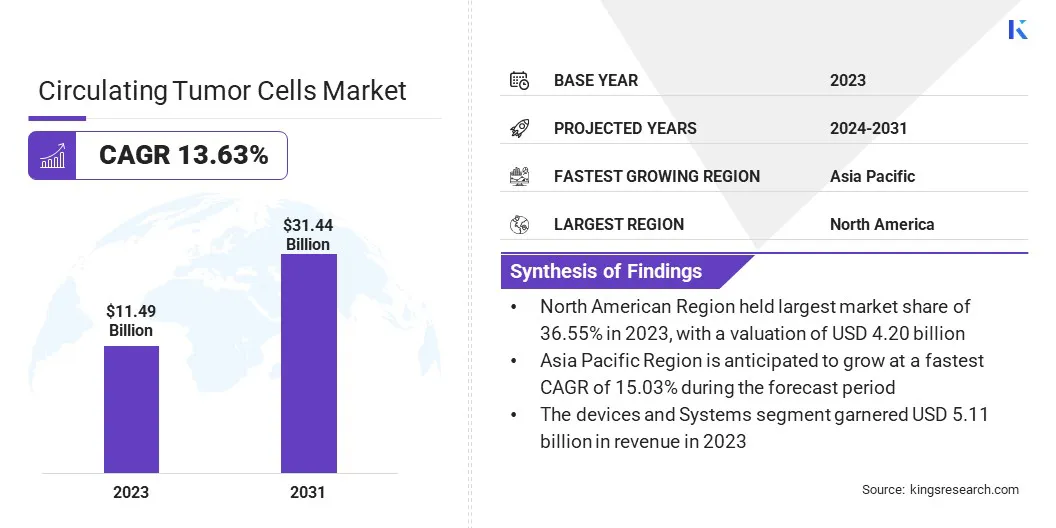

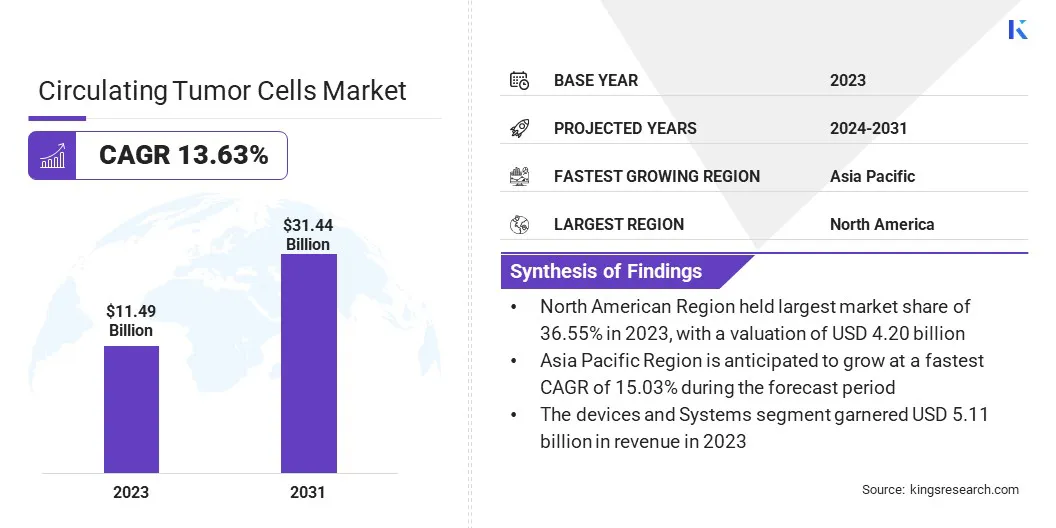

Circulating Tumor Cells Market Size

The global circulating tumor cells market size was valued at USD 11.49 billion in 2023 and is projected to grow from USD 12.85 billion in 2024 to USD 31.44 billion by 2031, exhibiting a CAGR of 13.63% during the forecast period.

