Market Definition

The market involves the production, distribution, and application of black phosphorus, valued for its high electrical conductivity and versatility. Its adoption is expanding across industries such as electronics, energy storage, and medical devices.

Market participants are focused leveraging its uniques properties to develop innovative solutions that enhance product performance and address evolving technological demands.

Black Phosphorus Market Overview

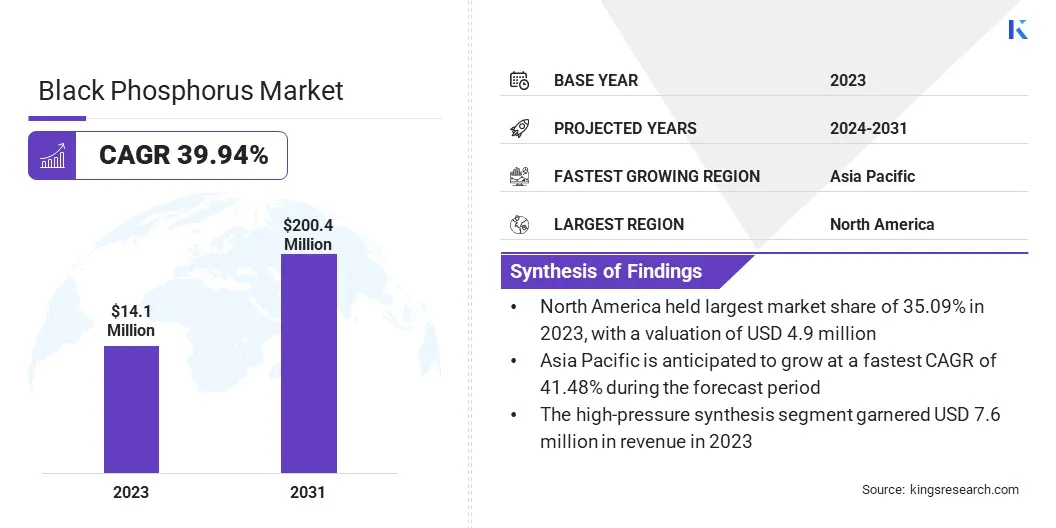

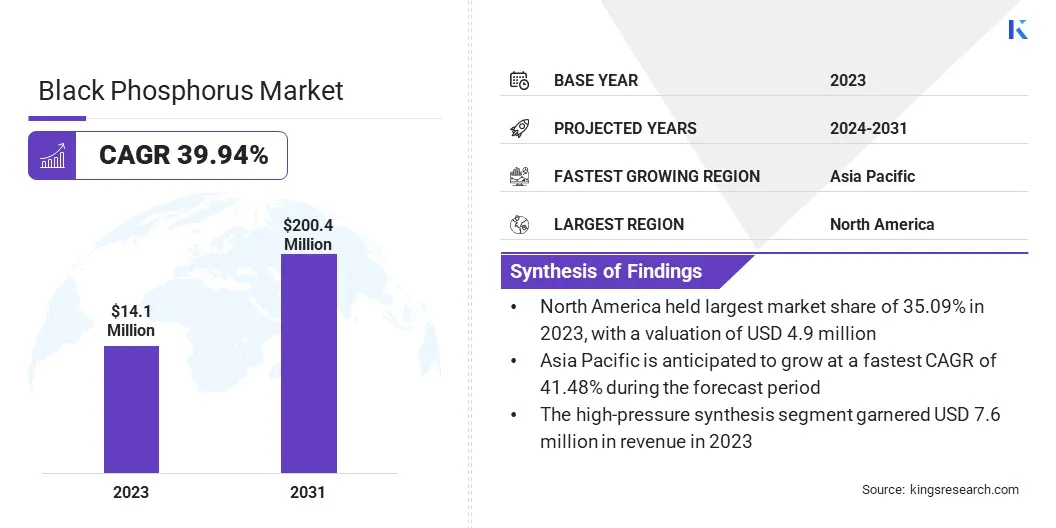

The global black phosphorus market size was valued at USD 14.1 million in 2023 and is projected to grow from USD 19.1 million in 2024 to USD 200.4 million by 2031, exhibiting a CAGR of 39.94% during the forecast period.

Market growth is driven by its increasing adoption in advanced electronics, optoelectronics, and energy storage applications. Its unique properties, such as high carrier mobility, allow for faster and more efficient electronic devices, while its thermal stability ensures reliable performance under demanding conditions.

The material’s tunable bandgap, which enables adjustments in electrical conductivity, makes it highly versatile for applications such as photodetectors, transistors, and flexible electronic devices.

Furthermore, the growing demand for miniaturized electronic components, particularly in smartphones, wearables, and medical devices, is highlighting the need for materials such as black phosphorus for compact, high-performance designs.

