Market Definition

The market focuses on the large-scale production of cells for use in research, clinical, and commercial applications. It supports advancements in regenerative medicine, cancer therapy, and stem cell research.

This market includes a range of products such as instruments, media, reagents, and cell culture systems. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market.

Cell Expansion Market Overview

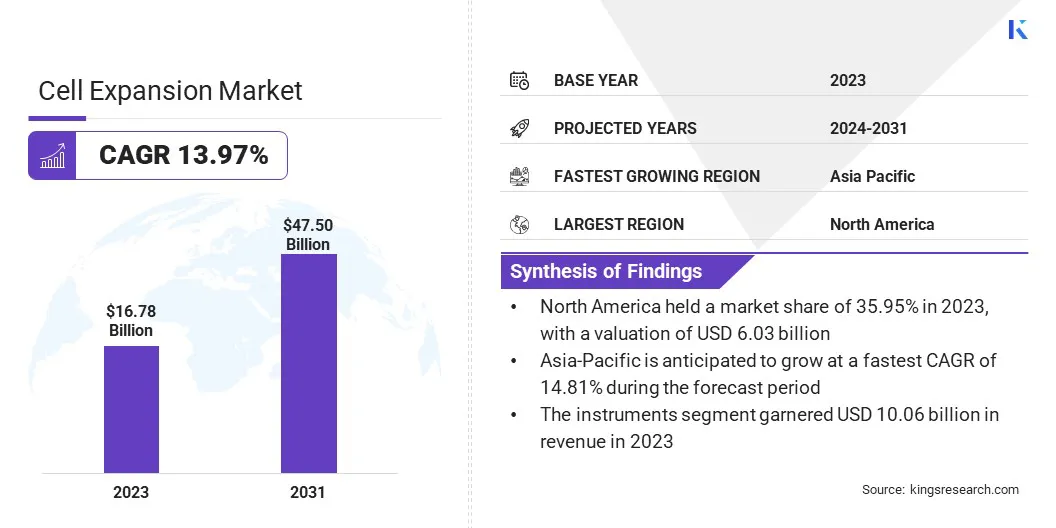

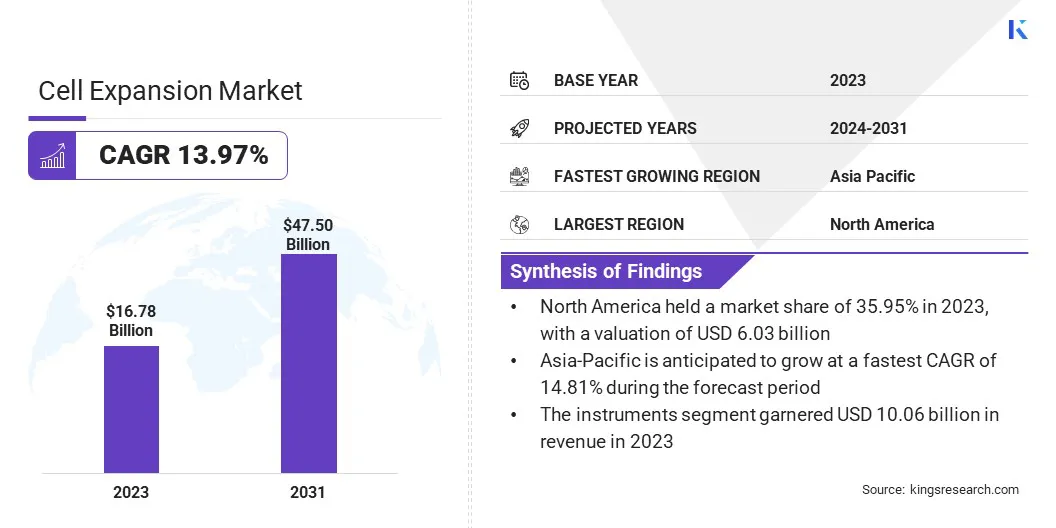

The global cell expansion market size was valued at USD 16.78 billion in 2023 and is projected to grow from USD 19.02 billion in 2024 to USD 47.50 billion by 2031, exhibiting a CAGR of 13.97% during the forecast period. The rise in chronic and infectious diseases is significantly driving the market.

