Market Definition

The market encompasses the extraction, production, and distribution of chromium and its alloys, primarily used in stainless steel manufacturing, chemicals, and various industrial applications. The report presents a comprehensive assessment of the primary growth factors, regional trends and the competitive landscape shaping the market.

Chromium Market Overview

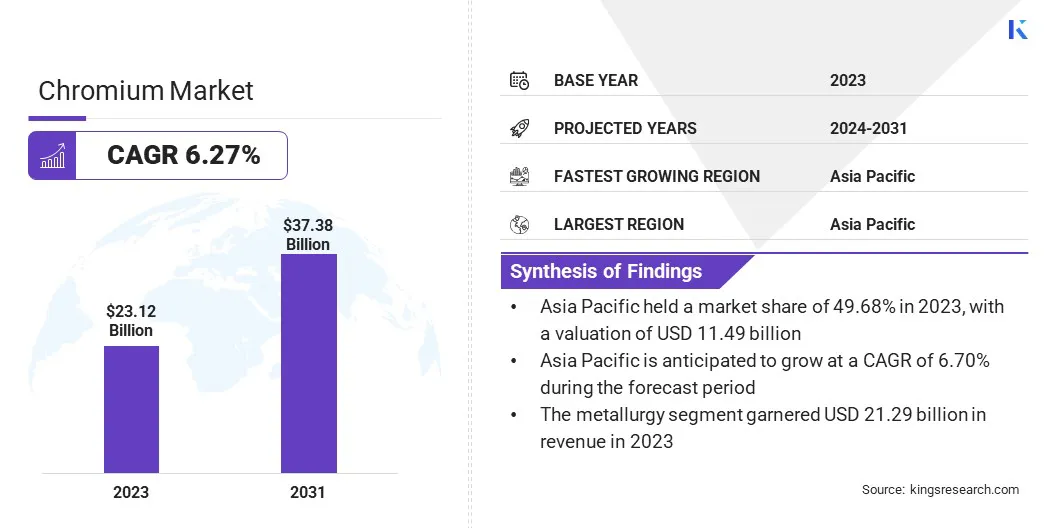

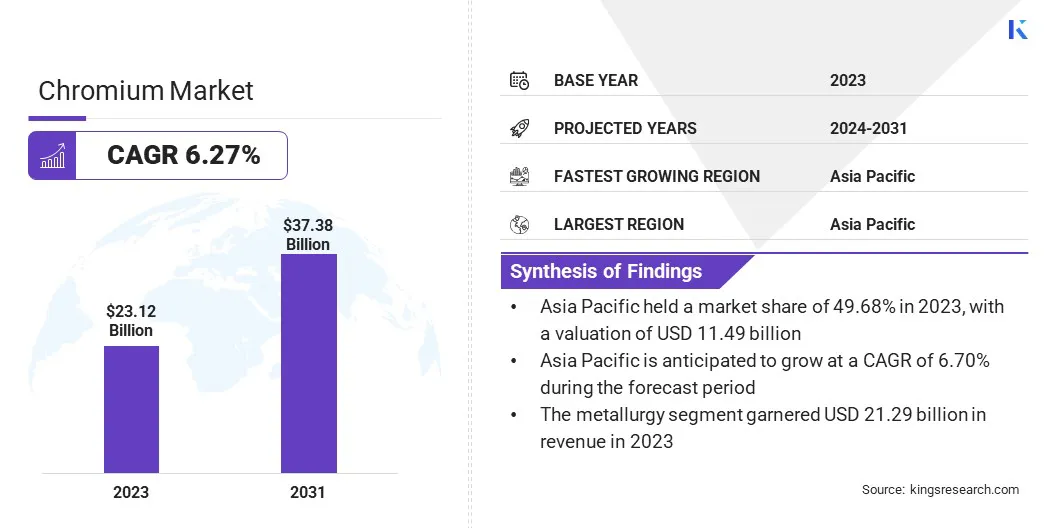

Global chromium Market size was valued at USD 23.12 billion in 2023, which is estimated to be valued at USD 24.42 billion in 2024 and reach USD 37.38 billion by 2031, growing at a CAGR of 6.27% from 2024 to 2031.

