Market Definition

A cloud native application protection platform (CNAPP) is a unified security solution that integrates multiple cloud capabilities, including CSPM, CWPP, and Kubernetes security. It also provides runtime protection and DevSecOps tools to secure cloud-native applications across their entire lifecycle.

It is designed to provide continuous visibility, compliance, threat detection, and risk management for applications that are built, deployed, and operated in cloud environments. The CNAPP market covers security solutions, platforms, and services that address the end-to-end protection needs of cloud-native applications, covering development, deployment, and runtime phases.

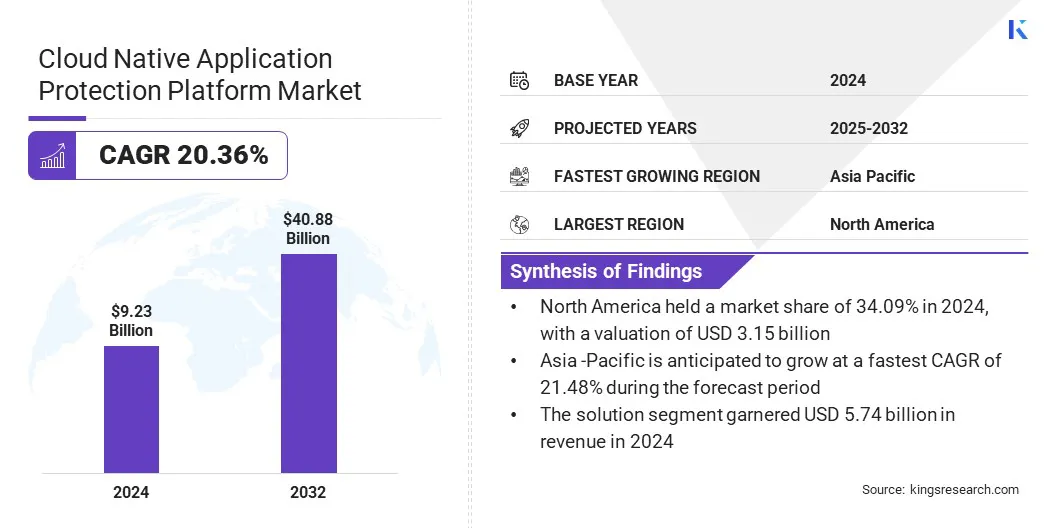

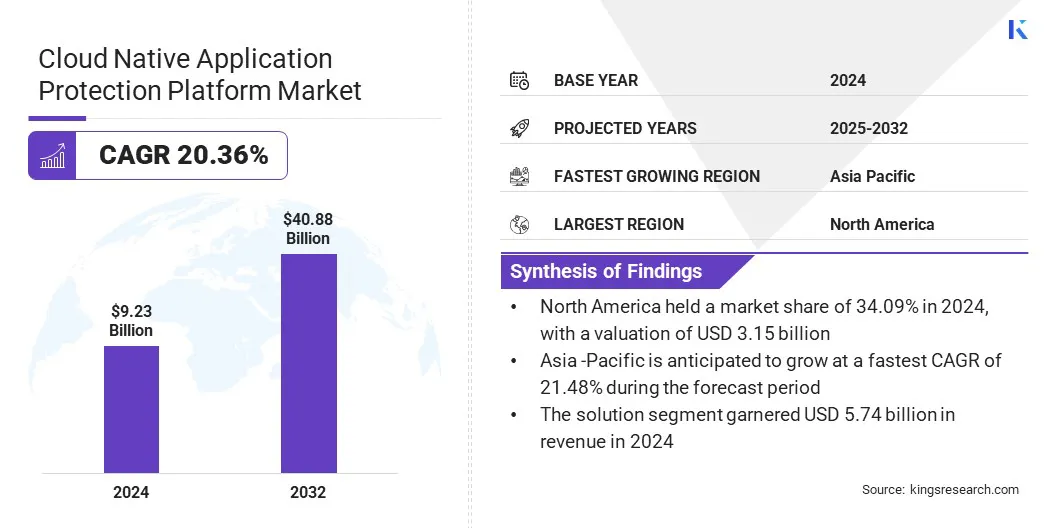

The global cloud native application protection platform market size was valued at USD 9.23 billion in 2024 and is projected to grow from USD 11.08 billion in 2025 to USD 40.88 billion by 2032, exhibiting a CAGR of 20.36% over the forecast period.

The market growth is driven by rising adoption of cloud native applications due to rapid digital transformation across enterprises. Growing sophistication of cyber threats targeting containers, Kubernetes, and serverless functions is also accelerating adoption of CNAPP platforms for proactive threat detection.

Key Highlights:

- The cloud native application protection platform industry size was valued at USD 9.23 billion in 2024.

- The market is projected to grow at a CAGR of 20.36% from 2024 to 2032.

- North America held a share of 34.09% in 2024, with a valuation of USD 3.15 billion.

- The solution segment garnered USD 5.74 billion in revenue in 2024.

- The public segment is expected to reach USD 15.62 billion by 2032.

