Biological Indicators Market Size

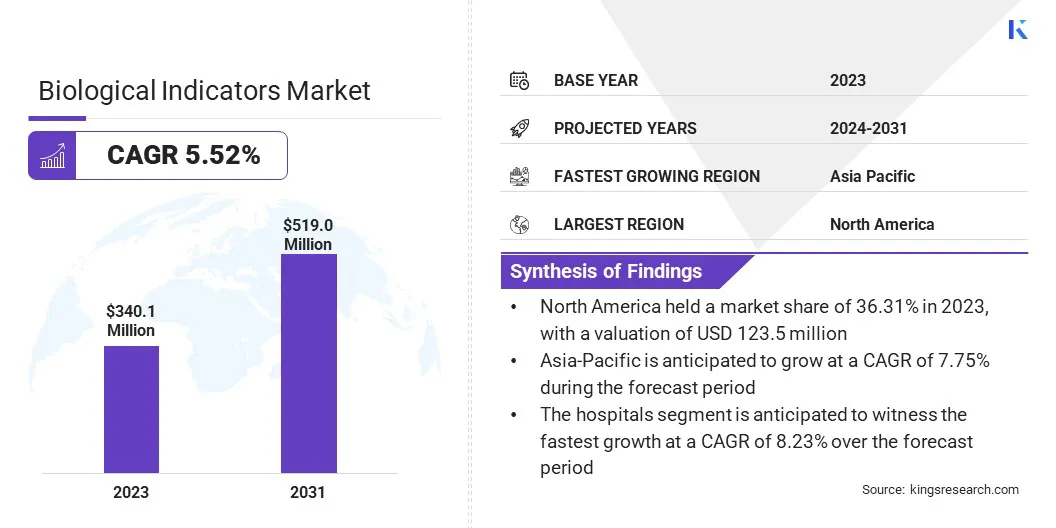

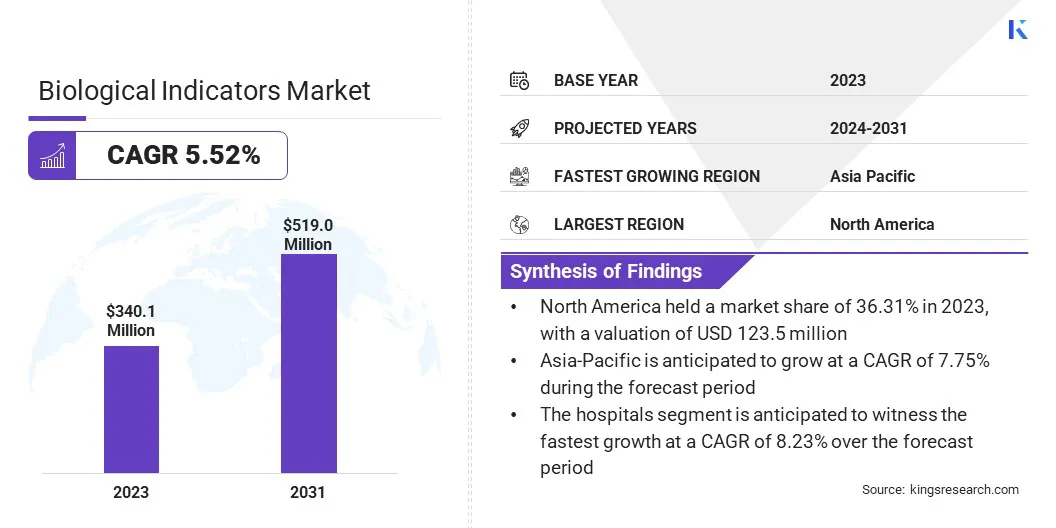

The global Biological Indicators Market size was valued at USD 340.1 million in 2023 and is projected to reach USD 519.0 million by 2031, growing at a CAGR of 5.52% during the forecast period. In the scope of work, the report includes solutions offered by companies such as 3M Company, STERIS plc, Getinge AB, Cantel Medical Corp., Mesa Laboratories, Inc., Tuttnauer USA Co., Ltd., Matachana Group, Excelsior Scientific, Inc., Andersen Products, Inc., Propper Manufacturing Company, Inc. and Others.

Stringent regulations governing sterilization and quality control processes across industries such as healthcare, pharmaceuticals, and food processing are major factors shaping the market growth. Regulatory bodies such as the FDA (Food and Drug Administration) in the U.S. and their counterparts globally enforce standards to ensure product safety and efficacy.

Compliance with these regulations necessitates the use of biological indicators to validate sterilization processes, monitor microbial contamination, and maintain quality standards.

- Companies are actively investing in robust biological indicator systems to comply with regulatory standards enforced by bodies such as the FDA in the U.S. and similar authorities worldwide. These systems are crucial for validating sterilization processes, monitoring microbial contamination, and upholding quality standards.

Biological Indicators (BIs) are test systems containing living microorganisms. These microorganisms are used to check the effectiveness of sterilization processes by their response to specific conditions. They serve as indicators of microbial lethality and are crucial for validating sterilization methods in healthcare, pharmaceuticals, and food processing industries.

BIs are designed to replicate the resistance of pathogenic organisms to sterilization processes, helping ensure that equipment, products, or environments are free from harmful microbes. Advancements such as miniaturization, rapid detection methods, and digital integration enhance the performance and versatility of biological indicators, which is driving their adoption across industries for quality control and safety assurance purposes.

Analyst’s Review

The global biological indicators market is experiencing steady growth and is poised to expand significantly over the upcoming years. Key factors driving market growth include increasing regulatory requirements for sterilization and quality control across industries, rising concerns regarding food safety and healthcare-associated infections, and technological advancements in BI systems.

