Market Definition

Cellulose ether, a chemically modified derivative of cellulose, is water-soluble and improves viscosity, stability, and film-forming properties. The market encompasses hydroxypropyl methylcellulose, carboxymethyl cellulose, methylcellulose, hydroxyethyl cellulose, and ethyl cellulose, serving industries such as construction, pharmaceuticals, food, personal care, and paints and coatings.

It is offered in various grades and formulations through multiple distribution channels to cater to diverse industrial requirements.

Cellulose Ether Market Overview

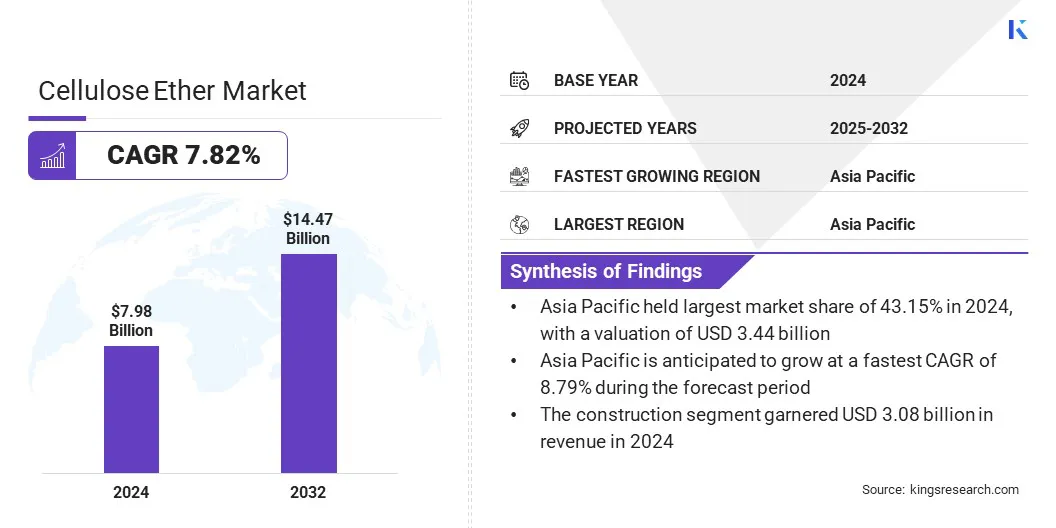

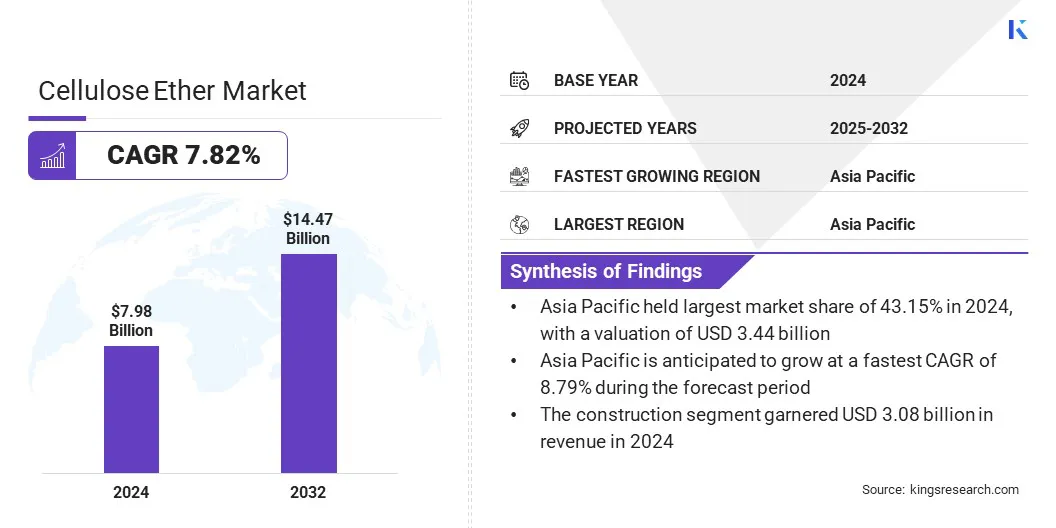

According to Kings Research, global cellulose ether market size was valued at USD 7.98 billion in 2024 and is projected to grow from USD 8.54 billion in 2025 to USD 14.47 billion by 2032, exhibiting a CAGR of 7.82% during the forecast period. This growth is fueled by increasing use in high-performance construction materials, pharmaceutical formulations, and specialty coatings.

Rising demand for plant-based, sustainable additives in personal care and food industries strengthens adoption. Manufacturers focus on developing tailored grades and advanced formulations, enhancing functionality and enabling broader industrial applications.

Key Market Highlights:

- The cellulose ether industry size was USD 7.98 billion in 2024.

- The market is projected to grow at a CAGR of 7.82% from 2025 to 2032.

- Asia Pacific held a share of 43.15% in 2024, valued at USD 3.44 billion.