Major companies operating in the black phosphorus industry are 2D Semiconductors, Ossila Ltd., Oceania International LLC, American Elements, Merck KGaA, HQ Graphene, ARITECH CHEMAZONE PVT LTD., ACS Material LLC, MTI Corporation, Smart-elements GmbH, and Manchester Nanomaterials Ltd.

Advancements in nanotechnology research are contributing to market growth, with black phosphorus gaining attention for its applications in advanced computing, quantum technologies, and high-performance sensors.

Additionally, rising investments in material science innovations and R&D activities further support its development and commercial adoption of black phosphorus across industries.

- In September 2023, researchers at the University of South Australia stated developed an innovative nano-thin antimicrobial material for use in wound dressings and medical implants to prevent or treat bacterial infections. A study by RMIT University and UniSA demonstrated black phosphorus-based nanotechnology’s effectiveness, eliminating over 99% of bacteria without harming healthy cells. Findings were published in Advanced Therapeutics.

Key Highlights

- The black phosphorus industry size was valued at USD 14.1 million in 2023.

- The market is projected to grow at a CAGR of 39.94% from 2024 to 2031.

- North America held a share of 35.09% in 2023, valued at USD 4.9 million.

- The bulk black phosphorus segment garnered USD 5.9 million in revenue in 2023.

- The high-purity black phosphorus (>99%) segment is expected to reach USD 75 million by 2031.

- The high-pressure synthesis segment is projected to generate a revenue of USD 98.3 million by 2031.

- The electronics & semiconductor industry segment is likely to reach USD 98.3 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 39.94% over the forecast period.

Market Driver

"Expanding Applications in Semiconductors and Nanotechnology"

The black phosphorus market is witnessing significant growth, fueled by increasing demand for advanced semiconductor materials and expanding research in nanotechnology and 2D materials.

Black phosphorus's exceptional electrical conductivity, thermal stability, and tunable bandgap make it highly suitable for next-generation semiconductor devices such as transistors, photodetectors, and optoelectronic components.

These properties allow black phosphorus to improve device efficiency, reduce power consumption, and enhance performance, making it an attractive material for manufacturers aiming to develop cutting-edge electronics.

Additionally, the rising focus on nanotechnology has accelerated research into 2D materials such as black phosphorus, known for its layer-by-layer exfoliation. This characteristic enables precise atomic-level manipulation, fostering advancements in flexible electronics, high-performance batteries, and biomedical sensors.

Market Challenge

"InStability under Ambient Conditions"

A significant challenge hindering the growth of the black phosphorus market is its instability under ambient conditions, limiting commercial adoption. Highly reactive to oxygen and moisture, black phosphrous degrades into phosphorus oxides, compromising its structural integrity and diminishing its electronic and optical properties over time.

This degradation limits its viability in semiconductors, sensors, and energy storage applications. Additionally, its short shelf life complicates large-scale production, while the potential release of hazardous by-products raises safety concerns, increasing handling and storage complexities.

Maintaining material integrity during storage, transportation, and usage is complex and costly, requiring specialized equipment, inert gas environments, or controlled conditions to preserve its stability.

To address this challenge, researchers and manufacturers are developing advanced protective solutions such as encapsulation techniques using stable polymers, metal oxide coatings, and inert gas packaging methods.

Additionally, innovations in synthesis techniques are being explored to produce more stable black phosphorus derivatives that retain their unique properties under varying conditions.

Market Trend

"Technological Advancements and Increasing Research"

The black phosphorus market is witnessing significant growth, propelled by advancements in photonic devices and energy storage technologies. Researchers are extensively exploring black phosphorus due to its exceptional optical properties, such as its tunable bandgap and strong light absorption across a wide spectrum.

These characteristics make it highly suitable for developing advanced photonic devices such as optical sensors, infrared lasers, and high-speed communication systems, enhancing signal processing and data transmission. Moreover, it's layered structure, similar to graphene but with superior electronic properties, has garnered significant attention in the energy storage sector.

With high charge carrier mobility and a large surface area, black phosphrous enhances ion diffusion and charge storage, making it an ideal material for next-generation batteries and super capacitors. These attributes are fostering innovations in sustainable energy storage solutions.

Black Phosphorus Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Bulk Black Phosphorus, Black Phosphorus Nanosheets, Black Phosphorus Nanorods, Black Phosphorus Quantum Dots

|

|

By Purity Level

|

High-Purity Black Phosphorus (>99%), Medium-Purity Black Phosphorus (95-99%), Low-Purity Black Phosphorus (<95)

|

|

By Production Method

|

High-Pressure Synthesis, Chemical Vapor Deposition (CVD), Liquid Phase Exfoliation, Plasma-Assisted Synthesis

|

|

By End-Use Industry

|

Electronics & Semiconductor Industry, Energy & Power Sector, Healthcare & Pharmaceuticals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Form (Bulk Black Phosphorus, Black Phosphorus Nanosheets, Black Phosphorus Nanorods, and Black Phosphorus Quantum Dots): The bulk black phosphorus segment earned USD 5.9 million in 2023 due to its extensive use in research, material development, and optoelectronic applications.

