Market Definition

The blowing agents market encompasses the production, distribution, and application of substances used to create tiny gas bubbles within materials, primarily foams, to achieve lightweight and insulating properties.

These agents play a crucial role in manufacturing polymer foams such as polyurethane, polystyrene, and rubber, enhancing insulation, reducing weight, and improving cushioning characteristics across various industries.

Blowing Agents Market Overview

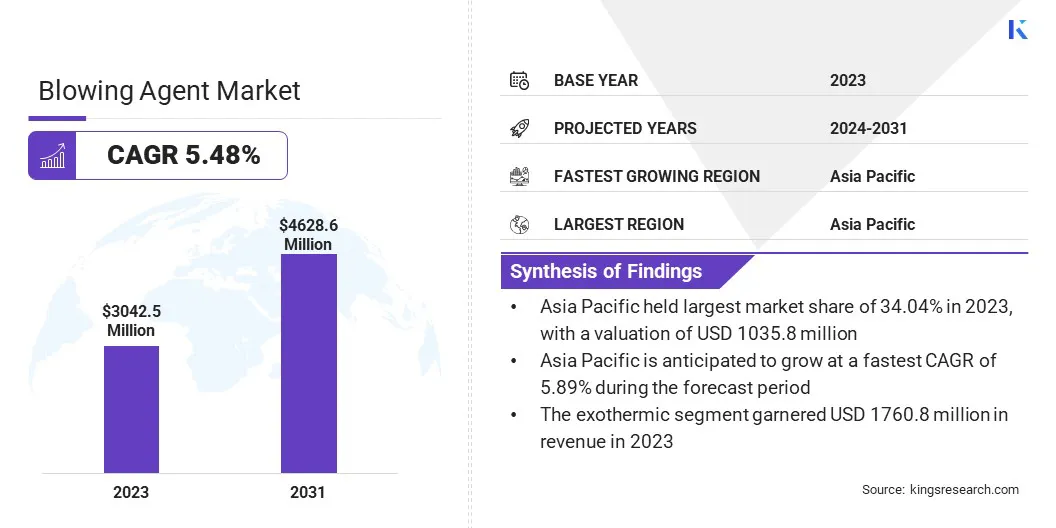

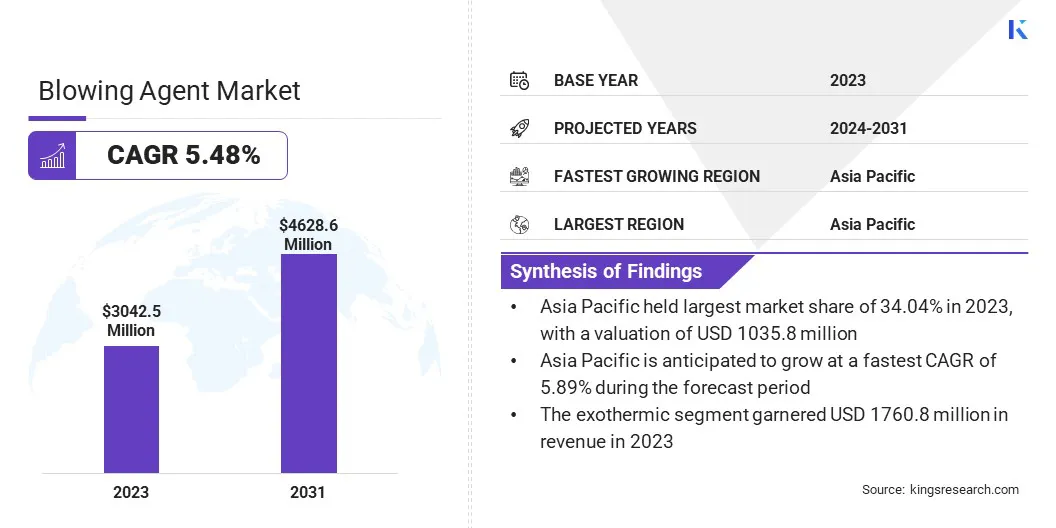

The global blowing agents market size was valued at USD 3042.5 million in 2023 and is projected to grow from USD 3185.6 million in 2024 to USD 4628.6 million by 2031, exhibiting a CAGR of 5.48% during the forecast period. This expansion is driven by increasing demand for lightweight and energy-efficient materials across various industries.

