Market Definition

Coiled tubing services use a continuous, flexible steel pipe wound on a spool to perform well intervention and maintenance tasks without dismantling existing production infrastructure. These services support operations such as wellbore cleanouts, acidizing, hydraulic fracturing, and real-time logging.

Coiled tubing is deployed across both onshore and offshore oilfields, offering faster response times and reduced operational costs. The service is widely used in shale gas development, mature field recovery, and emergency well control where efficiency and minimal disruption are critical.

Coiled Tubing Service Market Overview

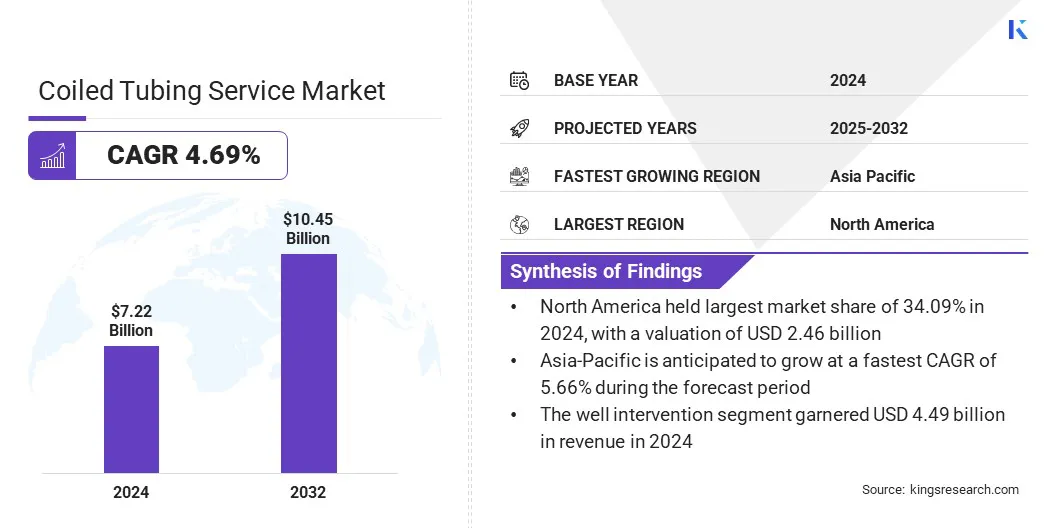

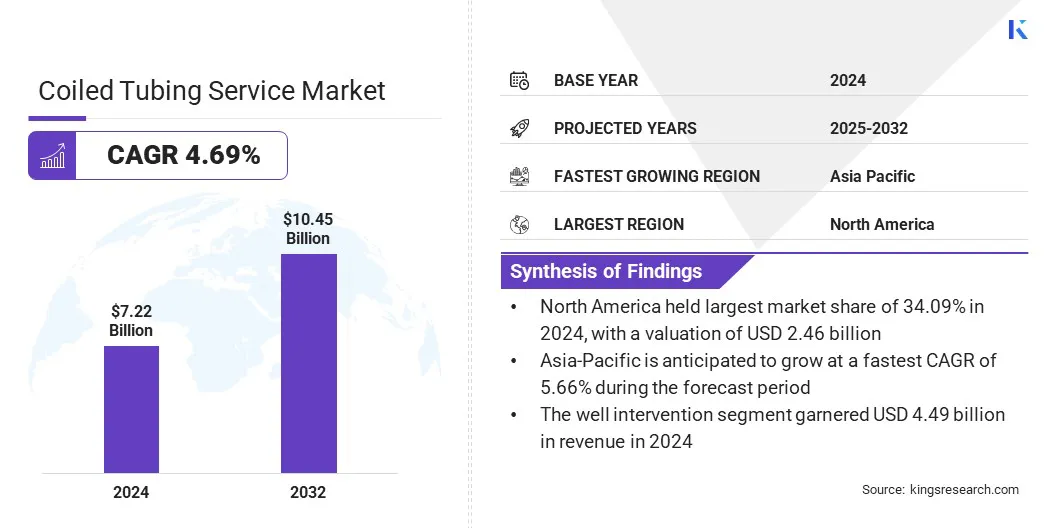

The global coiled tubing service market size was valued at USD 7.22 billion in 2024 and is projected to grow from USD 7.54 billion in 2025 to USD 10.45 billion by 2032, exhibiting a CAGR of 4.69% during the forecast period.

This growth is attributed to the rising adoption of coiled tubing services across key upstream oil & gas operations, particularly in well intervention and maintenance activities. Increasing demand for efficient wellbore cleanouts, stimulation treatments, and real-time downhole diagnostics is fueling the use of coiled tubing in both conventional and unconventional reservoirs.

