Market Definition

Coating additives are specialized substances added to coatings, such as paints, varnishes, and inks, in small quantities to enhance their performance, application properties, and durability.

These additives improve various characteristics of coatings such as adhesion, flow, leveling, UV resistance, corrosion protection, and surface appearance. Common coating additives include dispersants, defoamers, wetting agents, rheology modifiers, and biocides, each serving a specific function to optimize coating performance.

Coating Additives Market Overview

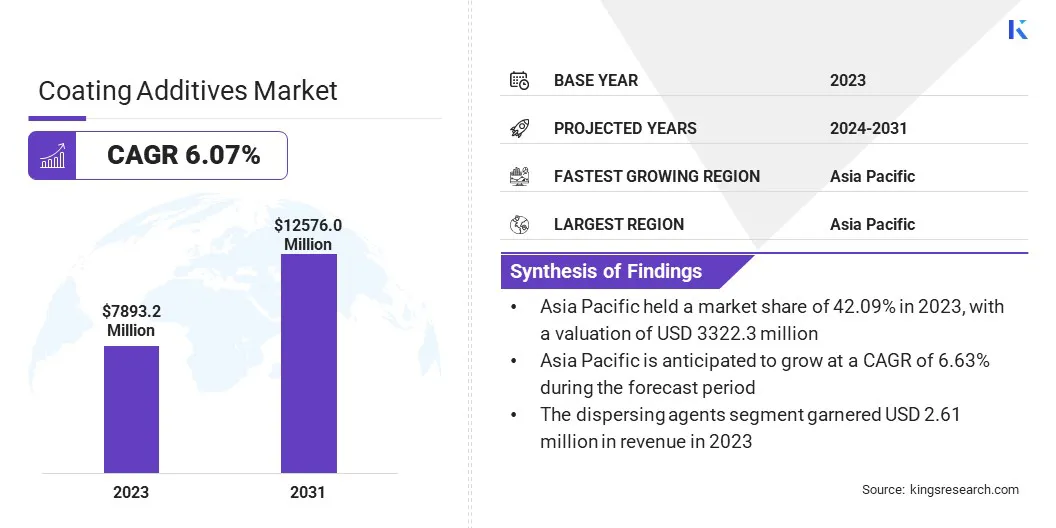

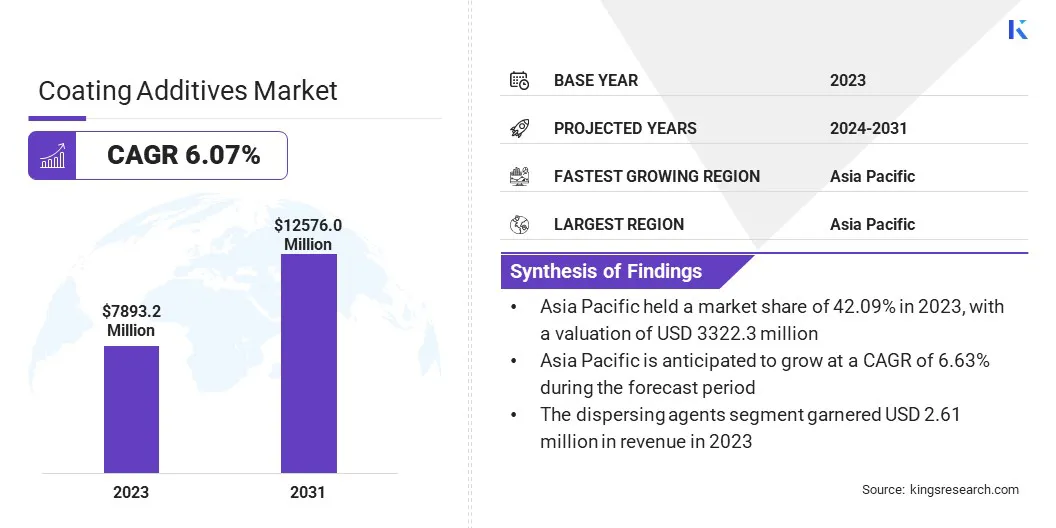

The global coating additives market was valued at USD 7,893.2 million in 2023 and is projected to grow from USD 8,326.6 million in 2024 to USD 12,576.0 million by 2031, exhibiting a CAGR of 6.07% during the forecast period.