The rising adoption of polymer foams in construction, automotive, packaging, and electronics is further supporting this expansion. In the construction sector, stringent energy efficiency regulations are boosting the use of insulation foams, while the automotive industry benefits from lightweight foams that enhance fuel efficiency and vehicle performance.

Major companies operating in the global blowing agents industry are Honeywell International Inc., Solvay, Arkema Group, Linde plc., The Chemours Company, BASF, International Chemical Investors, FSI, Harp International Ltd., INEOS AG, SINOCHEM LANTIAN CO., LTD., The Dow Chemical Company, Exxon Mobil Corporation, Marubeni Corporation, and Mitsubishi Corporation.

Advancements in environmentally friendly blowing agents are propelling market growth. The expansion of the packaging industry, particularly in e-commerce and food storage, is leading to the rising demand for high-performance foam materials.

Moreover, rapid industrialization and urbanization in emerging economies are creating new opportunities as manufacturers focus on sustainable and high-performance insulation solutions. With continuous innovation and increasing investments in research and development, the market is set to witness notable growth in the coming years.

- In August 2024, Honeywell announced that Mighty Buildings will use its Honeywell Solstice Liquid Blowing Agent (LBA) to produce 3D-printed home panels with low-global warming potential (GWP) foam insulation. This collaboration aims to reduce emissions and enhance energy efficiency of 3D-printed homes while accelerating sustainable construction practices. Solstice LBA offers 99.9% lower GWP than conventional blowing agents, significantly reducing the construction industry’s carbon footprint.

Key Highlights:

- The global blowing agents market size was valued at USD 3042.5 million in 2023.

- The market is projected to grow at a CAGR of 5.48% from 2024 to 2031.

- Asia Pacific held a share of 34.04% in 2023, valued at USD 1035.8 million.

- The exothermic segment garnered USD 1760.8 million in revenue in 2023.

- The hydrochlorofluorocarbons (HCFCs) segment is expected to reach USD 1240.5 million by 2031.

- The polyurethane segment is likely to generate a revenue of USD 1265.0 million by 2031.

- The building & construction segment is projected to register a valuation of USD 1244.2 million by 2031.

- Europe is anticipated to grow at a CAGR of 5.50% over the forecast period.

Market Driver

"Growing Demand for Energy-Efficient Insulation and Lightweight Materials"

The global blowing agents market is witnessing significant growth, primarily due to the increasing demand for energy-efficient insulation materials and the expanding automotive industry. With rising concerns over energy conservation and stricter environmental regulations, industries are focusing on improving insulation in buildings to reduce energy consumption.

Blowing agents are essential in producing high-performance insulation foams that enhance thermal efficiency and lower heating and cooling costs. Stringent energy efficiency regulations worldwide are boosting the demand for advanced blowing agents in construction.

Additionally, the automotive sector is increasingly adopting lightweight polymer foams to improve fuel efficiency. Blowing agents are essential in manufacturing these foams, reducing vehicle weight while maintaining structural integrity and safety.

The growing adoption of electric vehicles (EVs) is further fueling demand for lightweight, thermally efficient materials in battery insulation and vehicle interiors. As automotive manufacturers invest in sustainable and high-performance foam solutions, the need for innovative blowing agents continues to grow.

- In December 2024, Nouryon introduced Expancel BIO microspheres, a first-generation partially biobased lightweight filler and blowing agent. Designed for coatings, adhesives, construction, automotive, and footwear, it reduces material weight while supporting sustainable production practices. By replacing up to 55% of fossil-based materials with biobased alternatives, it supports circular economy principles and environmental goals.

Market Challenge

"Environmental Regulations and Cost Volatility"

The global blowing agents market faces several challenges, including environmental regulations and fluctuating raw material prices. Traditional blowing agents, such as hydrochlorofluorocarbons and hydrofluorocarbons, are being phased out due to their high global warming potential (GWP) and ozone depletion effects. Governments worldwide are enforcing strict emission standards, compelling manufacturers to transition to sustainable alternatives.

