Market Definition

Cladding systems comprise the materials, engineered systems, and services used to create the external and internal envelopes of buildings and infrastructure. It encompasses metal panels, ceramic and stone façades, concrete and precast systems, composite and insulated panels, glass curtain walls, engineered timber cladding, rainscreen and ventilated facades, and roof cladding solutions.

It further extends to integrated insulated panels, supported by framing, fasteners, sealants, as well as design, engineering, testing, and installation services. The market spans both new-build and retrofit projects across residential, commercial, industrial, and public infrastructure projects, and covers specification, testing, certification, maintenance, and remediation activities.

Cladding Systems Market Overview

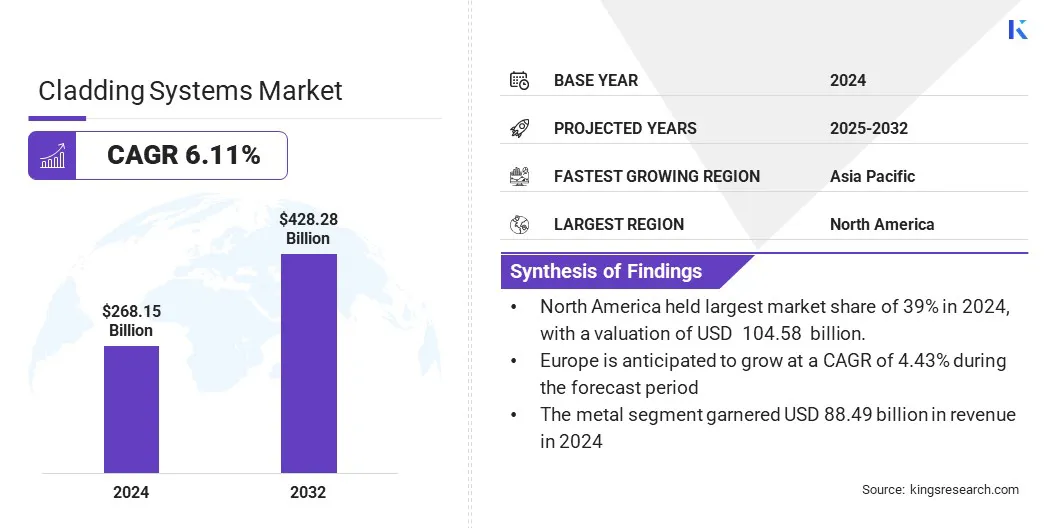

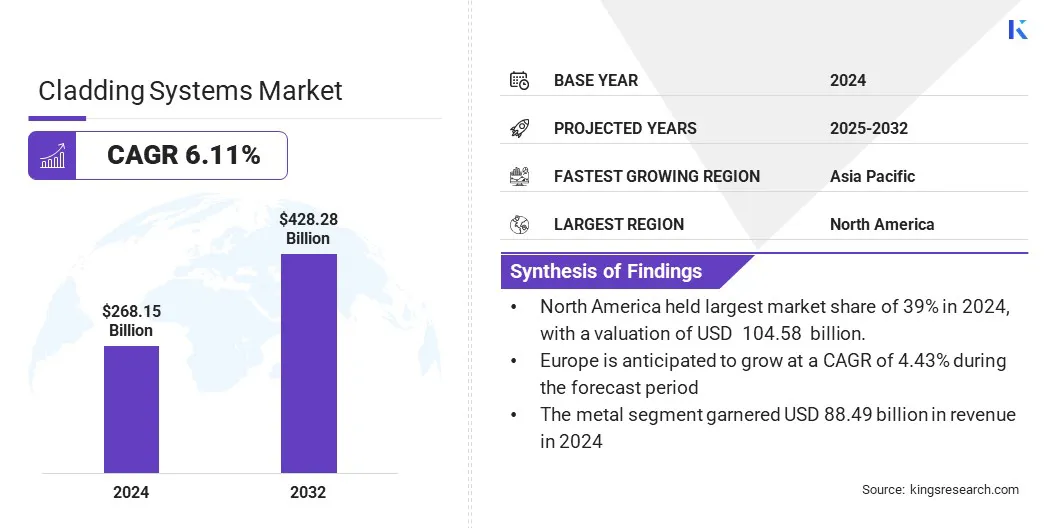

The global cladding systems market was valued at USD 268.15 billion in 2024 and is projected to grow from USD 282.83 billion in 2025 to USD 428.28 billion by 2032, exhibiting a CAGR of 6.11% during the forecast period.

