Market Definition

Carbon fiber construction repair is the process of restoring, strengthening, or reinforcing damaged or deteriorating concrete, masonry, steel, or timber structures using high-strength carbon fiber-reinforced polymer (CFRP) materials. It involves applying carbon fiber sheets, strips, or laminates combined with specialized adhesives to structural surfaces to improve load-bearing capacity, repair cracks, prevent corrosion, and extend the lifespan of infrastructure.

Carbon Fiber Construction Repair Market Overview

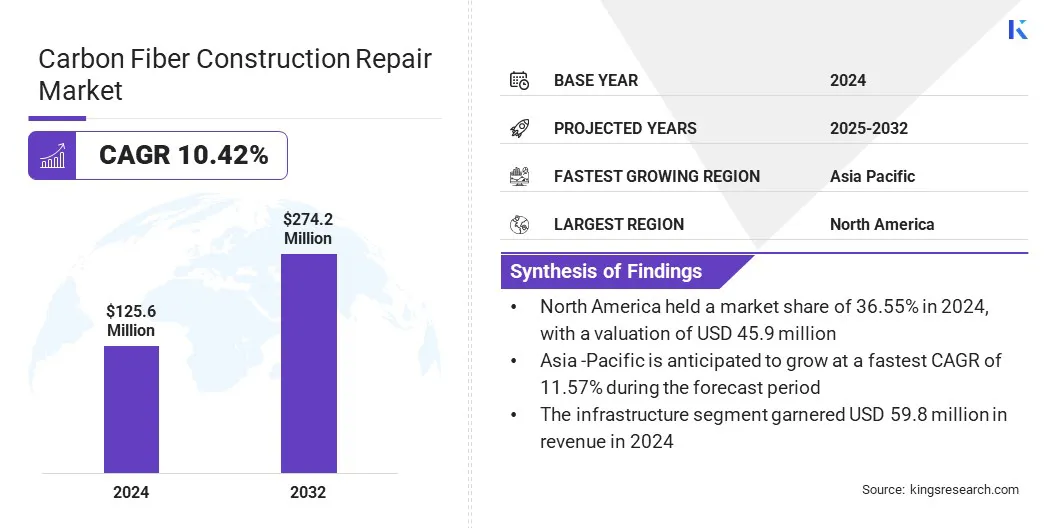

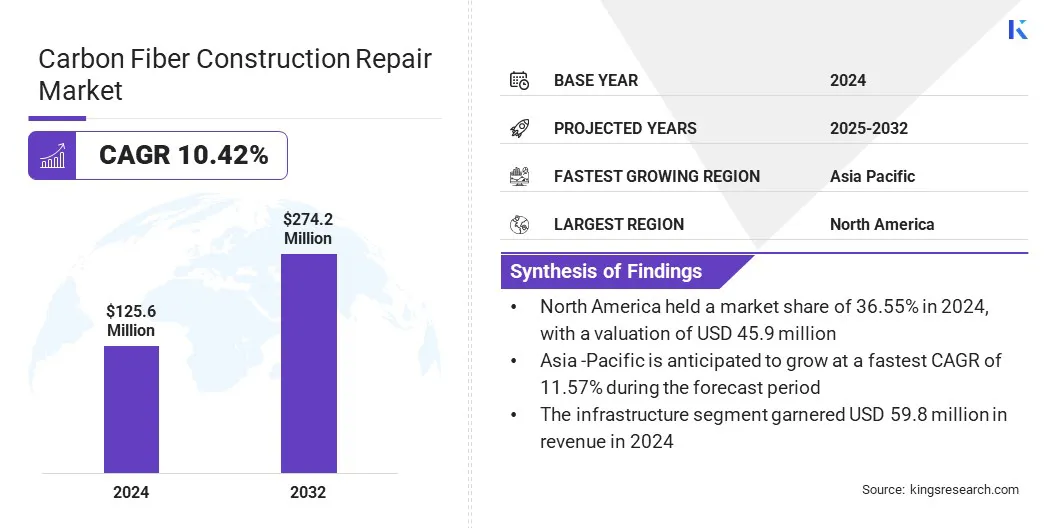

The global carbon fiber construction repair market size was valued at USD 125.6 million in 2024 and is projected to grow from USD 137.0 million in 2025 to USD 274.2 million by 2032, exhibiting a CAGR of 10.42% over the forecast period.

