Market Definition

A clinical trial management system (CTMS) is a specialized software platform designed to facilitate the planning, execution, and oversight of clinical trials while ensuring compliance with regulatory requirements.

The market encompasses software and services that support clinical trial planning, budgeting, site management, subject tracking, and reporting. It includes cloud-based and on-premise platforms adopted by pharmaceutical companies, contract research organizations, and academic institutions.

The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period.

Clinical Trial Management System Market Overview

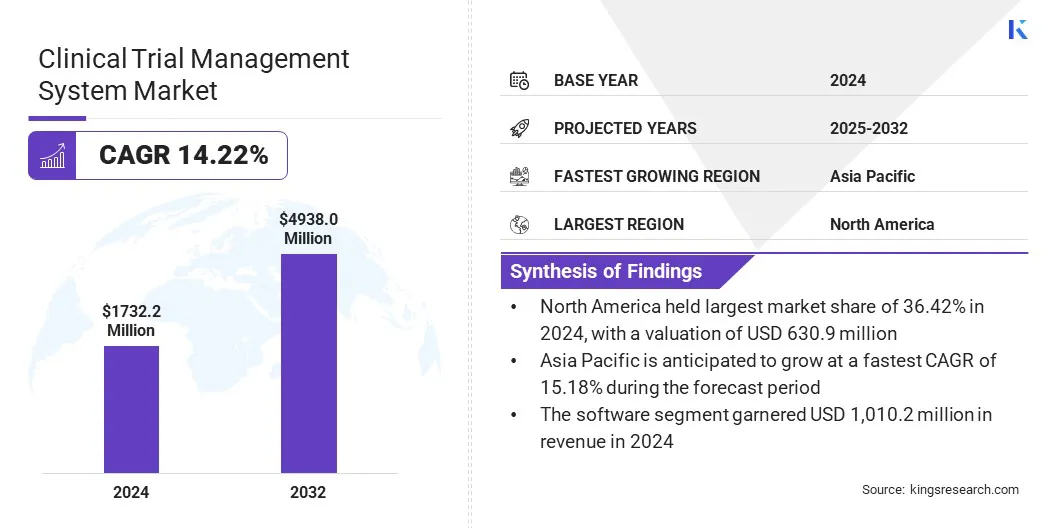

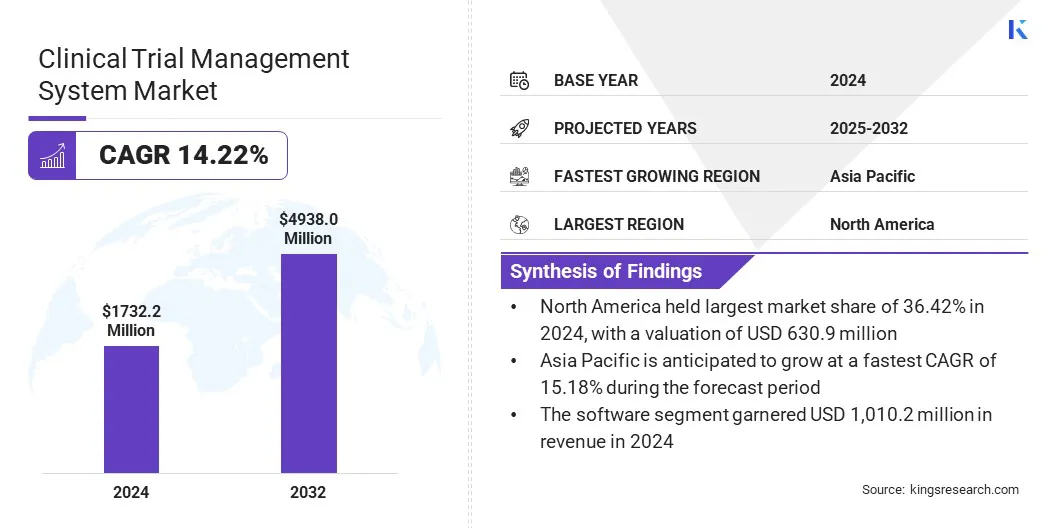

According to Kings Research, the global clinical trial management system market size was valued at USD 1,732.2 million in 2024 and is projected to grow from USD 1,946.5 million in 2025 to USD 4,938.0 million by 2032, exhibiting a CAGR of 14.22% during the forecast period.

The market is experiencing steady growth being driven by the increasing number of clinical trials and the rising complexity of trial protocols. The growing adoption of digital platforms by pharmaceutical and biotechnology companies to streamline trial operations and ensure regulatory compliance is contributing significantly to market expansion.

