Market Definition

The market includes medical services and support systems involved in stem cell transplants used to treat various blood-related diseases. It covers hospitals, transplant centers, donor matching services, and follow-up care.

Additionally, the market involves tools and technologies used during the transplant process, including diagnosis, recovery, and long-term patient monitoring. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Bone Marrow Transplant Market Overview

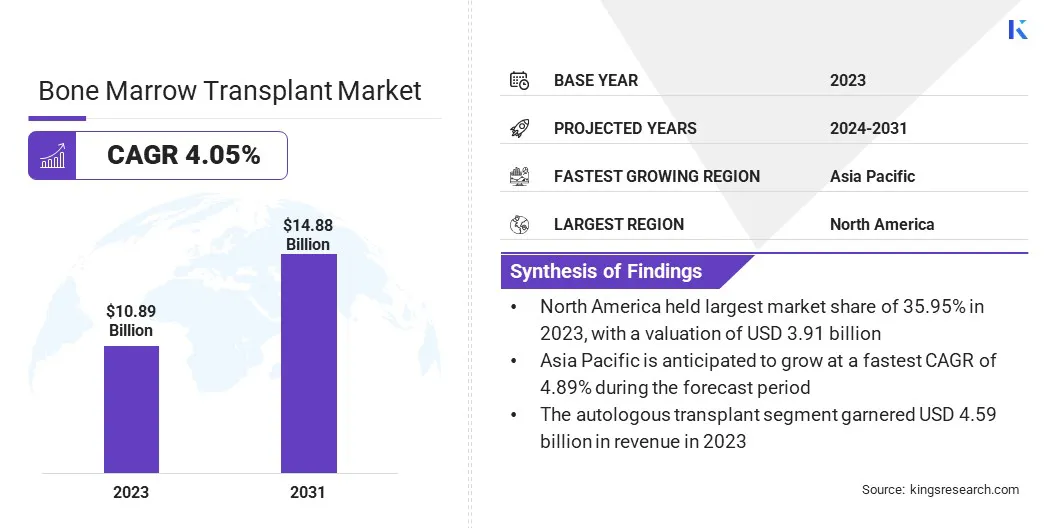

The global bone marrow transplant market size was valued at USD 10.89 billion in 2023 and is projected to grow from USD 11.27 billion in 2024 to USD 14.88 billion by 2031, exhibiting a CAGR of 4.05% during the forecast period.

Market growth is fueled by rising cases of blood cancers, such as lymphoma, leukemia and genetic blood disorders like thalassemia and sickle cell anemia. Increasing awareness of stem cell therapies and improved success rates of transplants are prompting patients and healthcare providers to opt for these treatments.

Major companies operating in the bone marrow transplant industry are Terumo BCT, Inc., Fresenius Kabi AG, Haemonetics, Nikkiso Co., Ltd., Medica SPA, Miltenyi Biotec, Baxter, Cerus Corporation, Haier Group, Kaneka Medix Corp., Infomed SA, Lmb Technologie GmbH, medicap clinic GmbH, Guangzhou DaJi Medical Science and Technology Co., Ltd., and B. Braun SE.

Advancements in transplant techniques, including haploidentical and cord blood transplants, are expanding treatment options for patients without fully matched donors. Additionally, growing investments in medical infrastructure and supportive government programs and policies are boosting the adoption of bone marrow transplants across both developed and emerging markets.

- For instance, in April 2025, Crown Bioscience, a global CRO under JSR Life Sciences and JSR Corporation, introduced its advanced 3D bone marrow niche (BMN) in vitro models at AACR 2025. It is designed to replicate the hematological tumor microenvironment, offering a robust platform for studying diseases such as AML and MM by mimicking key cellular interactions and growth conditions.

Key Highlights

- The bone marrow transplant market size was valued at USD 10.89 billion in 2023.

- The market is projected to grow at a CAGR of 4.05% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 3.91 billion.

- The autologous transplant segment garnered USD 4.59 billion in revenue in 2023.

- The leukemia segment is expected to reach USD 1.78 billion by 2031.

- The hospitals segment is estimated to generate a revenue of USD 5.96 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.89% over the forecast period.

Market Driver

Increasing Prevalence of Hematological Disorders

The market is expanding due to the increasing prevalence of hematologic disorders such as leukemia, lymphoma, and multiple myeloma.

These conditions often require bone marrow transplantation to restore the body’s ability to produce healthy blood cells following intensive treatments such as chemotherapy. As diagnostic rates rise and survival outcomes improve, the demand for both allogeneic and autologous transplant procedures is increasing.

This growth is further supported by advancements in transplant techniques, better donor registries, and expanded healthcare infrastructure, positioning bone marrow transplantation as a critical component in the treatment of blood-related diseases.

