Market Definition

The market encompasses a range of small and versatile machinery used in construction, landscaping, agriculture, and utility applications. This market includes equipment such as skid-steer loaders, compact excavators, compact track loaders, and backhoe loaders.

It covers new equipment sales and aftermarket services, addressing the needs for urban and confined-site operations across residential, commercial, and infrastructure development projects. The report explores key market drivers, offering detailed regional analysis and an overview of the competitive landscape shaping future opportunities.

Compact Construction Equipment Market Overview

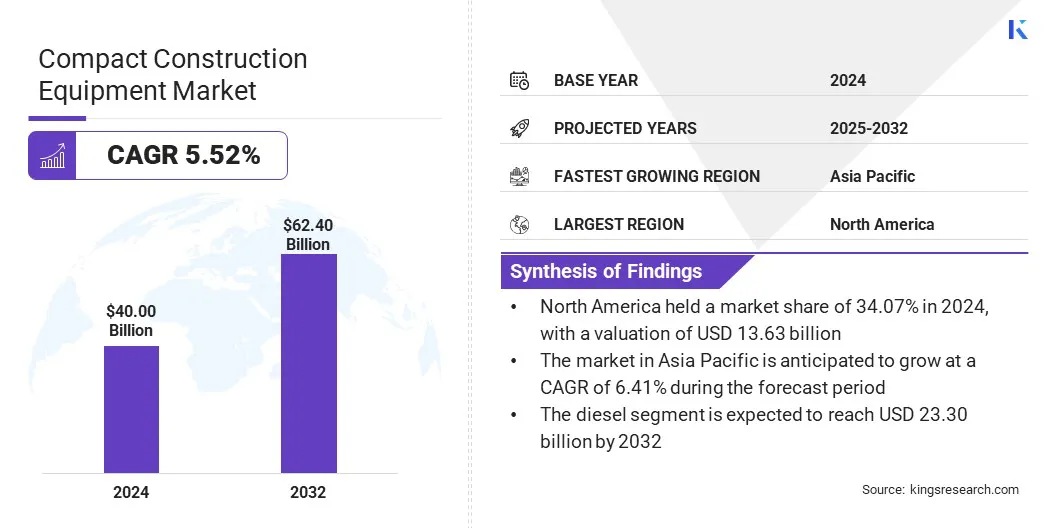

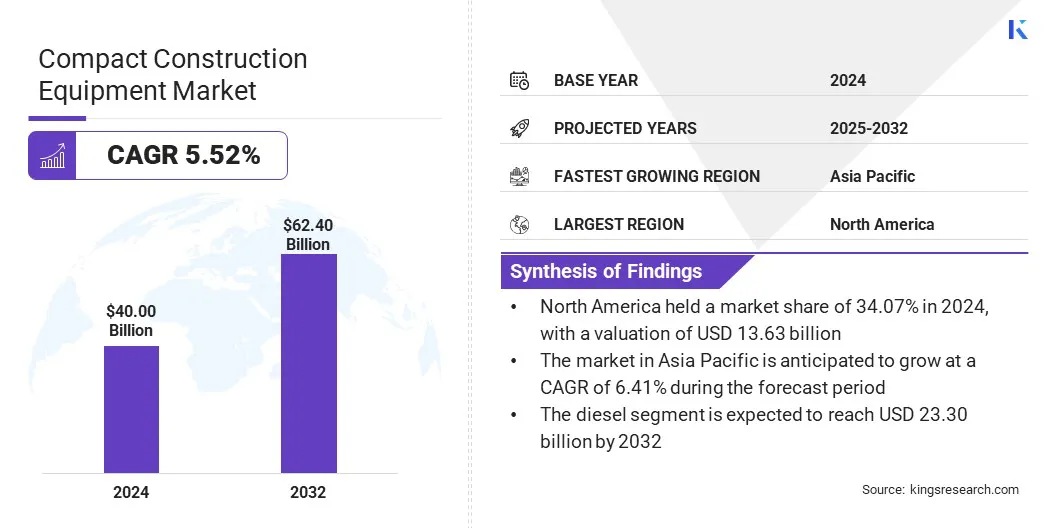

The global compact construction equipment market size was valued at USD 40.00 billion in 2024 and is projected to grow from USD 41.87 billion in 2025 to USD 62.40 billion by 2032, exhibiting a CAGR of 5.52% during the forecast period.