The recent expansion of the market is attributed to increasing cancer cases, Technological advancements and integration of AI, and continuous research to develop non-invasive tools and methods for early detection of cancer. Furthermore, the increased investment in research and development (R&D) is accelerating the pace of innovation in this field.

In the scope of work, the report includes products offered by companies such as Bio-Techne, QIAGEN, Greiner Bio-One International GmbH, Precision Medicine Group, LLC., Aviva Systems Biology Corporation, Cell Microsystems, Ikonisys Inc., Miltenyi Biotec, Creativ MicroTech, Inc., and Sysmex Corporation.

The circulating tumor cells market is focused on developing more efficient and less biased methods for capturing circulating tumor cells (CTCs), including microfluidic innovation and label-free technologies.

While CTCs are more established in breast, prostate and colorectal cancer, the market possesses a significant opportunity to validate clinical utility of the CTCs in other types of cancer, including lung, gastric, and ovarian cancers.

The U.S. National Cancer Institute defines CTCs as cancer cells that detach from the primary tumor, enter the bloodstream, and subsequently disseminate throughout the body, potentially forming secondary tumors (metastases). CTCs can be used in clinical setting for early detection and monitoring of cancer, as well as in a research environment for new drug development.

Analyst’s Review

The global circulating tumor cells market is characterized by large biotech companies heavily investing in research and technology to develop CTC tools and platforms in oncology. CTCs have the potential to revolutionize cancer care by improving early cancer detection, providing personalized treatment strategies, and accelerating drug development.

This substantial market opportunity has resulted in considerable investment inflows into the CTC market, signaling strong investor confidence in its future growth trajectory.

Companies in this market are capitalizing on the growing demand for non-invasive cancer detection methods by developing and commercializing technologies for isolating and enriching CTCs from blood samples. Furthermore, they are combining different technologies, such as size-based separation and immunocapture, to enhance CTC isolation and characterization.

However, companies must conduct large-scale multi-staged clinical trials to demonstrate the clinical utility of their CTC tests and obtain regulatory approvals from agencies like the FDA to gain acceptance and adoption of CTC testing in clinical practice.

- For instance, in January 2024, Menarini Silicon Biosystems announced the trial results of DETECT III, the largest study program utilizing CTC count and human epidermal growth factor receptor 2 (HER2) phenotype assessment to personalize treatment plans for negative HER2 metastatic breast cancer. These results indicate that CTCs have the potential to serve as an early cancer monitoring tool and offer a less invasive alternative to traditional tissue-based biomarkers.

Circulating Tumor Cells Market Growth Factors

The increasing global incidence of cancer is fueling the demand for effective cancer diagnostics and monitoring tools, thus driving the circulating tumor cells industry. Several lifestyle factors, including tobacco use, unhealthy dietary habits, and environmental factors, contribute to the rising cancer burden across various countries including Australia, the U.S., China, India, and the Republic of Korea.

- For instance, a study published by the World Health Organization (WHO) in November 2024 stated that 30.8% of total oral cancer cases are caused due to the consumption of smokeless tobacco or areca nut. The lower-middle-income group from South Central Asia and South Eastern Asia had the highest cancer burden.

The rising global cancer burden is driving the demand for non-invasive cancer diagnostics for detection and monitoring. Traditional biopsy procedures, often associated with complications such as bleeding and infection, have fueled the demand for minimally invasive biopsy techniques.

Biotechnology companies are responding with increased investments in research aimed at developing safer, more effective diagnostic tools that ultimately improve patient outcomes.

- In October 2024, QIAGEN, a global provider of molecular testing solution launche non-invasive liquid biopsy kits for research and clinical applications in areas such as oncology and organ transplantation. The new ccfDNA Kit, featuring a urine protocol for use with EZ1 and EZ2 instruments, is designed to streamline liquid biopsy workflows for cancer research.

The global circulating tumor cells market exhibits promising growth; however, some challenges like limited clinical evidence and high costs need to be addressed. The need for more large-scale clinical trials and adherence to clinical guidelines is growing.

