Market Definition

Camping furniture refers to lightweight, portable, and durable furnishings designed for outdoor use during camping trips, hiking excursions, or other outdoor activities.

These items, including folding chairs, tables, cots, hammocks, and storage units, are made from materials like aluminum, steel, and weather-resistant fabrics to ensure easy transportation, quick assembly, and resistance to outdoor conditions. Camping furniture enhances comfort and convenience, providing campers with functional seating, dining, and sleeping arrangements while exploring nature.

Camping Furniture Market Overview

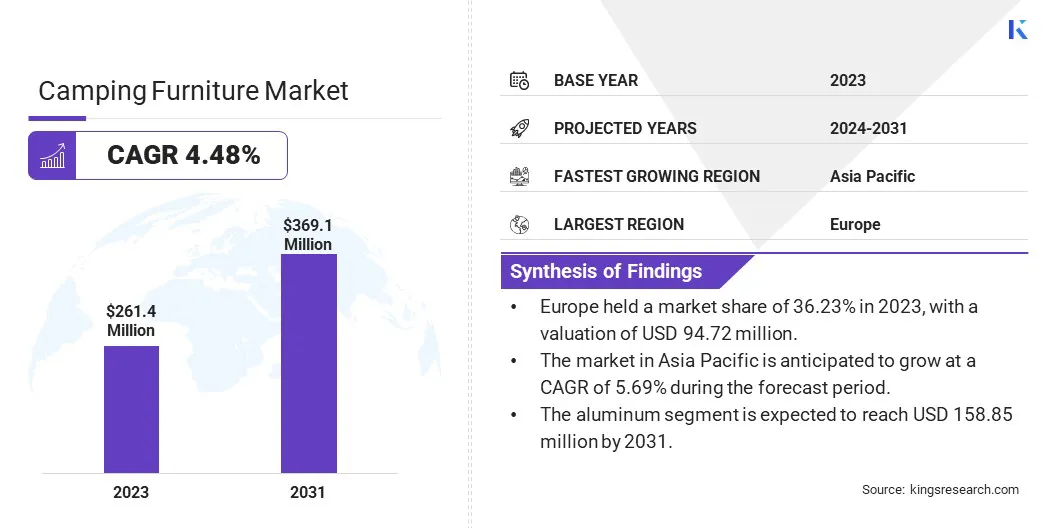

The global camping furniture market size was valued at USD 261.44 million in 2023, which is estimated to be valued at USD 271.62 million in 2024 and reach USD 369.17 million by 2031, growing at a CAGR of 4.48% from 2024 to 2031.

The growing preference for outdoor recreational activities is fueling demand within the market. Consumers are increasingly seeking lightweight, durable, and multifunctional furniture that enhances comfort and convenience during outdoor adventures.

Additionally, advancements in material technology, such as weather-resistant fabrics and eco-friendly components, are driving product innovation. The rise of eco-tourism and sustainable travel trends is further encouraging manufacturers to develop environmentally responsible camping furniture solutions.

Major companies operating in the camping furniture industry are The Coleman Company, Inc., Oase Outdoors ApS, Johnson Outdoors Inc., Helinox, Recreational Equipment, Inc., GCI Outdoor, Kamp-Rite, TREKOLOGY, ALPS Mountaineering, Big Agnes, Inc., Kelty, Thule Group (Tepui Outdoors, Inc.), CampTime.com, OUTWELL, and Exxel Outdoors, LLC.

The growing preference for group camping, corporate retreats, and outdoor team-building activities has increased the demand for durable and spacious camping furniture. Businesses and event organizers are incorporating outdoor experiences into their programs, requiring high-capacity tables, portable seating, and communal fire pit arrangements.

Consumers are investing in group-friendly recreational setups, including dining sets and lounge furniture, to enhance social interactions during outdoor trips. This trend has encouraged manufacturers to develop sturdy and easily transportable furniture designed for multiple users. The rising demand for outdoor group activities is accelerating the growth of the market by expanding its consumer base.

- The latest data from the BEA Outdoor Recreation Satellite Account shows that outdoor recreation contributed USD 1.2 trillion to economic output, representing 2.3% of GDP. In 2023, the sector accounted for 5 million jobs and made up 3.1% of total employment in the U.S.