The market is experiencing steady growth, driven by increasing urbanization, rising infrastructure investments, and the expanding adoption of equipment suitable for confined sites. The demand for efficient machinery is growing across residential and commercial construction, particularly in developed and emerging economies.

Major companies operating in the compact construction equipment industry are Caterpillar, Komatsu, Deere & Company, XCMG Group, Liebherr Group, SANY Group, AB Volvo, Hitachi Construction Machinery Co., Ltd., J C Bamford Excavators Ltd., Doosan Bobcat, KUBOTA Corporation, CNH Industrial N.V., HD Hyundai Construction Equipment Co.,Ltd., Kobelco Construction Machinery Co., Ltd., and Wacker Neuson SE.

Advancements in technology are playing a key role in shaping the market, with features like digital monitoring systems, automated controls, and energy-efficient designs. The shift toward environmentally responsible construction is also encouraging electric and low-emission machines that are compliant and meet the sustainability goals of the industry.

- In May 2025, Helios Technologies, Inc. launched MultiSlide, a compact and easy-to-use quick coupling system for compact excavators. The system offers hands-free operation, simple retrofit installation, and enhanced operator comfort. It features pressure-rated couplings, corrosion-resistant coating, and a broad temperature range.

Key Highlights

- The compact construction equipment industry size was valued at USD 40.00 billion in 2024.

- The market is projected to grow at a CAGR of 5.52% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 13.63 billion.

- The mini excavators segment garnered USD 11.96 billion in revenue in 2024.

- The diesel segment is expected to reach USD 23.30 billion by 2032.

- The loading segment is expected to reach USD 17.54 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.41% during the forecast period.

Market Driver

Rising Preference for Rental Equipment Enhances Operational Flexibility

The compact construction equipment market is experiencing robust growth, driven by a marked shift toward equipment rental models. This mitigates substantial upfront capital, optimizing cash flow and financial flexibility. Additionally, rental arrangements alleviate the operational burden associated with maintenance, servicing, and asset management, as this is typically assumed by rental providers.

The ability to expand equipment usage according to project demands, without long-term asset commitments, enhances agility and efficiency. Consequently, the increasing adoption of rental equipment solutions is stimulating market expansion and enabling contractors to balance cost control with access to a diverse fleet of compact construction machinery.

- In April 2025, CASE Construction Equipment launched new compact wheel loaders, electric compact wheel loaders, telescopic small articulated loaders, and updated compact track and skid steer loaders, to enhance its rental fleet .

Market Challenge

High Maintenance Complexity and Downtime in Compact Equipment

A major challenge in the compact construction equipment market is the maintenance complexity due to the integration of advanced systems in smaller machines. As compact equipment becomes more sophisticated with electronically controlled hydraulics, emissions-reducing after treatment systems, and telematics, its routine maintenance and diagnostics become more demanding.

This increases the risk of extended downtime and raises maintenance costs, particularly for smaller contractors who depend on equipment uptime to meet project schedules.

To overcome this challenge, manufacturers are focusing on centralized maintenance points, swing-out panels, and modular component layouts to enhance accessibility. Additionally, remote diagnostics via telematics is enabling proactive maintenance by alerting operators and service teams about potential issues before failures occur.

Market Trend

Adoption of Electric and Low-Emission Equipment

The compact construction equipment market is significantly driven by the adoption of electric and low-emission machinery. This is prompted by stringent environmental regulations and the growing emphasis on sustainability initiatives. Market participants are investing in technologies that are compliant, reduce carbon footprint, and minimize environmental impact.

This transition aligns with global sustainability mandates and offers lower fuel costs, reduced noise levels, and enhanced workplace safety. As a result, the adoption of eco-friendly equipment is shaping procurement strategies and product innovation within the compact construction equipment sector.

- In May 2024, HD Hyundai Construction Equipment updated its A Series compact excavator range of lightweight to mid-sized excavators. The lineup is equipped with fuel-efficient engines, responsive load-sensing hydraulics, upgraded safety features, and integrated telematics for streamlined maintenance and monitoring.