- The hydroxypropyl methylcellulose segment garnered USD 2.68 billion in revenue in 2024.

- The construction segment is expected to reach USD 5.35 billion by 2032.

- North America is anticipated to grow at a CAGR of 7.51% over the forecast period.

Major companies operating in the cellulose ether market are Ashland, Shin-Etsu Chemical Co., Ltd., Dow, Nouryon, LOTTE, Shandong Head Group Co., Ltd., FENCHEM, J. RETTENMAIER & SÖHNE GmbH, Daicel Corporation, Celotech Chemical Co., Ltd., Shijiazhuang Henggu Jianxin Cellulose Co., Ltd., Kaimaoxing Cellulose (Shandong) Co., Ltd, WOTAI Construction Chemical Manufacturer, Kima Chemical Co., Ltd., and Lamberti S.p.A.

Growing investment in cellulose production and research is supporting market expansion. Increased focus on production efficiency and quality enhances the availability and cost-effectiveness of cellulose, meeting demand across food, personal care, and industrial applications.

This investment allows manufacturers to develop improved formulations and optimize operations, enabling companies to respond effectively to evolving market requirements.

- In March 2025, Shin-Etsu Chemical expanded its pharmaceutical cellulose business in Japan and Germany by establishing a new L-HPC production facility and increasing warehouse capacity at the Naoetsu Plant. This investment aims to enhance supply stability and meet growing global demand for high-performance pharmaceutical cellulose used as tablet-coatings and disintegrants.

Market Driver

Increasing Demand for Cellulose Ethers in Drug Formulations

The growth of the global market is driven by expanding pharmaceutical applications, where these polymers act as critical excipients in tablets, capsules, and oral dosage forms. They serve as binders, film coatings, disintegrants, and controlled-release agents, improving drug stability, bioavailability, and patient compliance.

Increasing demand for safe, high-performance, and plant-derived excipients is fostering the development of specialized cellulose ether grades that meet stringent quality standards and support versatile formulation needs. By enhancing the efficacy, consistency, and performance of pharmaceutical products, cellulose ethers have become integral to modern drug development and large-scale production.

- In May 2025, Univar Solutions and Shandong Head Group partnered to distribute high-quality cellulose ethers, including methyl cellulose (MC) and hydroxypropyl methylcellulose (HPMC), for pharmaceutical and nutraceutical applications. The collaboration aims to enhance supply, support sustainable and multifunctional excipients, and provide technical expertise to improve drug formulation performance and accessibility across European markets.

Market Challenge

Consistency and Stability Issues in Product Performance

A significant challenge hindering the expansion of the cellulose ether market is ensuring consistent product performance across a wide range of applications. Variations in viscosity, solubility, and chemical properties can impact the quality and reliability of end-use products in industries such as pharmaceuticals, food, and personal care.

To address this challenge, manufacturers are focusing on the development of standardized grades with uniform properties to ensure predictable performance. They are also investing in advanced quality control systems and process optimization techniques to minimize variability.

Additionally, research and development efforts are aimed at creating tailored formulations that meet specific application requirements, enhancing product reliability and customer satisfaction.

Market Trend

Advancement in Low Nitrite Cellulose Ethers

The global market is witnessing a growing trend toward the development of low nitrite cellulose ethers to mitigate the risk of nitrosamine formation in finished pharmaceutical dosages. Manufacturers are enhancing process controls and employing advanced analytical techniques to ensure minimal nitrite content.

This trend emphasizes safety and quality in drug formulations, addressing regulatory concerns and supporting consistent performance in both controlled release and immediate release applications.

By prioritizing nitrosamine reduction, the market is witnessing a notable shift toward specialized, high-purity cellulose ether grades that maintain functional reliability while meeting stringent industry standards, boosting innovation and adoption in the pharmaceutical sector.

- In April 2025, IFF Pharma Solutions launched Low Nitrite METHOCEL hydroxypropyl methylcellulose (HPMC), a range of cellulose ethers designed to reduce nitrosamine formation in pharmaceutical formulations. The product ensures consistent nitrite levels below 200 parts per billion, providing reliable performance for controlled and immediate release formulations, backed by advanced analytical testing and polymer expertise.

Cellulose Ether Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Hydroxypropyl Methylcellulose, Carboxymethyl Cellulose, Methyl Cellulose, Hydroxyethyl Cellulose, Ethyl Cellulose, Others

|

|

By Application

|

Construction, Pharmaceuticals, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Hydroxypropyl Methylcellulose, Carboxymethyl Cellulose, Methyl Cellulose, Hydroxyethyl Cellulose, Ethyl Cellulose, and Others): The hydroxypropyl methylcellulose segment earned USD 2.68 billion in 2024, mainly due to its extensive use as a thickening, binding, and stabilizing agent in construction, pharmaceuticals, and personal care products.

- By Application (Construction, Pharmaceuticals, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, and Others): The construction segment held a share of 38.57% in 2024, attributed to the growing demand for high-performance, durable, and sustainable building materials.

