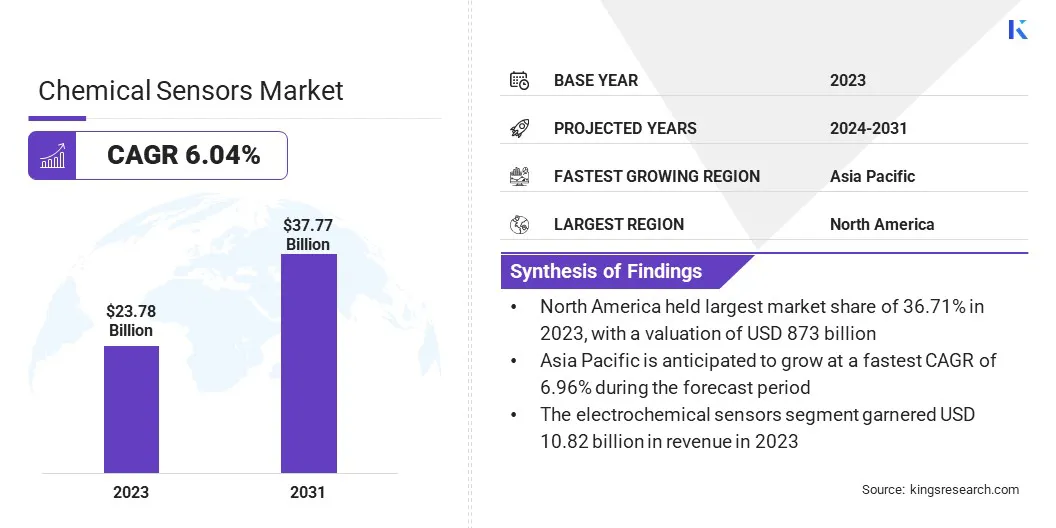

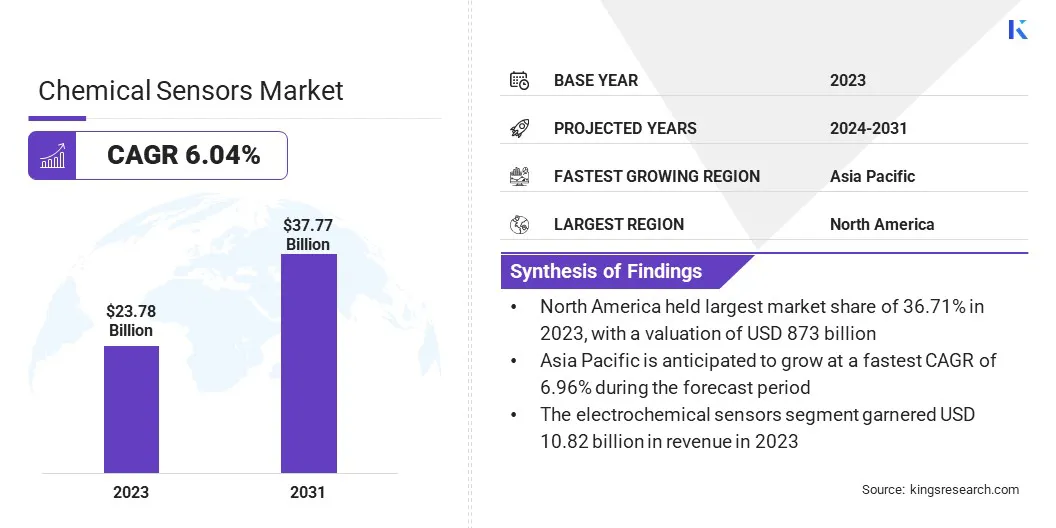

Chemical Sensors Market Size

The global chemical sensors market size was valued at USD 23.78 billion in 2023 and is projected to grow from USD 25.05 billion in 2024 to USD 37.77 billion by 2031, exhibiting a CAGR of 6.04% during the forecast period.

Increasing awareness of environmental pollution and strict regulations are driving the adoption of chemical sensors for monitoring air, water, and soil quality. These sensors are widely used to detect pollutants such as toxic gases and contaminants, which helps industries comply with regulatory standards.

In the scope of work, the report includes products offered by companies such as Honeywell International Inc., ABB, Emerson Electric Co., Siemens, MSA, Amphenol Corporation, Sensirion AG, Aeroqual , Yokogawa Electric Corporation, Baker Hughes Company, and others.

Moreover, chemical sensors are becoming essential in industries such as oil & gas, manufacturing, and food & beverage for process optimization, quality control, and safety monitoring. Their ability to detect hazardous chemicals and ensure workplace safety is fueling the chemical sensors market.

Chemical sensors are analytical devices designed to detect and measure the presence of specific chemical substances in various environments. They work by converting chemical information into a readable signal, often in the form of electrical, optical, or mechanical outputs.

