Market Definition

Coated glass is glass treated with one or more thin layers of metallic, ceramic, or polymer coatings on its surface to enhance its functional or aesthetic properties. These coatings are applied using techniques such as chemical vapor deposition (CVD), physical vapor deposition (PVD), or pyrolytic processes.

Coated glass is widely used in applications such as building facades, windows, automotive glazing, solar panels, and electronic displays to improve energy efficiency, comfort, and performance.

Coated Glass Market Overview

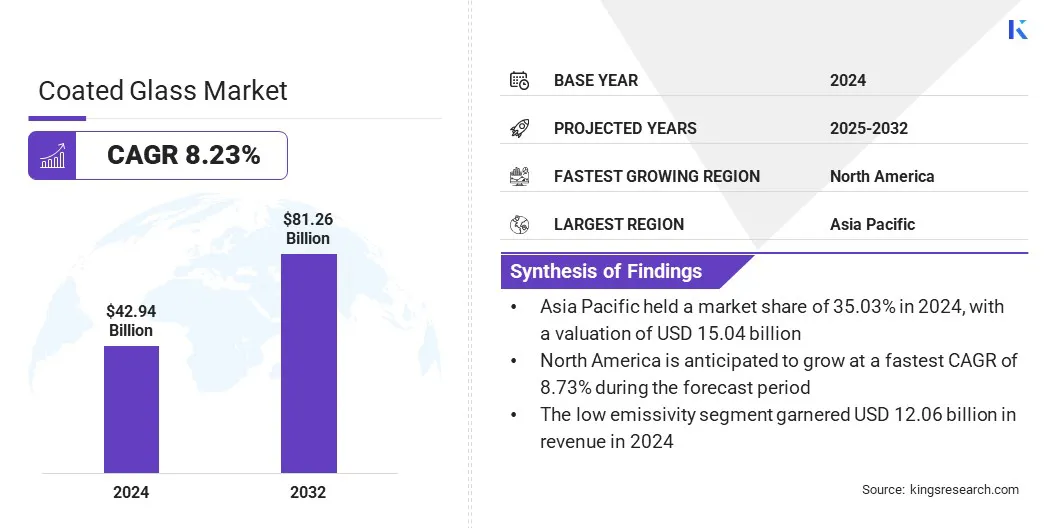

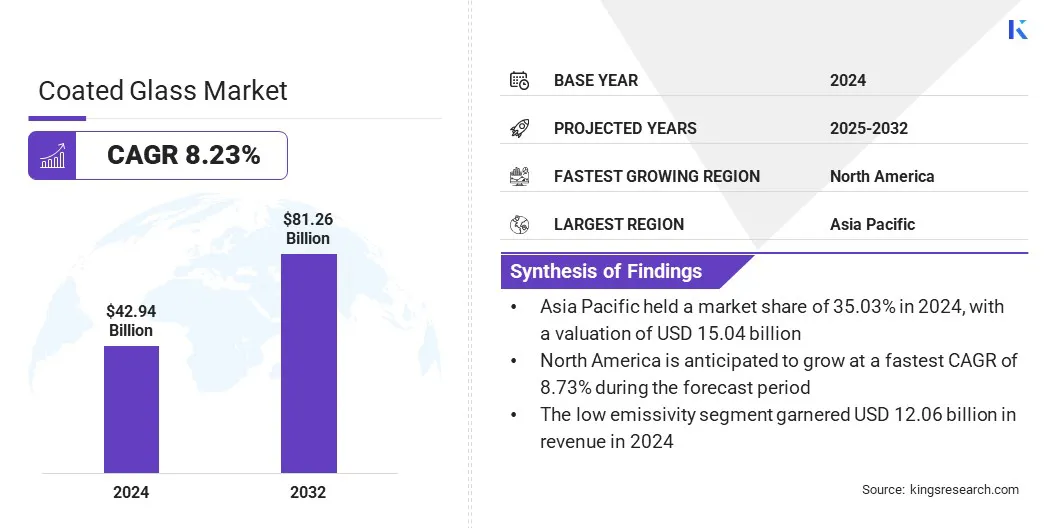

According to Kings Research, the global coated glass market size was valued at USD 42.94 billion in 2024 and is projected to grow from USD 46.35 billion in 2025 to USD 81.26 billion by 2032, exhibiting a CAGR of 8.23% over the forecast period.

The increasing focus of government on reducing energy consumption and environmental impact is driving the adoption of high-performance coated glass in residential and commercial buildings. The growing demand for durable, high-performance, and precision glass in smartphones, tablets, and other electronic devices is driving the adoption of advanced coatings.