The global prevalence of conditions like cancer, diabetes, and autoimmune disorders continues to increase, boosting the demand for advanced therapeutic solutions, including cell-based treatments. Additionally, the ongoing need for vaccines and biologics to combat infectious diseases is fueling the demand for cell expansion technologies.

Major companies operating in the cell expansion industry are Thermo Fisher Scientific Inc, DH Life Sciences LLC, Merck KGaA, Sartorius AG, Corning Incorporated, Lonza, BD, Eppendorf SE, FUJIFILM Europe GmbH, Terumo BCT, Miltenyi Biotec, STEMCELL Technologies, Takara Bio Inc, PromoCell, and HiMedia Laboratories.

The expansion of manufacturing capacity to meet rising demand for advanced cell therapies is significantly driving the market by enabling faster global distribution. Advanced treatments are becoming more widely available with increased production capabilities, which, in turn, accelerates their adoption across different regions. The market is further fueled by the ability to rapidly introduce new products into emerging markets.

- In April 2024, Bristol Myers Squibb signed a USD 380 million supply agreement with contract manufacturer Cellares to produce its CAR-T cell therapies in the U.S., the EU, and Japan. This collaboration aims to expand the manufacturing capacity of Bristol Myers in response to increasing demand. The company plans to launch its CAR-T blood cancer therapies, Abecma and Breyanzi, in several new countries.

Key Highlights:

- The cell expansion market size was valued at USD 16.78 billion in 2023.

- The market is projected to grow at a CAGR of 13.97% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 6.03 billion.

- The instruments segment garnered USD 10.06 billion in revenue in 2023.

- The human segment is expected to reach USD 19.73 billion by 2031.

- The biopharmaceuticals segment secured the largest revenue share of 29.90% in 2023.

- The research & academic institutes segment garnered USD 5.96 billion in revenue in 2023

- The market in Asia Pacific is anticipated to grow at a CAGR of 14.81% over the forecast period.

Market Driver

Technological Advancements in Cell Expansion Systems

Technological advancements in cell expansion systems are driving the market. Modern platforms now feature real-time monitoring of cell health and metabolic activity, enabling precise adjustment of culture conditions to optimize growth. Advanced systems are minimizing contamination risks and reducing manual intervention.

These advancements are improving the consistency, efficiency, and reproducibility of cell expansion processes, supporting the growing demand for high-quality cells used in cell and gene therapies, personalized medicine, and clinical manufacturing.

- In September 2024, PHC Corporation in Japan introduced a prototype of its new cell expansion system, LiCellGrow, at the ISCT European Regional Conference. Designed to support cell and gene therapy manufacturing, the system enables real-time monitoring of cellular metabolic changes and automatic adjustment of culture conditions. This innovation aims to enhance manufacturing efficiency, reduce production costs, and improve the stability & quality of cell therapies by minimizing process interruptions and optimizing cell growth conditions.

Market Challenge

Complexity in Scaling Up Production

Scaling up cell expansion processes while ensuring that cells retain their functionality and quality is a significant technical challenge. Maintaining uniformity and consistency becomes difficult as production volumes increase, particularly when moving from laboratory-scale to commercial-scale operations.

The risk of losing cell viability or functionality during the expansion process also grows, which can lead to costly delays and compromised product quality.

Companies are investing in more sophisticated bioreactor systems that can maintain optimal growth conditions over larger batches, improving reproducibility and consistency. The development of closed-system bioreactors is helping ensure aseptic conditions and reducing the risk of contamination.