Key Highlights:

Key Highlights:

- The camping furniture industry size was valued at USD 261.44 million in 2023.

- The market is projected to grow at a CAGR of 4.48% from 2024 to 2031.

- Europe held a market share of 36.23% in 2023, with a valuation of USD 94.72 million.

- The chairs & stools segment garnered USD 122.09 million in revenue in 2023.

- The aluminum segment is expected to reach USD 158.85 million by 2031.

- The furniture stores segment held 45.12% share of the market in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.69% during the forecast period.

Market Driver

"Rising Popularity of Outdoor Recreational Activities"

Increasing participation in outdoor activities has led to a higher demand for comfortable and functional camping furniture. More individuals and families are engaging in hiking, trekking, and camping, driving the need for lightweight and portable furniture solutions.

Government initiatives promoting ecotourism and outdoor adventure tourism have further contributed to market expansion. The rise in social media influence has encouraged travelers to seek well-equipped outdoor experiences, creating opportunities for manufacturers to introduce innovative designs. These trends are positively impacting the growth of the camping furniture market by increasing consumer demand for durable and ergonomic outdoor furniture.

- The 2024 Outdoor Industry Association report highlights that in 2023, the number of outdoor recreation participants grew by 4.1%, reaching a record 175.8 million, equivalent to 57.3% of all Americans aged six and older. Participation increased across various demographics and activities, with more casual enthusiasts engaging in hiking, biking, camping, running, and fishing. Additionally, 7.7 million Americans experienced at least one outdoor recreation activity for the first time during the year.

Market Challenge

"High Production Costs and Pricing Pressures"

The camping furniture market faces challenges, due to high production costs associated with premium materials, advanced designs, and sustainable manufacturing practices. Rising raw material prices, transportation costs, and labor expenses contribute to pricing pressures, making it difficult for manufacturers to balance affordability with quality.

Companies are investing in cost-effective production techniques, such as automation and modular designs, to streamline manufacturing. Additionally, sourcing sustainable yet affordable materials and optimizing supply chains help reduce costs. Many brands are also leveraging direct-to-consumer sales channels to enhance pricing competitiveness while maintaining product quality.

Market Trend

"Influence of Outdoor Wellness and Nature-based Therapy"

The increasing focus on outdoor wellness and nature-based therapy is driving consumer interest in high-quality camping furniture. More individuals are embracing camping as a way to disconnect from urban stress and improve mental well-being.

Outdoor retreats and wellness tourism initiatives are incorporating comfortable furniture to provide relaxing and rejuvenating experiences. Yoga retreats, meditation camps, and eco-therapy programs are contributing to market growth by increasing the demand for ergonomic and esthetically pleasing outdoor furniture.

Consumers are prioritizing mental and physical well-being through nature-based activities. Thus, the camping furniture market is registering heightened demand for products that enhance outdoor relaxation.

- The 2024 Camping and Outdoor Hospitality Report by Kampgrounds of America, Inc. (KOA) highlights a growing emphasis on health and wellness in travel decisions. Approximately 79% of travelers plan to incorporate activities such as forest immersion, meditation, yoga, or mindful strolls into their trips to embrace a slower pace of life. Campers show a strong preference for natural attractions, with top travel experiences for 2024 including natural events (50%), food tourism (31%), visits to small towns (29%), and the blending of work and leisure travel (25%).

Camping Furniture Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Chairs & Stools, Tables, Camping Cots and Hammocks, Others

|

|

By Material

|

Aluminum, Steel, Plastic, Wood, Others

|

|

By Sales Channel

|

Furniture Stores, Wholesalers & Distributors, Online Retailers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Chairs & Stools, Tables, Camping Cots and Hammocks, and Others): The chairs & stools segment earned USD 122.09 million in 2023, due to the increasing demand for lightweight, portable, and ergonomically designed seating solutions that enhance comfort and convenience for outdoor enthusiasts.

