Market Definition

The market includes tools used to remove tissue samples for diagnosing diseases such as cancer. These devices help doctors examine suspicious through minimally invasive or surgical procedures.

Key applications include hospitals, diagnostic imaging centers, and ambulatory surgical centers. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Biopsy Device Market Overview

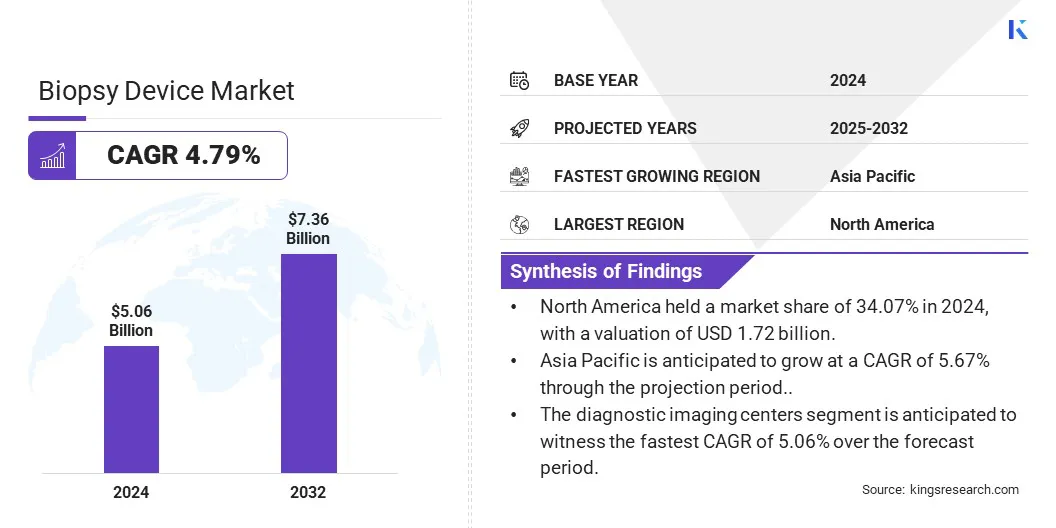

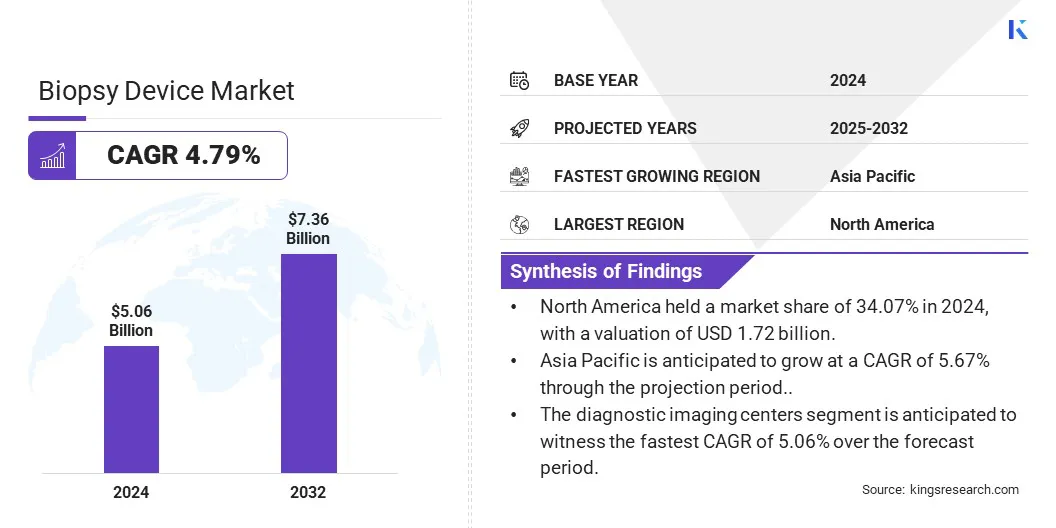

The global biopsy device market size was valued at USD 5.06 billion in 2024 and is projected to grow from USD 5.30 billion in 2025 to USD 7.36 billion by 2032, exhibiting a CAGR of 4.79% during the forecast period.

Market expansion is driven by rising demand for efficiency and accuracy and advancements in workflow-optimized core needle systems.This growth is further supported by the surging adoption of AI-enhanced liquid biopsy techniques that enable precise, non-invasive cancer detection and personalized treatment across clinical settings.

Major companies operating in the biopsy device market are BD, Devicor Medical Products, Inc., Medtronic, Hologic, Inc., Cardinal Health, Olympus America, Boston Scientific Corporation, FUJIFILM COLOMBIA S.A.S., Teleflex Incorporated, CONMED Corporation, Merit Medical Systems, Cook Group, Argon Medical Devices, INRAD, Inc., and Summit Medical LLC.