The market is shaped by large capital flows into new construction and renovation, stronger building-envelope performance standards, and notable demand for faster, lower-risk installation methods. Expansion is particularly strong in regions prioritizing renovation programmes, infrastructure development, and green procurement initiatives that emphasize thermal performance and durability.

Key Market Highlights:

- The cladding systems industry was recorded at USD 268.15 billion in 2024.

- The market is projected to grow at a CAGR of 6.11% from 2024 to 2032.

- Asia-Pacific held a share of 39% in 2024, valued at USD 104.58 billion.

- The metal segment garnered USD 88.49 billion in revenue in 2024.

- The walls type segment is expected to reach USD 297.95 billion by 2032.

- The external cladding segment registered a revenue of USD 222.57 billion in 2024.

- The commercial and industrial segment is expected to reach USD 366.02 billion by 2032.

Major companies operating in the cladding systems market are 3A Composites GmbH, Aditya Birla Group, ArcelorMittal Construction, Arconic Corporation , Enclos Group, Etex Group, Hunter Douglas, Kingspan Group, Mitsubishi Chemical Group, Permasteelisa Group, Saint-Gobain, Schüco International KG, Tata Steel, and YKK AP America Inc.

The cladding systems market is expanding as regulatory frameworks are prioritizing energy efficiency, fire safety, and sustainable construction. Governments are introducing directives targeting near-zero energy buildings, tightening thermal insulation standards, and offering retrofit incentives, which are accelerating the adoption of high-performance façade solutions.

Public procurement programs are specifying advanced cladding materials, while carbon reduction commitments are driving the use of recycled and responsibly sourced products.

- In June 2025, the European Commission introduced regulations requiring EU member states to implement the Energy Performance of Buildings Directive (EPBD). The directive seeks to improve energy efficiency, decarbonize the building sector, and improve housing affordability. Member states are expected to integrate the directive into national law by May 2026. The initiative is designed to strengthen energy independence, lower energy bills, and increase the use of renewable energy in buildings.

Market Driver

Stringent Energy Efficiency and Building-Envelope Regulations

Stricter building energy regulations and zero-emission targets are increasing demand for higher-performance cladding. Governments are setting minimum energy performance standards and offering incentives for envelope retrofits, which are making thermal insulation and airtightness primary design requirements.

Building owners aim to lower operational costs while meeting climate goals. Architects and contractors are preferring factory-made insulated panels and ventilated rainscreens to control thermal bridging and moisture.

Manufacturers are expanding portfolios with multi-layer façades, thermal-break framing, and pre-insulated curtain walls, supporting compliance, reducing energy consumption, and improving occupant comfort.

- In June 2025, the European Commission introduced new tools to support EU countries in preparing their National Building Renovation Plans. These include an annotated template and a data collection spreadsheet designed to simplify the planning and ensure alignment with the revised Energy Performance of Buildings Directive. The plan serves as a strategic roadmap for decarbonizing the building stock by 2050.

Market Challenge

Fire Safety Risks Associated with Combustible Cladding

Following major incidents and stricter regulations, combustible façade materials continue to pose a major challenge to the expansion of the cladding systems market. Existing buildings with aluminium composite panels using combustible cores face complex testing, financing, and remediation requirements, leading to project delays and high costs for owners.

Lenders, insurers, and regulators demand certified assemblies and compliance documentation. Market players are addressing these challenges through mandatory fire testing and classification, adoption of non-combustible cores and mineral-filled panels, and government-supported remediation funding.

Clear certification frameworks and accredited installers further reduce liability, speed approvals, and restore market confidence.