- By Material (Aluminum, Steel, Plastic, Wood, and Others): The aluminum segment held 39.52% share of the market in 2023, due to its exceptional durability, lightweight properties, and resistance to corrosion, ensuring high-quality packaging that preserves product stability and extends shelf life.

- By Sales Channel (Furniture Stores, Wholesalers & Distributors, and Online Retailers): The furniture stores segment is projected to reach USD 165.32 million by 2031, owing to their well-established retail presence, allowing consumers to physically assess product quality, receive personalized recommendations, and benefit from exclusive in-store promotions, enhancing purchasing confidence and driving higher sales volumes.

Camping Furniture Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

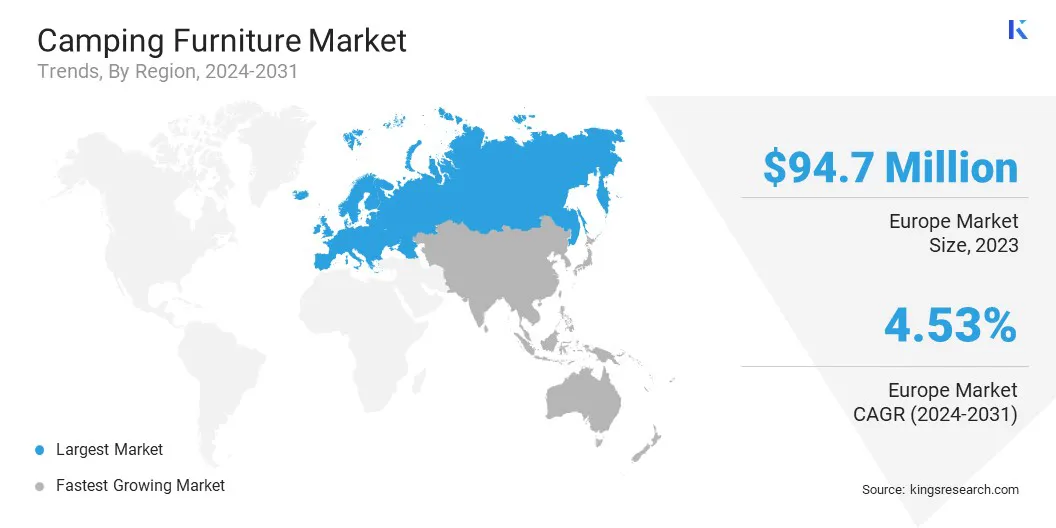

Europe accounted for around 36.23% share of the camping furniture market in 2023, with a valuation of USD 94.72 million. The increasing number of camping and glamping destinations in Europe is significantly contributing to the demand for high-quality camping furniture.

Europe accounted for around 36.23% share of the camping furniture market in 2023, with a valuation of USD 94.72 million. The increasing number of camping and glamping destinations in Europe is significantly contributing to the demand for high-quality camping furniture.

Countries like France, Germany, and the UK are witnessing a rise in luxury camping resorts offering well-furnished outdoor accommodations. Glamping operators are investing in premium outdoor furniture to enhance guest experiences, driving the market. The growing preference for nature-based tourism, coupled with the development of modern camping sites, is strengthening the market in Europe.

- The Caravan and Motorhome Club has expanded its European network for 2025 by adding 26 new campsites, increasing its total to over 350 locations across 16 countries. These sites provide access to nature-based activities such as birdwatching and hiking, aligning with the growing demand for eco-tourism experiences.

The van life movement is gaining momentum in Europe, with a growing number of travelers converting vans into mobile homes for long-term road trips. Countries such as Spain, Portugal, and Norway have registered an increase in mobile camping enthusiasts seeking compact and multifunctional furniture solutions. The demand for space-efficient, foldable, and easy-to-store camping furniture is expanding as more individuals embrace a nomadic lifestyle.

The camping furniture industry in Asia Pacific is poised for significant growth at a robust CAGR of 5.69% over the forecast period. The increasing interest in outdoor recreation and adventure tourism across Asia Pacific is fueling the demand for high-quality camping furniture.

Countries such as Japan, Australia, and South Korea are registering a surge in camping, trekking, and nature-based tourism as more consumers seek outdoor experiences. The rise in domestic travel, particularly post-pandemic, has encouraged families, solo travelers, and adventure groups to invest in durable and portable camping furniture.