However, the shift toward eco-friendly blowing agents, such as hydrofluoroolefins and bio-based options, demands significant investment in research, production infrastructure, and compliance. To address this challenge, manufacturers are accelerating R&D efforts to develop cost-effective, low-GWP solutions while collaborating with regulatory bodies to ensure seamless compliance with evolving policies.

Another major challenge is the fluctuation in raw material prices, which impacts production costs and profit margins. Blowing agents rely on petrochemical-based raw materials, making them vulnerable to supply chain disruptions, geopolitical factors, and market volatility.

Price surges in crude oil or key feedstocks directly impact manufacturing costs, making it difficult for producers to maintain stable pricing and profitability. Companies are diversifying their supply chains, investing in alternative raw materials, and improving production efficiencies to mitigate the impact of cost fluctuations and ensure a steady supply of blowing agents.

Market Trend

"Major Focus on Sustainability and Innovation"

The global blowing agents market is evolving with the increasing adoption of bio-based blowing agents and the rising demand for high-performance insulation materials. As sustainability becomes a key focus across industries, manufacturers are exploring bio-based and renewable alternatives to traditional chemical blowing agents.

These eco-friendly solutions, derived from natural sources, reduce environmental impact while maintaining efficiency in foam production. The shift toward greener materials is further supported by stringent government regulations and corporate sustainability goals.

Additionally, advancements in foam manufacturing technology are enhancing the efficiency and performance of blowing agents. Innovations in foam structure, cell size control, and thermal insulation properties are improving the durability and energy efficiency of polymer foams.

These developments are particularly beneficial in applications such as building insulation, refrigeration, and lightweight automotive components, where high-performance foams are crucial. With industries prioritizing sustainability and performance, the adoption of next-generation blowing agents is expected to accelerate.

- In April 2024, Solvay inaugurated its new Alve-One production unit in Italy. The production unit focuses on chemical blowing agents designed for thermoplastic foaming applications. The facility aims to provide safer and more sustainable blowing agents for various industries, including automotive, footwear, building & construction, and consumer goods. The emphasis is on reducing the carbon footprint of foamed end-products and enhancing health and safety standards.

Blowing Agents Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Exothermic, Endothermic

|

|

By Product

|

Hydrochlorofluorocarbons (HCFCs), Hydrofluorocarbons (HFCs), Hydrocarbons (HCs), Hydrofluoroolefin (HFO), Others

|

|

By Foam

|

Polyurethane, Polystyrene, Phenolic, Polypropylene, Polyethylene, Others

|

|

By Application

|

Building & Construction, Automotive, Bedding & Furniture, Appliances, Packaging, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Exothermic and Endothermic): The exothermic segment earned USD 1760.8 million in 2023 due to its ability to produce high gas volumes efficiently in foam manufacturing.

- By Product (Hydrochlorofluorocarbons (HCFCs), Hydrofluorocarbons (HFCs), Hydrocarbons (HCs), and Hydrofluoroolefin (HFO)): The hydrochlorofluorocarbons (HCFCs) segment held a share of 26.78% in 2023, propelled by its strong thermal insulation performance and widespread industrial use.

- By Foam (Polyurethane, Polystyrene, Phenolic, and Polypropylene): The polyurethane segment is projected to reach USD 1265.0 million by 2031, owing to its versatility in insulation, cushioning, and structural applications.

- By Application (Building & Construction, Automotive, Bedding & Furniture, Appliances, Packaging, and Others): The building & construction segment is projected to reach USD 1244.2 million by 2031, propelled by rapid urbanization and the need for energy-efficient materials.

Blowing Agents Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific blowing agents market accounted for a substantial share of 34.04% in 2023, valued at USD 1625.6 million. This dominance is fueled by the rapid expansion of industries such as construction, automotive, and packaging, which extensively use polymer foams for insulation, cushioning, and lightweight applications.

China remains at the forefront of this growth due to its large manufacturing base and increasing demand for energy-efficient building materials. India is witnessing strong growth, supported by government initiatives promoting infrastructure development and smart cities, creating a strong demand for insulation foams. Japan and South Korea contribute significantly to this expansion, particularly in the electronics and automotive sectors, where lightweight materials enhance fuel efficiency and reduce carbon emissions.

