Market Definition

Carbon composites are advanced materials made by combining carbon fibers with a polymer, metal, or ceramic matrix to create lightweight, high-strength structures. The market encompasses the production, development, and application of these materials across various sectors, including aerospace, automotive, energy, marine, construction, and sports.

It includes different matrix types, manufacturing processes, and end-use applications where durability, performance, and material efficiency are essential for structural and functional purposes.

Carbon Composites Market Overview

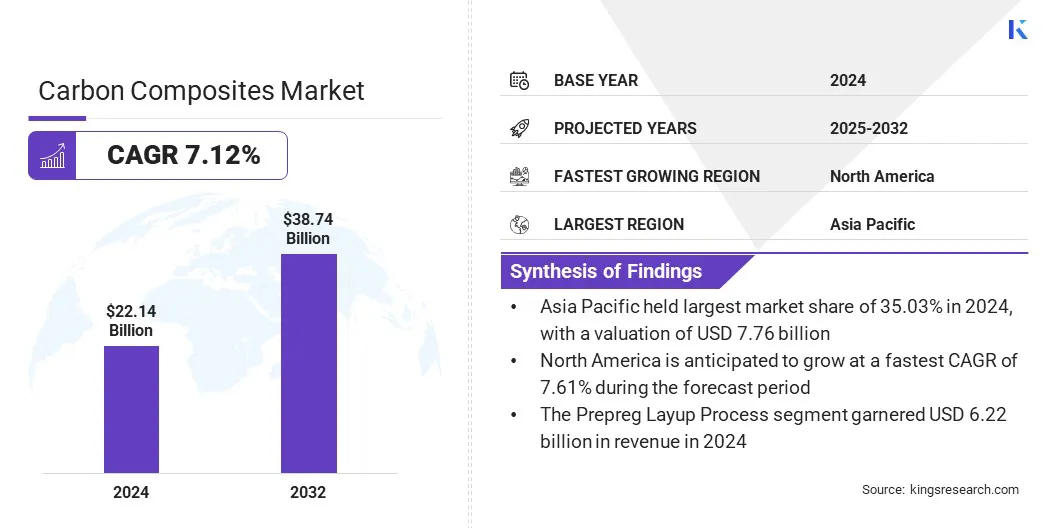

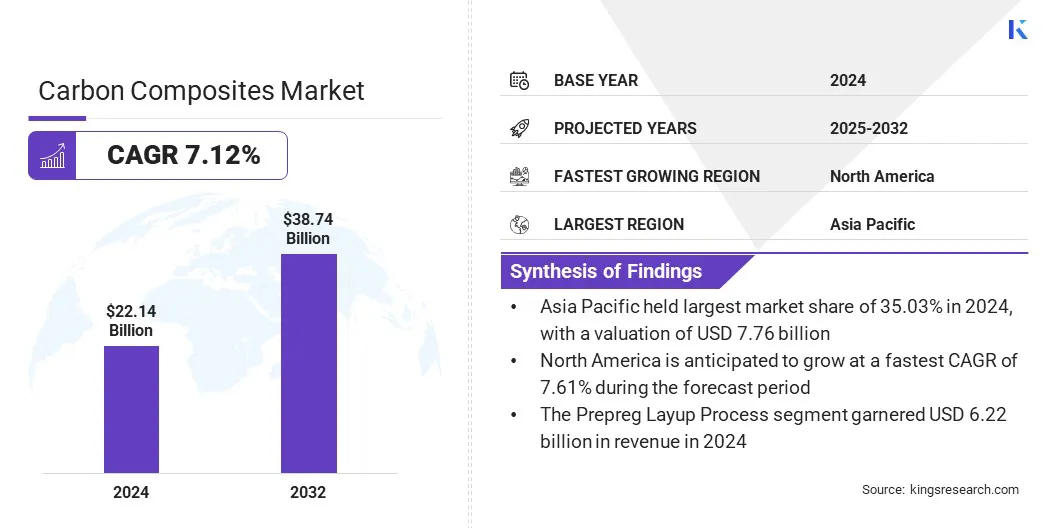

The global carbon composites market size was valued at USD 22.14 billion in 2024 and is projected to grow from USD 23.58 billion in 2025 to USD 38.74 billion by 2032, exhibiting a CAGR of 7.12% during the forecast period.