- In 2024, the Leukemia & Lymphoma Society reported an estimated 187,740 new cases of leukemia, lymphoma, or myeloma in the U.S. These blood cancers are expected to account for 9.4% of all new cancer diagnoses and 57,260 deaths. Additionally, about 1.7 million people in the US are living with or in remission from leukemia, lymphoma, myeloma, myelodysplastic syndromes (MDS), or myeloproliferative neoplasms (MPNs).

Market Challenge

Limited Availability of Suitable Bone Marrow

A significant challenge hampering the expansion of the bone marrow transplant market is the limited availability of compatible donors, which directly affects transplant success rates. Identifying a compatible donor is essential for the success of bone marrow transplants; however, the process can be particularly challenging and time-consuming for patients from diverse ethnic backgrounds, especially those belonging to minority groups.

This scarcity of donors can lead to delays in treatment, affecting the overall success rate and outcomes of transplants. This challenge can be addressed through the expansion of bone marrow registries globally, along with the increased use of stem cell and gene therapies, which could reduce the reliance on matched donors.

Market Trend

Advancement in Cellular Therapies

A key trend in the market is the increasing use of advanced cellular therapies, such as stem cell and gene therapies, along with traditional bone marrow transplants. These therapies are helping improve treatment outcomes, making bone marrow transplants more effective for patients with blood cancers such as leukemia and lymphoma.

Stem cell and gene therapies work by targeting the root causes of blood disorders, offering more personalized and precise treatment options. As these technologies advance, they are significantly improving the effectiveness of treatments, allowing for better outcomes and faster recovery times for patients undergoing bone marrow transplants.

This progress is contributing to the expansion of the market by increasing the range of treatable conditions and making these procedures more accessible to a wider patient population.

- In December 2024, the U.S. Food and Drug Administration (FDA) approved Ryoncil, the first mesenchymal stromal cell (MSC) therapy, for the treatment of steroid-refractory acute graft-versus-host disease in pediatric patients aged 2 months and older. The therapy, derived from bone marrow of healthy adult donors, demonstrated a 30% complete response rate and 41% partial response rate in a multicenter study of 54 participants following allogeneic hematopoietic stem cell transplantation.

Bone Marrow Transplant Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Autologous Transplant, Allogenic Transplant, Others

|

|

By Treatment

|

Leukemia, Lymphoma, Myeloma, Myelodysplastic Syndrome, Myeloproliferative Disorders, Aplastic Anemia, Solid Tumors, Sickle cell Anemia, Thalassemia, Others

|

|

By End User

|

Hospitals, Multi-specialty Clinics, Ambulatory Surgical Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Autologous Transplant, Allogenic Transplant, and Others): The autologous transplant segment earned USD 4.59 billion in 2023 due to its lower risk of graft-versus-host disease and wider use in treating multiple myeloma and lymphoma.

- By Treatment (Leukemia, Lymphoma, Myeloma, Myelodysplastic Syndrome, Myeloproliferative Disorders, Aplastic Anemia, Solid Tumors, Sickle cell Anemia, Thalassemia, and Others): The leukemia segment held a share of 12.28% in 2023, fueled by the high incidence of acute leukemia’s requiring stem cell transplantation for long-term remission.

- By End User (Hospitals, Multi-specialty Clinics, and Ambulatory Surgical Centers): The hospitals segment is projected to reach USD 5.96 billion by 2031, stimulared by the availability of advanced transplant facilities and skilled healthcare professionals in hospital settings.

Bone Marrow Transplant Market Regional Analysis

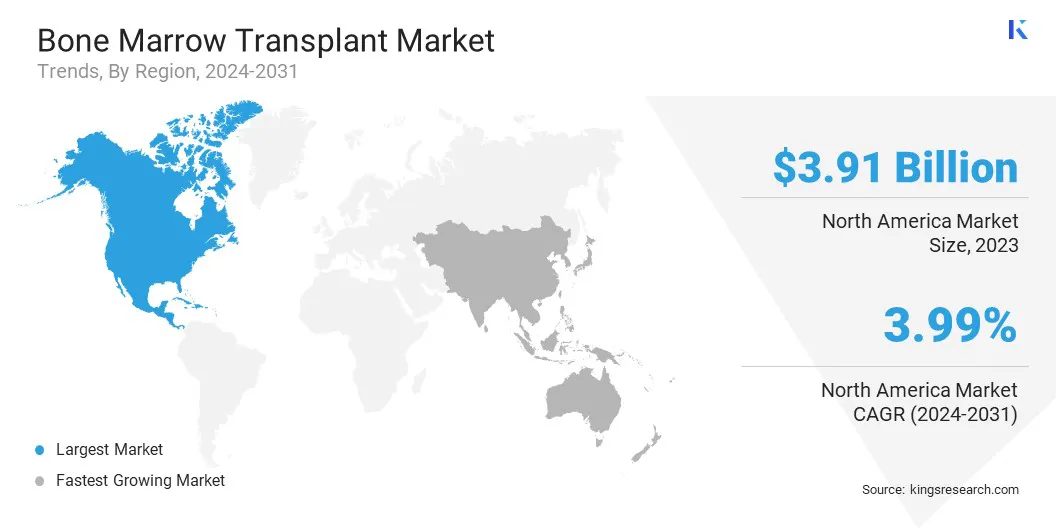

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America bone marrow transplant market accounted for a substantial share of 35.95% in 2023, valued at USD 3.91 billion. This dominance is reinforced by the United States’ strong integration of bone marrow transplant procedures into oncology care pathways, particularly for relapsed or refractory blood cancers.