Chemical sensors are used in a wide range of applications, including environmental monitoring, healthcare, industrial process control, and safety systems. These sensors detect changes in chemical composition, such as the concentration of gases, liquids, or solids, and are critical for ensuring safety, quality, and efficiency across many industries.

Analyst’s Review

The rapid evolution of industrial automation is creating high demand for chemical sensors capable of monitoring and controlling complex manufacturing processes. These sensors have become integral to monitoring and controlling complex manufacturing operations, ensuring operational safety and efficiency.

Their ability to detect hazardous chemicals and optimize resource utilization aligns with industry goals to enhance productivity while reducing costs.

- In August 2024, Honeywell revealed that its Emissions Management Suite has achieved Hazardous Location (HazLoc) and marine certifications, positioning it as one of the industry's first comprehensive solutions for offshore oil & gas assets to measure, monitor, report, and reduce emissions. Additionally, Honeywell has integrated new solar capabilities into the suite, extending the lifespan of its gas detectors by over eight years with minimal additional maintenance.

Integration with advanced automation technologies, including robotics and IoT-enabled platforms, has significantly improved precision in industrial processes, further boosting demand. Sectors such as petrochemicals, pharmaceuticals, and semiconductors are increasingly leveraging chemical sensors to uphold quality standards and mitigate operational risks.

This trend underscores the growing role of chemical sensors in advancing industrial automation, positioning them as a vital component in modern manufacturing environments.

Chemical Sensors Market Growth Factors

The increasing prevalence of chronic diseases and the demand for real-time diagnostic tools are fueling the adoption of chemical sensors in healthcare. These sensors play a critical role in monitoring vital parameters, including blood glucose levels and respiratory functions, through non-invasive and wearable devices.

- According to a September 2023 report by the World Health Organization, noncommunicable diseases (NCDs) are responsible for 41 million deaths annually, representing 74% of global fatalities. Cardiovascular diseases lead the toll, causing 17.9 million deaths each year, followed by cancer with 9.3 million, chronic respiratory diseases with 4.1 million, and diabetes, alongside diabetes-related kidney disease claiming 2 million lives. Chemical sensors play a crucial role in detecting biomarkers for conditions like cardiovascular diseases, diabetes, and respiratory issues, enabling early detection, continuous monitoring, and improved patient outcomes.

The integration of chemical sensors into advanced diagnostic technologies enhances patient outcomes by providing accurate and timely health insights. Growing investments in healthcare infrastructure and medical technology innovations are further driving their utilization across clinical and homecare settings, solidifying their importance in enhancing the quality of care and patient monitoring systems.

Moreover, government policies and institutional investments aimed at fostering innovation in sensor technology are significantly influencing the market's growth trajectory. Funding for research and development (R&D), coupled with grants and subsidies for adopting advanced chemical sensors, is encouraging industries to integrate these technologies.

Regulatory frameworks emphasizing environmental protection and industrial safety have accelerated the adoption of chemical sensors across diverse applications.

Collaborative efforts between private enterprises and public institutions are driving innovation, enabling the development of cutting-edge sensing solutions that address the growing demand for monitoring capabilities in both developed and developing economies.

However, the growth of the chemical sensors market is hindered by the high cost of advanced sensor technologies, which limits its adoption. The complex manufacturing process, coupled with the need for specialized materials, drives up costs.

To overcome this challenge, companies are focusing on reducing production costs through innovations in sensor design and materials, such as developing more cost-effective, durable sensors. Additionally, manufacturers are investing in automation and scaling production to drive economies of scale, making sensors more affordable and accessible to a wider range of industries, thus boosting market growth.

Chemical Sensors Market Trends

The chemical sensors market is experiencing robust growth, due to innovations in sensor technology, including miniaturization, enhanced sensitivity, and wireless integration. These advancements have expanded the application range of chemical sensors across industrial automation, smart devices, and environmental monitoring systems.

Improvements in nanotechnology and materials science have enabled the development of more accurate and reliable sensors, meeting the evolving demands of industries. The rising adoption of IoT-enabled devices has further driven the use of chemical sensors in connected systems, allowing real-time data analysis and remote monitoring.

- In May 2024, Aqsen Innovations announced a collaboration with CENSIS, Scotland’s innovation center for sensing, imaging, and IoT technologies, to enhance the development of its Aquasense sensor system. This versatile technology is designed to monitor various water parameters, including temperature, oxygen levels, salinity, and chemical presence, such as chlorine.

The integration of chemical sensors into wearable devices and consumer electronics is creating new opportunities for the market. Smartwatches and fitness trackers now incorporate sensors for monitoring environmental conditions, air quality, and health parameters, catering to consumer demand for personalized health and lifestyle management tools.