Moreover, the availability of cost-effective raw materials, coupled with a rising shift toward environmentally friendly blowing agents, strengthens the region’s position as the largest market.

Europe blowing agents industry is expected to register the fastest CAGR of 5.50% over the forecast period. This growth is primarily fueled by stringent environmental regulations promoting the adoption of sustainable and low-GWP (Global Warming Potential) blowing agents, such as hydrofluoroolefins and hydrocarbons. Countries are boosting the adoption of energy-efficient and eco-friendly insulation materials, particularly in the construction and automotive industries.

The European Union’s policies on reducing greenhouse gas emissions and increasing the energy efficiency of buildings have further accelerated the demand for advanced polymer foams. Additionally, the automotive sector's growing demand for lightweight materials to improve fuel efficiency and comply with emission standards is highligjhting the need for innovative foam solutions.

With ongoing research and development in sustainable foam technologies and a strong emphasis on green building initiatives, Europe is set to emerge as a key market for blowing agents in the coming years.

- In September 2024, manufacturers in Germany highlighted the benefits of chemical blowing agents for foaming large plastic parts using injection molding. This technology offers material savings, weight reduction, and improved product properties without requiring significant investment. The use of chemical foaming agents enhances energy efficiency, reduces cycle time, and improves mechanical properties.

Regulatory Frameworks:

- In the U.S., the Environmental Protection Agency (EPA) regulates blowing agents under the Significant New Alternatives Policy (SNAP) program to phase out ozone-depleting substances and promote environmentally friendly alternatives.

- In Europe, the European Chemicals Agency (ECHA) enforces regulations under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework to assess and control the environmental and health risks of blowing agents.

- In China, the Ministry of Ecology and Environment (MEE) implements regulations to phase out hydrofluorocarbons (HFCs) and other ozone-depleting blowing agents in compliance with the Kigali Amendment to the Montreal Protocol. The country also follows national environmental policies to promote low-GWP alternatives.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and the Ministry of the Environment (MOE) regulate the use of blowing agents under the Fluorocarbons Emission Control Law. Japan actively promotes non-fluorinated and environmentally friendly blowing agents through national sustainability initiatives.

- In India, the Central Pollution Control Board (CPCB) and the Ministry of Environment, Forest and Climate Change (MoEFCC) oversee the regulation of blowing agents, aligning with the Ozone-Depleting Substances (Regulation and Control) Rules to phase out harmful chemicals.

Competitive Landscape

Companies operating in the blowing agents market are increasingly focusing on developing eco-friendly blowing agents with low global warming potential and zero ozone depletion potential to align with stringent environmental regulations.

Technological advancements are shaping the market, with significant investments in research and development to enhance the performance and efficiency of blowing agents used in polymer foams.

Companies are focusing on regional expansion to establish production facilities and distribution networks in high-growth markets such as Asia Pacific and Europe to strengthen their presence. Strategic partnerships, mergers, and acquisitions are key approaches to enhancing product portfolios and market reach.

Additionally, cost optimization remains crucial as manufacturers strive to balance performance with affordability to cater to various industries, including construction, automotive, packaging, and appliances.

- In March 2023, Evonik and Chemours collaborated to enhance spray polyurethane foam (SPF) systems by optimizing the performance of low-global warming potential (GWP) blowing agents. The partnership aims to support the SPF industry in successfully adopting fourth-generation blowing agent technologies, reducing ozone-depleting emissions, and enhancing energy efficiency in insulation applications.

List of Key Companies in Blowing Agents Market:

- Honeywell International Inc.

- Solvay

- Arkema Group

- Linde plc.

- The Chemours Company

- BASF

- International Chemical Investors

- FSI

- Harp International Ltd.

- INEOS AG

- SINOCHEM LANTIAN CO., LTD.

- The Dow Chemical Company

- Exxon Mobil Corporation

- Marubeni Corporation

- Mitsubishi Corporation

Recent Developments (Agreement)

- In April 2024, Honeywell collaborated with Bosch to integrate Honeywell’s Solstice low-global warming potential (GWP) refrigerant into Bosch’s latest heat pumps, aimed at reducing carbon emissions. Additionally, Solstice blowing agents offer low-GWP solutions for insulation materials, imporoving energy efficiency in the building and construction industry.