Canes and Crutches Market Size

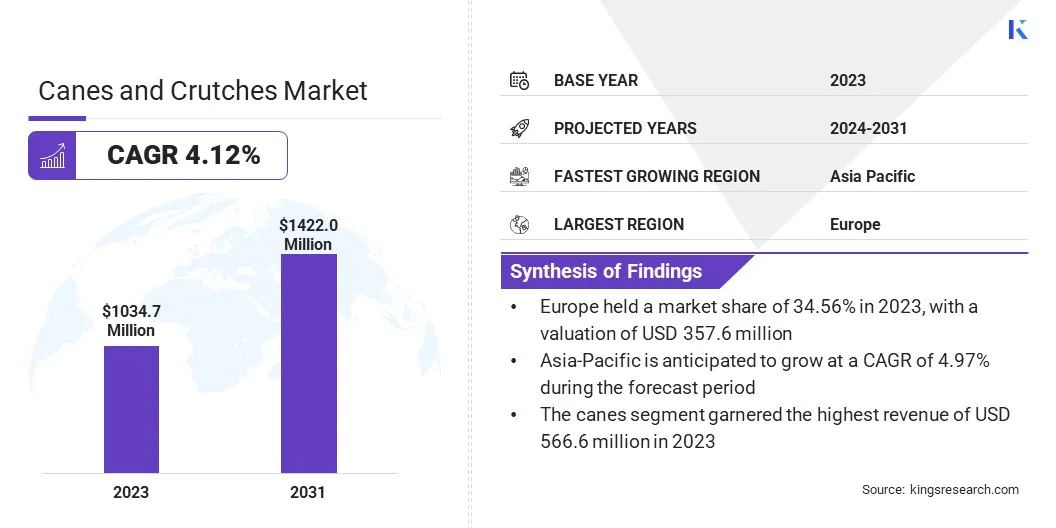

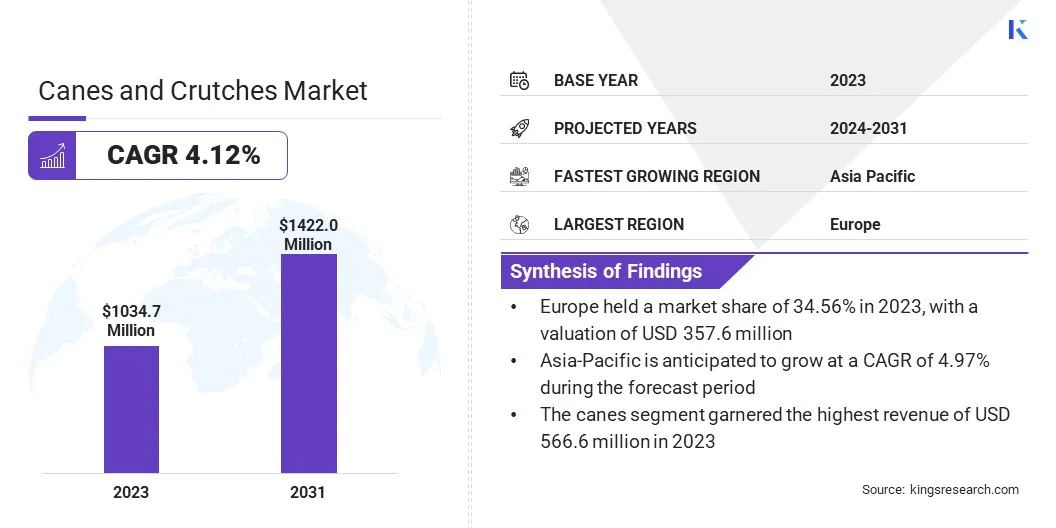

Global Canes and Crutches Market size was recorded at USD 1,034.7 million in 2023, which is estimated to be at USD 1,071.8 million in 2024 and projected to reach USD 1,422.0 million by 2031, growing at a CAGR of 4.12% from 2024 to 2031.

In the scope of work, the report includes solutions offered by companies such as Drive DeVilbiss International, Cardinal Health, Medline at Home, GF Health Products, Inc., NOVA Medical Products., Invacare Corporation, Ergoactives, Sunrise Medical Limited, Ossenberg GmbH, BESCO MEDICAL LIMITED and others.

The growth of the market is driven by several key factors, including the rising geriatric population, increased incidence of musculoskeletal disorders, and advancements in medical technology. As the global population ages, there is an increasing demand for mobility aids such as canes and crutches. Additionally, the rising prevalence of conditions such as rheumatoid arthritis and osteoarthritis is contributing to this demand.

- Technological advancements are further playing a crucial role, with manufacturers actively concentrating on developing ergonomic, lightweight designs and integrating smart features such as sensors for real-time gait analysis. These innovations are enhancing patient rehabilitation outcomes, thereby further propelling market growth.

The canes and crutches market is experiencing robust growth, primarily attributable to numerous factors such as an aging global population and the rising incidence of accidents and injuries that necessitate mobility aids. As an increasing number of individuals seek solutions to enhance mobility and independence, the demand for canes and crutches continues to rise.