The market is driven by increasing demand for eco-friendly and high-performance coatings across construction, automotive, and packaging industries. Stringent environmental regulations promote the adoption of low-VOC and sustainable additives, encouraging innovation in waterborne and bio-based formulations.

Additionally, rapid urbanization and infrastructure development, particularly in emerging economies, fuel the need for durable and weather-resistant coatings, further accelerating market growth.

Major companies operating in the global coating additives industry are Akzo Nobel N.V., Axalta Coating Systems Ltd., Allnex, The Lubrizol Corporation, BASF, Dow, Evonik, Clariant AG, Eastman Chemical Company, Solvay S.A., Huntsman Corporation, Ashland Global Holdings Inc., Momentive Performance Materials Inc., Arkema, Croda International Plc, and others.

The expansion of the global electronics sector is fueling the demand for specialized coating additives. Electronics manufacturers require coatings with superior protective and insulating properties to enhance the durability of devices.

Coating additives improve scratch resistance, thermal stability, and moisture protection in electronic components, ensuring long-lasting performance. The market is fueled by the increasing ownership of smartphones, wearables, and home appliances.

Growing preference for high-quality finishes and durable coatings drive innovation in functional additives. Businesses invest in coatings that offer anti-smudge, anti-static, and conductive properties, ensuring reliability in electronic products.

Key Highlights:

- The global coating additives market size was recorded at USD 7,893.2 million in 2023.

- The market is projected to grow at a CAGR of 6.07% from 2024 to 2031.

- Asia Pacific held a market share of 42.09% in 2023, with a valuation of USD xx.xx million.

- The dispersing agents segment garnered USD 2,061.7 million in revenue in 2023.

- The water-based coatings segment is expected to reach USD 5,953.5 million by 2031.

- The automotive coatings segment is poised for a robust CAGR of 7.21% over the forecast period.

- Europe is anticipated to grow at a CAGR of 5.84% during the forecast period.

Market Driver

"Rising Adoption of Anti-Microbial Coatings"

Growing health concerns and hygiene awareness drive the demand for anti-microbial coatings in healthcare, food packaging, and public infrastructure. Additives enhance microbial resistance, preventing the growth of bacteria and fungi on coated surfaces.

The coating additives market also benefits from advancements in silver-ion and nanotechnology-based anti-microbial solutions. Hospitals, schools, and commercial spaces increasingly adopt coatings with built-in microbial protection to improve sanitation and safety.

Businesses develop next-generation additives to meet stringent hygiene standards, reinforcing market growth. The expansion of the healthcare and consumer safety sectors further accelerates the demand for anti-microbial coating solutions.

- In June 2024, NEI Corporation unveiled NANOMYTE AM-100EC, a micron-thick, easy-to-clean antimicrobial coating. Designed for high-touch surfaces such as plastics, metals, and ceramics, it meets the hygiene demands of industries requiring strict sanitation standards. The coating delivers exceptional abrasion resistance and achieves a 99.99% reduction in E. coli, making it ideal for applications in healthcare, food service, and public transportation.

Market Challenge

"High Raw Material Costs and Supply Chain Disruptions"

The coating additives market faces a significant challenge due to rising raw material costs and supply chain disruptions. Fluctuations in the prices of key ingredients, such as specialty chemicals and bio-based raw materials, impact production costs and profit margins.

Additionally, global supply chain constraints, geopolitical tensions, and transportation bottlenecks further strain material availability. To mitigate these challenges, companies are diversifying sourcing strategies, establishing regional supply networks, and investing in local production facilities.