The region's large aging population and increased incidence of hematologic malignancies have fueled demand for transplant-based treatment options. Additionally, North America's well-established private and public donor registries, such as “Be The Match”, significantly reduce wait times for allogeneic transplants.

Additionally, broad insurance coverage for transplant procedures and strong clinical trial activity focused on improving transplant outcomes reinforce the region’s dominant position.

Asia Pacific bone marrow transplant industry is expected to register the fastest growth, valued at CAGR of 4.89% over the forecast period. This growth fueled by high prevalence of region-specific disease, prevalence particularly the high incidence of beta-thalassemia in India and southern China, where transplant is often the only curative option.

Moreover, several high-volume, cost-effective transplant centers in India, such as CMC Vellore and Tata Memorial Hospital, attract both domestic and international patients. In China, a growing number of transplant centers are adopting haploidentical transplantation, which has significantly expanded access to treatment amid donor shortages.

Japan’s progress in using cord blood as a stem cell source and South Korea’s rapidly advancing cell therapy ecosystem are further propelling regional market growth.

- In March 2025, American Oncology Institute (AOI), in collaboration with Babina Specialty Hospital, launched Manipur’s first Bone Marrow Transplant (BMT) unit at AOI Imphal to provide transplant services to patients in Manipur and neighboring Northeastern states.

Regulatory Frameworks

- In the United States, the regulatory framework for bone marrow transplants is primarily governed by the Food and Drug Administration (FDA), which oversees the safety and efficacy of stem cell products, including those used in transplants. The Centers for Medicare & Medicaid Services (CMS) sets reimbursement policies for transplant procedures, ensuring that healthcare providers meet specific quality standards. Additionally, the National Marrow Donor Program (NMDP) operates as a key registry for donor matching and provides guidelines for the safe and effective collection and use of stem cells.

- In Europe, the European Medicines Agency (EMA) regulates stem cell-based therapies, ensuring they meet the necessary safety and quality standards before approval for clinical use. Each country in Europe also has its own regulatory body overseeing transplant procedures and stem cell applications, with guidelines set for both autologous and allogeneic transplants.

Competitive Landscape

The bone marrow transplant market is characterized by major players focusing on improving treatment results and expanding their services. A key strategy is partnering with hospitals and research centers to conduct clinical trials that help improve transplant methods and reduce side effects.

Companies are also advancing personalized transplant techniques to enhnace safety and efficacy. Many are expanding into growing markets by establishing new centers or collaborating with local healthcare providers to meet the rising demand for bone marrow transplants in regions with limited access to specialized care.

To strengthen their market position, key players are investing in advanced technologies such as gene editing and stem cell therapies, aiming to offer more effective alternatives to traditional transplants. Furthermore, there is a growing use of digital tools to track patients, find better donor matches, and manage care after the transplant.

Companies are increasingly focusing on developing comprehensive patient management systems that integrate electronic health records, telemedicine, and remote monitoring, ensuring continuous care and improving long-term outcomes.

- In September 2024, Ossium Health, a pioneering bioengineering firm with a unique bone marrow bank, secured a USD 21 million base contract with BARDA, under the U.S. Department of Health and Human Services, to support emergency preparedness. The agreement, aimed at advancing Ossium’s stem cell therapies, includes additional funding options that could bring the total of USD 125 million over five years.

List of Key Companies in Bone Marrow Transplant Market:

- Terumo BCT, Inc.

- Fresenius Kabi AG

- Haemonetics

- Nikkiso Co., Ltd.

- Medica SPA

- Miltenyi Biotec

- Baxter

- Cerus Corporation

- Haier Group

- Kaneka Medix Corp.

- Infomed SA

- Lmb Technologie GmbH

- medicap clinic GmbH

- Guangzhou DaJi Medical Science and Technology Co., Ltd.

- B. Braun SE

Recent Developments (Medical breaktrough/Regulatory Approval)

- In February 2025, researchers at the Johns Hopkins Kimmel Cancer Center and 20 additional cancer centers nationwide announced successful results from a trial of reduced-intensity haploidentical bone marrow transplant for sickle cell disease. The treatment showed a 95% survival rate and an 88% cure rate in patients.

- In July 2024, Actinium Pharmaceuticals, Inc., a leading developer of Antibody Radiation Conjugates and targeted radiotherapies, announced FDA clearance of its Investigational New Drug (IND) application to evaluate Iomab-ACT as a targeted conditioning regimen prior to bone marrow transplantation in patients with sickle cell disease, marking a key milestone in its clinical development strategy.