Additionally, companies are leveraging Artificial Intelligence (AI) and Machine Learning (ML), to optimize growth parameters and predict outcomes, thereby enhancing control during the scaling process.

Market Trend

Shift Toward Automated and Closed-system Expansion

The cell expansion market is shifting toward the use of automated and closed-system technologies to enhance process efficiency, safety, and scalability. Traditional open and manual cell culture methods are prone to contamination, human error, and batch variability.

In contrast, automated closed systems such as single-use bioreactors and integrated cell processing platforms are minimizing these risks while ensuring consistent product quality.

Moreover, automation reduces labor intensity and supports GMP compliance, making it ideal for clinical and commercial manufacturing. Such innovations are becoming essential for achieving cost-effective and scalable cell expansion as the demand for cell therapies grows.

- In March 2025, Limula introduced LimONE, an automated cell therapy system designed to streamline complex processes into a closed, single-use consumable system. This system includes a hardware device, consumables, and software for protocol creation, offering adaptability for both research and GMP-compliant manufacturing. LimONE aims to improve production efficiency for various cell therapies, including CAR-Ts and gene-edited HSCs, while reducing labor, equipment, and infrastructure costs.

Cell Expansion Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Consumables (Reagents, Media, SERA, Vessels), Instruments (Automated Cell Expansion Systems, Cell Counters, Centrifuges, Bioreactors, Others)

|

|

By Cell

|

Human, Animal, Microbial, Others,

|

|

By Application

|

Biopharmaceuticals, Tissue Culture & Engineering, Gene Therapy, Drug Screening & Development, Stem Cell Research, Others

|

|

By End Use Industry

|

Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, Hospitals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Consumables (Reagents, Media, SERA, Vessels), Instruments (Automated Cell Expansion Systems, Cell Counters, Centrifuges, Bioreactors, Others)): The instruments segment earned USD 10.06 billion in 2023, due to the increased demand for advanced cell therapy manufacturing tools.

- By Cell (Human, Animal, Microbial, and Others): The human segment held 36.22% share of the market in 2023, due to the growing focus on personalized medicine and regenerative therapies.

- By Application (Biopharmaceuticals, Tissue Culture & Engineering, Gene Therapy, Drug Screening & Development, Stem Cell Research, Others): The biopharmaceuticals segment is projected to reach USD 14.22 billion by 2031, owing to the rising demand for innovative treatments and drug development.

- By End-Use Industry (Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, Hospitals, Others): The pharmaceutical & biotechnology companies segment is anticipated to grow at a CAGR of 14.20% over the forecast period, propelled by advancements in cell therapy and personalized medicine.

Cell Expansion Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 35.95% share of the cell expansion market in 2023, with a valuation of USD 6.03 billion. This market dominance is driven by significant investments in large-scale manufacturing and R&D infrastructure. The region is registering the establishment of multiple advanced facilities dedicated to producing innovative therapies, including cell and gene therapies.

A strong push toward domestic end-to-end production is improving supply chain resilience and ensuring faster delivery of critical treatments. Additionally, the presence of research hubs in innovation-driven areas is accelerating technological advancements.

- In April 2025, Novartis committed USD 23 billion over five years to expand its manufacturing and R&D infrastructure across the U.S. The investment spans 10 facilities, including seven newly constructed sites, aiming to produce 100% of its key medicines domestically. This expansion enhances capabilities across all core technology platforms, including small molecules, biologics, and cell therapies. The initiative also includes establishing a new R&D hub in San Diego to foster innovation and reinforce the company's leadership in next-generation therapies like cell and gene therapy.

The cell expansion industry in Asia Pacific is set to grow at a robust CAGR of 14.81% over the forecast period. This growth is fueled by rapid advancements in regenerative medicine and strong collaborations in biotechnological innovation.

The region benefits from increasing investments in R&D, as demonstrated by the development of advanced technologies like real-time monitoring systems and stable cell product manufacturing. Local firms are also focused on commercializing next-generation cell expansion systems, enhancing both quality and process optimization. These efforts are supported by a skilled workforce and expanding healthcare infrastructure.

