Market Definition

The market encompasses the production, distribution, and application of carbon disulfide, a volatile, flammable chemical used primarily in the manufacture of rayon, cellophane, and carbon tetrachloride. It also finds use in rubber processing, pesticides, and solvents.

The market includes raw material sourcing, technological advancements, regulatory frameworks, and demand across various industrial and agricultural sectors globally. The report outlines the major factors driving the market, along with key drivers and the competitive landscape shaping the growth trajectory over the forecast period.

Carbon Disulfide Market Overview

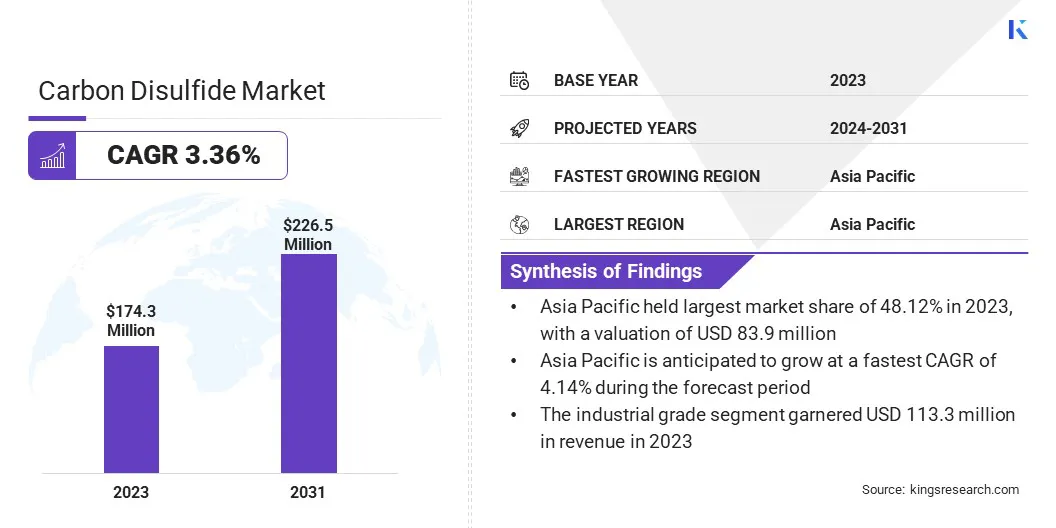

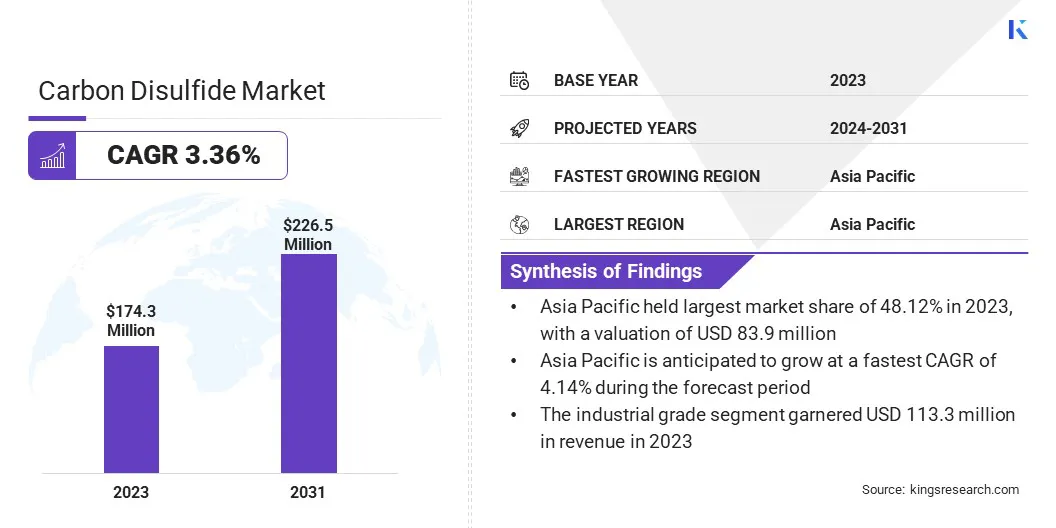

The global carbon disulfide market size was valued at USD 174.3 million in 2023 and is projected to grow from USD 179.7 million in 2024 to USD 226.5 million by 2031, exhibiting a CAGR of 3.36% during the forecast period.

This market is registering steady growth, driven primarily by its widespread use in the production of viscose rayon, cellophane films, and rubber processing chemicals. One of the most significant growth factors is the rising demand for viscose fibers in the textile industry, particularly in emerging economies where apparel manufacturing is expanding rapidly.

Additionally, the agricultural sector's need for soil fumigants and pesticides supports the market, as carbon disulfide serves as a key intermediate in several agrochemical formulations.