Major companies operating in the clinical trial management system industry are Oracle, IQVIA, Veeva Systems Inc., Dassault Systèmes, RealTime Software Solutions, LLC, CIOCoverage, PHARMASEAL, Wipro, Castor, Salesforce, Inc., Advarra, Cloudbyz, Fortrea, SimpleTrials, and Clario.

Key Market Highlights:

- The clinical trial management system market size was valued at USD 1,732.2 million in 2024.

- The market is projected to grow at a CAGR of 14.22% from 2025 to 2032.

- North America held a market share of 36.42% in 2024, with a valuation of USD 630.9 million.

- The software segment garnered USD 1,010.2 million in revenue in 2024.

- The on premise segment is expected to reach USD 2,733.0 million by 2032.

- The pharmaceutical and biopharmaceutical companies segment is expected to reach USD 2,297.4 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 15.18% during the forecast period.

The shift towards decentralized trials and the growing need for real-time data access are driving the adoption of cloud-based CTMS solutions. These platforms offer flexibility, scalability, and improved collaboration across distributed research sites, aligning well with evolving trial models.

The use of cloud-based CTMS solutions is contributing to market growth by improving data management, enabling faster workflows, and supporting decentralized trial operations.

- In April 2025, Veeva Systems introduced Veeva SiteVault CTMS, a cloud-based clinical trial management system for research sites. The solution integrates with SiteVault eISF and SiteVault eConsent to enable comprehensive trial management within a unified platform. It also offers seamless bidirectional data flow with sponsors through Veeva’s Clinical Platform to reduce manual processes and improve site efficiency.

Real-Time Data Access and Site Management is Driving CTMS Adoption

The market is experiencing steady growth due to the increasing need for real-time data access and effective site management. The increasing complexity and global expansion of clinical trials is driving the need to prioritize efficient oversight.

Sponsors and contract research organizations demand real-time visibility into key performance indicators such as patient enrollment, site productivity, protocol adherence, and adverse event reporting to drive operational efficiency and ensure regulatory compliance. Real-time access to operational and clinical data supports faster decision-making, reduces delays, and improves overall study execution.

- In February 2025, Inovalon launched Clinical Research Patient Finder, an AI-powered solution that integrates with electronic health records (EHRs) to enable real-time identification of eligible patients for clinical trials. Designed to reduce recruitment delays and administrative burden, the tool automates pre-screening based on study-specific criteria and connects sponsors with research-ready sites through the Inovalon Research Network.

This development aligns with the growing demand for real-time data access and streamlined site coordination. It reflects the ongoing shift toward data-driven trial operations and efficient executions, which is driving the adoption of CTMS platforms.

A key challenge in the clinical trial management system market is the fragmentation of technology platforms among contract research organizations (CROs), sponsors, and trial sites. This fragmentation results in disconnected data, inconsistent workflows, and communication barriers that hinder collaboration and delay in trial activities.

Lack of interoperability between different software systems leads to redundant tasks, increased administrative costs, and challenges in supply chain management. These inefficiencies negatively affect timelines, data quality, and regulatory compliance.

To address this, vendors are adopting vendor-agnostic CTMS solutions that enable seamless integration with multiple third-party platforms. This integration facilitates centralized data management and unified workflows, aligning all stakeholders in an automated supply chain process, thereby improving trial efficiency and mitigating operational risks.

- In June 2025, Oracle introduced new interoperability enhancements to its Randomization and Trial Supply Management (RTSM) solution, enabling automated drug supply management and inventory pooling across multiple clinical trials and vendors. The update supports integration with systems such as SAP (logistics), Almac (clinical supply), and Catalent (drug manufacturing), aiming to reduce inefficiencies, accelerate trial timelines, and improve resource utilization through a unified and vendor-agnostic platform.

A key trend in the CTMS market is the integration of clinical trial solutions with advanced data platforms and artificial intelligence (AI) technologies. This integration allows seamless aggregation, analysis, and management of extensive clinical data from multiple sources, improving data accuracy and accessibility. AI-powered tools enhance predictive analytics, risk assessment, and workflow automation, leading to better patient recruitment, monitoring, and overall trial efficiency.

- In June 2024, Medidata launched Clinical Data Studio, a unified platform designed to accelerate clinical trial data review and reconciliation by integrating data from Medidata and non-Medidata sources. Leveraging embedded AI, the solution enables faster anomaly detection, risk-based quality management, and real-time insights, helping sponsors and study teams streamline data workflows and improve trial execution.