- By Purity Level (High-Purity Black Phosphorus (>99%), Medium-Purity Black Phosphorus (95-99%), and Low-Purity Black Phosphorus (<95%)): The high-purity black phosphorus (>99%) segment held a share of 48.09% in 2023, largely attributed to its critical role in high-performance electronics and precision-based technologies.

- By Production Method (High-Pressure Synthesis, Chemical Vapor Deposition (CVD), Liquid Phase Exfoliation, and Plasma-Assisted Synthesis): The high-pressure synthesis segment is projected to reach USD 98.3 million by 2031, owing to its ability to produce high-quality black phosphorus with enhanced structural integrity.

- By End-Use Industry (Electronics & Semiconductor Industry, Energy & Power Sector, Healthcare & Pharmaceuticals, and Others): The electronics & semiconductor industry segment is projected to reach USD 98.3 million by 2031 on account of the growing demand for advanced materials in next-generation electronic devices and sensors.

Black Phosphorus Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America black phosphorus market accounted for a substantial share of 35.09% in 2023, valued at USD 4.9 million. This dominance is reinforced by the region's well-established ecosystem for advanced electronics and semiconductor research, which drives continuous innovation in material science.

Leading technology hubs are actively engaged in exploring new materials such as black phosphorus for improved electronic performance. Significant investments in R&D by both public and private sectors have accelerated the development of black phosphorus-based technologies. Government funding has supported extensive research in nanotechnology and advanced materials, accelerating breakthroughs in black phosphorus applications.

Moreover, the presence of major technology companies that specialize in electronics, semiconductors, and optoelectronics has fueled demand for black phosphorus in high-performance devices such as transistors, photodetectors, and flexible electronics. These companies often collaborate with universities and research institutions to enhance product development and explore new applications.

Asia Pacific black phosphorus industry is expected to register the fastest CAGR of 41.48% over the forecast period. This growth is marked by the region's expanding electronics manufacturing industry, particularly in major economies such as China, Japan, and South Korea.

Leading countries in semiconductor production and consumer electronics are creating a strong demand for advanced materials such as black phosphorus that offer superior electrical and thermal properties.

The increasing focus on developing high-performance devices with improved efficiency, speed, and miniaturization has accelerated the adoption of black phosphorus in semiconductor manufacturing.

Additionally, supportive government initiatives, including increased funding for nanotechnology research, public-private partnerships, and dedicated innovation hubs, are fostering advancements in black phosphorus applications.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees the management of chemical substances, including black phosphorus, under the Toxic Substances Control Act (TSCA).

- In Europe, the European Chemicals Agency (ECHA) regulates chemicals under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework.

- In China, the Ministry of Ecology and Environment (MEE) enforces the regulation on the Environmental Management of New Chemical Substances. Entities dealing with black phosphorus are required to register and evaluate the substance, adhering to environmental and safety protocols to prevent adverse effects.

- In Japan, the Ministry of Economy, Trade, and Industry (METI) administers black phosphrous under the Chemical Substances Control Law (CSCL), mandating its evaluation.

- In India, the Ministry of Environment, Forest and Climate Change oversees chemical management through regulations on the manufacture, storage, and import of hazardous chemicals.

Competitive Landscape

The global black phosphorus industry is characterized by a growing number of participants, including established material science firms, emerging startups, and research institutions actively developing innovative solutions.

Continuous advancements in production techniques are boosting growth, with manufacturers focusing on improving synthesis methods to enhance purity, yield, and scalability.

High-pressure synthesis, chemical vapor deposition, and liquid phase exfoliation are among the prominent methods being refined to produce high-quality black phosphorus suitable for industrial applications.

Market participants are increasingly investing in research collaborations and partnerships with academic institutions to explore new applications in electronics and energy storage.

The development of black phosphorus-based transistors, photodetectors, and flexible electronic devices is accelerating, driven by it's exceptional electrical and optical properties.

The growing focus on nanotechnology and miniaturized electronic components has further intensified competition, with companies aiming to develop black phosphorus nanosheets, nanorods, and quantum dots for high-tech applications. Additionally, industry players are exploring its integration into biomedicine, particularly for drug delivery and bioimaging.

List of Key Companies in Black Phosphorus Market:

-

- 2D Semiconductors

- Ossila Ltd.

- Oceania International LLC

- American Elements

- Merck KGaA

- HQ Graphene

- ARITECH CHEMAZONE PVT LTD.

- ACS Material LLC

- MTI Corporation

- Smart-elements GmbH

- Manchester Nanomaterials Ltd.