Market Definition

Cast elastomers are high-performance materials known for their strength, abrasion resistance, and flexibility. Manufactured through a controlled casting process, they offer consistent mechanical properties under demanding conditions.

These materials find applications in dynamic components that require durability and load-bearing capability. They are widely used in industrial equipment, automotive systems, oil and gas operations, and mining applications where long service life and resistance to harsh environments are essential.

Cast Elastomer Market Overview

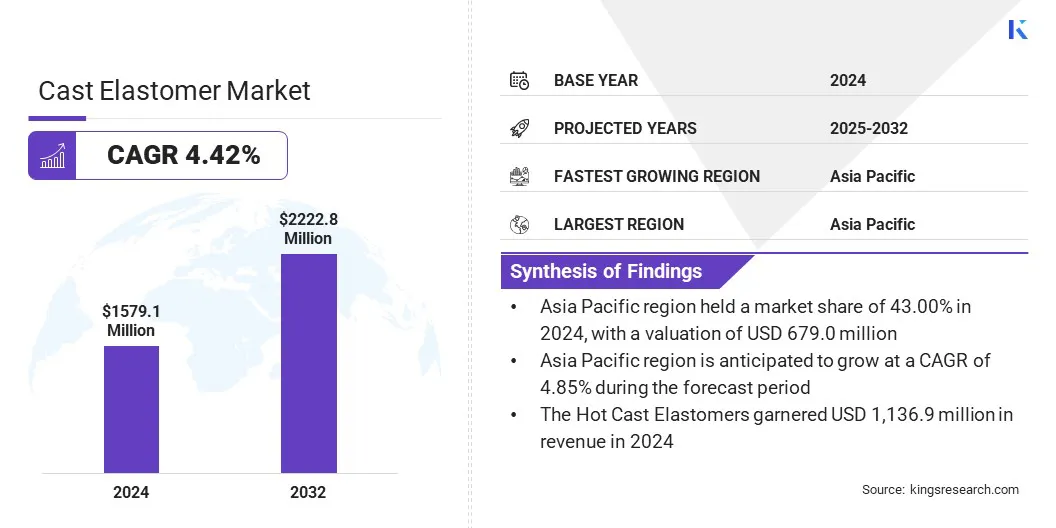

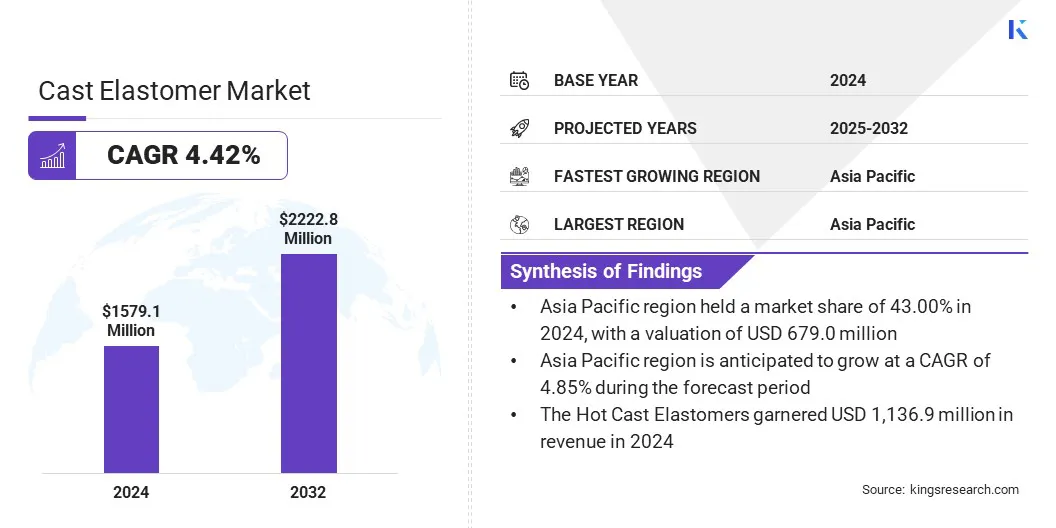

The global cast elastomer market size was valued at USD 1,579.1 million in 2024 and is projected to grow from USD 1,642.3 million in 2025 to USD 2,222.8 million by 2032, exhibiting a CAGR of 4.42% during the forecast period. This growth is driven by rising demand for durable and wear-resistant materials in industrial, automotive, and oil and gas applications.