Major companies operating in the carbon disulfide industry are Arkema, Chemtrade Logistics, Merck KGaA, GFS Chemicals, Inc., Thermo Fisher Scientific Inc., BAIJIN, SHIKOKU CHEMICALS CORPORATION, Avantor, Nouryon, Volzhsky Orgsynthese, JSC, UPL, American Elements, KANTO KAGAKU, Hefei TNJ Chemical Industry Co.,Ltd., and Honeywell International Inc.

The chemical industry's continued reliance on carbon disulfide for synthesizing solvents and flotation agents in mining also contributes to market expansion. Furthermore, increasing industrialization, and technological advancements in chemical manufacturing processes are enhancing production efficiency and expanding application areas.

- In May 2024, Methanol Chemicals Company (Chemanol) entered into a land allocation agreement with JABEEN to invest over USD 112 million in a chemicals facility at PlasChem Park Jubail 2. The plant produces choline chloride and methyl diethanolamine, key intermediates in chemical manufacturing, potentially boosting the demand for carbon disulphide as a precursor in related production processes.

Key Highlights:

- The carbon disulfide industry size was valued at USD 174.3 million in 2023.

- The market is projected to grow at a CAGR of 3.36% from 2024 to 2031.

- Asia Pacific held a market share of 48.12% in 2023, with a valuation of USD 83.9 million.

- The industrial grade segment garnered USD 113.3 million in revenue in 2023.

- The natural gas-based production segment is expected to reach USD 134.9 million by 2031.

- The direct sales segment is expected to reach USD 133.2 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 3.37% during the forecast period.

Market Driver

Viscose Rayon Production and Agrochemical Demand

The market is significantly driven by the growing demand from two core industries: viscose fiber production and agrochemicals. In the textile sector, carbon disulfide is essential in the viscose process, where it enables the transformation of cellulose into usable fibers.

The rising preference for man-made cellulosic fibers (MMCFs), especially viscose, is being fueled by constraints in cotton production and increasing emphasis on ethical and resource-efficient alternatives. Viscose maintains a dominant share of the MMCF market, boosting the demand for carbon disulfide.

Simultaneously, in the agricultural sector, carbon disulfide is used in the production of various crop protection products, including fumigants and pesticides. Rising need for higher agricultural yields and food security globally is boosting the demand for reliable agrochemical inputs, further reinforcing the role of carbon disulfide as a valuable industrial compound.

- In July 2023, the carbon disulfide adsorption plant (CAP) at the Purwakarta facility in Indonesia commenced operations. This strategic implementation enhances environmental compliance and operational efficiency in carbon disulphide handling which is critical in viscose and chemical production. The move underscores regional market growth, reinforcing Southeast Asia’s role in the expanding global carbon disulphide market and improving sustainability across the value chain.

Market Challenge

Concerns Pertaining to Environmental Risks and Occupational Hazards

A major challenge in the carbon disulfide market is its associated health and environmental risks, which have led to increasingly strict regulatory controls across multiple regions. Carbon disulfide is highly toxic and volatile, posing serious occupational hazards during handling and production.

Long-term exposure has been linked to neurological, cardiovascular, and reproductive health issues, prompting regulatory agencies to impose stringent emission standards and workplace safety guidelines. These regulations increase compliance costs and restrict production flexibility, especially for manufacturers in regions with evolving environmental policies.

Industry participants are adopting advanced emission control technologies, such as closed-loop recovery systems and real-time monitoring solutions, which significantly reduce workplace exposure and environmental discharge.

Market Trend

Innovation and Feedstock Diversification

The market is undergoing transformation driven by technological innovation and increased focus on environmental responsibility. Industry players are actively investing in research and development to enhance operational efficiency, minimize chemical waste, and improve safety for both workers and the surrounding environment.

Key advancements include the adoption of closed-loop systems, implementation of sophisticated emission control technologies, and the integration of automated material handling processes. These measures aim to reduce exposure risks and ensure compliance with stringent regulatory frameworks.

Concurrently, there is a clear movement toward sustainable production practices, with companies incorporating greener chemical processes and sourcing strategies. This shift reflects a strategic response to evolving environmental standards and consumer expectations, particularly within fiber manufacturing applications.

Carbon Disulfide Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Industrial Grade, Pure Grade, Ultra-pure Grade

|

|

By Production Process

|

Natural Gas-based Production, Charcoal & Sulfur-based Production, Others

|

|

By Distribution Channel

|

Direct Sales, Distributors & Traders, Online Sales & Specialty Chemical Retailers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Grade (Industrial Grade, Pure Grade, and Ultra-pure Grade): The industrial grade segment earned USD 113.3 million in 2023, due to its widespread use in large-scale chemical and textile manufacturing operations.

- By Production Process (Natural Gas-based Production, Charcoal & Sulfur-based Production, Others): The natural gas-based production segment held 60.12% share of the market in 2023, due to its cost-efficiency, cleaner process, and consistent raw material availability.