Rising industrial demand for high-performance materials in sectors such as aerospace, military, and manufacturing is boosting market growth. Chromium's critical role in producing alloys strengthens its demand across these industries.

Major companies operating in the chromium industry are Glencore, Samancor Chrome, Tata Steel, TNC Kazchrome JSC, IMFA, CVK Madencilik, Al Tamman Ferro Alloys (FZC) LLC, Oman Chromite Company (S.A.O.G), CHROMPIK, Ferro Alloys Corporation Ltd.(FACOR), Arij Global Trading, Odisha Mining Corporation Ltd. (O M C LTD), Ferbasa, Outokumpu, Balasore Alloys Limited, and others.

The market is witnessing a significant shift toward sustainability, supported by increasing environmental awareness and stricter regulations. Companies are adopting sustainable mining practices, reducing environmental impact, improving waste management, enahcing water efficiency, and minimizing carbon emissions.

Additionally, growing emphasis on chromium recycling is helping conserve resources, lower energy consumption, and reduce waste. These efforts support environmental objectives and enhance the long-term sustainability of chromium supply.

- A study conducted in October 2023 by Chulalongkorn University, Khon Kaen University, Naresuan University, and the Synchrotron Light Research Institute deveoped an environmentally friendly process for sequential washing and recovery of metals, specifically copper (Cu) and chromium (Cr) from industrial sludge. The method utilizes biosurfactants and chelating agents, followed by metal recovery with magnetite nanoparticles (Fe3O4), promoting sustainable management and circular economy practices.

Key Highlights:

- The chromium industry size was recorded at USD 23.12 billion in 2023.

- The market is projected to grow at a CAGR of 6.27% from 2024 to 2031.

- Asia Pacific held a share of 49.68% in 2023, valued at USD 11.49 billion.

- The ferrochromium segment garnered USD 18.94 billion in revenue in 2023.

- The metallurgy segment is expected to reach USD 34.40 billion by 2031.

- North America is anticipated to grow at a CAGR of 6.65% over the forecast period.

Market Driver

"Rising Industrial Demand for High-Performance Materials"

The growing industrial demand for high-performance materials, particularly in the aerospace, military, and manufacturing sectors, is fueling the expansion of the chromium market. Chromium is essential for producing durable, heat-resistant alloys used in critical applications such as jet engines, military equipment, and high-performance machinery.

As industries advance materials to meet stringent performance requirements, the demand for chromium is rising, bolstering market growth and supporting innovation and technological advancements.

- In October 2024, Oman Chromite Company signed a mining concession with the Ministry of Energy and Minerals to explore chromite, copper, and other minerals in northern Oman. This agreement aims to expand chromium production to meet growing industrial demand.

Market Challenge

"Geopolitical Instability"

Geopolitical instability poses a significant challenge to the progress of the chromium market, as the industry relies heavily on a few key regions.

According to the Indian Ferro Alloy Producers' Association, South Africa, Kazakhstan, and India hold substantial chromite reserves, while Russia and China also contribute notably to global supply. Trade disputes, political conflicts, and sanctions can disrupt supply chains, leading to price volatility and market uncertainty.

To mitigate this challenge, industry players are diversifying sourcing regions, investing in new reserve exploration, and fostering international cooperation to reduce dependence on specific areas. Enhancing supply chain transparency and strategic reserves further strenghthen resilience togeopolitical risks.

Market Trend

"Increased Adoption of Robotics"

The chromium market is witnessing a growing trend toward the adoption of robotics, particularly AI-powered systems, to enhance operational efficiency and safety.

These systems automate routine tasks, optimize production processes, and reduce the risks associated with human exposure to hazardous environments. This shift improves workplace safety, boosts productivity, minimizes downtime and errors, and supports more advanced, sustainable manufacturing practices.

- In June 2024, Outokumpu deployed its first ANYmal robot "Jokkeri" at the Tornio ferrochrome plant in Finland, highlighting a trend toward energy-efficient and safer production. This robotic technology optimizes production, enhances safety, and reduces environmental impact, reflecting rising focus on sustainable and cost-effective innovations.