Technological advancements and innovative designs are further propelling market expansion, with manufacturers focusing on lightweight materials, ergonomic designs, and additional features to improve user comfort and functionality.

Moreover, the integration of smart technologies into these devices is boosting their appeal and utility. With a growing emphasis on enhancing the quality of life for individuals with mobility challenges, the canes and crutches market is poised to witness sustained growth and innovation.

Canes, which are commonly known as canes, and crutches are essential mobility aids specifically designed to assist individuals with walking difficulties or balance issues due to age, injury, or medical conditions.

Canes provide support and stability for those with mild to moderate mobility impairments and are typically made from lightweight materials such as aluminum, wood, or carbon fiber. They are available in various designs, including single-tip and quad-tip for extra stability, featuring ergonomic handles and adjustable heights to suit different user needs.

Crutches, on the other hand, are used by individuals unable to bear weight on their legs, often due to injury or surgery. Types of crutches include axillary (underarm) crutches, forearm (Lofstrand) crutches, and platform crutches, each designed to transfer weight from the legs to the upper body, thereby enhancing mobility and independence.

Made from durable materials such as aluminum or steel, crutches are adjustable and often feature padded supports for comfort. Both canes and crutches play a crucial role in improving the quality of life for individuals with mobility challenges by offering necessary support and stability.

Analyst’s Review

With an aging global population and an increasing incidence of injuries and surgeries, the demand for mobility aids is steadily rising. Key market players, such as Drive DeVilbiss Healthcare, Medline Industries, and Invacare Corporation, are strategically investing in research and development to introduce lightweight, durable materials and ergonomic designs. These innovations aim to enhance user comfort and functionality, thus catering to the diverse needs of consumers.

Furthermore, companies are expanding their market presence through strategic partnerships, acquisitions, and a focus on emerging markets. By leveraging e-commerce platforms and direct-to-consumer channels, manufacturers are improving accessibility and gaining valuable consumer insights.

- As the market evolves, companies that prioritize user-centric design, technological integration, and strategic expansion are poised to capitalize on the growing demand for mobility aids.

Canes and Crutches Market Growth Factors

The rise in the geriatric population and the increase in the incidence of rheumatoid arthritis and other disabilities are significantly contributing to the growth of the canes and crutches market.

- According to the World Population Prospects, there were 771 million people aged 65 years or older globally in 2022. This number is projected to reach 994 million by 2030 and 1.6 billion by 2050.

The substantial growth in the elderly population worldwide is likely to create a strong demand for canes and crutches, thus supporting market expansion. Furthermore, musculoskeletal diseases (MSDs) are a major contributor to global disability.

- According to the World Health Organization (WHO) data updated in July 2022, MSDs affected 1.71 billion people globally. The increasing burden of MSDs is expected to boost the demand for mobility aids such as canes and crutches.

A significant challenge hindering the growth of the canes and crutches market is the complexity of reimbursement processes. Numerous insurance companies impose strict regulations and limitations concerning coverage for mobility assistance devices. This pose a significant barrier for patients who are seeking to obtain advanced canes and crutches, especially those with innovative features or smart technology integration.

Leading market players are forging partnerships with healthcare providers such as physical therapists and rehabilitation centers. These partnerships allow for better communication and collaboration regarding the benefits of advanced canes and crutches tailored to specific patient needs. By providing data on improved patient outcomes and cost-effectiveness in the long run, manufacturers are convincing insurers of the value proposition these advanced devices offer.

By implementing these strategies, key players are navigating the reimbursement challenge, thereby ensuring wider access to innovative mobility assistance solutions for patients who need them most. This leads to a conducive environment for advanced canes and crutches, thereby fostering innovation and improving patient care within the healthcare system.

Canes and Crutches Market Trends

The increasing emphasis on physical rehabilitation following injuries and surgeries is significantly boosting the demand for canes and crutches. These tools are essential in helping patients regain mobility, improve strength, and facilitate a seamless return to independent living.

This trend is further fueled by ongoing advancements in surgical techniques and a growing focus on early intervention and rehabilitation to enhance patient outcomes. The healthcare landscape is increasingly prioritizing rehabilitation, thereby creating substantial demand for canes and crutches.

Advancements in surgical techniques, particularly minimally invasive procedures, are leading to faster recovery times. This focus on early intervention and rehabilitation benefits patients by improving their long-term outcomes and is also propelling demand for these essential mobility assistance tools.

- For instance, according to an article published by the Archives of Rehabilitation Research and Clinical Translation in September 2022, patients suffering from hip osteoarthritis exhibit greater hip loading on the healthy side compared to the affected side. This imbalance underscores the necessity for supportive devices such as canes and crutches to help distribute weight more evenly and reduce strain on the affected hip, thereby increasing the demand for these mobility aids.

The canes and crutches market is experiencing significant technological advancements. Manufacturers are focusing on developing lightweight, ergonomic designs with adjustable features to enhance user comfort and safety.