- By Distribution Channel (Direct Sales, Distributors & Traders, Online Sales & Specialty Chemical Retailers): The direct sales segment is projected to reach USD 133.2 million by 2031, owing to strong relationships between manufacturers and end users that ensure reliable supply and pricing advantages.

Carbon Disulfide Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 48.12% share of the carbon disulfide market in 2023, with a valuation of USD 83.9 million. This dominance is largely driven by high consumption in China and India, where carbon disulfide is extensively used in viscose rayon and cellophane production, aligning with the region's large textile manufacturing base.

China alone is a major global producer and exporter of viscose fiber, significantly contributing to demand. In addition to its textile-driven demand, the market in Asia Pacific is bolstered by the expanding industrial chemicals sector in the region.

Countries like South Korea and Japan are investing in carbon disulfide for use in advanced material synthesis and electronics-related applications. Furthermore, China's vertically integrated manufacturing ecosystem allows for streamlined production and domestic consumption, reducing dependency on imports and enhancing market stability.

The market in Europe is expected to register the fastest growth, with a projected CAGR of 3.37% over the forecast period. This is attributed to the region’s robust industrial base and demand for high-performance chemical intermediates.

Countries like Germany, France, and Italy have well-established chemical and manufacturing sectors where carbon disulfide is used in the production of rubber chemicals, cellulose products, and synthetic fibers. The region’s focus on technological advancement and product innovation is leading to the development of specialized carbon disulfide grades tailored for precision applications in sectors such as automotive, electronics, and industrial coatings.

Additionally, the presence of major chemical conglomerates and advanced production infrastructure enables consistent supply and quality, making Europe an attractive hub for carbon disulfide consumption across high-value industries.

- In June 2024, OxCarbon entered into a strategic partnership with Downforce Technologies to enhance transparency and validation in Soil Organic Carbon (SOC) projects using patented natural capital assessment tools. This collaboration supports the carbon disulphide market by advancing credible carbon credit generation, which is crucial for emissions-intensive industries seeking offsets, thereby reinforcing climate accountability and sustainable environmental practices.

Regulatory Frameworks

- In the U.S., carbon disulfide is regulated by the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) and by the Occupational Safety and Health Administration (OSHA), which sets permissible exposure limits for workplace safety.

- In the European Union (EU), carbon disulfide is governed by the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, enforced by the European Chemicals Agency (ECHA). It is classified as a hazardous substance with strict requirements for handling and labeling under the CLP Regulation.

- In China, carbon disulfide is subject to regulation under the Measures on the Environmental Management of New Chemical Substances and the Catalogue of Priority Hazardous Chemicals, managed by the Ministry of Ecology and Environment (MEE).

- The Industrial Safety and Health Act (ISHA) and the Chemical Substances Control Law (CSCL) regulate the use of carbon disulfide in Japan. The Ministry of Health, Labour and Welfare (MHLW) sets occupational exposure limits and requires hazard communication for carbon disulfide use.

- In India, carbon disulfide is regulated under the Factories Act, 1948 and the Manufacture, Storage and Import of Hazardous Chemical Rules, 1989, overseen by the Ministry of Environment, Forest and Climate Change (MoEFCC).

Competitive Landscape

The carbon disulfide market is characterized by the presence of a mix of established producers and emerging players competing on the basis of product quality, pricing strategies, and supply chain efficiency. Key players are primarily focused on expanding their production capacities and optimizing manufacturing processes to achieve higher purity levels and cost efficiency.

Strategic collaborations and joint ventures are increasingly being pursued to strengthen market presence and gain access to new customer bases across different regions. Mergers and acquisitions are also being leveraged to consolidate market share and integrate vertically across the value chain from raw material sourcing to end-user distribution.

Additionally, companies are investing in R&D to develop customized grades of carbon disulfide for specific industrial applications, including use in specialty chemicals and advanced materials. Some market players are also entering long-term supply agreements with end-use industries to ensure consistent demand and build strategic partnerships, thereby enhancing customer retention and long-term revenue stability.

List of Key Companies in Carbon Disulfide Market:

- Arkema

- Chemtrade Logistics

- Merck KGaA

- GFS Chemicals, Inc.

- Thermo Fisher Scientific Inc.

- BAIJIN

- SHIKOKU CHEMICALS CORPORATION

- Avantor

- Nouryon

- Volzhsky Orgsynthese, JSC

- UPL

- American Elements

- KANTO KAGAKU

- Hefei TNJ Chemical Industry Co.,Ltd.

- Honeywell International Inc

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In January 2024, Birla Cellulose’s Kharach Unit in Gujarat successfully commissioned a Carbon-disulfide Adsorption Plant (CAP) for CS₂ recovery from exhaust gases, achieving EU BAT compliance. The closed-loop technology enables the recovery of 90–95% sulfur by capturing CS₂ and converting H₂S into elemental sulfur.