The expanding healthcare and pharmaceutical sectors in emerging markets, the development of customized BI solutions, and collaborations for market penetration and innovation are slated to positively influence the industry outlook. Companies are employing strategies such as lucrative partnerships, investments in R&D activities, and a focus on addressing industry-specific challenges to capitalize on the growing demand for biological indicators globally.

How are growing food safety concerns driving the market?

Rising concerns regarding food safety and healthcare-associated infections are significant drivers fueling the demand for biological indicators. In industries such as food processing and healthcare facilities, ensuring sterility and microbial control is paramount to prevent contamination and protect public health. Biological indicators play a crucial role in validating sterilization processes for medical instruments, equipment, and packaging in healthcare settings.

In food processing, BIs are used to confirm and verify the effectiveness of sterilization, pasteurization, and sanitation methods. With increasing awareness among consumers and regulatory bodies emphasizing stringent hygiene standards, the adoption of biological indicators is rising to address these concerns effectively.

The biological indicators market is challenged by the high initial investment costs associated with advanced BI systems. Implementing cutting-edge technologies such as rapid microbial detection methods, digital integration, and miniaturized BI devices requires significant capital investment for equipment, software, training, and maintenance.

Small and medium-sized enterprises (SMEs) and emerging market players face difficulties in covering the upfront costs, of implementing advanced BI solutions. This can limit their entry or ability to adopt such solutions. As economies of scale improve and technology becomes more accessible, the cost barrier is expected to decrease gradually, opening opportunities for wider adoption across industries and market segments.

How are changing trends in microbial detection affecting the market?

The increasing adoption of rapid microbial detection methods is fueling the growth of the biological indicators market. Traditional microbial testing methods can take several days to generate results, leading to delays in decision-making and quality control processes. Rapid microbial detection methods, including molecular techniques, biosensors, and automated systems, offer real-time or rapid results within hours or minutes, enhancing efficiency and productivity.

These methods complement traditional biological indicators by providing timely insights into microbial contamination, helping industries maintain stringent hygiene standards, and ensuring product safety and quality. As the demand for faster and more accurate microbial monitoring grows, the adoption of rapid detection methods is expected to continue rising across diverse sectors.

Segmentation Analysis

The global market is segmented based on type, end-use, and geography.

What is the market share of the self-contained biological indicator segment?

Based on type, the market is bifurcated into self-contained biological indicator (SCBI) and biological indicator strip. The self-contained biological indicator (SCBI) segment dominated the biological indicators market with a revenue share of 52.35% in 2023, due to its superior efficacy and reliability in sterilization monitoring.

A study published in the Journal of Hospital Infection highlights SCBIs as the most effective method for assessing the efficacy of steam sterilization processes, especially for non-liquid items.

- SCBIs are regarded as the "gold standard" in the industry due to their ability to detect lower levels of microbial spores, providing accurate and reliable results. This accuracy and reliability are fostering the widespread adoption of biological indicators across various industries.

How fast will the hospitals segment grow in this market?

Based on end-use, the biological indicators market is segmented into hospitals, pharmaceutical companies, research laboratories, and others. The hospitals segment is anticipated to witness the fastest growth at a CAGR of 8.23% over the forecast period.

The increasing emphasis on infection control practices and expanding healthcare infrastructure globally are fueling the expansion of the segment. Hospitals and healthcare facilities require stringent sterilization protocols to prevent Healthcare-Associated Infections (HAIs) and ensure patient safety.

Biological indicators play a critical role in validating sterilization processes for medical devices, instruments, and equipment used in patient care, surgery, and diagnostics. With growing awareness about HAIs and regulatory mandates for sterilization compliance, hospitals are increasingly investing in sterilization monitoring solutions, which is foreseen to bolster segment growth.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America Biological Indicators Market share stood around 36.31% in 2023 in the global market, with a valuation of USD 123.5 million, due to well-established healthcare infrastructure, and stringent regulatory standards for sterilization. The region's robust pharmaceutical and healthcare sectors, and ongoing research and development initiatives, are driving the demand for biological indicators.

Moreover, strategic collaborations between key market players, healthcare institutions, and regulatory bodies are propelling market growth and innovation in biological indicator systems. Continual advancements in BI technology, coupled with favorable reimbursement policies and investments in healthcare quality initiatives, contributed to the region’s dominance in the market.

Asia-Pacific is likely to experience significant growth at a 7.75% CAGR between 2024 and 2031 owing to expanding healthcare infrastructure, increasing healthcare expenditure, and rising awareness about infection control measures. Countries such as China, India, and Japan are witnessing rapid industrialization, urbanization, and advancements in healthcare services, driving demand for sterilization monitoring solutions and quality control measures across industries.

Government initiatives promoting healthcare reforms, investments in medical facilities, and collaborations with international regulatory bodies to align with global standards, boosting product uptake in the region.

Competitive Landscape

The biological indicators market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are likely to create new opportunities for market growth.

Key Companies in Biological Indicators Market

- 3M Company

- STERIS plc

- Getinge AB

- Cantel Medical Corp.

- Mesa Laboratories, Inc.

- Tuttnauer USA Co., Ltd.

- Matachana Group

- Excelsior Scientific, Inc.

- Andersen Products, Inc.

- Propper Manufacturing Company, Inc.

The Global Biological Indicators Market is Segmented as:

By Type

- Self-Contained Biological Indicator (SCBI)

- Biological Indicator Strip

By End-Use

- Hospitals

- Pharmaceutical Companies

- Research Laboratories

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.