Key Highlights

- The coiled tubing service industry size was valued at USD 7.22 billion in 2024.

- The market is projected to grow at a CAGR of 4.69% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 2.46 billion.

- The well intervention segment garnered USD 4.49 billion in revenue in 2024.

- The onshore segment is expected to reach USD 5.95 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.66% through the forecast period.

Major companies operating in the coiled tubing service market are Baker Hughes Company, Calfrac Well Services Ltd., Halliburton Energy Services, Inc., SLB, STEP ENERGY SERVICES, Tenaris, Weatherford, RPC, Inc., Oceaneering International, Inc., Trican, Superior Oilfield Services LLC, National Energy Services Reunited Corp., NOV., NexTier Completion Solutions, and Stewart & Stevenson.

The growing emphasis on extending the life of mature wells, optimizing production, and minimizing operational downtime is fueling the market. Additionally, advancements in coiled tubing equipment, improved deployment techniques, and increased offshore exploration spending are accelerating the market development.

- In March 2025, Tenaris showcased its latest coiled tubing technologies at the 2025 SPE/ICoTA Well Intervention Conference in the Woodlands, Texas. The lineup highlighted its high-reliability BlueCoil system, tailored for operations like milling, fishing, drilling, fracturing, logging, perforating, and stimulation.

Market Driver

Increased Demand for Well Intervention in Mature Fields

The coiled tubing service market is propelled by the increasing need for efficient well intervention solutions in aging oil & gas fields. Declining production rates, formation damage, and reservoir pressure loss in mature wells have heightened the demand for targeted intervention techniques that can restore productivity without extensive downtime.

Coiled tubing enables rapid execution of operations such as cleanouts, acid stimulation, and water shutoff while maintaining well integrity and reducing overall costs This growing reliance on coiled tubing in field rejuvenation is reinforced by global upstream operators seeking to maximize recovery from existing assets.

The strategic focus on extending well life and improving recovery factors is prompting continuous investment in advanced coiled tubing technologies, thereby accelerating the market growth.

- In February 2024, Expro announced the acquisition of Aberdeen-based Coretrax for USD 210 million to strengthen its well construction and intervention offerings. The deal brings in specialized technologies suited for coiled tubing operations and expands Expro’s global footprint.

Market Challenge

Mechanical Fatigue and Tubing Integrity Issues

Mechanical fatigue and tubing integrity issues pose substantial challenges to the performance and reliability of coiled tubing services, especially in high-pressure, high-temperature, and extended-reach wells. Repeated bending and straightening during deployment cycles induce structural stress, which weakens the tubing over time and increases the likelihood of failure during operations.

The need for continuous inspection, fatigue modeling, and use of corrosion-resistant materials drives up maintenance requirements and operational costs. These challenges can impact service continuity, safety, and overall project efficiency in demanding well environments.

Service providers are adopting advanced metallurgy, enhanced fatigue life prediction tools, and real-time monitoring systems that ensure early detection of tubing degradation. The integration of automated inspection technologies and data-driven maintenance strategies is improving reliability and reducing downtime. Additionally, the use of coiled tubing strings engineered for ultra-deep and sour wells is expanding operational capabilities while mitigating integrity risks.

Market Trend

Adoption of Intelligent Coiled Tubing Systems & Real-time Data Analytics

Adoption of intelligent coiled tubing systems and real-time data analytics is transforming the coiled tubing service market by improving operational control, safety, and efficiency in complex well environments.

Advanced sensors, downhole telemetry, and data-driven platforms enable continuous monitoring of pressure, temperature, and mechanical stress during interventions, allowing precise, adaptive decision-making. These technologies are enhancing the performance of coiled tubing operations in shale plays, deep-water wells, and high-pressure environments where precision and reliability are critical.

- In May 2025, Halliburton deployed its largest-ever coiled tubing (CT) intervention system in deep-water Gulf of Mexico operations. The system, designed for ultra-deep wells, enables extended reach, improved downhole control, and enhanced real-time monitoring. It marks a significant advancement in well-intervention capabilities, offering oil and gas operators greater efficiency and precision in challenging offshore environments.

The integration of digital platforms supports predictive maintenance, reduces non-productive time, and optimizes resource allocation across field operations. Additionally, real-time data visualization and automated control systems are streamlining intervention workflows and minimizing operational risks. The development of smart coiled tubing units with enhanced diagnostics and automation is paving the way for more agile, efficient, and cost-effective well services.