Additionally, the integration of smart technology, such as sensors and tracking devices, is becoming more prevalent in the design of crutches. These innovations enable real-time gait analysis and data collection, which are invaluable for optimizing rehabilitation programs.

Prominent companies in the market are creating crutches equipped with these advanced technologies, providing healthcare professionals with critical insights to tailor rehabilitation programs and improve recovery outcomes. By leveraging these technological advancements, the canes and crutches market is expected to revolutionize patient rehabilitation and significantly enhance the overall well-being of individuals who require mobility assistance in the coming years.

Segmentation Analysis

The global market is segmented based on type, distribution channel, and geography.

By Type

Based on type, the canes and crutches market is categorized canes, crutches, and accessories. The canes segment garnered the highest revenue of USD 566.6 million in 2023.

With an aging population and a rise in mobility impairments due to injuries or medical conditions, the demand for canes as essential walking aids continues to increase. Technological advancements have led to the development of ergonomic designs, adjustable features, and lightweight materials, thereby enhancing user comfort and convenience.

Additionally, the integration of smart features such as GPS tracking and fall detection sensors adds value to modern cane designs, catering to the safety and peace of mind of users and caregivers. Manufacturers are diversifying their product offerings and implementing targeted marketing strategies to reach different consumer demographics effectively. With ongoing innovation and expanding market reach, the canes segment is poised to witness notable growth in the forthcoming years.

By Distribution Channel

Based on distribution channel, the market is divided into hospital pharmacies, medical retail stores, and online stores. The hospital pharmacies segment captured the largest canes and crutches market share of 48.67% in 2023.

These pharmacies serve as critical distribution points and care providers for patients requiring mobility aids during hospitalization or outpatient visits. They maintain a diverse inventory of canes and crutches, working closely with healthcare professionals to ensure that patients receive appropriate devices tailored to their needs.

Hospital pharmacies prioritize patient education and support by offering guidance on device selection, fitting, and proper usage, aiming to optimize rehabilitation outcomes. Additionally, they integrate technology to streamline operations and enhance patient care, utilizing electronic inventory systems and telehealth solutions.

By fostering collaborative care approaches and comprehensive product offerings, hospital pharmacies significantly influence patient mobility and rehabilitation, thereby contributing to improved outcomes and satisfaction.

Canes and Crutches Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Canes and Crutches Market share stood around 34.56% in 2023 in the global market, with a valuation of USD 357.6 million. This growth is mainly attributed to an aging population and a rising incidence of injuries and chronic conditions.

The robust healthcare infrastructure and universal healthcare coverage across many European countries ensure that mobility aids are accessible and affordable for a wide range of patients. Major markets such as Germany, the UK, France, and Italy are experiencing substantial demand, supported by advanced healthcare technologies and significant healthcare expenditure.

The region's stringent regulatory standards further guarantee the production of high-quality, and safe products, thereby fostering consumer confidence. Despite facing economic challenges and competition from alternative mobility solutions, prominent market participants are focusing on product innovation and forming strategic partnerships to sustain their growth trajectory.

Asia-Pacific is anticipated to witness the highest growth, recording a CAGR of 4.97% over the forecast period. This robust growth is majorly fueled by demographic shifts, economic development, and increasing healthcare awareness. Major countries such as China, India, Japan, and South Korea are leading this expansion due to their large aging populations and rising incidence of mobility-related issues.

Rapid urbanization and improved access to healthcare services are further boosting the demand for mobility aids. In both China and India, growing middle-class incomes and increased healthcare spending enable more individuals to afford quality mobility aids. Japan, charaterized by its advanced healthcare system and high elderly population, shows a strong demand for innovative, and superior mobility aids.

Technological advancements are enhancing product functionality and comfort, with local manufacturers adopting new materials and designs. Smart technologies, such as GPS and fall detection, are becoming increasingly prevalent, particularly in Japan and South Korea, which is likely to support canes and crutches market expansion.

Competitive Landscape

The canes and crutches market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (RandD), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Canes and Crutches Market

- Drive DeVilbiss International

- Cardinal Health.

- Medline at Home

- GF Health Products, Inc.

- NOVA Medical Products.

- Invacare Corporation

- Ergoactives

- Sunrise Medical Limited

- Ossenberg GmbH

- BESCO MEDICAL LIMITED

Key Industry Developments

- August 2022(Launch): The University College of London Hospitals (UCLH) launched the walking aid 'return and reuse' scheme. According to this scheme, patients visiting the emergency department at University College Hospital or the Grafton Way Building are encouraged to return crutches to UCLH once they are no longer needed. This initiative aims to promote sustainability and ensure that mobility aids are available for reuse by other patients, thereby optimizing resource utilization and potentially reducing costs associated with purchasing new equipment.

The Global Canes and Crutches Market is Segmented as:

By Type

- Canes

- Crutches

- Accessories

By Distribution Channel

- Hospital Pharmacies

- Medical Retail Stores

- Online Stores

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East and Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America