Clinical Trial Management System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Services

|

|

By Delivery Mode

|

Web & Cloud Based, On Premise

|

|

By End User

|

Pharmaceutical and Biopharmaceutical Companies, Medical Device Firms, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software, and Services): The software segment earned USD 1,010.2 million in 2024 due to the growing need for centralized trial oversight and data integration capabilities.

- By Delivery Mode (Web & Cloud Based, and Premise): The on premise segment held 57.36% of the market in 2024, due to the preference for in-house data control and compliance with institutional IT policies.

- By End User (Pharmaceutical and Biopharmaceutical Companies, Medical Device Firms, and Others): The pharmaceutical and biopharmaceutical companies segment is projected to reach USD 2,297.4 million by 2032, owing to the high volume of clinical trials and demand for efficient trial management systems.

Clinical Trial Management System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 36.42% share of the clinical trial management system market in 2024, with a valuation of USD 630.9 million. The region’s dominance is attributed to the high volume of ongoing clinical trials. For instance, data from the World Health Organization indicates that 7,008 trials were registered in the United States.

This is further supported by the strong presence of major pharmaceutical companies and contract research organizations, which are actively adopting advanced digital platforms to streamline trial operations. In addition, the presence of academic medical centers and research universities engaged in clinical development contributes to the steady demand for robust trial management systems.

The clinical trial management system industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 15.18% over the forecast period. This growth is supported by the increasing use of digital systems to improve trial operations and coordination.

For instance, in Australia, New South Wales Health has implemented a centralized clinical trial management system across all public health organizations. The platform serves as a shared online environment to streamline financial management, participant tracking, forecasting, and reporting, thereby enhancing the efficiency of clinical trial execution in the region.

Additionally, the growing presence of multinational pharmaceutical companies in the region has accelerated the need for robust CTMS infrastructure.

These firms are increasingly outsourcing Phase II and III clinical trials to Asia Pacific to benefit from cost efficiencies, faster patient recruitment, and access to diverse populations. This has created strong demand for scalable CTMS solutions that meet regional regulatory standards and operational complexities.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates clinical trials to ensure they are designed, conducted, and reported in accordance with federal regulations and Good Clinical Practice (GCP) standards.

- In Japan, the regulatory authority for clinical trials is the Pharmaceuticals and Medical Devices Agency (PMDA), which operates under the Ministry of Health, Labour and Welfare (MHLW). The PMDA is responsible for reviewing clinical trial applications, ensuring their scientific validity and ethical standards, and monitoring post-market safety.

Competitive Landscape

The clinical trial management system market is characterized by on-going technological advancements, platform integration, and strategic consolidation among participants. Key players are focusing on expanding solution capabilities through the development of modular, interoperable platforms that support complex trial workflows.

- In January 2025, Advarra introduced its Study Collaboration solution aimed at streamlining clinical trial startup activities. The platform integrates automated workflows, real-time visibility, and single sign-on access to streamline processes such as site activation, document exchange, site training, and enrollment planning. It combines existing technology assets to reduce redundancies, improve compliance, and support faster study execution across sponsor, CRO, and site networks.

This launch reflects a broader strategic shift among vendors toward delivering integrated, end-to-end solutions that address operational inefficiencies, particularly during the startup phase.

Furthermore, companies are increasingly investing in cloud-native architectures and real-time analytics to support decentralized and hybrid trial models. These strategies are shaping a competitive environment defined by functionality, integration depth, and operational efficiency.

Key Companies in Clinical Trial Management System Market:

- Oracle

- IQVIA

- Veeva Systems Inc.

- Dassault Systèmes

- RealTime Software Solutions, LLC

- CIOCoverage

- PHARMASEAL

- Wipro

- Castor

- Salesforce, Inc.

- Advarra

- Cloudbyz

- Fortrea

- SimpleTrials

- Clario

Recent Developments (Product Launches)

- In April 2025, BSI Life Sciences released BSI CTMS / eTMF Version 25.1, introducing enhanced configurability, a new sponsor portal, dynamic questionnaires for monitoring, and an upgraded feasibility assessment portal. The update aims to streamline site monitoring, improve oversight, and reduce CRA workload across clinical trial workflows in Europe and North America.

- In March 2025, Jeeva Clinical Trials launched its CRO Partnership Program to accelerate next-generation clinical trials through a unified, AI-driven Clinical Trial Management System. The initiative aims to support CROs specializing in obesity, dermatology, oncology, and rare diseases by enhancing trial efficiency, compliance, and patient retention with real-time collaboration tools and automated workflows.