The market is driven by aging infrastructure worldwide, creating demand for durable repair solutions that restore integrity, enhance safety, and reduce maintenance. Public sector investments through federal and state programs are further boosting large-scale repair and modernization, fueling demand for advanced, sustainable materials and technologies.

Key Highlights:

- The carbon fiber construction repair industry size was recorded at USD 125.6 million in 2024.

- The market is projected to grow at a CAGR of 10.42% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 45.9 million.

- The fabric segment garnered USD 59.4 million in revenue in 2024.

- The infrastructure segment is expected to reach USD 146.5 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 11.57% over the forecast period.

Major companies operating in the carbon fiber construction repair market are Carbon Light Private Limited, Fosroc, Inc, Shanghai Horse Construction Co., Ltd, Sika AG, MAPEI Corporation, Mitsubishi Chemical Infratec Co., Ltd, SGL Carbon, Simpson Strong-Tie Company, Inc, Dextra Group, Structural Technologies LLC, Freyssinet Limited, AB-SCHOMBURG Yapi Kimyasallari A.S., Advanced FRP Systems, Drizoro S.A.U, and Hindustan Engineers.

Government investments in infrastructure and energy projects are fueling demand for durable, high-performance reinforcement solutions. This is driving the adoption of carbon fiber composites for strengthening, retrofitting, and extending the lifespan of critical structures.

- In January 2025, the U.S. Internal Revenue Service (IRS) allocated approximately USD 6 billion of 48C advanced energy manufacturing tax credits to over 140 projects across 30 states. This allocation is driving infrastructure development and retrofitting, thereby increasing the adoption of high-performance materials such as carbon fiber composites in energy and industrial facilities.

Market Driver

Increasing Demand for Durable Infrastructure Maintenance and Retrofitting

A key driver propelling the growth of the carbon fiber construction repair market is the increasing demand for durable infrastructure maintenance and retrofitting. Aging bridges, highways, and public utilities require effective reinforcement methods to ensure safety and longevity by restoring structural integrity.

This rising need is driving the use of high-performance materials that offer superior strength, corrosion resistance, and longevity compared to traditional options. The focus on rapid, minimally disruptive repair techniques is further supporting the adoption of innovative solutions, enabling infrastructure to meet growing urbanization and industrial development requirements efficiently.

- The American Society of Civil Engineers (ASCE) reported that the U.S. requires USD 9.1 trillion in investments over the next 10 years (2024–2033) to bring all infrastructure categories to a state of good repair. This significant funding gap highlights the growing demand for advanced repair and retrofitting solutions, including carbon fiber composites, to strengthen and maintain bridges, highways, and other critical infrastructure.

Market Challenge

High Cost of Carbon Fiber Materials

A key challenge in the carbon fiber construction repair market is the high cost of carbon fiber materials. The production of carbon fibers involves energy-intensive processes and advanced manufacturing technologies, making them significantly more expensive than traditional construction materials. This high cost limits adoption in many infrastructure projects and creates a barrier to large-scale implementation of carbon fiber-based repair and reinforcement solutions.

To address this challenge, market players are focusing on technological innovations and strategic initiatives to reduce the expenses of carbon fiber production. Companies are investing in advanced manufacturing techniques, such as automated fiber production and recycling of carbon fiber waste, to lower production costs.

Market Trend

Increasing Adoption of Advanced Carbon Fiber Composites

A key trend influencing the carbon fiber construction repair market is the increasing adoption of advanced carbon fiber composites with enhanced durability and fire resistance.

Construction and infrastructure companies are leveraging these materials to reinforce bridges, highways, and industrial structures, ensuring long-term structural integrity under harsh environmental and load conditions. The superior strength, corrosion resistance, and fire-retardant properties of these composites improve safety and reduce maintenance requirements.

Carbon Fiber Construction Repair Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Rebar, Fabric, Plate, Others

|

|

By Application

|

Residential and Commercial, Infrastructure, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Rebar, Fabric, Plate, and Others): The fabric segment earned USD 59.4 million in 2024 due to its widespread use in strengthening and retrofitting concrete structures with enhanced durability and load-bearing capacity.

- By Application (Residential and Commercial, Infrastructure, and Industrial): The infrastructure segment held 47.65% of the market in 2024, due to increasing investments in bridges, highways, and public utilities requiring rapid and effective structural repair solutions.