Cellulose Ether Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific cellulose ether market accounted for a substantial share of 43.15% in 2024, valued at USD 3.44 billion. This dominance is reinforced by rapid urbanization and robust growth in the construction and coatings sectors across South and Southeast Asia.

Rising demand for high-performance, versatile polymers in adhesives, sealants, and elastomers further supports this expansion. Strong industrial networks and increasing collaborations among regional suppliers and distributors enhance product accessibility and technical support, enabling manufacturers to address diverse formulation requirements and optimize performance.

- In April 2025, Brenntag Specialties partnered with Gaomi Silver Hawk to distribute Hydroxy Ethyl Cellulose (HEC) and Methyl Hydroxy Ethyl Cellulose (MHEC) across Bangladesh, India, Nepal, and Sri Lanka. The collaboration targets the CASE and construction industries in South Asia, providing high-quality cellulose ethers and leveraging technical expertise to optimize performance and support customer formulation requirements.

The North America cellulose ether industry is expected to register the fastest CAGR of 7.51% over the forecast period. This growth is fueled by the strong expansion of the pharmaceutical sector, supported by rising demand for advanced drug delivery systems and high-performance cellulose ether excipients.

Companies are focusing on product innovation, developing specialized cellulose ether grades to meet evolving formulation needs. Rising adoption of controlled-release, sustained-release, and patient-centric therapies further drives regional market expansion.

Strong technical expertise and established distribution networks enhance product development and accessibility, positioning North America as a leading region for pharmaceutical applications and innovative cellulose ether solutions.

- In May 2024, IFF Pharma Solutions launched a controlled release platform featuring its METHOCEL, ETHOCEL, and POLYOX products. The platform provides comprehensive solutions for pharmaceutical therapies, enhancing active ingredient release, patient compliance, and formulation performance. It includes educational resources, technical support, and guidance on optimizing controlled release dosage forms across solid and liquid pharmaceutical applications.

Regulatory Frameworks

- In the U.S., cellulose ether use is regulated by the Food and Drug Administration (FDA) for food and pharmaceutical applications, while the Environmental Protection Agency (EPA) oversees environmental compliance in industrial use.

- In Europe, the European Chemicals Agency (ECHA) governs chemical safety under REACH regulations.

- In China, the National Medical Products Administration (NMPA) and the Ministry of Ecology and Environment (MEE) manage pharmaceutical and industrial standards.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates food and pharmaceutical use.

- In India, the Food Safety and Standards Authority of India (FSSAI) and the Central Pollution Control Board (CPCB) oversee quality and environmental compliance.

Competitive Landscape

Key players in the cellulose ether market are strengthening their presence through strategic partnerships and continuous product innovation. Companies are entering collaborations with regional distributors, manufacturers, and industry stakeholders to expand their market presence, ensuring better accessibility and distribution of products.

Companies are focusing on product innovation by developing advanced cellulose ether grades and specialized formulations tailored to specific applications in pharmaceuticals, construction, personal care, and food industries.

These innovations enhance performance attributes such as viscosity, stability, and controlled-release properties. By combining partnership strategies with product development, companies aim to address diverse customer needs and maintain a strong market foothold.

- In May 2025, Colorcon and ASHA Cellulose formed an exclusive partnership, with Colorcon becoming the representative for ASHACEL and ASHAKOTE products across Europe, the Middle East, Africa, Northeast Asia, and Southeast Asia. The collaboration aims to enhance support in controlled release, taste-masking, and barrier membrane applications, combining ASHA’s polymer expertise with Colorcon’s technical and regulatory capabilities.

Top Companies in Cellulose Ether Market:

- Ashland

- Shin-Etsu Chemical Co., Ltd.

- Dow

- Nouryon

- LOTTE

- Shandong Head Group Co., Ltd.

- FENCHEM

- RETTENMAIER & SÖHNE GmbH

- Daicel Corporation

- Celotech Chemical Co., Ltd.

- Shijiazhuang Henggu Jianxin Cellulose Co., Ltd.

- Kaimaoxing Cellulose (Shandong) Co., Ltd

- WOTAI Construction Chemical Manufacturer

- Kima Chemical Co., Ltd.

- Lamberti S.p.A.

Recent Developments (Acquisition/Partnership)

- In June 2025, LANDU acquired ZOVAE to advance green chemistry and intelligent manufacturing. The partnership combines LANDU’s R&D and sales network with ZOVAE’s expertise in cellulose ether, redispersible latex powder, and specialty additives, enabling efficient production, customized solutions, and enhanced global competitiveness in the chemical new materials industry.

- In November 2024, Colorcon and LOTTE Fine Chemical partnered to support the development and manufacture of pharmaceutical and dietary supplement formulations. Colorcon will exclusively represent LOTTE’s AnyCoat Hypromellose and AnyCoat-P Hypromellose Phthalate polymers, enabling applications in immediate, controlled, and enteric drug release, combining LOTTE’s specialty chemical expertise with Colorcon’s global technical and service network.