Companies are investing in large-scale clinical trials to generate robust data supporting the clinical utility of CTCs across various applications, such as early cancer detection, treatment response monitoring, and prognosis prediction.

Circulating Tumor Cells Industry Trends

The integration of advanced technologies is transforming the analysis of circulating tumor cells, enhancing analytical capabilities and driving impactful research in the circulating tumor cells market. Rapid advancements in technologies such as microfluidics, nanotechnology, and molecular analysis are improving the accuracy and clinical utility of circulating tumor cell diagnostics.

These advancements, particularly in microfluidic device technology, are enabling more efficient and precise CTC isolation, positioning leading companies to capture a significant share of this rapidly evolving market.

- In June 2024, Bio-Rad Laboratories, a market leader in life science and clinical diagnostics products, launched Celselect Slides 2.0 to effectively capture CTC. This product is compatible with the company's Genesis Cell Isolation System, which offers researchers unbiased, size-based microfluidic cell selection for CTC isolation.

Furthermore, companies are raising funds to research about CTC and develop AI-powered tools. Government agencies like the National Institutes of Health (NIH) in the U.S, the European Commission in Europe, and similar organizations in other countries provide significant funding for cancer research, including CTC-related projects.

Collaborations between academic researchers and industry partners across the world are driving innovation in CTC technologies and expanding their clinical applications.

Segmentation Analysis

The global market is segmented based on technology, application, product, end-user, and geography.

By Technology

Based on technology, the circulating tumor cells market has been categorized broadly into CTC detection & enrichment methods, CTC direct detection methods, and CTC analysis. The CTC detection & enrichment methods segment was widely adopted by hospital, clinics, and research institutes, generating USD 5.36 billion revenue in 2023.

The low number of CTCs in blood makes their detection and analysis challenging. This scarcity necessitates the use of highly sensitive and advanced detection techniques, such as microscopy and molecular methods, to accurately identify and characterize these cells.

To further enhance detection, CTCs can be enriched through various methods: physical methods, such as density-based separation and microfluidic devices, or biological methods, such as immunocapture and aptamers. Both physical and biological enrichment methods aim to effectively isolate CTCs from the vast excess of other blood cells.

Microfluidic devices employed in the physical enrichment of CTCs are registering increased market demand, due to their high efficiency and label-free capabilities. These devices utilize microchannels and microposts to capture CTCs based on their size and physical properties.

This technology offers the potential to significantly improve CTC detection and analysis, leading to earlier diagnoses, more accurate prognoses, and the development of personalized treatment plans.

By Application

Based on application, the circulating tumor cells industry has been bifurcated into clinical/liquid biopsy and research. The liquid biopsy segment is poised for significant expansion, with a projected CAGR of 14.14%, driven by the increasing demand for less invasive diagnostic methods in cancer detection.

The global increase in cancer cases is fueling the demand for non-invasive cancer detection methods. CTCs offer a valuable tool for detecting cancer, particularly when tissue biopsies are not feasible. Moreover, the number and characteristics of CTCs can provide prognostic information, predicting disease progression and patient outcomes in various cancers, including breast and prostate cancer.

For example, in patients with metastatic breast cancer, CTC analysis is used to monitor treatment response and detect early signs of recurrence, offering critical insights for clinical decision-making.

By Product

Based on product, the circulating tumor cells market has been segregated into kits & reagents, blood collection tubes, and devices or systems. The devices or systems segment is rapidly growing and is expected to generate USD 5.72 billion revenue in 2024.

Devices or systems used for detection, enrichment, and analysis of CTCs improve the accuracy and reliability of CTC testing and, thereby, enable personalized treatment strategies based on CTC characteristics. These devices or systems hold a distinct advantage over kits, reagents, and other consumables, due to their standardized and automated processing capabilities, minimizing variability and improving workflow efficiency.

Established instruments and platforms, such as the CellSearch system, Parsortix system, and Liquid Biopsy platform, leverage advanced technologies to effectively detect and characterize CTCs, further driving adoption and growth within this segment.