- The small and medium enterprises segment is anticipated to witness the fastest CAGR of 20.99% over the forecast period.

- The BFSI segment held a market share of 24.20% in 2024

- Asia Pacific is anticipated to grow at a CAGR of 21.48% over the forecast period.

Major companies operating in the cloud native application protection platform market are Wiz, Inc, CrowdStrike Holdings, Inc, Palo Alto Networks, Inc, Microsoft Corporation, Orca Security Ltd, SentinelOne, Inc, Check Point Software Technologies Ltd, Sysdig, Inc, Fortinet, Inc, Zscaler, Inc, Qualys, Inc, Tenable, Inc, Cisco Systems, Inc, Rapid7 LLC, and Sophos Ltd.

Increasing investments in cybersecurity across civilian agencies to strengthen national cyber defenses is creating a demand for advanced cloud-native protection platforms. These investments are driving enterprises and public institutions to adopt CNAPP solutions for unified visibility, compliance, and threat protection in multi-cloud environments.

- In March 2024, the U.S. government allocated USD 13 billion in cybersecurity funding across civilian agencies, including USD 103 million designated for Cybersecurity and Infrastructure Security Agency (CISA) to strengthen national cyber defenses.

Market Driver

Growing Sophistication of Cyber Threats

A key factor propelling the growth of the cloud native application protection platform market is the growing sophistication of cyber threats. For instance, in 2024, the U.K. National Cyber Security Centre (NCSC) reported a 16% year-over-year increase in hostile cyber activity, with 430 significant incidents recorded compared to 371 in 2023.

Enterprises are facing increasingly complex attacks targeting cloud-native environments, where vulnerabilities in containers, Kubernetes clusters, and serverless functions are being actively exploited.

Cybercriminals are using automated exploits, lateral movement, and supply chain infiltration to bypass conventional defenses. Organizations are therefore prioritizing proactive and integrated protection strategies that provide continuous monitoring, runtime security, and real-time threat detection. This heightened need to safeguard critical cloud workloads and applications is accelerating the adoption of CNAPP solutions.

- In December 2024, the UK National Cyber Security Centre (NCSC) reported a 16% year-over-year increase in hostile cyber activity, recording 430 significant incidents compared to 371 in 2023.

Market Challenge

Integration with Existing Security Tools

A major challenge hindering the growth of the cloud native application protection platform market is the difficulty of integrating with existing security tools. Enterprises operate complex ecosystems comprising legacy security solutions, SIEM platforms, identity management systems, and third-party cloud services.

Aligning CNAPP with these demands significant customization, technical expertise, and process adjustments. Integration gaps can result in fragmented visibility, operational inefficiencies, and slower incident response. These barriers make it challenging for organizations to realize the complete potential of CNAPP adoption.

To address this challenge, market players are developing platforms with enhanced interoperability and pre-built connectors for popular identity and access management (IAM) and cloud management systems.

Vendors are offering unified dashboards, APIs, and automation to streamline deployment and reduce complexity. They are also providing professional services, training, and best-practice frameworks to assist organizations through integration of CNAPP solutions with existing security tools.

Market Trend

Integration of Artificial Intelligence in Cloud-Native Infrastructure

A key trend influencing the cloud native application protection platform market is the growing integration of artificial intelligence within cloud-native infrastructure. AI-powered tools are helping organizations in automating threat detection, prioritizing risks, and remedying vulnerabilities in real time.

These technologies are also streamlining cloud operations, enhancing scalability and resilience, and reducing manual security efforts. The adoption of AI-driven cloud-native platforms is improving operational efficiency, and accelerating deployment of advanced cloud protection solutions.

- In October 2024, Juniper Networks launched a local cloud instance in India, leveraging Mist AI for microservices agility, resilience, and automation. The platform provides secure, cloud-native networking solutions with local hosting and storage.

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

Private, Public, Hybrid

|

|

By Organization Size

|

Small and Medium Enterprises, Large Enterprises

|

|

By Vertical

|

BFSI, Retail, Healthcare, IT & Telecommunications, Government, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solution, and Services): The solution segment earned USD 5.74 billion in 2024 due to increasing adoption of integrated cloud-native security platforms.

- By Deployment (Private, Public, and Hybrid): The public segment held 38.61% of the market in 2024, driven by scalability and cost-effectiveness of public cloud environments.

- By Organization Size (Small and Medium Enterprises, and Large Enterprises): The large enterprises segment is projected to reach USD 24.57 billion by 2032, owing to higher investment in comprehensive cloud security solutions.

- By Vertical (BFSI, Retail, Healthcare, and IT & Telecommunications, Government Manufacturing, and Others): By vertical, the healthcare segment is anticipated to witness the fastest CAGR of 20.52% over the forecast period, driven by stringent data protection and compliance requirements.

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America cloud native application protection platform market share stood at 34.09% in 2024, valued at USD 3.15 billion in the global market. This dominance is attributed to the increasing adoption of multi-cloud and hybrid environments, prompting organizations to deploy comprehensive security platforms for complex infrastructures.

