Market Definition

The market comprises integrated solutions used to safeguard commercial properties, assets, and personnel. It includes surveillance equipment, access control systems, intrusion alarms, and fire safety technologies implemented across sectors such as retail, banking, corporate offices, and industrial sites.

The market also covers services such as system installation, maintenance, and remote monitoring across diverse environments. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Commercial Security System Market Overview

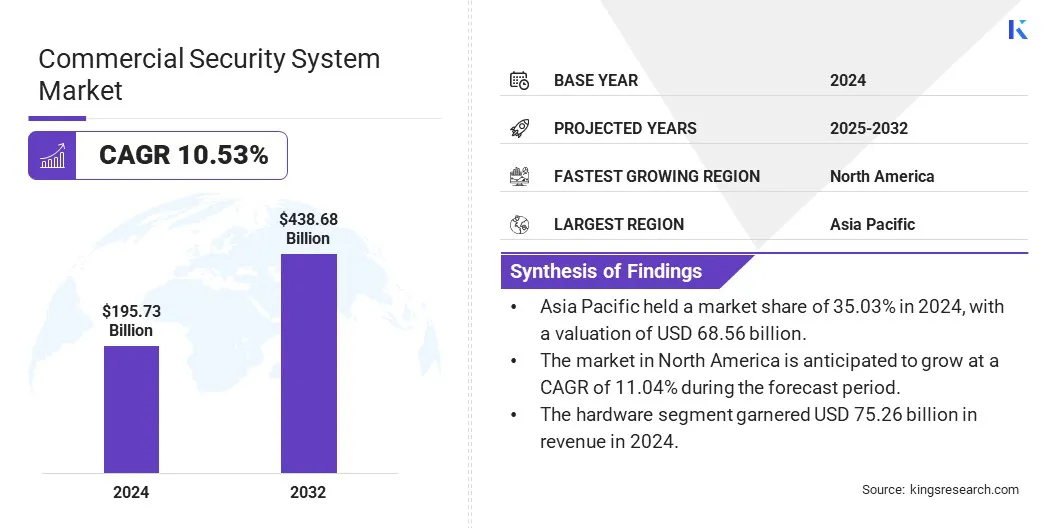

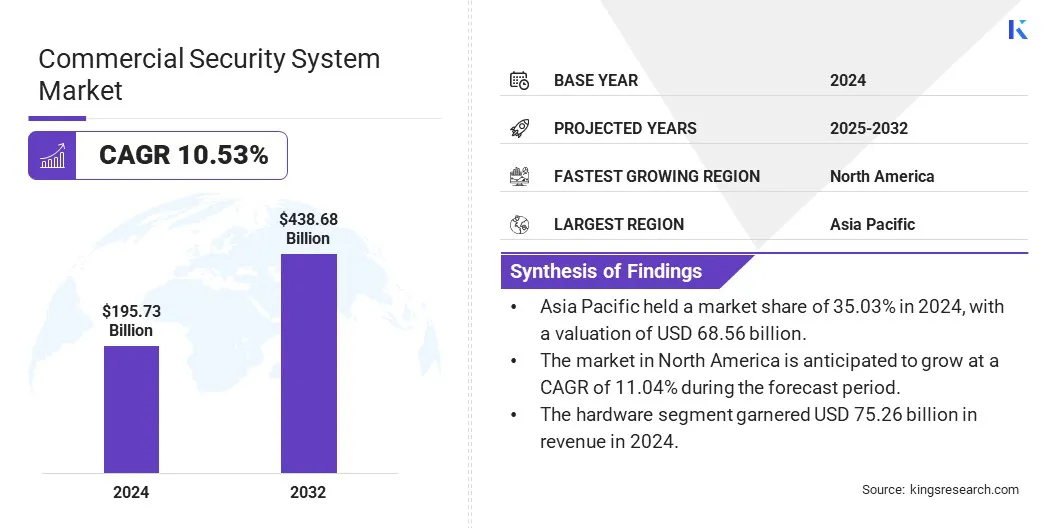

The global commercial security system market size was valued at USD 195.73 billion in 2024 and is projected to grow from USD 215.62 billion in 2025 to USD 438.68 billion by 2032, exhibiting a CAGR of 10.53% during the forecast period.

The market is witnessing significant expansion supported by the growing emphasis on safeguarding business assets, ensuring employee safety, and meeting regulatory standards. Rapid urban development and the proliferation of commercial facilities, especially in developing regions, are elevating the demand for sophisticated security solutions.

