Market Definition

The market encompasses a wide range of medical interventions and services aimed at managing and treating cervical cancer across various stages and cancer types. The market includes therapies such as radiation, surgery, chemotherapy, targeted therapy, immunotherapy, and other emerging treatment options.

It spans different disease stages, including early-stage, locally advanced, and metastatic cervical cancer. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market growth.

Cervical Cancer Treatment Market Overview

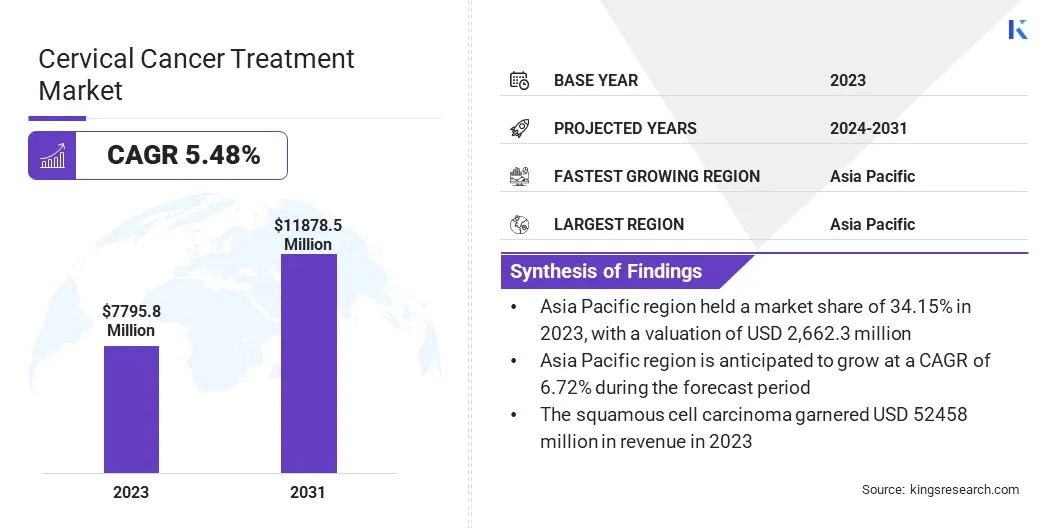

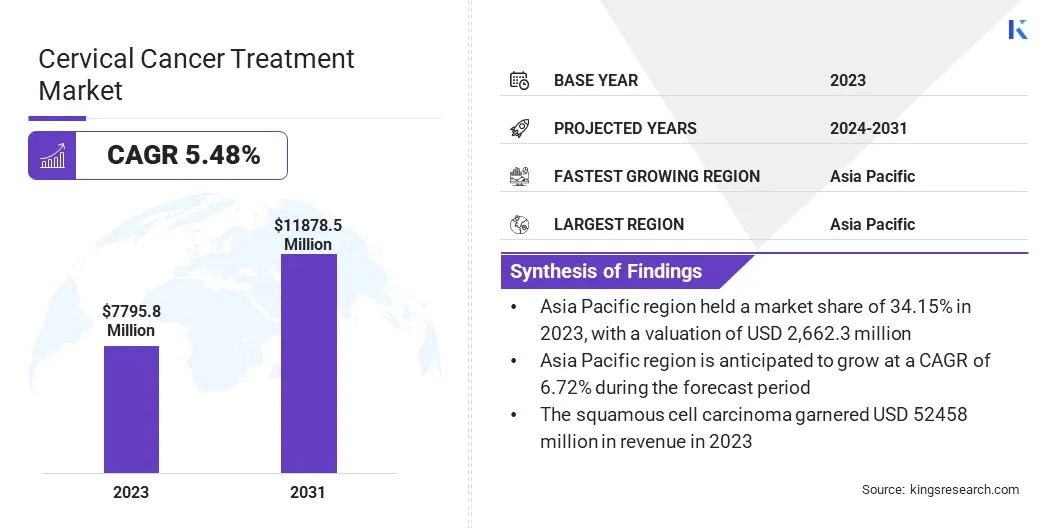

The global cervical cancer treatment market size was valued at USD 7,795.8 million in 2023 and is projected to grow from USD 8,177.3 million in 2024 to USD 11,878.5 million by 2031, exhibiting a CAGR of 5.48% during the forecast period.

This growth is attributed to the high prevalence of cervical cancer globally. Rising cases of cervical cancer, one of the most common cancers in women in developing regions, are fueling the demand for effective treatment options.

The rise in risk factors, such as human papillomavirus (HPV) infections and delayed screenings, further contributes to the growing incidence of the disease, highlighting the urgent need for advanced treatment solutions.

