Market Definition

The market encompasses a wide range of activities related to the production, formulation, distribution, and utilization of calcium propionate across multiple industries. Calcium propionate is made through a chemical reaction between calcium hydroxide and propionic acid.

The market primarily serves the food & beverage sector, where calcium propionate is used to extend the shelf life of bakery and dairy products by inhibiting mold and bacterial growth. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting the market growth through the forecast period.

Calcium Propionate Market Overview

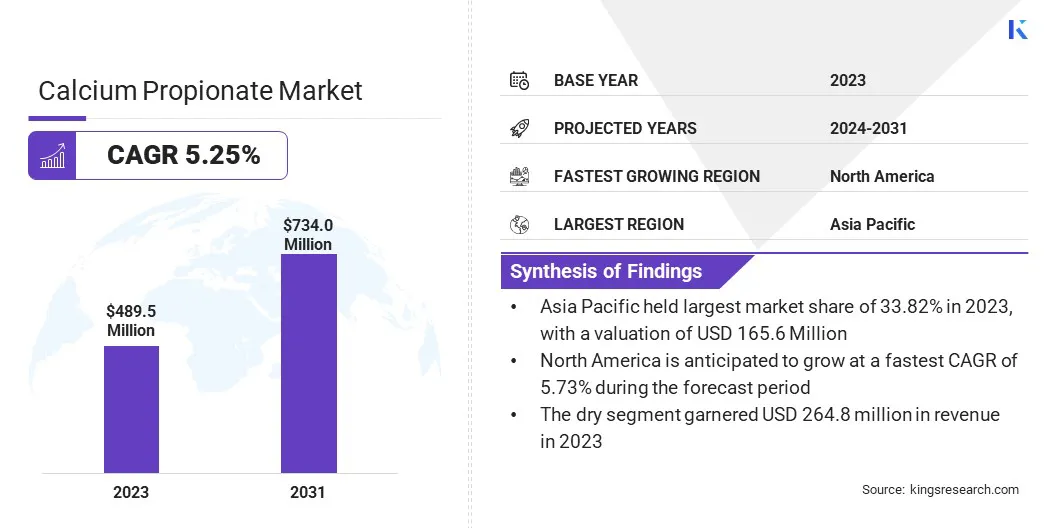

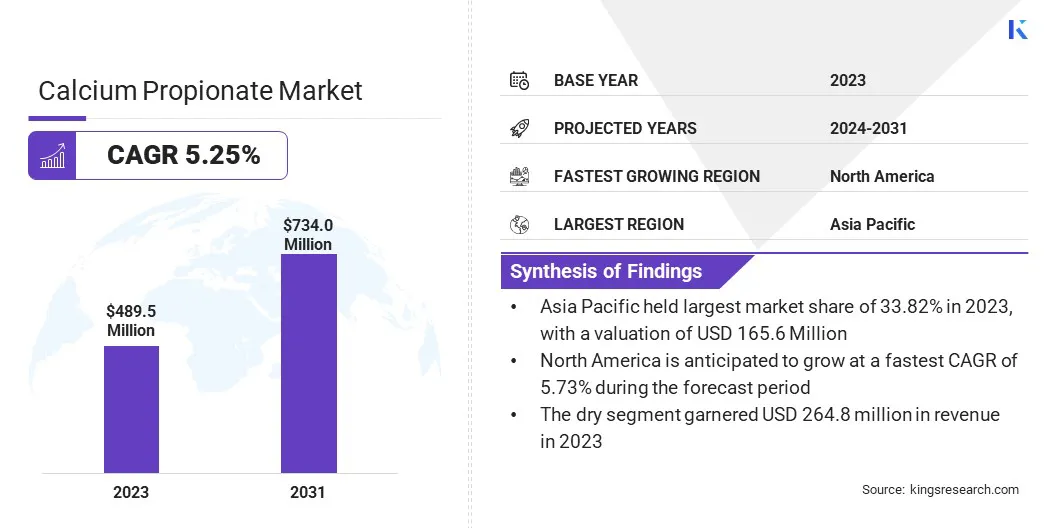

The global calcium propionate market size was valued at USD 489.5 million in 2023 and is projected to grow from USD 513.0 million in 2024 to USD 734.0 million by 2031, exhibiting a CAGR of 5.25% during the forecast period.