Key Market Highlights:

- The commercial security system market size was valued at USD 195.73 billion in 2024.

- The market is projected to grow at a CAGR of 10.53% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 68.56 billion.

- The hardware segment garnered USD 75.26 billion in revenue in 2024.

- The healthcare segment is expected to reach USD 106.56 billion by 2032.

- The market in North America is anticipated to grow at a CAGR of 11.04% during the forecast period.

Major companies operating in the commercial security system industry are Honeywell International Inc., Johnson Controls, Robert Bosch Stiftung GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, Axis Communications AB, ADT, Panasonic Holdings Corporation, Teledyne Technologies Incorporated, ASSA ABLOY, Allegion, Genetec Inc., Cisco Systems, Inc., Canon Inc., and Suprema Inc.

Advancements in digital technologies such as cloud-based surveillance, mobile-enabled access control, and real-time video analytics are improving system functionality and responsiveness.

Moreover, the increasing integration of smart building systems and the shift toward unified security management platforms are prompting businesses to adopt comprehensive, scalable solutions that enhance protection and operational oversight.

- In March 2025, Johnson Controls introduced upgrades to its commercial access control and video surveillance solutions, including the C•CURE IQ 3.10 platform with enhanced mapping, AI-driven analytics, and system health dashboards. The iSTAR G2 door controllers and Victor VideoEdge NVRs were improved for higher capacity and performance. A new integrated platform combining access control, video surveillance, and intrusion detection was also launched to enhance operational efficiency and threat response.

Market Driver

Rising Demand for Secure and Integrated Hybrid Cloud Security Architectures

The market is experiencing significant growth driven by the increasing need for secure and integrated connectivity across hybrid cloud environments.

As organizations expand their digital infrastructure, they are adopting hybrid cloud models to balance performance, cost-efficiency, and data sovereignty. This requires advanced security systems capable of safeguarding both on-premises assets and cloud-based operations.

As a result, there is a growing demand for solutions that provide unified visibility, consistent access controls, and proactive threat detection across diverse IT environments. These capabilities are critical for maintaining security standards, managing risk, and ensuring compliance in increasingly complex and distributed enterprise networks.

- In April 2025, Hewlett Packard Enterprise (HPE) expanded its HPE Aruba Networking and HPE GreenLake cloud platforms to enhance secure connectivity and hybrid cloud operations. The developments include enterprise-grade zero trust network access capabilities, threat-adaptive security for private clouds, and cybersecurity services tailored for sovereign cloud and AI environments.

Market Challenge

Challenge of High-Volume Security System Data

A key challenge in the commercial security system market is managing the vast amount of data generated by multi-layered security devices and sensors. Modern commercial systems often deploy numerous cameras, access controls, motion detectors, and other smart sensors, all producing continuous streams of data.

Effectively processing, storing, and analyzing this data in real time to detect genuine threats without overwhelming security personnel is a complex technical and operational hurdle.

The solution lies in leveraging edge computing and advanced analytics, which process data locally at the device level to filter and prioritize critical information before sending it to centralized systems.

This approach reduces latency, bandwidth usage, and false alarms, enabling faster decision-making and more efficient resource allocation, thereby improving overall security system effectiveness without requiring human oversight.

- In May 2025, IOTech Systems launched Edge Central 4.0, an open edge data platform designed to accelerate the deployment of AI-driven industrial edge solutions. The platform offers features such as Edge Historian Service for scalable data storage and enhanced security with advanced access controls. Optimized for demanding industrial environments, Edge Central 4.0 supports interoperability through alignment with EdgeX Foundry standards and provides developers with expanded capabilities via a new Python SDK and API.

Market Trend

Shift Toward Cloud-Native and Unified Security Architectures

A key trend in the market is the adoption of cloud-based, scalable, and unified security management platforms. This is driven by the need for streamlined operations, enhanced situational awareness, and improved coordination across security functions.

Organizations are increasingly integrating systems such as video surveillance, access control, and visitor management into centralized, cloud-native platforms that offer real-time visibility and remote management capabilities.

These unified solutions support seamless scalability across multi-site operations and enable consistent security policies, making them well-suited to modern commercial environments that prioritize agility, compliance, and operational efficiency.

- In March 2025, Motorola Solutions entered into a definitive agreement to acquire InVisit, a cloud-based visitor management solution provider. The acquisition aims to expand Motorola’s Avigilon Alta enterprise security suite by integrating scalable visitor management capabilities to enhance safety and operational efficiency across commercial offices, multi-tenant buildings, education, and healthcare sectors.