Many manufacturers are also exploring alternative raw materials and sustainable feedstock to reduce dependency on volatile supply chains and ensure cost-effective, long-term solutions.

Market Trend

"Shift Toward Environmentally Friendly and Low-VOC Coatings"

Stringent environmental regulations and sustainability initiatives influence manufacturers to adopt eco-friendly coatings. Waterborne and bio-based coatings require additives that enhance performance and minimize volatile organic compound (VOC) emissions. Businesses align with regulatory frameworks that promote cleaner production and lower the environmental impact.

The coating additives market expands as industries prioritize sustainable formulations without compromising quality and durability. Consumer awareness of green products fuels the demand for coatings with low toxicity and improved safety. Innovation in biodegradable and non-toxic additives strengthens market growth, offering eco-friendly solutions for various applications, including architectural, automotive, and industrial coatings.

- In April 2024, BASF's Coatings division launched a new range of eco-efficient clearcoats and undercoats to enhance quality, boost productivity, and significantly lower CO₂ emissions. This extensive portfolio is intended to help body shops improve profitability while advancing sustainability efforts.

Coating Additives Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Dispersing Agents, Rheology Modifiers, Surfactants, Anti-Foaming Agents, Defoamers, Crosslinking Agents, Others

|

|

By Formulation

|

Water-Based Coatings, Solvent-Based Coatings, Powder Coatings, Radiation-Curable Coatings, High-Solid Coatings, Others

|

|

By Application

|

Architectural Coatings, Industrial Coatings, Automotive Coatings, Wood Coatings, Plastic Coatings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Dispersing Agents, Rheology Modifiers, Surfactants, Anti-Foaming Agents, Defoamers, Crosslinking Agents, and Others): The dispersing agents segment earned USD 2,061.7 million in 2023 due to its critical role in enhancing pigment stability, improving color strength, and ensuring uniform dispersion, driving its demand across high-performance coating applications in automotive, construction, and industrial settings.

- By Formulation (Water-Based Coatings, Solvent-Based Coatings, Powder Coatings, Radiation-Curable Coatings, High-Solid Coatings, and Others): The water-based coatings segment held 09% of the market in 2023, due to stringent environmental regulations limiting VOC emissions, increasing demand for sustainable solutions, and superior performance characteristics such as low toxicity, durability, and ease of application across industries.

- By Application (Architectural Coatings, Industrial Coatings, Automotive Coatings, Wood Coatings, Plastic Coatings, Others): The automotive coatings segment is poised for significant growth at a CAGR of 7.21% over the forecast period, attributed to the increasing demand for high-performance coatings that enhance durability, corrosion resistance, and aesthetic appeal, driven by rising vehicle production, stringent environmental regulations, and the growing adoption of waterborne and eco-friendly coating solutions.

Coating Additives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific coating additives market share stood around 42.09% in 2023 in the global market, with a valuation of USD 3,322.3 million. Asia-Pacific is home to some of the world’s largest automotive manufacturers, including China, Japan, South Korea, and India.

The demand for coatings in original equipment manufacturing (OEM) and refinishing applications is rising as automakers adopt high-quality, durable finishes. Coating additives improve scratch resistance, corrosion protection, and gloss retention in automotive coatings. The shift toward electric vehicles (EVs) further accelerates innovation in coating technologies, boosting the growth of the market in the region.

Furthermore, the rising demand for high-performance coatings in residential and commercial construction directly contributes to the market growth in the region.

Asia-Pacific is experiencing unprecedented urban expansion, with governments investing heavily in smart cities, highways, and commercial buildings. Countries like China, India, and Indonesia are allocating significant budgets to large-scale infrastructure projects. Coating additives enhance the durability, aesthetics, and protective properties of coatings used in these developments.

- Data from UN-Habitat and ESCAP indicates that the Asia-Pacific is undergoing rapid urbanization, and accounts for over 50% of the global urban population. This figure is expected to rise substantially by 2050, positioning the region as a key center for urban development.