Major companies operating in the cervical cancer treatment industry are Novartis AG, AstraZeneca, Agenus Inc., F. Hoffmann-La Roche Ltd, Biocon Limited, Bristol-Myers Squibb Company, Pfizer Inc., Dr. Reddy's Laboratories Ltd., Eli Lilly and Company, Merck & Co., Inc., IOVANCE Biotherapeutics, Inc., DAIICHI SANKYO COMPANY, LIMITED, GSK plc, Amgen Inc., and Genmab A/S.

The integration of Artificial Intelligence (AI) in screening technologies has improved early detection rates, enabling timely intervention and reducing mortality rates. These innovations, combined with ongoing research and clinical trials, are expanding the range of treatment options available to patients.

- In January 2024, Merck announced that the U.S. Food and Drug Administration (FDA) approved KEYTRUDA, in combination with chemoradiotherapy (CRT), for the treatment of patients with FIGO 2014 Stage III-IVA cervical cancer.

Key Highlights:

- The cervical cancer treatment industry size was valued at USD 7,795.8 million in 2023.

- The market is projected to grow at a CAGR of 5.48% from 2024 to 2031.

- Asia Pacific held a market share of 34.15% in 2023, with a valuation of USD 2,662.3 million.

- The radiation therapy segment garnered USD 2,271.7 million in revenue in 2023.

- The locally advanced cervical cancer (Stage IIB–IVA) segment is expected to reach USD 3,642.2 million by 2031.

- The squamous cell carcinoma segment is expected to reach USD 5,245.8 million by 2031.

- The 30-50 Years segment is expected to reach USD 6,119.5 million by 2031.

- The hospitals segment garnered USD 3,060.6 million in revenue in 2023.

- The market in North America is anticipated to grow at a CAGR of 4.80% during the forecast period.

Market Driver

"Increasing Prevalence of Cervical Cancer"

The cervical cancer treatment market is registering growth, due to the rising prevalence of cervical cancer globally. Increasing cancer rates, particularly in developing regions, have led to a higher demand for effective treatment solutions.

Factors such as persistent HPV infections, limited access to early screening, and delayed diagnosis are contributing to a growing patient pool. The need for advanced therapies continues to expand as more cases progress to advanced stages. This surge in disease burden is pushing healthcare providers and pharmaceutical companies to invest in improving treatment options, thereby fueling the market.

- In January 2025, the American Cancer Society estimated that approximately 13,360 new cases of invasive cervical cancer will be diagnosed in the U.S., with about 4,320 women expected to die from the disease. The organization also noted that cervical pre-cancers are diagnosed far more frequently than invasive cervical cancer.

Market Challenge

"High Cost of Advanced Therapies"

A major challenge in the cervical cancer treatment market is the high cost of advanced therapies, particularly targeted therapies and immunotherapies. These treatments, while effective, are often expensive, making them less accessible to patients in low- and middle-income countries.

This cost barrier limits the widespread adoption of cutting-edge treatment options, affecting patient outcomes. A potential solution is the development of more affordable biosimilars and generic versions of these therapies.

Governments and pharmaceutical companies can collaborate to increase access to cost-effective treatment options, ensuring that patients benefit from advancements in cervical cancer care.

Market Trend

"Technological Advancements in Early Detection"

A notable trend in the cervical cancer treatment market is the integration of AI-driven screening tools. These technologies are revolutionizing early detection by providing more accurate and efficient methods for identifying cervical cancer.

AI algorithms can analyze large volumes of patient data, including pap smears and HPV tests, to detect abnormalities with greater precision than traditional methods. This advancement allows for earlier diagnosis, enabling timely intervention and improving patient outcomes.

The growing use of AI in diagnostics is expected to drive the market by increasing the effectiveness and accessibility of screening, particularly in underserved regions.

- In September 2024, NTL Healthcare introduced its CerviCARE AI cervical cancer screening system at 2024 TGCS held in Hua Hin, Thailand. CerviCARE AI, an AI-powered cervical cancer image recognition system, was highlighted for its potential to assist healthcare professionals, particularly in resource-limited areas, by providing quick, accurate results for decision-making.

Cervical Cancer Treatment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Therapy Type

|

Radiation Therapy, Surgery, Chemotherapy, Targeted Therapy, Immunotherapy, Others

|

|

By Disease Stage

|

Locally Advanced Cervical Cancer (Stage IIB–IVA), Early-stage Cervical Cancer (Stage I–IIA), Metastatic Cervical Cancer (Stage IVB)

|

|

By Cancer Type

|

Squamous cell carcinoma, Adenocarcinoma, Adenosquamous carcinoma

|

|

By Age Group

|

30–50 Years, Above 50 Years, Below 30 Years

|

|

By End User

|

Hospitals, Cancer and Radiation Therapy Centers, Specilty Clinics, Diagnostic Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Therapy Type (Radiation Therapy, Surgery, Chemotherapy, Targeted Therapy, and Immunotherapy, Others): The radiation therapy segment earned USD 2,271.7 million in 2023, due to its widespread use in both early and advanced stages of cervical cancer.