A key trend influencing the market is the development of advanced solutions to improve safety and performance, such as anti-static wheels for material handling and specialized components for hazardous environments.

Key Highlights:

- The cast elastomer industry size was recorded at USD 1,579.1 million in 2024.

- The market is projected to grow at a CAGR of 4.42% from 2025 to 2032.

- Asia Pacific held a share of 43.00% in 2024, valued at USD 679.0 million.

- The hot cast elastomers segment garnered USD 1,136.9 million in revenue in 2024.

- The wheels & rollers segment is expected to record USD 676.3 million by 2032.

- The industrial segment is projected to reach USD 902.4 million by 2032.

- North America is anticipated to grow at a CAGR of 4.08% over the forecast period.

Major companies operating in the cast elastomer market are BASF, Era Polymers Pty Ltd, Huntsman International LLC, Covestro AG, LANXESS, Notedome, STOCKMEIER Group, Coim Group, RÄDER-VOGEL, Argonics, Inc., Plan Tech, Inc., PSI Urethanes, Inc., Precision Urethane, GallagherCorp, and Uniflex Inc.

Market growth is propelled by the increasing adoption of bio-based and sustainable polyurethane systems in cast elastomer production. Manufacturers are incorporating renewable raw materials to reduce environmental impact and meet stringent sustainability standards set by industries.

These eco-friendly formulations offer comparable mechanical strength and durability to conventional systems, making them suitable for heavy-duty applications. Growing emphasis on green manufacturing practices and regulatory support for low-carbon solutions is accelerating the shift toward sustainable elastomer technologies.

Market Driver

Rising Demand for Durable and Wear-Resistant Materials

The growth of the cast elastomer market is fueled by the rising demand for durable and wear-resistant materials in industrial machinery and material handling equipment. These elastomers provide superior abrasion resistance, high load-bearing capacity, and excellent mechanical strength, making them ideal for components that operate in harsh conditions.

Industries such as mining, manufacturing, and logistics require materials that can withstand continuous stress and heavy-duty applications without frequent replacement. This need for long-lasting performance and reduced maintenance costs has significantly increased the adoption of cast elastomers in critical industrial operations.

Market Challenge

Volatile Raw Material Prices

A major challenge impeding the progress of the cast elastomer market is volatility in prices of raw materials such as polyols, isocyanates, and additives used in polyurethane production. Such fluctuations disrupt cost planning and affect profit margins for manufacturers, creating pricing pressures across the supply chain, particularly during periods of high demand and limited availability of feedstock chemicals.

To address this issue, companies are entering into long-term contracts with suppliers and increasing backward integration to secure raw material availability. They are also adopting cost optimization strategies and improving procurement practices to mitigate the impact of price volatility and maintain stable production.

Market Trend

Adoption of Advanced Anti-static Wheels

The cast elastomer market is witnessing a notable trend toward the adoption of advanced anti-static wheels for industrial and material handling applications. These wheels prevent static electricity buildup, which can cause safety hazards in environments such as warehouses, cleanrooms, and chemical plants.

The integration of anti-static properties enhances operational safety while maintaining the durability and load-bearing strength of cast elastomers. This shift aligns with increasing safety standards across industries, creating a strong demand for specialized elastomer components that combine performance and compliance.