The market is growing steadily due to rising demand for lightweight, durable, and high-performance materials across key industries such as automotive, aerospace and defense, wind energy, construction, and industrial manufacturing. Their superior mechanical properties, along with the need to enhance fuel efficiency and reduce carbon emissions, are driving adoption across these sectors.

Key Highlights

- The carbon composites industry size was valued at USD 22.14 billion in 2024.

- The market is projected to grow at a CAGR of 7.12% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 7.76 billion.

- The metal segment garnered USD 6.07 billion in revenue in 2024.

- The prepreg layup process segment is expected to reach USD 10.89 billion by 2032.

- The aerospace & defense segment is projected to reach USD 9.41 billion by 2032.

- The market in North America is anticipated to grow at a CAGR of 7.61% during the forecast period.

Major companies operating in the carbon composites market are TORAY INDUSTRIES, INC., Hexcel Corporation, TEIJIN LIMITED, Mitsubishi Corporation, SGL Carbon, Solvay, Formosa M Co., Ltd., HS HYOSUNG ADVANCED MATERIALS, Nippon Graphite Fiber Co., Ltd., Syensqo, KUREHA CORPORATION, Aksa Akrilik Kimya Sanayii A.Ş., Alfa Chemistry, UNITIKA LTD, and EVERTECH ENVISAFE ECOLOGY CO., LTD.

Investment in advanced composite manufacturing by major industry players is driving market growth. Such investments aim to enhance domestic production capabilities, accelerate innovation, and support the development of next-generation composite materials for high-demand applications such as electric vehicle components, commercial aircraft structures, wind turbine blades, and pressure vessels for hydrogen storage.

- In June 2024, Sumitomo Corporation invested in Epsilon Composite, a French CFRP manufacturer. The deal aims to expand Sumitomo's downstream carbon fiber business and promote CFRP-based products for applications such as overhead transmission lines, contributing to renewable energy and CO₂ reduction goals.

Market Driver

Rising Adoption of Carbon Composites in Electric Vehicles and Industrial Manufacturing

The carbon composites market is driven by the rising demand for lightweight materials in electric vehicles and industrial applications. In the EV sector, manufacturers increasingly using carbon composites in battery enclosures, structural components, and body panels to reduce vehicle weight. This enhances energy efficiency, extends driving range, and helps meet strict emission regulations.

In industrial settings, carbon composites enable the production of strong, lightweight components that improve operational performance while lowering energy consumption. Their resistance to corrosion and long service life contribute to reduced maintenance costs.

The ongoing shift toward more efficient and sustainable production methods is significantly boosting the use of carbon composites across automotive, machinery, and equipment manufacturing, thereby driving market growth.

- In May 2025, Sichuan Kingoda Glass Fiber Co., Ltd. launched high-performance carbon fiber sheets designed for EV battery enclosures and lightweight automotive components. These eco-friendly composites support improved energy efficiency and enhanced durability across multiple industries.

Market Challenge

High Production Costs Limiting Wider Adoption

The carbon composites market faces a significant challenge due to high production costs. This results from the use of expensive raw materials, complex fabrication techniques, and energy-intensive curing processes. These cost factors limit adoption, especially in price-sensitive industries such as automotive and construction.

Companies are implementing advanced manufacturing solutions that reduce labor input, material waste, and cycle time, leading to lower production costs. By improving manufacturing efficiency while maintaining performance standards, these innovations support the broader application of carbon composites across various industrial sectors.

- In February 2025, KraussMaffei showcased advanced composite manufacturing technologies at JEC World, including automated high-pressure RTM, pultrusion, long fiber injection, and large-format additive manufacturing. These solutions aim to reduce production costs and cycle times while improving scalability and efficiency, supporting applications across automotive, construction, and renewable energy sectors.