Key Market Highlights:

- The coated glass industry size was recorded at USD 42.94 billion in 2024.

- The market is projected to grow at a CAGR of 8.23% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 15.04 billion.

- The low emissivity segment garnered USD 12.06 billion in revenue in 2024.

- The architectural segment is expected to reach USD 20.27 billion by 2032.

- North America is anticipated to grow at a CAGR of 8.73% over the forecast period.

Major companies operating in the coated glass market are AGC Glass, Saint-Gobain S.A, Guardian Industries Holdings, Nippon Sheet Glass Co., Ltd, Vitro, CARDINAL GLASS INDUSTRIES, INC, Schott AG, Şişecam, Asahi India Glass Limited, CEVITAL GROUP, Guardian Industries, Corning Incorporated, Xinyi Glass Holdings Limited, Sunglass Industry S.R.L., and Borosil Renewables Limited.

Increasing investment in coated glass production by market players is further driving market growth. Companies are expanding production capacity, enhancing operational efficiency, and diversifying high-value product offerings to meet rising demand.

These strategic investments strengthen market presence, improve competitiveness, and support the broader adoption of advanced coated glass solutions across architectural and automotive applications.

- In March 2024, Şişecam invested USD 114 million to expand three coated glass production lines in Turkey, Italy, and Bulgaria. The investment is aimed at increasing the production capacity by nearly 20 million m² and strengthening its market presence.

Market Driver

Expansion of Solar Energy Adoption

A major driver in the market is the expansion of solar energy adoption worldwide. The growing deployment of solar photovoltaic (PV) systems and concentrated solar power projects is increasing demand for high-performance glass that enhances light transmission, reduces reflection, and ensures durability under environmental stress.

Manufacturers and developers are increasingly using coated glass solutions, such as anti-reflective and low-iron variants, to improve the efficiency and longevity of solar modules, supporting the global shift toward renewable energy.

- The International Energy Agency (IEA) projected global investment in solar energy to reach USD 450 billion in 2025, making it the largest single clean energy investment item. This surge in solar investment is expected to drive demand for advanced coated glass solutions.

Market Challenge

High Production Costs

A key challenge in the coated glass market is the high cost of production associated with advanced coating technologies. This process of applying metallic, ceramic, or polymer coatings using chemical vapor deposition (CVD), physical vapor deposition (PVD), or pyrolytic methods requires specialized equipment, skilled labor, and strict process control. These high production costs can increase the final price of coated glass and limit adoption among smaller manufacturers.

To address this challenge, market players are investing in advanced chemical vapor deposition, physical vapor deposition, and pyrolytic coating technologies, along with automation and robotics to reduce labor and operational expenses. They are optimizing chemical formulations and deposition processes to improve material utilization and minimize waste.

Additionally, some players are expanding production in regions with lower operational costs and establishing vertically integrated facilities to achieve economies of scale and improve overall cost efficiency.

Market Trend

Rising Adoption of Solar Control Coatings

A key trend influencing the market is the rising adoption of solar control coatings for energy-efficient buildings. Manufacturers are developing glass with high visible light transmission and low solar heat gain to reduce cooling requirements and support sustainability.

This shift prompts innovation in selective and low-emissivity coatings, enhancing indoor comfort, aesthetics, and complies with stricter building regulations across commercial and residential construction projects.

- In March 2024, Saint-Gobain Glass launched COOL-LITE SKN 175, a new solar control coated glass with a high selectivity of 2.00. The product combines 70% light transmission with a 35% solar factor. It supports energy efficiency, reduces CO₂ emissions, and compliance with tighter building regulations.

Coated Glass Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Low Emissivity, Low Emissivity, Reflective, Self-Cleaning, Others

|

|

By Application

|

Architectural, Automotive, Solar Panels, Electronics, Optical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Low Emissivity, Low Emissivity, Reflective, Self-Cleaning, and Others): The low emissivity segment earned USD 12.06 billion in 2024 due to increasing demand for energy-efficient buildings and regulatory compliance for sustainable construction.

- By Application (Architectural, Automotive, Solar Panels, Electronics, and Others): The architectural segment held 24.88% of the market in 2024, due to rising construction activities and the adoption of energy-saving and solar control glass in commercial and residential projects.

Coated Glass Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific coated glass market share stood at 35.03% in 2024 in the global market, with a valuation of USD 15.04 billion. This dominance is due to the rapid growth of the construction and real estate sector, which is increasing demand for advanced architectural glass solutions.