Coiled Tubing Service Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service

|

Well Intervention, and Drilling

|

|

By Application

|

Onshore, and Offshore

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Well Intervention, and Drilling): The well intervention segment earned USD 4.49 billion in 2024, due to the rising demand for cost-effective solutions to maintain and enhance production in aging oil & gas wells.

- By Application (Onshore, and Offshore): The onshore segment held a market share of 57.70% in 2024, due to the high volume of mature field operations and the cost-efficiency of deploying coiled tubing services in land-based wells.

Coiled Tubing Service Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America coiled tubing service market share stood at around 34.09% in 2024, valued at USD 2.46 billion. This market dominance is reinforced by the region’s extensive shale reserves, well-established upstream infrastructure, and widespread use of advanced drilling & well intervention technologies.

The presence of major oilfield service providers and continued investment in unconventional resource development further contribute to the high demand for coiled tubing services across North America.

The region’s focus on production optimization, well revitalization, and cost-efficient field operations reinforces its market leadership. Growing adoption of real-time data analytics, automation in well servicing, and the expansion of horizontal drilling & multi-stage fracturing activities continue to strengthen the regional market growth.

The coiled tubing service industry in Asia Pacific is set to grow at a CAGR of 5.66% over the forecast period. This growth is propelled by increasing upstream investments and strategic initiatives to enhance domestic oil & gas production across key countries in the region. Rising demand for energy, supported by industrial expansion and urbanization, is driving the need for efficient well intervention and maintenance solutions.

Government policies aimed at improving hydrocarbon recovery and reducing dependency on imports are further fueling the adoption of coiled tubing services. Moreover, the development of deep-water assets and unconventional reserves is accelerating the deployment of advanced coiled tubing technologies throughout the region.

- In April 2025, the Intervention & Coiled Tubing Association (ICoTA) re-established its China Chapter to support technical exchange, local training, and innovation in well-intervention. The move reflected growing market activity, with over 12,000 coiled tubing interventions conducted in China in 2024.

Regulatory Frameworks

- In the U.S., the OSHA Standard 29 CFR Part 1910 regulates workplace health and safety across general industry operations. It establishes mandatory requirements for personal protective equipment, machinery guarding, hazardous materials handling, and emergency preparedness.

- In the European Union (EU), Directive 2014/34/EU (ATEX “equipment” Directive) regulates equipment and protective systems intended for use in potentially explosive atmospheres. It requires machinery and components in hazardous environments, such as coiled tubing operations, to be designed and tested to prevent ignition of flammable gases and vapors, ensuring safe oil & gas operations.

- Globally, the International Organization for Standardization ISO 16530‑1:2017 regulates well integrity lifecycle governance. It provides minimum requirements and recommended techniques to manage well integrity before, during, and after interventions, including coiled tubing applications, ensuring that barrier assessment and containment are maintained throughout the well’s lifecycle.

Competitive Landscape

Companies operating in the coiled tubing service industry are actively enhancing their competitive position through technology upgrades, service portfolio expansion, and targeted regional growth strategies. Key players are investing in advanced coiled tubing equipment, real-time downhole telemetry, and automation solutions to improve operational efficiency, safety, and performance in complex well environments.

They are also developing intelligent coiled tubing systems with integrated data analytics and remote monitoring capabilities to meet the evolving needs of unconventional and offshore operations. Additionally, firms are forming strategic partnerships with exploration and production companies, securing long-term service contracts, and expanding their presence in high-growth regions to strengthen market share and profitability.

- In February 2023, MinEx CRC and Anglo American completed a 5,000 m coiled tubing drilling trial, achieving rapid penetration, minimal surface impact, and efficient core recovery. The trial demonstrated reduced water and diesel use, a smaller footprint, and effective hole closure compared to conventional rigs.

Key Companies in Coiled Tubing Service Market:

- Baker Hughes Company

- Calfrac Well Services Ltd.

- Halliburton Energy Services, Inc.

- SLB

- STEP ENERGY SERVICES

- Tenaris

- Weatherford

- RPC, Inc.

- Oceaneering International, Inc.

- Trican

- Superior Oilfield Services LLC

- National Energy Services Reunited Corp.

- NOV.

- NexTier Completion Solutions

- Stewart & Stevenson

Recent Developments (Launch)

- In April 2025, Alleima launched a mobile on-site tubing unit in Canada to support hydrogen projects. The system processes thick-walled coiled tubing directly at construction sites, cutting waste, simplifying logistics, and speeding up hydrogen station installations.