Furthermore, social media platforms are playing a major role in promoting outdoor lifestyles and encouraging consumers to explore camping, glamping, and road trips. Influencers and digital content creators across platforms such as Instagram and YouTube are driving awareness about premium camping gear, including ergonomic and multifunctional furniture.

The rise of "experience-driven travel" has increased consumer spending on high-quality outdoor products. The market in Asia Pacific is expanding to cater to the growing consumer base as social media continues to shape travel trends.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) oversees the safety of consumer products, including camping furniture. Manufacturers must ensure that their products are free from defects that could pose unreasonable risks to consumers.

- In Europe, the European Union (EU) established comprehensive regulations to ensure consumer safety and environmental protection concerning camping furniture. The General Product Safety Directive (GPSD) mandates that all consumer products, including camping furniture, must be safe under normal or reasonably foreseeable conditions of use. Manufacturers are required to provide relevant information and warnings to consumers.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates consumer products under the Consumer Product Safety Act. Camping furniture must meet safety standards, and certain products may require the PSC (Product Safety of Consumer Products) mark, indicating compliance with technical regulations.

- South Korea's Ministry of Trade, Industry and Energy (MOTIE) oversees product safety standards. The Korean Agency for Technology and Standards (KATS) establishes regulations that camping furniture must comply with, focusing on safety, quality, and environmental impact.

Competitive Landscape:

The global camping furniture market is characterized by a large number of participants, including both established corporations and rising organizations. Key market players are implementing strategies focused on product innovation and design enhancements, driving the market.

Companies are developing lightweight, durable, and multifunctional camping furniture to meet evolving consumer preferences. Advanced materials, ergonomic designs, and compact, easy-to-assemble structures are being introduced to enhance convenience and portability.

Additionally, manufacturers are integrating sustainable materials and eco-friendly production processes to align with increasing environmental consciousness. Collaborations with outdoor brands and technology integration, such as smart features and modular components, are further strengthening market growth. These strategic advancements are enabling companies to differentiate their offerings and capture a larger consumer base.

- In February 2025, Ethimo, in collaboration with Studio Zanellato/Bortotto, introduced Patio, a new outdoor furniture collection distinguished by its innovative weaving techniques and the natural elegance of teak. Designed as a lounge collection, Patio features a cocoon-like structure, offering a comforting and ergonomic structure for enhanced outdoor relaxation.

List of Key Companies in Camping Furniture Market:

- The Coleman Company, Inc.

- Oase Outdoors ApS

- Johnson Outdoors Inc.

- Helinox

- Recreational Equipment, Inc.

- GCI Outdoor

- Kamp-Rite

- TREKOLOGY

- ALPS Mountaineering

- Big Agnes, Inc.

- Kelty

- Thule Group (Tepui Outdoors, Inc.)

- CampTime.com

- OUTWELL

- Exxel Outdoors, LLC

Recent Developments (Partnerships/New Product Launch)

- In June 2024, TRAPSKI announced a new partnership with GCI OUTDOOR, introducing a complete range of rockers, chairs, tables, and canopies designed to elevate outdoor experiences. This collaboration represents a major milestone for TRAPSKI, broadening its product lineup with a carefully curated selection of GCI’s premium outdoor gear.

- In May 2024, Welly Health PBC introduced the "Happy Campers Kit," a limited-edition camp trunk created in partnership with the famous celebrity mom, Tiffani Thiessen. This exclusive kit features a thoughtfully curated selection of essentials and extras designed to provide parents with peace of mind while ensuring campers have a comfortable and enjoyable overnight camp experience.

Key Highlights:

Key Highlights: Europe accounted for around 36.23% share of the camping furniture market in 2023, with a valuation of USD 94.72 million. The increasing number of camping and glamping destinations in Europe is significantly contributing to the demand for high-quality camping furniture.

Europe accounted for around 36.23% share of the camping furniture market in 2023, with a valuation of USD 94.72 million. The increasing number of camping and glamping destinations in Europe is significantly contributing to the demand for high-quality camping furniture.