The growing need for longer shelf life in bakery & dairy products and rising consumer preference for safe food preservatives is driving the market. Food manufacturers aim to reduce spoilage and meet regulatory standards without compromising on product quality, hence, they are increasingly adopting calcium propionate as a reliable mold inhibitor in processed foods.

Major companies operating in the calcium propionate industry are Perstorp, Macco, AB Mauri, Fine Organic Industries Limited, Impextraco NV, Kemin Industries, Inc., Brenntag, Batory Foods, Jainex Speciality Chemicals, Puratos, Titan Biotech, BioVeritas, LLC, Addcon GmbH, Niacet Corporation, and ABF Ingredients.

Rising consumer demand for convenience and ready-to-eat meals is pushing manufacturers to incorporate effective preservatives like calcium propionate to enhance shelf life and prevent mold growth. Additionally, the growing trend of packaged bakery products, along with the need for longer-lasting, safe food, is further driving the adoption of calcium propionate in food preservation.

Key Highlights:

- The calcium propionate industry size was valued at USD 5 million in 2023.

- The market is projected to grow at a CAGR of 5.25% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 165.6 million.

- The dry segment garnered USD 264.8 million in revenue in 2023.

- The bakery segment is expected to reach USD 219.8 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 5.73% during the forecast period.

Market Driver

Rapidly Expanding Market for Processed Foods

The continuous growth of the food processing industry is driving the calcium propionate market. The rapid expansion enhances the demand for food-grade preservatives like calcium propionate to maintain shelf life and product safety across an increasingly complex supply chain.

Calcium propionate is effective in preventing mold growth, extending shelf life, and maintaining product quality, catering to the needs of both manufacturers and consumers. The demand for processed foods is expected to continue as global populations become more urbanized, supporting the growth of the market.

- As of June 2024, the Ministry of Food Processing Industries (MoFPI) approved 41 mega food parks, 399 cold chain projects, 76 agro-processing clusters, 588 food processing units, 61 backward & forward linkages projects, and 52 operation green projects under various PMKSY schemes. Additionally, the MoFPI approved 92,549 micro food processing enterprises under the PMFME scheme and 172 companies under the PLISFPI scheme.

Market Challenge

Shift toward Clean-label Alternatives

The growing consumer demand for clean-label, natural ingredients presents a challenge for the calcium propionate market. Consumers seek transparency in food ingredients, boosting the preference for products without synthetic preservatives.

Calcium propionate, commonly used in food preservation, is now under scrutiny as a synthetic additive. Manufacturers are facing pressure to adapt to this shift while maintaining product quality and shelf life. The challenge lies in finding natural alternatives that meet both consumer expectations and industry standards for food safety.

Companies are investing in the development of natural, fermentation-based preservatives that meet clean label requirements. These preservatives, such as fermented calcium propionate, offer a solution by maintaining preservation efficacy while adhering to clean label standards.

By focusing on fermentation technology, manufacturers can create products that satisfy consumer desires for natural ingredients. This innovation helps businesses reduce reliance on synthetic preservatives while ensuring food safety and quality.

Market Trend

Advancements in Food Preservation Technology

New production methods, such as fermentation-based techniques, are enhancing the quality and effectiveness of calcium propionate as a preservative. These innovations support cleaner-label formulations, improve mold-inhibition performance, and help extend the shelf life of bakery & processed food products.

The demand for technologically advanced calcium propionate continues to grow across the global food industry as food manufacturers seek safer, more natural, and sustainable additives.