Commercial security system Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware (Fire Protection System, Access Control System, Biometrics, Building Management System, Others), Software (Fire Analysis, Video Analytics, Video Management Software, Others), Services (Professional, Managed)

|

|

By Application

|

Healthcare, Transportation, Retail, Government, BFSI, Energy & Utility, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, Services): The hardware segment earned USD 75.26 billion in 2024 due to the widespread deployment of surveillance cameras, access control systems, and alarm devices across commercial facilities.

- By Application (Healthcare, Transportation, Retail, Government, BFSI, Energy & Utility, and Others): The healthcare segment held 24.20% of the market in 2024, due to heightened security concerns around patient safety, controlled access to sensitive areas, and compliance with health data protection regulations.

Commercial Security System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 35.03% share of the commercial security system market in 2024, with a valuation of USD 68.56 billion. This dominance is largely driven by the accelerated growth of commercial infrastructure in countries like China, India, Japan, and South Korea.

The increasing development of high-density business parks, manufacturing hubs, and retail complexes, requiring scalable and reliable security solutions is driving the adoption of commercial security systems.

Additionally, the widespread digitization of commercial operations and rising demand for centralized monitoring systems among enterprises are significantly contributing to the increased adoption of commercial security technologies across this region.

The commercial security system industry in North America is expected to register the fastest growth, with a projected CAGR of 11.04% over the forecast period. This growth is driven by the region’s strong technological infrastructure and early adoption of advanced commercial security solutions.

U.S.-based enterprises are leading the deployment of integrated systems combining video surveillance, access control, and real-time analytics. The presence of major corporate headquarters, extensive data center networks, and technology-driven retail formats is fueling demand for sophisticated security infrastructure.

Additionally, the shift toward hybrid work models is increasing investment in remote security management and cloud-connected systems to safeguard distributed assets.

Regulatory Frameworks

- In the U.S., commercial security systems are regulated through a combination of standards and frameworks, including cybersecurity guidelines from the National Institute of Standards and Technology (NIST) and data privacy laws like the California Consumer Privacy Act (CCPA) impact how security systems handle personal information.

- In Europe, commercial security systems must comply with strict data protection regulations under the General Data Protection Regulation (GDPR), ensuring the privacy and security of personal data collected by surveillance and access control systems. The European Union Agency for Cybersecurity (ENISA) also provides cybersecurity guidance.

Competitive Landscape

The commercial security system market is characterized by key players adopting diverse strategies to maintain and grow their market share. Market players are investing in R&D to develop integrated, interoperable systems that combine video surveillance, access control, and alarm management.

Strategic acquisitions and partnerships are being pursued to expand geographic reach and enhance solution portfolios. They are also offering subscription-based models and managed services to secure recurring revenue streams.

Additionally, key players are offering customization options, ensuring seamless integration with existing infrastructure, and providing robust customer support to secure large-scale commercial deployments.

- In September 2024, Vitaprotech Group completed the acquisition and merger of Identiv’s Security and Identity Reader Business, relaunching the Hirsch brand. The move aimed to create a comprehensive high-security platform encompassing access control, video surveillance, perimeter protection, and identity solutions for commercial and government applications.

Key Companies in Commercial Security System Market:

- Honeywell International Inc.

- Johnson Controls

- Robert Bosch Stiftung GmbH

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd

- Axis Communications AB

- ADT

- Panasonic Holdings Corporation

- Teledyne Technologies Incorporated

- ASSA ABLOY

- Allegion

- Genetec Inc.

- Cisco Systems, Inc.

- Canon Inc.

- Suprema Inc.

Recent Developments (Partnership/Product Launch)

- In April 2025, Bosch introduced AI-enabled video surveillance solutions at ISC West, including the expanded IVA Pro suite with deep neural network-based analytics for accurate detection and automated decision-making. The new IVA Pro Context solution adds AI reasoning for scene interpretation, while enhanced IVA Pro Perimeter enables long-distance threat detection. Additional offerings include license plate recognition, vehicle identification, and appearance-based search to support proactive security and operational efficiency.

- In April 2025, Blaize Holdings, Inc. and VSBLTY Groupe Technologies Corp. entered into a joint commercial agreement to develop AI-enabled safety and security solutions. The partnership focuses on optimizing VSBLTY’s software for Blaize’s edge computing hardware, targeting large-scale applications such as municipal surveillance and border control. As part of this collaboration, a new technology center featuring a Digital Twin Lab is being established to support the development of flexible and scalable computer vision solutions.