The rising sophistication of cyber threats targeting microservices and serverless architectures is fueling the adoption of proactive protection solutions. Regulatory compliance and industry standards, such as Federal Risk and Authorization Management Program (FedRAMP) is enforcing more stringent security requirements.

This includes FedRAMP High Authorization and NIST SP 800‑53 integration, with Aqua Security achieving FedRAMP High Authorization by implementing over 400 security controls and integrating NIST SP 800‑53 standards into CNAPPs. Additionally, the growing focus of regional players on combining AI-driven workload protection with cloud-native security is accelerating the adoption of advanced, automated CNAPP solutions in the region.

- In February 2024, SentinelOne acquired CNAPP provider PingSafe to combine its AI-powered workload protection with comprehensive cloud-native security. The acquisition has also strengthened the company’s unified platform across endpoints, workloads, and cloud environments.

Asia Pacific cloud native application protection platform industry is set to grow at a robust CAGR of 21.48% over the forecast period. This growth is driven by rapid digital transformation, which is accelerating cloud adoption and deployment of cloud-native applications. The increasing sophistication of cyberattacks in banking, government, and telecommunications sectors is prompting the adoption of integrated cloud security solutions.

Regulatory mandates in APAC countries, such as India’s Personal Data Protection Bill and China’s Cybersecurity Law, are boosting demand for CNAPP solutions by requiring strict data protection, localization, and compliance measures. Additionally, the rise of AI-powered cloud security infrastructure and the expansion of local data centers is enhancing visibility, automation, and protection capabilities, further supporting CNAPP adoption.

- In March 2025, Varonis launched two data centers in India to support its cloud-native Data Security Platform. The centers provide AI-driven data protection, ensure compliance with local privacy laws, and enhance cloud security for enterprises in the region.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates cloud security practices by enforcing data privacy, consumer protection, and cybersecurity standards, ensuring CNAPP solutions comply with Health Insurance Portability and Accountability Act (HIPAA) and Gramm-Leach-Bliley Act (GLBA) for secure handling of sensitive enterprise and consumer data.

- In the UK, the Information Commissioner’s Office (ICO) regulates cloud-native security solutions under General Data Protection Regulation (GDPR) and the Data Protection Act, overseeing data privacy, breach notifications, and ensuring CNAPP providers implement strong encryption, access controls, and monitoring practices.

- The Cyberspace Administration of China (CAC) regulates cybersecurity and data protection by overseeing cloud service providers and CNAPP platforms to ensure compliance with national laws, cross-border data transfer rules, and protection of critical information infrastructure.

- The Data Security Council of India (DSCI) regulates cloud security and data protection standards, guiding CNAPP vendors on secure cloud deployment, incident response, and compliance with data localization and sector-specific cybersecurity requirements.

Competitive Landscape

Companies operating in the cloud native application protection platform industry are strengthening their competitive positioning through advanced technological innovation, AI integration, and extensive cloud security portfolios. Key players are enhancing automated threat detection, cloud workload protection, and runtime security across microservices and serverless environments.

Market participants are investing in R&D to deliver unified platforms combining Cloud Security Posture Management (CSPM) and Development, Security, and Operations (DevSecOps) capabilities. Additionally, they are focusing on strategic acquisitions to integrate AI-driven automation for enabling autonomous remediation and enhancing cloud-native security capabilities.

- In May 2025, Orca Security acquired Opus, an agentic AI-driven cloud security automation provider. The integration enables Orca to advance from risk observation to autonomous remediation and prevention, strengthening its CNAPP capabilities.

Top Key Companies in Cloud Native Application Protection Platform Market:

- Wiz, Inc

- CrowdStrike Holdings, Inc

- Palo Alto Networks, Inc

- Microsoft Corporation

- Orca Security Ltd

- SentinelOne, Inc

- Check Point Software Technologies Ltd

- Sysdig, Inc

- Fortinet, Inc

- Zscaler, Inc

- Qualys, Inc

- Tenable, Inc

- Cisco Systems, Inc

- Rapid7 LLC

- Sophos Ltd.

Recent Developments

- In August 2025, F5 acquired MantisNet, a provider of real-time network observability and intelligence. The integration enables F5 to enhance visibility and threat detection in cloud-native environments.

- In August 2025, Yotta Data Services launched Urja and Sudarshan cloud-native platforms for rendering and media asset management. These platforms offer AI-driven workflows, low-latency performance, and secure hyperscale cloud infrastructure.

- In March 2025, Google announced an agreement to acquire Wiz for USD 32 billion. The acquisition enables Google Cloud to enhance its multicloud and AI-driven security offerings, and scale automated security platforms.

- In July 2024, Sysdig expanded its cloud-native application protection platform (CNAPP) to India with a SaaS-based regional deployment. The platform leverages AI-driven, real-time threat detection and response, providing localized, sovereign cloud security.

- In May 2024, HGS launched a comprehensive suite of cybersecurity solutions, including Cloud Security and CNAPP offerings. The platform leverages AI and ML-driven threat detection, SecOps automation, and managed security services to enhance cloud-native protection.