Compact Construction Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Equipment

|

Mini excavators, Compact wheel loaders, Skid steer loaders, Compact track loaders, Backhoe loaders, Others

|

|

By Propulsion

|

Electric, Diesel, CNG/RNG

|

|

By Application

|

Loading, Excavation, Material handling, Lifting & hoisting, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Equipment (Mini excavators, Compact wheel loaders, Skid steer loaders, Compact track loaders, Backhoe loaders and Others): The mini excavators segment earned USD 11.96 billion in 2024, owing to its versatility and efficiency in confined construction sites.

- By Propulsion (Electric, Diesel and CNG/RNG): The diesel segment held 37.70% of the market in 2024, due to its widespread availability and reliable power output for heavy-duty tasks.

- By Application (Loading, Excavation, Material handling, Lifting & hoisting, and Others): The loading segment is projected to reach USD 17.54 billion by 2032, on account of the increased infrastructure development and demand for rapid material movement.

Compact Construction Equipment Market Regional Analysis

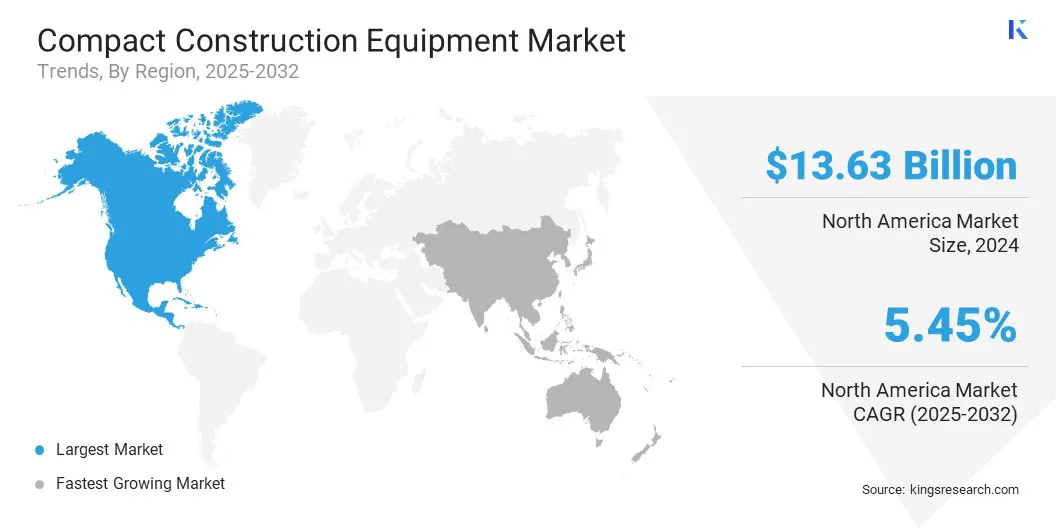

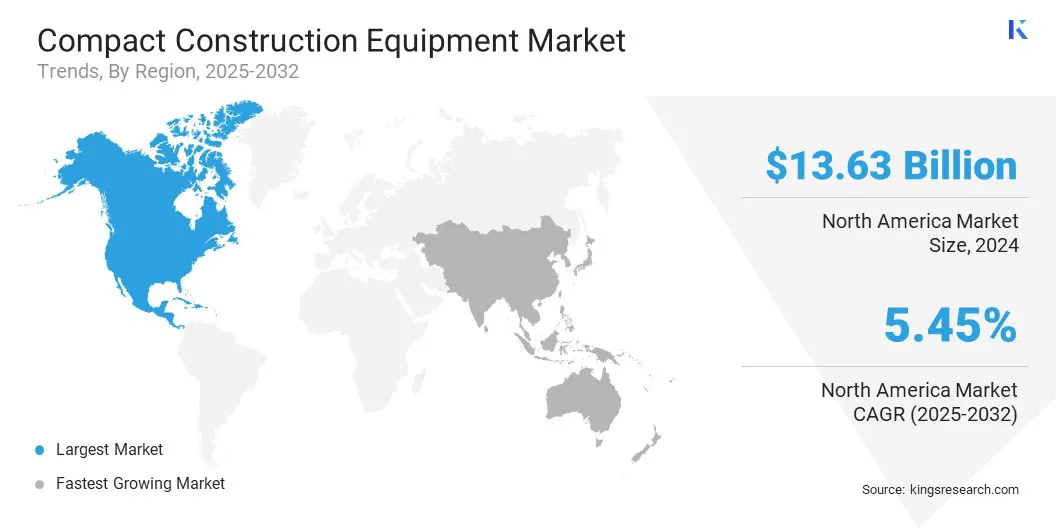

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America compact construction equipment market accounted for a substantial market share of 34.07% in 2024 in the global market, with a valuation of USD 13.63 billion. The region is supported by a mature construction environment with high efficiency, safety, and precision. Compact machines are widely used for residential redevelopment, utility installation, road maintenance, and landscaping.

The U.S. continues to see strong investment in infrastructure rehabilitation, driving demand for skid steer loaders, mini excavators, and track loaders. Additionally, a robust rental ecosystem allows contractors to scale operations flexibly without major capital outlay, while stringent emissions and safety standards prompt faster upgrades to more efficient models.

- In January 2025, Volvo Construction Equipment and Herc Rentals entered into a multi-year agreement involving the delivery of approximately 300 EC37 compact excavators. These 3.7-ton excavators were developed collaboratively to address the specific demands of the rental market. Incorporating direct feedback from Herc Rentals staff, the EC37 model features enhanced fuel efficiency, improved operator comfort, and simplified attachment changes—making it well-suited for diverse rental applications across North America.

Asia Pacific compact construction equipment industryis expected to register the fastest growth with a projected CAGR of 6.41% over the forecast period. This growth is driven by rapid industrialization, large-scale government infrastructure programs, and the continued migration to urban centers.