Market Trend

Rising Adoption of Prefabricated and Modular Façade Systems

The growing adoption of prefabricated and modular façade systems is shaping the cladding market by improving efficiency, quality, and sustainability. Off-site manufacturing and unitized curtain wall systems reduce on-site labor needs, shorten project timelines, and enhance precision.

Governments and large clients are supporting this trend through preferential procurement policies and published guidebooks on modern methods of construction (MMC). Factory-assembled façades deliver integrated insulation, pre-tested connections, and quicker installation, lowering risks and material waste.

Designed for disassembly, modular units also enable repeatability and circularity. This approach is gaining traction in high-rise, institutional, and large commercial projects where certainty and quality control are critical, encouraging stronger collaboration between architects, façade engineers, and fabricators.

- In December 2024, Fraunhofer developed a BIPV facade element with integrated thermal insulation as part of the "BAU-DNS" project. Constructed from natural, reusable materials such as hemp and mushrooms, the units promote a circular economy. Prototypes demonstrated quick and simple installation. This modular solution combines power generation and weather protection, showcasing an innovative approach to building efficiency and sustainability.

Cladding Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Metal, Ceramic, Brick & Stone, Concrete, Composite, Wood, Glass, Others

|

|

By Type

|

Roof, Walls, Others

|

|

By Application

|

Exterior Cladding, Interior Cladding

|

|

By End-User

|

Residential, Commercial and Industrial, Public Infrastructure

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material Type (Metal, Ceramic, Brick & Stone, Concrete, Composite, Wood, Glass, and Others): The metal segment earned USD 88.49 billion in 2024, fueled by aluminium and steel’s combination of light weight, formability, recyclability and wide use in insulated panels, curtain walls and metal rainscreens, making metals the preferred choice for high-performance, low-maintenance façades.

- By Type (Roof, Walls, Others): The walls segment held a share of 68% in 2024, reflecting the critical role of wall assemblies in energy performance, fire testing regimes, and façade aesthetics, along with extensive retrofit programs focused on wall-mounted insulation and rainscreen replacements.

- By Application (Exterior Cladding, Interior Cladding): The external cladding segment is projected to reach USD 366.02 billion by 2032, propelled by urbanization , renovation waves, stricter envelope codes, and growth in commercial construction, which increases demand for exterior façades and high-performance rainscreen systems.

- By End-User (Residential, Commercial and Industrial, and Public Infrastructure): The commercial and industrial segment earned USD 126.03 billion in 2024, propelled by large office, logistics, and industrial projects adopting unitized curtain walls, insulated metal panels, and prefinished systems for faster installation and reliable long-term performance.

Cladding Systems Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific cladding systems market accounted for a share of 39.00% in 2024, valued at USD 104.58 billion. The region is experiencing strong production of metal, glass, and composite façade materials, supported by major fabricators and extruders. Public investment in infrastructure and social housing is creating a steady demand for cost-effective cladding materials with short lead times.

Growing policy focus on energy efficiency and national building codes is elevating technical standards. The regional market further benefits from the large-scale production in China, continued growth in South and Southeast Asia, and the high-specification projects in Australia and Japan.

- The Government of India's draft Climate Finance Taxonomy identifies the buildings sector as a key area for decarbonization. Policies such as the Energy Conservation Sustainable Building Code (ECBC) for commercial buildings and the Eco Niwas Samhita for residential buildings are strengthening technical standards for materials. This focus is creating demand for innovative façade solutions and other advanced building technologies.

The Europe cladding systems industry is set to grow at a CAGR of 4.43% over the forecast period. Public procurement and financing mechanisms are increasingly supporting deep-retrofit solutions aimed at improving envelope U-values and reducing whole-life carbon.

Additionally, the region enforces strict fire performance and product conformity under the Construction Products Regulation. To address energy efficiency and circularity obligations, manufacturers are focusing on pre-insulated rainscreens, low-carbon aluminum solutions, and unitized façades.