Market growth is fueled by the rising incidence of hard-to-detect cancers, such as brain tumors, which increases the demand for advanced diagnostic procedures. Traditional detection methods often fail to identify these cancers early, underscoring the need for more sensitive, non-invasive biopsy solutions.

Innovations using circulating tumor DNA in blood samples address this gap, enabling earlier diagnosis and expanding the role of biopsy devices in cancer screening and monitoring.

- In April 2025, the Johns Hopkins Kimmel Cancer Center developed an advanced liquid biopsy technique that uses AI to detect brain cancer by analyzing tumor-related DNA fragments in blood. This breakthrough significantly improves detection accuracy to 75%, a significant improvement over the previous rate of less than 10%. This highlights a major advancement in biopsy device technology, offering earlier, non-invasive cancer diagnosis.

Key Highlights:

- The biopsy device industry size was recorded at USD 5.06 billion in 2024.

- The market is projected to grow at a CAGR of 4.79% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 1.72 billion.

- The needle-based biopsy guns segment garnered USD 1.42 billion in revenue in 2024.

- The gastroenterology segment is expected to reach USD 2.02 billion by 2032.

- The diagnostic imaging centers segment is anticipated to witness the fastest CAGR of 5.06% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.67% through the projection period.

Market Driver

Increased Clinical Productivity Enabled by Advanced Core Needle Systems

The growth of the biopsy device market is driven by increased clinical productivity enabled by advanced core needle systems. Features such as single-insertion design, automated sampling, and one-handed operation streamline workflows, reduce procedure time, and enhance precision.

This efficiency supports higher patient throughput, and maintains diagnostic accuracy. As a result, healthcare facilities can manage greater volumes while improving the overall biopsy experience, reinforcing the demand for next-generation, workflow-optimized biopsy devices across clinical and outpatient settings.

- In November 2024, Mammotome launched the AutoCore Single Insertion Core Biopsy System, the first automated spring-loaded core needle device. This innovative system enhances breast biopsy efficiency by enabling one-handed operation, reducing procedural steps, and improving sample handling featuring touchless tissue transfer. It streamlines ultrasound-guided biopsies, delivering precise sampling while improving both physician workflow and patient experience.

Market Challenge

Infection Risks Associated with Biopsy Procedure

Infection risks associated with biopsy procedure acceptance pose a significant challenge to the expansion of the biopsy device market. Patients often hesitate to undergo biopsies due to concerns over complications and infections, limiting market growth. The invasive nature of traditional biopsy methods increases the likelihood of infection, impacting patient compliance and clinical outcomes.

To address this challenge, companies are developing minimally invasive and sterile biopsy devices with improved safety features. Innovations include single-use disposable needles, enhanced sterilization protocols, and automated systems that reduce handling errors. These advancements aim to minimize infection risk, increase patient confidence, and expand the adoption of biopsy procedures globally.

Market Trend

Increasing Use of Liquid Biopsy Techniques

The biopsy device market is experiencing a significant trend toward the increasing use of liquid biopsy techniques. These non-invasive methods analyze circulating tumor DNA in blood, enabling earlier and more accurate cancer detection compared to traditional tissue biopsies.

Enhanced by artificial intelligence and advanced sequencing technologies, liquid biopsies provide real-time insights into tumor genetics, facilitating personalized treatment plans. This shift supports improved patient outcomes, reduces procedural risks, and expands the application of biopsy devices across diverse clinical settings worldwide.

- In September 2024, Policlinico Gemelli, a leading Italian hospital system, launched in-house Guardant360 CDx liquid biopsy testing in partnership with Guardant Health, enhancing precision oncology services for advanced cancer patients. This collaboration enables on-site analysis using Guardant Health’s proprietary digital sequencing technology, improving diagnostic capabilities and patient outcomes. The initiative marks a key advancement in cancer diagnostics within Italy’s major oncology center, supporting clinical research and patient care.

Biopsy Device Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Needle-based Biopsy Guns (Vacuum-assisted Biopsy (VAB) Devices, Fine Needle Aspiration Biopsy (FNAB) Devices, Core Needle Biopsy (CNB) devices), Biopsy Forceps, Biopsy Guidance Systems (Manual, Robotic), Visualization Device, Others

|

|

By Application

|

Oncology, Gastroenterology, Colorectal Biopsy, Prostate Biopsy, Others

|

|

By End User

|

Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Needle-based Biopsy Guns, Biopsy Forceps, Biopsy Guidance Systems, Visualization Device, and Others): The needle-based biopsy gun segment earned USD 1.42 billion in 2024 due to its widespread adoption for minimally invasive procedures and compatibility with various imaging techniques.