Chromium Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Ferrochromium, Chromium Chemicals, Chromium Metals, Others

|

|

By Application

|

Metallurgy, Chemicals, Refractory, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Ferrochromium, Chromium Chemicals, Chromium Metals, and Others): The ferrochromium segment earned USD 18.94 billion in 2023 due to its crucial role in stainless steel production and high demand for alloys.

- By Application (Metallurgy, Chemicals, Refractory, and Others): The metallurgy segment held a notabke share of 92.09% in 2023, largely attributed to its growing use in producing stainless steel and industrial alloys.

Chromium Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific chromium market share stood at around 49.68% in 2023, valued at USD 11.49 billion. The dominance is reinforced by significant demand from countries such as China and India. In India, the Ministry of Mines reported a provisional chromite production of 3.14 million tons in 2023-24, reflecting a 3.1% increase from the previous year.

Odisha remained the major contributor to the country's chromite output, supported by major producers such as Odisha Mining Corporation (OMC), Tata Steel Mining Ltd., and Indian Metals & Ferro Alloys Ltd. The region’s expanding industrial sectors, including metallurgy and manufacturing, are boosting chromium consumption.

Additionally, large-scale mining and strategic infrastructure investments reinforce Asia-Pacific's position as the leading region in chromium production and consumption.

North America chromium industry is likely to grow at a CAGR of 6.65% over the forecast period. This growth is fueled by increasing demand from industries such as aerospace, automotive, and manufacturing.

The region's growing focus on infrastructure development and technological advancements is fostering chromium consumption, particularly in high-performance alloys and coatings.

Additionally, North America is making substantial investments in chromium exploration and production to reduce reliance on imports. These factors, along with rising industrial production, position North America as a key market for chromium.

Regulatory Frameworks

- In India, the Mines and Minerals (Development and Regulation) Act, 1957 governs chromite mining, which ensures legal compliance, mineral exploration, sustainable practices, and environmental oversight.

- In the U.S., the Clean Water Act (CWA) regulates pollutant discharges into navigable waters, including chromium, through the EPA's National Pollutant Discharge Elimination System (NPDES).

- In the EU, the REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals) oversees the use of chromium chemicals, focusing on risk assessment and management to safeguard human health and the environment.

Competitive Landscape

Companies in the chromium industry are expanding mining operations, investing in advanced technologies, and increasing automation to enhance production efficiency. They are exploring new deposits to secure long-term supply while minimizing environmental impact through sustainable practices.

Additionally, they are integrating recycling and developing low-carbon production methods to meet the growing demand for chromium in critical industries such asaerospace, automotive, and stainless steel manufacturing.

- In January 2025, Outokumpu reported a 95% increase in mineral reserves at its Kemi chrome mine in Finland, significantly expanding the mine's lifespan . This development strengthens the company's strategic position, ensuring a stable supply for ferrochrome production and supporting its sustainability efforts.

List of Key Companies in Chromium Market:

- Glencore

- Samancor Chrome

- Tata Steel

- TNC Kazchrome JSC

- IMFA

- CVK Madencilik

- Al Tamman Ferro Alloys (FZC) LLC

- Oman Chromite Company (S.A.O.G)

- CHROMPIK

- Ferro Alloys Corporation Ltd.(FACOR)

- Arij Global Trading

- Odisha Mining Corporation Ltd. (O M C LTD)

- Ferbasa

- Outokumpu

- Balasore Alloys Limited

Recent Developments (Expansion/New Product Launch)

- In December 2024, ERG launched its highly automated Bolashak chromium mine in Kazakhstan, with a planned annual capacity of 7.5 million tonnes of ore. This USD 2 billion investment aims to secure a steady supply of chromite for local ferroalloy plants, enhancing productivity and safety.

- In July 2024, Tata Steel conducted a trial of biomass usage in ferrochrome production at its Ferrochrome Plant in Athagarh, Odisha. This initiative, part of the company’s sustainability efforts, aims to reduce carbon emissions and align with global trends toward more eco-friendly production practices.