Carbon Fiber Construction Repair Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America carbon fiber construction repair market share stood at 36.55% in 2024 in the global market, valued at USD 45.9 million. This dominance is primarily driven by the increasing need to maintain and retrofit aging infrastructure, including bridges, highways, and public utilities, which require durable and long-lasting repair solutions.

Government initiatives and funding, including federal and state infrastructure programs, rehabilitation grants, and urban development projects, are accelerating market growth by driving large-scale infrastructure repair activities across the region.

Moreover, the expansion of key construction and repair service providers across the region is enhancing access to advanced repair capabilities, supporting broader implementation of carbon fiber reinforcement solutions, thereby fueling market expansion.

- In April 2025, Structural Group, Inc. (SGI) expanded its presence in North America by acquiring Vector Construction / Restoration, which includes nine branch locations across the United States and Canada. The acquisition enhances SGI’s capabilities in concrete repair, preservation, and structural reinforcement.

Asia Pacific is set to grow at a CAGR of 11.57% over the forecast period. This growth is attributed to the rapid expansion of construction projects in the region, which is increasing the demand for durable and efficient infrastructure repair solutions that can extend the lifespan of bridges, roads, and commercial buildings.

The prevalence of aging bridges, roads, and ports across the region is driving the adoption of high-strength, corrosion-resistant carbon fiber composites. Increasing government investments in large-scale infrastructure projects, including smart cities and renewable energy facilities, are further accelerating market growth.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates the safe handling, installation, and application of carbon fiber materials in construction repair projects. OSHA oversees worker exposure to airborne fibers, chemical adhesives, and resins, ensuring compliance with health guidelines, use of personal protective equipment, and safe operational procedures to prevent accidents and long-term health risks.

- In the UK, the Health and Safety Executive (HSE) regulates safe practices for handling and applying carbon fiber composites in construction repair. HSE oversees exposure to fibers, resins, and adhesives, enforces workplace safety standards, and monitors risk management to prevent accidents and health hazards while maintaining structural integrity in reinforced or retrofitted buildings and infrastructure.

- In China, the Ministry of Housing and Urban-Rural Development (MOHURD) regulates the use of advanced materials, including carbon fiber composites, in construction, repair and retrofitting. MOHURD oversees structural safety standards, material performance, and proper installation practices to ensure bridges, buildings, and industrial facilities meet national construction codes and durability requirements.

- In India, the Bureau of Indian Standards (BIS) regulates the quality, safety, and performance of construction materials, including carbon fiber composites. BIS oversees material certification, testing protocols, and compliance with Indian Standards for reinforced concrete and retrofitting, ensuring carbon fiber-based repair solutions deliver durability, load-bearing capacity, and long-term performance across infrastructure projects.

Competitive Landscape

Major players in the carbon fiber construction repair industry are increasingly forming strategic partnerships to expand their product portfolios and enhance access to high-performance carbon fiber materials. They are focusing on developing reinforced intermediates, such as fabrics, prepregs, and laminates, to provide lightweight, durable, and energy-efficient solutions for structural strengthening.

Additionally, companies are enhancing technical support and customer services to improve the adoption of carbon fiber repair systems,ensuring proper installation and performance optimization for long-term durability in infrastructure and industrial applications.

- In February 2025, Bodo Möller Chemie partnered with Dow Aksa to offer carbon fibre products and reinforced intermediates, targeting lightweight, durable, and energy-efficient applications.

Key Companies in Carbon Fiber Construction Repair Market:

- Carbon Light Private Limited

- Fosroc, Inc

- Shanghai Horse Construction Co., Ltd

- Sika AG

- MAPEI Corporation

- Mitsubishi Chemical Infratec Co.,Ltd

- SGL Carbon

- Simpson Strong-Tie Company, Inc

- Dextra Group

- Structural Technologies LLC

- Freyssinet Limited

- AB-SCHOMBURG Yapi Kimyasallari A.S.

- Advanced FRP Systems

- Drizoro S.A.U

- Hindustan Engineers.

Recent Developments (Product Launch)

- In May 2025, Teijin Carbon launched Tenax Next, a next-generation brand of circular carbon fibers with a significantly reduced CO₂ footprint. The materials maintain the strength, durability, and performance of traditional Tenax carbon fibers.