China and India are investing in roads, metros, affordable housing, and utilities, creating a steady demand for machines that can navigate densely populated and space-constrained sites.

Furthermore, higher equipment efficiency, better financing options, and OEMs offering localized solutions are strengthening the region’s growth in the market. As urban projects become more complex, compact machines are emerging as essential tools for completing tasks quickly and safely in high-density environments.

Regulatory Frameworks

- In the U.S., the regulatory authority for construction equipment safety and operation is the Occupational Safety and Health Administration (OSHA). OSHA ensures that employers provide a safe workplace and follow safety regulations for construction equipment. The Federal Motor Carrier Safety Administration (FMCSA) regulates off-road motorized equipment.

- In India, the Ministry of Road Transport and Highways (MoRTH) regulates construction equipment under the Central Motor Vehicles Rules (CMVR), which set safety standards for both the equipment and its operation on public roads.

Competitive Landscape

The compact construction equipment industry is characterized by key players focusing on innovation, geographic expansion, and strategic partnerships. Companies develop advanced machinery, including electric and hybrid models, to meet evolving market demands.

They also refine aftermarket services and digital support platforms to enhance customer retention and expand distribution channels to increase market reach. Manufacturers prefer modular designs for better efficiency and shorter launch times. Many players also utilize strategic collaborations and offer customized solutions to better address customer requirements and maintain their competitive advantage.

- In March 2025, LG Energy Solution and Doosan Bobcat signed a Memorandum of Understanding to develop standardized battery pack solutions for compact construction equipment, including skid-steer loaders and excavators, using LG’s cylindrical battery technology.

List of Key Companies in Compact Construction Equipment Market:

- Caterpillar

- Komatsu

- Deere & Company

- XCMG Group

- Liebherr Group

- SANY Group

- AB Volvo

- Hitachi Construction Machinery Co., Ltd.

- J C Bamford Excavators Ltd.

- Doosan Bobcat

- KUBOTA Corporation

- CNH Industrial N.V.

- HD Hyundai Construction Equipment Co.,Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Wacker Neuson SE

Recent Developments (Product Launch)

- In April 2025, CASE Construction Equipment introduced new compact wheel loaders, electric loaders, upgraded motor graders, and small articulated loaders with a telescopic arm. Enhancements to dozers, compact track loaders, and skid steer loaders will improve control, safety, telematics, and operator comfort for construction and utility crews.