- In March 2025, Huntsman Corporation collaborated with RÄDER-VOGEL to develop a new generation of polyurethane-based anti-static PEVOTEC wheels. The partnership leveraged Huntsman’s TECNOTHANE hot cast elastomers to create wheels optimized for industrial applications requiring enhanced safety and performance, including warehouses, cleanrooms, and automated systems.

Cast Elastomer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hot Cast Elastomers, Cold Cast Elastomers

|

|

By Application

|

Wheels & Rollers, Pipe Linings & Hoses, Seals & Gaskets, Conveyor Scrapers, Bushings & Mounts, Others

|

|

By End-Use Industry

|

Industrial, Automotive & Transportation, Oil & Gas, Mining, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Hot Cast Elastomers and Cold Cast Elastomers): The hot cast elastomers segment earned USD 1,136.9 million in 2024, largely due to their superior mechanical strength and ability to withstand high loads in demanding applications.

- By Application (Wheels & Rollers, Pipe Linings & Hoses, Seals & Gaskets, Conveyor Scrapers, Bushings & Mounts, and Others): The wheels & rollers segment held a share of 30.00% in 2024, fueled by the widespread use in material handling systems and heavy-duty industrial equipment.

- By End-Use Industry (Industrial, Automotive & Transportation, Oil & Gas, Mining, and Others): The industrial segment is projected to reach USD 902.4 million by 2032, owing to increasing demand for durable elastomer components in machinery and manufacturing processes.

Cast Elastomer Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific cast elastomer market share stood at 43.00% in 2024, valued at USD 679.0 million. This dominance is reinforced by the strong presence of major manufacturers and the continuous expansion of production capacities across China, India, and Southeast Asian countries.

Regional players are investing in advanced manufacturing facilities to meet the growing demand from the industrial and automotive sectors. This focus on large-scale production and localized supply chains positions the region as the leading market for cast elastomers.

- In July 2024, Covestro showcased its latest innovations in cast elastomers at UTECH Asia / PU China 2024 in Shanghai. The presentation focused on solutions for offshore wind, material handling, and electric vehicles, highlighting advancements in durability and performance.

The North America cast elastomer industry is poised to grow at a CAGR of 4.08% over the forecast period. This growth is fostered by the adoption of advanced elastomer technologies for components requiring durability and chemical resistance. Increasing investments in specialized polyurethane systems for energy and transportation infrastructure further support regional market expansion.

Regulatory Frameworks

- In the U.S, cast elastomer products must comply with regulations set by the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) for chemical safety and reporting.

- In Europe, manufacturers follow the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation to ensure safe use of substances in elastomer formulations.

- In India, compliance with the Bureau of Indian Standards (BIS) and environmental norms under the Hazardous Chemicals Rules is mandatory for the production and use of polyurethane-based elastomers.

Competitive Landscape

Key players operating in the cast elastomer industry are focusing on geographical expansion to strengthen their global footprint and capture growth opportunities. Companies are establishing new production facilities in emerging regions to address the increasing demand for industrial machinery, automotive parts, and oil and gas components.

Companies are expanding distribution networks and logistics capabilities to reduce delivery time and maintain a reliable supply. Strategic collaborations and regional partnerships are being adopted to meet local compliance standards and optimize market entry strategies. These initiatives enable companies to enhance customer proximity, improve operational efficiency, and secure a stronger competitive position across key regions.

Key Companies in Cast Elastomer Market:

- BASF

- Era Polymers Pty Ltd

- Huntsman International LLC

- Covestro AG

- LANXESS

- Notedome

- STOCKMEIER Group

- Coim Group

- RÄDER-VOGEL

- Argonics, Inc.

- Plan Tech, Inc.

- PSI Urethanes, Inc.

- Precision Urethane

- GallagherCorp

- Uniflex Inc.

Recent Developments (Expansion)

- In July 2025, Covestro expanded its cast polyurethane elastomers business network in Taiwan to strengthen sales and local support. The initiative targets applications in smart logistics, automated equipment, offshore wind power, infrastructure protection, and the pulp and paper industry.