Expanding industrialization and urbanization are boosting the need for high-performance glazing in commercial and infrastructure projects. Technological advancements, such as chemical vapor deposition (CVD), physical vapor deposition (PVD), and pyrolytic coating methods, are enabling manufacturers to offer innovative coated glass products with enhanced durability, improved scratch resistance, and superior aesthetics.

Additionally, the increasing focus on sustainability and eco-friendly production practices is driving the adoption of certified high-performance coated glass across the region.

- In September 2024, AGC Glass Asia received Cradle to Cradle Certified Bronze for its float and coated glass products manufactured in Indonesia and Thailand. The certification validates the products’ sustainability credentials and supports their use in green building projects, including LEED, WELL, and Green Star.

North America is set to grow at a robust CAGR of 8.73% over the forecast period. This growth is attributed to the rising demand for energy-efficient and sustainable building materials. Increased adoption of solar control and low-emissivity (Low-E) glass in commercial and residential construction is further boosting growth of coated glass industry.

Expansion of coated glass use in electronic displays and specialty optics is creating new opportunities for manufacturers and suppliers to meet high-performance and precision requirements.

Additionally, strategic investments and acquisitions by key players to enhance high-performance coating capabilities and vertically integrate production are accelerating technological advancement and market growth in the region.

- In September 2024, Apogee Enterprises acquired UW Solutions for USD 240 million to expand its specialty coatings and materials portfolio. The deal integrates Apogee’s Large-Scale Optical segment with UW’s high-performance coated substrates.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) enforces the Consumer Product Safety Improvement Act and related regulations, including 16 CFR 1201, which govern coatings, laminations, and glazing types such as organic-coated glass. The CPSC ensures that materials used in consumer products, such as doors, shower enclosures, and architectural components, meet performance and safety standards.

- In the UK, the Office for Product Safety and Standards (OPSS) enforces the Construction Products Regulations (amended 2022), ensuring that coated glass meets safety, performance, and quality requirements. The OPSS conducts market surveillance, inspections, and regulatory enforcement to protect public safety and maintain building integrity.

- In China, the State Administration for Market Regulation (SAMR) oversees national standards for construction and coated glass products. It implements standards such as GB/T 41314-2022, GB/T 18915.1-2013, and GB/T 43083-2023, regulating requirements, testing, and labeling for coated and self-cleaning solar-control glass.

- In India, the Bureau of Indian Standards (BIS) mandates ISI-mark certification for coated and safety glass under the Safety Glass (Quality Control) Order (IS 2553 Parts 1 & 2). BIS ensures compliance with mechanical, physical, and safety standards for both domestic and imported glass used in architecture, buildings, and automotive applications.

Competitive Landscape

Major players operating in the coated glass market are expanding regional operations to strengthen their manufacturing footprint and enhance market reach for high-performance and specialty glass products. They are enhancing technical capabilities by integrating advanced thin-film coatings with specialized etching solutions to offer high-performance glass for displays, optics, and touchscreen devices.

Market players are forming strategic acquisitions and partnerships to combine complementary technologies, such as thin-film coatings and etched anti-glare solutions, and accelerate innovation in high-performance glass for displays, optics, and touchscreen products.

Additionally, players are focusing on scaling production and maintaining quality standards to meet growing demand for high-performance and precision products.

- In May 2025, Abrisa Technologies acquired Agama Glass Technologies to expand its East Coast operations and add etched anti-glare glass capabilities. The acquisition combines Abrisa’s thin-film coating expertise with Agama’s AgamaEtch solutions to enhance technical glass processing for display, optics, and touchscreen applications.

Top Companies in Coated Glass Market:

- AGC Glass

- Saint-Gobain S.A

- Guardian Industries Holdings

- Nippon Sheet Glass Co., Ltd

- Vitro

- CARDINAL GLASS INDUSTRIES, INC

- Schott AG

- Şişecam

- Asahi India Glass Limited

- CEVITAL GROUP

- Guardian Industries

- Corning Incorporated

- Xinyi Glass Holdings Limited

- sunglass industry s.r.l.

- Borosil Renewables Limited

Recent Developments (M&A/Product Launch)

- In January 2025, AGC Glass Europe acquired Sicherheitsglastechnik Oelsnitz GmbH (SGT) and its related entities in Germany to expand its European footprint. The deal strengthens its façade and architectural glass portfolio while enhancing capabilities in complex coated and safety glass solutions.

- In November 2024, Varrotec launched a hot-end glass coating solution with its new VC1 hood, designed to reduce coating losses and improve efficiency for pharmaceutical and container glass production. The solution integrates AI-powered process control and predictive analytics, enhancing sustainability and reliability in coated glass manufacturing.