- In March 2025, PHC Corporation and Cyfuse Biomedical jointly developed a new production technology to support the commercialization of 3D cell products in regenerative and cell therapy. By combining Cyfuse’s Bio 3D Printing technology with PHC’s in-line monitoring system, the collaboration enables real-time tracking of cell conditions to ensure stability and quality during manufacturing.

Regulatory Framework

- In the U.S., the FDA's Center for Biologics Evaluation and Research (CBER) regulates cell and gene therapies, including those involving cell expansion. Cell expansion, as part of cell therapy, is considered a biological product and requires approval under a Biologics License Application (BLA) before commercialization.

- In China, the National Medical Products Administration (NMPA) is the primary regulatory body overseeing cell therapies and their development, including cell expansion. The NMPA regulates cell therapies as biological drugs, subject to the same approval processes as other pharmaceuticals.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) is the primary regulatory authority for cell and gene therapy products, including cell expansion processes.

Competitive Landscape

Market participants in the cell expansion market are focusing on strategic acquisitions and market expansions. They are enhancing their T cell expansion and manufacturing capabilities by acquiring complementary technologies. They are also expanding their global presence by establishing manufacturing hubs in key regions to meet the rising demand for cell therapies.

Additionally, these market players are working on simplifying processes to accelerate time-to-market, ensuring that therapies can be scaled rapidly in response to the growing demand.

- In January 2025, Terumo Blood and Cell Technologies (Terumo BCT) and FUJIFILM Irvine Scientific formed a strategic collaboration to accelerate T cell expansion for cell therapy developers. The partnership combines Fujifilm's PRIME-XV T Cell Expansion Media with Terumo BCT’s Quantum Flex Cell Expansion System, offering a turnkey solution designed to simplify and scale T cell expansion.

List of Key Companies in Cell Expansion Market:

Recent Developments (M&A/Partnerships/Product Launches)

- In January 2025, Terumo Blood and Cell Technologies (Terumo BCT) and FUJIFILM Irvine Scientific formed a strategic collaboration to accelerate T cell expansion for cell therapy developers. The partnership combines Fujifilm's PRIME-XV T Cell Expansion Media with Terumo BCT’s Quantum Flex Cell Expansion System, offering a turnkey solution designed to simplify and scale T cell expansion. This optimized workflow provides a ready-to-use process, helping developers overcome challenges in scaling production and improving efficiency in cell therapy development.

- In November 2024, FUJIFILM Diosynth Biotechnologies launched the first phase of its global CDMO ecosystem expansion at its Hillerød, Denmark site. This phase adds six 20,000-liter mammalian cell bioreactors, increasing the site’s total to 12, with further expansion planned to include eight more bioreactors and two downstream processing streams. The initiative aims to enhance biologics production capacity, support global biopharma delivery, and create up to 2,200 new jobs.

- In April 2024, Fujifilm invested USD 1.2 billion to expand its Large-Scale Cell Culture CDMO business at the FUJIFILM Diosynth Biotechnologies facility in Holly Springs, North Carolina, bringing the total commitment to over USD 3.2 billion. This expansion includes the addition of 8 x 20,000-liter mammalian cell culture bioreactors, creating 680 highly skilled jobs by 2031. The site will become one of the largest cell culture biopharmaceutical CDMO facilities in North America.

- In July 2023, Merck expanded its facility in Lenexa, Kansas, U.S., adding 9,100 sq m² of lab and production space to manufacture cell culture media. This expansion makes the Lenexa site the company’s largest dry powder cell culture media facility and Center of Excellence in North America. The investment is set to bring 60 jobs to the Kansas City area and strengthen Merck's ability to meet the global demand for critical materials used in bio manufacturing. This move reflects Merck's strategy to diversify and expand its supply chain, ensuring consistent supply for life-saving therapies.