which is hindering the entry of new technologies into the market. Moreover, the development and implementation of companion diagnostics require expertise in molecular biology, bioinformatics, and clinical diagnostics. The current shortage of skilled professionals in these areas poses a challenge to the smooth operation and development of companion diagnostics tests.

Companion Diagnostics Market Trends

Growing emphasis on early detection, coupled with the development of companion diagnostics tailored to identify patients in the initial stages of disease, is driving market growth. This focus on early detection enables healthcare providers to intervene more effectively, potentially improving treatment outcomes and patient prognosis.

By identifying biomarkers indicative of disease progression at an early stage, companion diagnostics facilitate timely interventions, thereby enhancing the efficacy of therapeutic strategies. Moreover, there is a growing trend toward conducting multiple testing, wherein assays combine tests for multiple biomarkers in a single platform. This approach offers a more comprehensive analysis of patient profiles, enabling healthcare providers to gather a broader spectrum of diagnostic information from a single test.

Furthermore, the consolidation of multiple tests into a single assay, offers the advantage of reduced test times, thereby leading to improved efficiency and optimized resource utilization in clinical settings. This trend toward multiple testing emphasizes the importance of streamlining diagnostic workflows and maximizing the utility of companion diagnostics in patient care.

Additionally, there is a notable shift toward the integration of companion diagnostics with digital platforms for enhanced data analysis and personalized treatment recommendations. By leveraging digital technologies, companion diagnostics are offering advanced data analytics capabilities, allowing for a more precise interpretation of diagnostic results and tailored treatment strategies.

Integration with digital platforms enables real-time data monitoring and analysis, empowering healthcare providers to make informed decisions and optimize patient care pathways. Furthermore, the growing adoption of liquid biopsies is driving the development of companion diagnostics specifically tailored for non-invasive sample collection methods.

Liquid biopsies, which utilize blood samples for analysis, offer a less invasive alternative to traditional tissue biopsies, thereby improving patient comfort and compliance. The development of companion diagnostics for liquid biopsies reflects the increasing demand for non-invasive diagnostic solutions and the expanding utility of biomarker analysis in liquid samples.

Segmentation Analysis

The global companion diagnostics market is segmented based on technology, end user, indication, and geography.

By Technology

Based on technology, the market is categorized into polymerase chain reaction (PCR), next-generation gene sequence, immunohistochemistry, and others. The polymerase chain reaction (PCR) segment garnered the highest revenue of USD 2.75 billion in 2023. This dominance can be attributed to the widespread adoption of PCR technology in molecular diagnostics, due to its high sensitivity, specificity, and efficiency in detecting genetic mutations and biomarkers associated with various diseases.

Additionally, PCR-based companion diagnostics offer rapid turnaround times and scalability, making them well-suited for clinical applications and high-throughput testing environments. As technological advancements continue to enhance the capabilities and performance of PCR-based assays, this segment is poised to maintain its dominance in the market over the forecast period, catering to the evolving needs of personalized medicine and precision healthcare.

By End User

Based on end user, the market is classified into pharmaceutical & biopharma companies, reference laboratories, and contract research organizations. The pharmaceutical & biopharma companies captured the largest companion diagnostics market share of 54.83% in 2023.

Pharmaceutical companies utilize companion diagnostics to identify patient populations most likely to benefit from their therapies, thereby enabling targeted drug development and personalized treatment approaches. Furthermore, collaborations between pharmaceutical companies and diagnostic manufacturers are supporting the expansion of the segment by facilitating the co-development and commercialization of companion diagnostics alongside therapeutic products.

By Indication

Based on indication, the market is divided into cancer, neurological diseases, infectious diseases, cardiovascular diseases, and others. The infectious diseases segment is set to register a substantial CAGR of 15.27% over 2024-2031. This growth is fueled by several factors, including the increasing prevalence of infectious diseases worldwide, the emergence of antimicrobial resistance, and the demand for rapid and accurate diagnostic solutions.

Companion diagnostics for infectious diseases play a critical role in guiding treatment decisions, optimizing antimicrobial therapy, and combating the spread of infectious pathogens. As infectious diseases continue to pose significant global health challenges, the adoption of companion diagnostics for infectious disease management is estimated to grow, thereby fostering expansion and innovation in this segment.

Efforts aimed at the development of novel biomarkers, enhancement of diagnostic accuracy, and improvement of assay performance are projected to contribute to the advancement of companion diagnostics for infectious diseases, thereby supporting the growth of the segment in the coming years.

Companion Diagnostics Market Regional Analysis

Based on region, the global companion diagnostics market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Companion Diagnostics Market share stood around 32.22% in 2023 in the global market, with a valuation of USD 2.22 billion. Advancements in pharmacogenomics, expanding medicare coverage, and the rise of boutique diagnostics labs are driving regional market growth.

The North America Companion Diagnostics Market share stood around 32.22% in 2023 in the global market, with a valuation of USD 2.22 billion. Advancements in pharmacogenomics, expanding medicare coverage, and the rise of boutique diagnostics labs are driving regional market growth.

The region boasts a robust presence in genetic research, which fosters the development of companion diagnostics linked to pharmacogenomics. This personalized approach to drug therapy, tailored to individual genetic variations, promises enhanced treatment outcomes and minimized side effects.

Moreover, recent policy changes, which extend medicare coverage for companion diagnostics, especially in oncology, are poised to enhance patient access and stimulate regional market growth. The rise of boutique diagnostics labs in North America signifies a notable shift toward specialized, niche testing services, thus fostering innovation and market competition while offering faster turnaround times and catering to specific therapeutic areas.

Europe is anticipated to witness a substantial CAGR of 12.96% over 2024-2031. The region is witnessing a significant rise in precision medicine initiatives, particularly led by countries such as the U.K. and Germany.

These large-scale government-supported initiatives are creating a conducive environment for the development and adoption of companion diagnostics, as they aim to tailor treatment approaches to individual patient characteristics. Moreover, harmonization efforts to standardize companion diagnostics regulations across Europe are facilitating streamlined market entry processes and ensuring wider availability of these tests across the region.

Competitive Landscape

The companion diagnostics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in Companion Diagnostics Market

- Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Abbott

- Agilent Technologies, Inc.

- QIAGEN

- BIOMÉRIEUX

- Illumina, Inc.

- ARUP Laboratories

- Myriad Genetics

Key Industry Development

- February 2024 (Collaboration) - Roche partnered with artificial intelligence expert PathAI to accelerate the advancement of digital pathology technologies,. This collaboration aims to facilitate patient-drug matching and bolster novel drug research efforts. As part of the expanded partnership, the entities intend to focus on creating authenticated biomarkers suitable for integration into companion diagnostics.

The global Companion Diagnostics Market is segmented as:

By Technology

- Polymerase Chain Reaction (PCR)

- Next-Generation Gene Sequence

- Immunohistochemistry

- Other Technologies

By End User

- Pharmaceutical & Biopharma Companies

- Reference Laboratories

- Contract Research Organizations

By Indication

- Cancer

- Neurological Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Other Diseases

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

The North America Companion Diagnostics Market share stood around 32.22% in 2023 in the global market, with a valuation of USD 2.22 billion. Advancements in pharmacogenomics, expanding medicare coverage, and the rise of boutique diagnostics labs are driving regional market growth.

The North America Companion Diagnostics Market share stood around 32.22% in 2023 in the global market, with a valuation of USD 2.22 billion. Advancements in pharmacogenomics, expanding medicare coverage, and the rise of boutique diagnostics labs are driving regional market growth.