The coating additives industry in europe is poised for significant growth at a robust CAGR of 5.84% over the forecast period. The EU enforces some of the world’s strictest environmental regulations, pushing industries to adopt sustainable and low-VOC coatings.

Regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the Eco-design Directive drive demand for eco-friendly additives that enhance coating performance without harmful emissions. Companies focus on bio-based and waterborne additives to meet sustainability goals, accelerating market growth.

Additionally, with a strong presence in shipbuilding and marine transportation, European consumers require high-performance coatings that can withstand harsh maritime conditions. Coating additives enhance anti-fouling, corrosion resistance, and hydrophobic properties in marine coatings.

As a result, countries such as Norway, Italy, and the Netherlands are investing in advanced ship coatings that are compliant with global environmental standards, driving the demand for innovative additives.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) enforces the National Emission Standards for Hazardous Air Pollutants (NESHAP) under the Clean Air Act, targeting emissions from surface coating operations. Additionally, the Occupational Safety and Health Administration (OSHA) regulates workplace exposure to hazardous chemicals in the coatings industry.

- In Europe, the EU implements the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, mandating the registration and assessment of chemicals used in coatings. The Classification, Labeling, and Packaging (CLP) regulation ensures proper hazard communication. Recent reports highlight delays in the EU's chemical control processes, raising concerns about public health and environmental protection.

- China's regulatory framework for coating additives is implemented by the Ministry of Ecology and Environment (MEE), which enforces regulations on chemical substances to ensure environmental safety and public health.

- The Ministry of Health, Labour and Welfare (MHLW) in Japan regulates chemicals under the Chemical Substances Control Law (CSCL), ensuring that substances used in coatings are assessed for safety and environmental impact.

- India's Central Pollution Control Board (CPCB) under the Ministry of Environment, Forest and Climate Change (MoEFCC) oversees regulations about the use of hazardous chemicals in industries, including coating additives, to prevent environmental pollution and health hazards.

Competitive Landscape:

The global coating additives market is characterized by various participants, including both established corporations and rising organizations. Market players are implementing strategies focused on innovation and the development of advanced coating additives, driving market growth.

By investing in research and development, companies are introducing high-performance additives that enhance durability, sustainability, and efficiency in coatings. These advancements cater to the evolving industry demands, including eco-friendly formulations and superior functional properties, strengthening the competitive landscape and accelerating market expansion.

- In April 2024, Evonik Coating Additives launched two advanced defoamers, TEGO Foamex 16 and TEGO Foamex 11 . These innovative additives enhance the sustainability and performance of waterborne architectural coatings.

List of Key Companies in Coating Additives Market:

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- Allnex

- The Lubrizol Corporation

- BASF

- Dow

- Evonik

- Clariant AG

- Eastman Chemical Company

- Solvay S.A.

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Momentive Performance Materials Inc.

- Arkema

- Croda International Plc

Recent Developments (Collaboration/Expansion/Product Launch)

- In October 2024, BASF unveiled plans to expand its advanced additives plant at the Nanjing site. Fueled by the increasing market demand across Asia and globally, the expansion will feature a state-of-the-art production line dedicated to BASF’s high-performance Controlled Free Radical Polymerization (CFRP) dispersants, using its proprietary and advanced technologies.

- In November 2024, Eastman’s Solus additives collaborated with UPM Specialty Papers to develop a flexible, food-safe packaging solution. This innovative approach integrates the compostable and biobased Solus portfolio with BioPBS, enabling extrusion coating onto UPM’s barrier base papers.

- In November 2023, Clariant revealed plans to present its latest range of wetting and dispersing agentsfor water-based formulations in industrial coatings for containers, transportation, and construction. The showcased portfolio includes an expanding selection of PTFE-free additives, providing safer and more sustainable solutions for paints and coatings.