- By Application (Oncology, Gastroenterology, Colorectal Biopsy, and Prostate Biopsy): The gastroenterology segment held a share of 27.44% in 2024, fueled by the increasing prevalence of gastrointestinal disorders requiring precise tissue sampling for accurate diagnosis and treatment.

- By End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, and Others): The hospitals segment is projected to reach USD 2.72 billion by 2032, attributed to the availability of advanced diagnostic infrastructure and the high volume of complex biopsy procedures.

Biopsy Device Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America biopsy device market share stood at around 34.07% in 2024, valued at USD 1.72 billion. This dominance is reinforced by the rapid adoption of innovative diagnostic technologies and robust healthcare infrastructure. The regional market further benefits from favorable regulatory frameworks and significant investments in research and development, enabling the development of advanced biopsy systems.

High prevalence of cancer and increasing demand for minimally invasive procedures further fuel regional market growth. Additionally, widespread access to cutting-edge imaging and biopsy integration supports efficient workflows, establishing North America as a leading market for biopsy devices.

- In February 2025, Hologic announced CE marking for its Affirm Contrast Biopsy Software, enhancing lesion targeting during contrast-enhanced mammography (CEM). Integrated with Selenia Dimensions systems, it offers an efficient alternative to MRI-guided biopsies, improving workflow, reducing procedure time, and enhancing patient experience. This software, alongside Hologic’s biopsy portfolio, supports a seamless clinical pathway from screening to diagnosis and biopsy.

The Asia-Pacific biopsy device industry is estimated to grow at a CAGR of 5.67% over the forecast period. Increasing research collaborations between academic institutions and healthcare providers, coupled with rising investments in advanced medical technologies, are propelling regional market expansion.

Enhanced awareness of early disease diagnosis and a favorable regulatory environment further support adoption. Additionally, expanding availability of minimally invasive diagnostic procedures accelerates market penetration.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA), specifically its Center for Devices and Radiological Health (CDRH), regulates biopsy devices, ensuring their safety and effectiveness prior to market approval and continuously monitoring performance post-market to maintain compliance and protect patient safety.

- In India, biopsy devices are regulated by the Central Drugs Standard Control Organisation (CDSCO) under the Ministry of Health, overseeing the safety, efficacy, and quality of devices, including their import, manufacture, distribution, and sale, to ensure regulatory compliance.

- In Europe, biopsy devices are regulated under the European Union Medical Device Regulation (EU MDR), effective since 2021, which oversees the manufacturing, approval, and distribution of medical devices to ensure safety, performance, and compliance across the EU market.

Competitive Landscape

Key players in the biopsy device industry are actively engaging in mergers and acquisitions to strengthen their market presence and expand product portfolios. Companies are launching new biopsy devices with advanced features to enhance their competitive positioning. These strategic initiatives are shaping market landscape, with firms focusing on broadening their technological capabilities and geographical reach.

Such initiatives reflect ongoing efforts by market participants to strengthen their foothold and respond to evolving market demands through targeted corporate actions and product innovations.

- In May 2023, Argon Medical Devices launched the SuperCore Advantage Semi-Automatic Biopsy Instrument, expanding its soft tissue biopsy portfolio in the U.S. This disposable, next-generation device delivers larger tissue samples, enhancing diagnostic accuracy. Available in multiple lengths and gauges, it allows physicians to select the optimal instrument for varied clinical applications, supporting improved pathology analysis and patient outcomes.

List of Key Companies in Biopsy Device Market:

- BD

- Devicor Medical Products, Inc.

- Medtronic

- Hologic, Inc.

- Cardinal Health

- Olympus America

- Boston Scientific Corporation

- FUJIFILM COLOMBIA S.A.S.

- Teleflex Incorporated

- CONMED Corporation

- Merit Medical Systems

- Cook Group

- Argon Medical Devices

- INRAD, Inc.

- Summit Medical LLC.

Recent Developments (New Product Launch)

- In April 2025, QIAGEN’s QCI Interpret One was selected by Royal Marsden NHS Foundation Trust to enhance the Marsden360 liquid biopsy service with ESR1 mutation testing for breast cancer patients. This minimally invasive biopsy alternative enables rapid mutation detection in solid tumors. QCI Interpret One leverages AI and expert curation for accurate variant interpretation, delivering actionable insights that improve diagnostic precision and patient outcomes.

- In August 2023, Mammotome launched the HydroMARK Plus Breast Biopsy Site Marker, designed to improve ultrasound visibility and reduce displacement during surgery. Featuring hydrogel technology for long-term visibility and a “dragonfly” shape for tissue anchoring, the device enhances biopsy site localization and surgical accuracy within the HydroMARK portfolio.