Market Trend

Shift Toward Sustainable and Recyclable Composite Solutions

A key trend in the global carbon composites market is the development and use of sustainable and recyclable materials. This shift is driven by growing environmental concerns and regulatory pressure to reduce emissions and minimize industrial waste. Manufacturers are focusing on bio-based resins, recyclable fiber systems, and low-emission production processes to meet rising sustainability standards.

These advanced materials provide the same strength and performance as traditional composites while offering significant environmental benefits. The push for recyclable solutions supports long-term resource efficiency by enabling recovery and reuse at the end of product life. Growing industry focus on eco-friendly practices is driving demand for sustainable carbon composites.

This shift is influencing how manufacturers develop and adopt new composite formulations, processing technologies, and recycling methods across the automotive, energy, and industrial sectors, leading to long-term transformation in composite manufacturing.

- In February 2025, Westlake Epoxy launched the EpoVIVE portfolio, a range of epoxy products with sustainable characteristics including lower carbon footprint, energy efficiency, safer materials, reduced emissions, and circular solutions. The portfolio targets a broad range of applications across aerospace, automotive, construction, wind energy, electronics, and marine industries.

Carbon Composites Market Report Snapshot

|

Segmentation

|

Details

|

|

By Matrix

|

Hybrid, Metal, Ceramic, Carbon, Polymer (Thermosetting, Thermoplastic)

|

|

By Process

|

Prepreg Layup Process, Pultrusion & Winding, Wet Lamination & Infusion Process, Press & Injection Processes, Others

|

|

By Application

|

Aerospace & Defense, Automotive, Energy & Power, Sport & Leisure, Construction, Marine, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Matrix (Hybrid, Metal, Ceramic, Carbon, and Polymer): The metal segment earned USD 6.07 billion in 2024 due to its high strength, thermal conductivity, and suitability for structural applications in the automotive and aerospace industries.

- By Process (Prepreg Layup Process, Pultrusion & Winding, Wet Lamination & Infusion Process, Press & Injection Processes, and Others): The prepreg layup process segment held 28.08% of the market in 2024, due to its ability to deliver high-quality, uniform composites with excellent mechanical properties for critical applications.

- By Application (Aerospace & Defense, Automotive, Energy & Power, Sport & Leisure, Construction, Marine, and Others): The aerospace & defense segment is projected to reach USD 9.41 billion by 2032, owing to increased demand for lightweight, high-performance materials that enhance fuel efficiency and operational capabilities.

Carbon Composites Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific carbon composites market share stood at around 35.03% in 2024 in the global market, with a valuation of USD 7.76 billion. The growth is driven by the increasing demand from the automotive and industrial sectors. Countries such as China, Japan, and South Korea are expanding the use of lightweight materials to meet fuel efficiency targets and emissions regulations.

The rising adoption of electric vehicles is driving demand for carbon composites as these materials offer the strength and lightness needed in key components like battery enclosures and structural parts. Reducing vehicle weight improves energy efficiency and driving range, making lightweight composites a preferred choice for EV manufacturers. Rapid industrialization and infrastructure development across emerging economies are contributing to increased demand for carbon composites.

These materials are being used in construction, industrial machinery, and renewable energy equipment due to their strength, durability, and lightweight properties. Growing emphasis on performance, energy efficiency, and compliance with environmental regulations is further accelerating adoption across key industries in the region.

- In May 2025, Sicona Battery Technologies and Himadri Speciality Chemical Ltd entered a strategic partnership through a technology licensing agreement. The collaboration includes a USD 10 million investment by Himadri to commercialize Sicona’s SiCx silicon-carbon anode technology in India. The partnership aims to accelerate production for electric vehicle applications and strengthen global battery supply chains.