Furthermore, renovation finance instruments and regional grants are enabling large-scale heritage and residential retrofit programs, which is maintaining demand for cladding retrofit solutions across member states.

- The June 2025 EPBD guidance document outlines a framework for decarbonizing the EU building stock by 2050. It promotes deep retrofits by focusing on whole-life carbon reduction and emphasizes financial incentives and regional grants as essential for renovation programs viable across member states. Furthermore, the document also sets provisions on technical building systems and energy performance calculations, aligning with the Construction Products Regulation’s requirements for high-quality, pre-insulated, and fire-resistant materials.

Regulatory Frameworks

- In the UK, the Building Safety Act 2022, along with the Building Safety Fund and Cladding Safety Scheme, sets remediation responsibilities, funding mechanisms, and compliance requirements for external cladding on higher-risk residential buildings.

- In the EU, the recast Energy Performance of Buildings Directive (EPBD, 2024/1275) requires national renovation plans and tighter energy performance standards for building envelopes.

- In the U.S., the International Building Code (IBC) governs exterior wall requirements, while NFPA 285 establishes fire safety testing for multi-storey exterior wall assemblies with combustible components. Additionally, the Department of Energy (DOE) supports research and pilot projects for building envelope retrofits.

- In India, the National Building Code (NBC 2016) and Bureau of Indian Standards (BIS) standards provide specifications for cladding, fire protection, and the adoption of advanced technologies in large-scale housing and retrofits.

Competitive Landscape

Key players in the cladding systems market are adopting strategies that emphasize compliance, innovation, and delivery efficiency. Companies are introducing prefabricated and non-combustible solutions to align with stricter fire safety and energy efficiency regulations across regions.

Product portfolios are expanding to include pre-insulated panels, ventilated rainscreens, and unitized curtain walls, often incorporating recycled or sustainably sourced materials. Supply-chain integration is strengthening, with fabricators, system suppliers, and installers offering design-assist services and modular assemblies to reduce on-site risks and shorten timelines.

Public procurement requirements and updated building codes are further shaping strategies, driving investment in certified high-performance cladding systems.

- In March 2025, Sotech launched the Optima BrickTech System, a non-combustible brick rainscreen cladding solution that combines traditional brick aesthetics with modern performance features. Tested to CWCT Sequence B with UKAS accreditation, the system ensures safety and durability. Featuring a complete subframe and support structure, it facilitates easy installation for both new construction and refurbishment projects across varied architectural applications.

Key Companies in Cladding Systems Market:

- 3A Composites GmbH

- Aditya Birla Group

- ArcelorMittal Construction

- Arconic

- Arconic Corporation

- Enclos Group

- Etex Group

- Hunter Douglas

- Kingspan Group

- Mitsubishi Chemical Group

- Permasteelisa Group

- Saint-Gobain

- Schüco International KG

- Tata Steel

- YKK AP America Inc.

Recent Developments (M&A/New Product Launch)

- In August 2025, Sotech launched the Optima FlatFix, an aluminum cladding system featuring a flat, seamless façade profile. Designed for new and refurbishment projects, it included a drained and ventilated cavity, mechanical fixing for fire safety compliance, and materials certified to Euroclass A1 and A2. The system complied with CWCT standards, was tested for weather resistance, and offered multiple finishes and custom panel sizes.

- In May 2025, ClarkDietrich introduced ProChannel Ci – Vertical, a cladding support system designed for installing vertical rainscreen cladding over continuous insulation. The system used Grip-Deck TubeSeal fasteners to reduce air and water intrusion, provided a 7/8" rainscreen cavity for moisture drainage and air movement, and met AISI S100-16 (2020), AISI S240-20, ASTM E331, and ASTM E2357 standards for water penetration and air leakage.

- In October 2024, profine Group acquired EFP International B.V., a Netherlands-based manufacturer of aluminum profile systems for facades and cladding substructures. Operating across multiple global markets, EFP served diverse building types. The acquisition expanded profine Group’s product portfolio with advanced aluminum system solutions and reinforced its presence in the international construction and renovation markets.