- In June 2024, Creative Enzymes introduced fermented calcium propionate, a new food preservative designed to meet the evolving needs of food manufacturers. This innovative ingredient helps extend the shelf life of various food products by preventing mold growth while preserving freshness and taste. Thus, Creative Enzymes created a high-quality preservative that meets industry standards using advanced fermentation technology.

Calcium Propionate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Dry, Liquid

|

|

By Application

|

Bakery, Dairy & Frozen Desserts, Meat Processing, Animal Feed, Beverages, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Form (Dry, Liquid): The dry segment earned USD 264.8 million in 2023, due to its longer shelf life, ease of storage and transportation, and greater compatibility with dry food processing systems, making it the preferred choice among food manufacturers.

- By Application (Bakery, Dairy & Frozen Desserts, Meat Processing, Animal Feed, Beverages and Others): The bakery segment held 29.90% share of the market in 2023, due to the high susceptibility of bakery products to mold spoilage and the increasing consumption of packaged and ready-to-eat bakery goods globally.

Calcium Propionate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific calcium propionate market share stood at around 33.82% in 2023, with a valuation of USD 165.6 million. This strong market position is largely attributed to the rapid growth of the food processing industry across key countries like China, India, and Southeast Asian nations.

The demand for effective food preservatives such as calcium propionate continues to rise as urbanization increases and consumer lifestyles shift toward more convenient and packaged food options.

The region is registering significant industrial expansion, with many global and local manufacturers investing in production facilities. Government support for food safety and increased awareness about shelf life & food quality are also contributing factors to the market growth. These developments make Asia Pacific a highly active and rapidly evolving market for calcium propionate.

The calcium propionate industry in North America is poised for significant growth at a robust CAGR of 5.73% over the forecast period. This growth is attributed to the rising consumer demand for safe, high-quality packaged and processed foods, along with increasing awareness of food preservation techniques.

The region benefits from advanced food manufacturing. Additionally, the growing trend of extended-shelf-life products is encouraging food producers to adopt reliable preservatives. With continuous innovation and investment in food technology, North America is well-positioned to expand its role in the market.

Regulatory Framework

- In the U.S., the Food and Drug Administration (FDA) regulates calcium propionate under its Generally Recognized as Safe (GRAS) provisions outlined in 21 CFR § 184.1221. It permits the use of calcium propionate as an antimicrobial agent in various food products.

- In China, the National Health Commission regulates calcium propionate under the standard GB 1886.356-2022, which was implemented on December 30, 2022. This standard governs the production, purity, and use of food-grade calcium propionate and ensures that it meets national safety and quality specifications for use in food preservation.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates calcium propionate under the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011. It is approved for use as a preservative in bakery and dairy products, and must comply with FSSAI's safety limits and labeling requirements.

- In Canada, Health Canada permits the use of calcium propionate as a preservative in baked goods and cheese. The combined total of calcium and sodium propionate must not exceed 2,000 ppm, calculated as propionic acid. It is listed in the List of Permitted Preservatives, ensuring that the additive complies with national food safety standards.

Competitive Landscape

The calcium propionate industry is characterized by several participants, including both established corporations and rising organizations. Key players in the market are focusing on expanding their presence through various strategies, including market expansion and product innovation, all aimed at capturing a larger market share.

Market players are investing in research and development to maintain a competitive edge, continuously enhancing the effectiveness and stability of food additives and preservatives. These innovations help them meet the changing needs of the food industry.

List of Key Companies in Calcium Propionate Market:

- Perstorp

- Macco

- AB Mauri

- Fine Organics Industries Limited.

- Impextraco NV

- Kemin Industries, Inc.

- Brenntag

- Batory Foods

- Jainex Speciality Chemicals

- Puratos

- Titan Biotech

- BioVeritas, LLC.

- Addcon GmbH

- Niacet

- ABF ingredients.

Recent Developments (Agreements)

- In July 2024, Manuchar, a leading global chemical distributor headquartered in Antwerp, Belgium, entered into an agreement to acquire a controlling stake in Proquiel Químicos. This strategic acquisition supports the company's goal of broadening its product portfolio.