The carbon composites industry in North America is expected to register the fastest growth in the market, with a projected CAGR of 7.61% over the forecast period. The growth is driven by the increasing demand from the aerospace and defense sector. The presence of major aerospace manufacturers such as Boeing and Lockheed Martin continues to boost carbon composite usage in aircraft production.

Expansion of defense-related manufacturing is another key factor, increasing the need for lightweight and high-strength materials to enhance fuel efficiency and structural integrity in both military and commercial aviation. These factors contribute to the steady adoption of carbon composites across various applications such as fuselage panels, wing structures, engine nacelles, and interior components, thereby driving market growth in the region.

- In January 2024, Toray Composite Materials America, Inc. commissioned its expanded carbon fiber production line in Decatur, Alabama. The USD 15 million expansion is expected to double the production capacity of TORAYCA T1100 carbon fiber, which supports several U.S. Department of Defense weapons systems and the Future Vertical Lift program.

Regulatory Frameworks

- In the U.S., carbon composites used in industrial applications are regulated by the Occupational Safety and Health Administration (OSHA) for worker safety and the Environmental Protection Agency (EPA) for emissions and waste handling.

- In the European Union, carbon composite production and usage are governed by REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and CLP (Classification, Labelling and Packaging) regulations to ensure chemical safety.

- In Japan, the Ministry of the Environment and the Ministry of Health, Labour and Welfare regulate chemical safety and workplace exposure related to composite manufacturing.

Competitive Landscape

The carbon composites industry is characterized by companies focusing on strategic initiatives to strengthen their market position and operational reach. Market players are developing advanced composites with improved strength, durability, and processing efficiency to address evolving performance requirements in sectors such as sports equipment, consumer electronics, and industrial tooling. Companies are also pursuing mergers and acquisitions to enhance their market presence and gain access to proprietary technologies.

- In March 2025, the Mercedes F1 Team announced the use of sustainable carbon fibre composites in its W16 race car for the 2025 Formula 1 season. The project, developed in collaboration with INEOS Nitriles, Toray, Syensqo, and Sigmatex, aims to maintain performance while introducing sustainability in high-performance motorsport materials.

Key Companies in Carbon Composites Market:

- TORAY INDUSTRIES, INC.

- Hexcel Corporation

- TEIJIN LIMITED

- Mitsubishi Corporation

- SGL Carbon

- Solvay

- Formosa M Co., Ltd.

- HS HYOSUNG ADVANCED MATERIALS

- Nippon Graphite Fiber Co., Ltd.

- Syensqo

- KUREHA CORPORATION

- Aksa Akrilik Kimya Sanayii A.Ş.

- Alfa Chemistry

- UNITIKA LTD

- EVERTECH ENVISAFE ECOLOGY CO., LTD

Recent Developments (Partnerships/Product Launches)

- In March 2025, Teijin Carbon launched Tenax Next, a new brand of sustainable carbon fiber products featuring circular feedstock and reduced CO₂ emissions. The first products include HTS45 E23 24K filament yarn and R2S P513 6mm short fiber, offering high performance and supporting circularity in aerospace, automotive, and industrial applications.

- In March 2025, Syensqo and Vartega collaborated to recycle Syensqo’s carbon fiber waste into Vartega’s EasyFeed Bundles, which will be used in Syensqo’s ECHO portfolio for high-performance automotive applications, promoting circularity and sustainability in carbon fiber usage.

- In February 2025, Bodo Möller Chemie and DowAksa collaborated through a strategic distribution partnership to offer high-performance carbon fiber products in Europe. The partnership expands Bodo Möller Chemie’s portfolio with DowAksa’s lightweight materials for sectors such as automotive, aerospace, and wind energy, supporting energy efficiency and sustainability goals.

- In October 2024, Envalior launched new Tepex continuous fiber-reinforced thermoplastic composites. The products offer high temperature resistance, sustainability through bio-based materials, and enhanced mechanical properties, targeting applications in aerospace, automotive, sporting goods, and metal substitution.

These strategies reflect the industry's commitment to innovation, value creation, and long-term competitiveness across a broad range of end-use industries.