The growing popularity of smart homes and connected devices has also increased the adoption of chemical sensors for air purification systems, gas leak detection, and energy-efficient solutions. This trend is supported by advancements in miniaturized sensor designs, which allow seamless integration into compact and portable devices.

Segmentation Analysis

The global market is segmented based on product type, end-user, and geography.

By Product Type

Based on product type, the market is segmented into electrochemical sensors, optical sensors, thermal sensors, and others. The electrochemical sensors segment led the chemical sensors market in 2023, reaching the valuation of USD 10.82 billion. This segment is further divided into amperometric, conductometric, and others.

These sensors are particularly valued for their cost-effectiveness and reliability in industries such as environmental monitoring, healthcare, and industrial safety. Their ability to detect low concentrations of gases, including toxic substances, makes them ideal for applications where safety and regulatory compliance are paramount.

Furthermore, the increasing demand for portable and easy-to-maintain solutions in critical monitoring applications has further driven the adoption of electrochemical sensors, positioning them as a dominant product type in the market.

By End-User

Based on end-user, the market is classified into government and research institutions, healthcare institutions, automotive industry, industrial manufacturing, and others.

The healthcare institutions segment is poised for significant growth at a robust CAGR of 6.70% through the forecast period, due to the increasing demand for advanced diagnostic tools and patient monitoring systems. Chemical sensors play a critical role in detecting biomarkers, monitoring blood glucose levels, respiratory conditions, and other vital parameters, contributing to more accurate and timely medical interventions.

Moreover, the rising trend of wearable medical devices and remote patient monitoring further fuels the adoption of chemical sensors in healthcare settings, ensuring sustained market growth.

Chemical Sensors Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

The chemical sensors market in North America accounted for a share of 36.71% in 2023, with a valuation of USD 8.73 billion. The enforcement of stringent environmental policies is driving the adoption of chemical sensors across North America.

Regulatory agencies such as the Environmental Protection Agency (EPA) mandate rigorous monitoring of air, water, and soil pollution, leading industries to deploy advanced sensors for compliance. These regulations have spurred significant investments in monitoring technologies to address emissions and ensure environmental sustainability, fostering market growth.

Moreover, the automotive sector in North America is contributing to the growth of the chemical sensors market through the integration of advanced emission control systems and fuel efficiency technologies. Rising consumer demand for sustainable and high-performance vehicles has increased the need for sensors capable of monitoring exhaust gases and optimizing engine performance.

Additionally, the growing adoption of electric vehicles (EVs) has further driven the demand for specialized chemical sensors tailored to EV-specific requirements.

- The Environmental Defense Fund's report, released in August 2024, projects that by 2027, U.S. EV manufacturing facilities will have the capacity to produce around 5.8 million new EVs each year. This would account for 36% of all vehicles sold in the U.S. in 2023.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 6.96% over the forecast period. The accelerated pace of industrial development and urban expansion in Asia Pacific is significantly boosting the demand for chemical sensors. Industries such as manufacturing, petrochemicals, and mining are integrating sensors to optimize processes and enhance operational safety.

Additionally, urban growth is driving the need for environmental monitoring solutions to address pollution and ensure sustainable urban planning, creating substantial opportunities for sensor manufacturers.

Furthermore, growing investments in Industry 4.0 initiatives, particularly in countries like Japan, South Korea, and China, are accelerating the integration of sensors with IoT-enabled systems, fostering robust market growth.

Competitive Landscape

The global chemical sensors market report will provide valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Chemical Sensors Market

- Honeywell International Inc

- ABB

- Emerson Electric Co.

- Siemens

- MSA

- Amphenol Corporation

- Sensirion AG

- Aeroqual

- Yokogawa Electric Corporation

- Baker Hughes Company

Key Industry Developments

- July 2024 (Product Launch): ABB launched NINVA TSP341-N, the first SIL2-certified non-invasive temperature sensor, aimed at simplifying and improving safety in temperature measurement across chemical and oil & gas industries.

- June 2024 (Product Launch): Baker Hughes launched three new sensor technologies XMTCpro, HygroPro XP, and T5MAX aimed at enhancing safety and productivity in hydrogen and other industrial applications. The XMTCpro is a thermal conductivity-based gas analyzer that provides reliable monitoring of gas concentrations and HygroPro XP is a transmitter that accurately measures trace moisture in gases and hydrocarbon liquids.

The global chemical sensors market is segmented as:

By Product Type

- Electrochemical Sensors

- Amperometric

- Conductometric

- Others

- Optical Sensors

- Thermal Sensors

- Others

By End-user

- Government and Research Institutions

- Healthcare Institutions

- Automotive Industry

- Industrial Manufacturing

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of AsiaPacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America