- By Disease Stage (Locally Advanced Cervical Cancer (Stage IIB–IVA), Early-stage Cervical Cancer (Stage I–IIA), Metastatic Cervical Cancer (Stage IVB)): The locally advanced cervical cancer (Stage IIB–IVA) held 46.72% share of the market in 2023, due to the high number of diagnoses at this stage requiring multimodal treatment.

- By Cancer Type (Squamous cell carcinoma, Adenocarcinoma, Adenosquamous carcinoma, and Sub3_Seg4): The squamous cell carcinoma segment is projected to reach USD 7,200.9 million by 2031, owing to its high prevalence among cervical cancer patients.

- By Age Group (30–50 Years, Above 50 Years, Below 30 Years): The 30–50 Years segment is projected to reach USD 6,119.5 million by 2031, owing to the rising incidence in this age group and increased screening awareness.

- By End User (Hospitals, Cancer and Radiation Therapy Centers, Specilty Clinics, Diagnostic Centers): The hospitals segment earned USD 3,060.6 million in 2023, due to their access to comprehensive treatment facilities and multidisciplinary care teams.

Cervical Cancer Treatment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific cervical cancer treatment market share stood at around 34.15% in 2023, with a valuation of USD 2,662.3 million. The dominance is attributed to the high prevalence of cervical cancer, particularly in India and China. Government-led healthcare initiatives and rising investments in cancer care have improved access to diagnostics and treatment.

Public awareness campaigns have strengthened early detection. The growing adoption of advanced therapies and expanding healthcare infrastructure support the overall market growth across the region.

- In September 2024, the U.S., India, Australia, and Japan jointly launched the Quad Cancer Moonshot Initiative to reduce the cancer burden in the Indo-Pacific region. The initiative initially targets cervical cancer and aims to strengthen cancer care infrastructure, promote HPV vaccination, increase screening access, and expand treatment options across underserved areas.

The cervical cancer treatment industry in North America is poised to grow at a significant CAGR of 4.80% over the forecast period. The growth is attributed to the well-established healthcare systems and high public awareness of screening and vaccination.

Early diagnosis, combined with access to advanced treatment options, has driven positive patient outcomes. Strong R&D activity and presence of leading pharmaceutical companies continue to support innovation in targeted therapies. Reimbursement support and favorable regulatory environments have further accelerated the market expansion in the region.

Regulatory Frameworks

- In the U.S., cervical cancer treatment is regulated by the U.S. Food and Drug Administration (FDA), which oversees the approval of cancer drugs, vaccines, and medical devices. The FDA evaluates clinical trial data for therapies such as chemotherapy, immunotherapy, and HPV vaccines.

- In Europe, cervical cancer treatments are regulated by the European Medicines Agency (EMA). Products undergo scientific evaluation through the Committee for Medicinal Products for Human Use (CHMP). The HPV vaccine and cancer therapies are authorized under the centralized procedure, allowing them to be marketed across EU member states.

Competitive Landscape

Key players in the cervical cancer treatment industry are actively investing in research and development to introduce advanced therapies, including immunotherapies and targeted treatments. Partnerships with research institutions and biotechnology firms are being formed to accelerate clinical pipelines and gain access to innovative technologies.

Firms are expanding their geographic footprint through regulatory approvals and product launches in emerging markets. Several players are entering licensing agreements and joint ventures to enhance access to proprietary drug platforms and diagnostic tools.

Emphasis is being placed on expanding treatment portfolios through acquisitions of specialized oncology assets. Cost-effective treatment models and integration of digital health solutions are also being explored to improve patient outcomes and streamline care delivery.

- In April 2024, Pfizer Inc. and Genmab A/S announced the full approval of the FDA for TIVDAK (tisotumab vedotin-tftv) to treat recurrent or metastatic cervical cancer. This approval follows the positive results from the global Phase 3 innovaTV 301 clinical trial, which demonstrated an overall survival benefit for TIVDAK compared to chemotherapy.

List of Key Companies in Cervical Cancer Treatment Market:

- Novartis AG

- AstraZeneca

- Agenus Inc.

- F. Hoffmann-La Roche Ltd

- Biocon Limited

- Bristol-Myers Squibb Company

- Pfizer Inc.

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- Merck & Co., Inc.

- IOVANCE Biotherapeutics, Inc.

- DAIICHI SANKYO COMPANY, LIMITED

- GSK plc

- Amgen Inc.

- Genmab A/S

Recent Developments (Approval)

- In April 2025, Biocon Biologics Ltd received FDA approval for Jobevne (bevacizumab-nwgd), for intravenous use across multiple oncology indications. The approval strengthens the company’s oncology portfolio in the U.S., which includes OGIVRI and FULPHILA.