By End-user

Based on end-user, the circulating tumor cells industry has been categorized into research and academic institutions, hospitals and clinics, and diagnostic centers. The research and academic institutions segment represent a significant market segment of 46.71% in 2023, leveraging CTCs to develop innovative diagnostic and prognostic tools and study cancer in detail.

Research institutes and medical research centers widely utilize CTCs as a minimally invasive tool to investigate the fundamental biology of cancer. By analyzing CTCs, researchers gain valuable insights on how cancer spreads from the primary tumor to distant organs (also known as metastasis) and thereby facilitating the development of novel prevention and treatment strategies.

Furthermore, the analysis of CTCs helps to screen for drugs that can effectively kill cancer cells or reduce their growth, thereby accelerating the development of more effective cancer therapies and driving advancements in oncology.

Circulating Tumor Cells Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North American circulating tumor cells market accounted for 36.55% share of the global market and was valued at USD 4.20 billion in 2023. The dominance of North America in the global market is attributed to high cancer prevalence and advanced healthcare infrastructure.

The increasing cases of cancer due to unhealthy dietary habits, stress, and consumption of alcohol has fueled the demand for non-invasive cancer detection procedures in this region. This contributes to the adoption of CTC testing in clinical practice and fuels the market.

- According to estimates from the American Cancer Society (ACS), Texas is projected to have the highest number of new cancer diagnoses in the U.S. for 2023, totaling 139,100 cases. The ACS report further highlights tobacco uses and obesity as key risk factors contributing to this elevated cancer burden within the state.

Asia Pacific has emerged as a growing circulating tumor cells market, and is projected to generate USD 2.65 billion revenue in 2024. Rapid economic growth across several countries in the region, including India, China, Thailand, and Malaysia, is driving increased healthcare expenditure and improved access to healthcare services.

This economic expansion is facilitating greater investment in advanced medical technologies like CTC testing, thereby increasing their availability and accessibility to a wider population.

Competitive Landscape

The global circulating tumor cells market report will provide valuable insights with a specialized emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in R&D, establishment of service delivery centers, and optimization of their service delivery processes, which are likely to create opportunities for market growth.

List of Key Companies in Circulating Tumor Cells Market

- Bio-Techne

- QIAGEN

- Greiner Bio-One International GmbH

- Precision Medicine Group, LLC.

- Aviva Systems Biology Corporation

- Cell Microsystems

- Ikonisys Inc.

- Miltenyi Biotec

- Creativ MicroTech, Inc.

- Sysmex Corporation

Key Industry Developments

- November 2024 (Partnership): Bio-Techne, a global provider of tools and reagents for research and clinical diagnosis, partnered with ALZpath to expedite research and development in neurodegenerative disease therapeutics. This collaboration enables Bio-Techne to leverage ALZpath's proprietary pTau217 assay for the advancement in research and development of new treatments, including Alzheimer’s.

- November 2024 (Partnership): QIAGEN, a global provider of molecular testing solutions headquartered in the Netherlands partnered with McGill University, Canada's leading medical doctoral university, to advance microbiome research. This collaboration establishes McGill University as a key beta-testing site for QIAGEN's innovative microbiome portfolio.

- May 2024 (Acquisition): Precision Medicine Group, LLC, a bio-marker driven clinical R&D services organization acquired Algorics, to expand its presence in Asia Pacific. This acquisition is also aimed to strengthen Precision’s capabilities in clinical data management, biostatistics, and programming.

The global circulating tumor cells market is segmented as:

By Technology

- CTC Detection & Enrichment Methods

- Immunocapture (Label-based)

- Size-based Separation (Label-free)

- Density-based Separation (Label-free)

- Combined Methods

- CTC Direct Detection Methods

- CTC Analysis

By Application

- Clinical/ Liquid Biopsy

- Risk Assessment

- Screening and Monitoring

- Research

- Cancer Stem Cell & Tumorogenesis Research

- Drug/Therapy Development

By Product

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

By End-user

- Research and Academic Institutes

- Hospital and Clinics

- Diagnostic Centers

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America