Market Definition

Bioimpedance analyzers are medical devices that measure body composition by evaluating the resistance of biological tissues to a low electrical current. The market covers a diverse range of devices, including advanced segmental analyzers, portable models, and stand-on systems, available in both wired and wireless formats.

These analyzers are used in clinical, fitness, and personal settings for applications such as patient monitoring, sports performance assessment, nutrition planning, and research, highlighting their importance across healthcare and wellness domains.

Bioimpedance Analyzers Market Overview

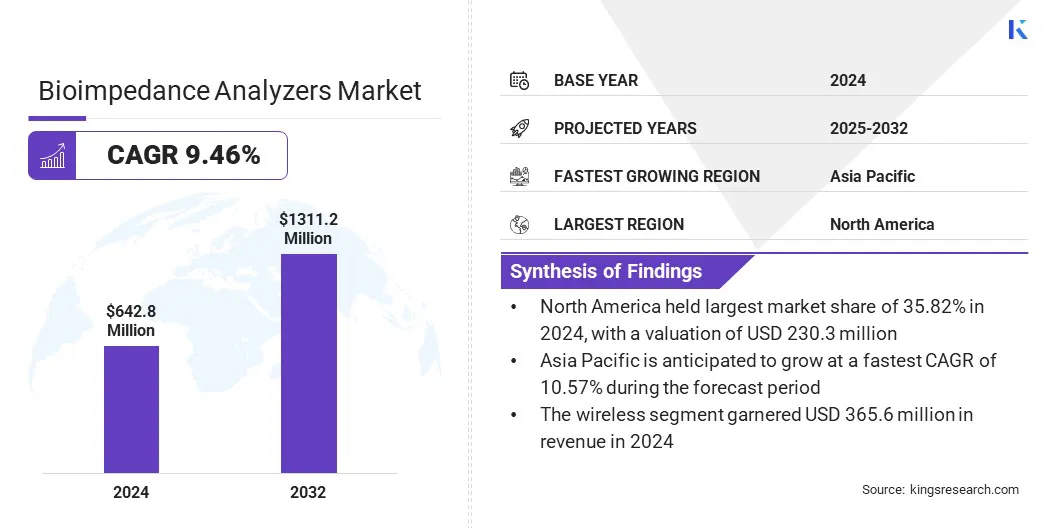

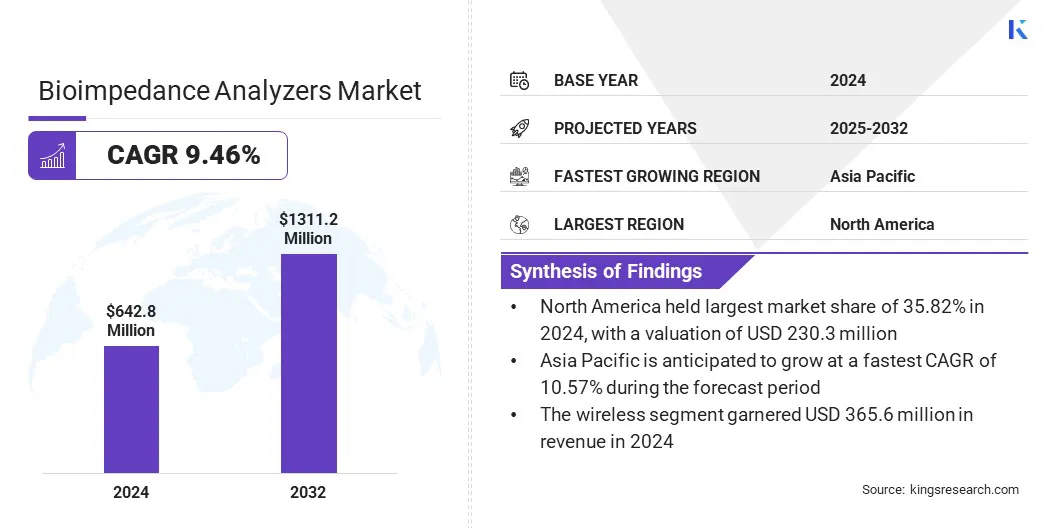

The global bioimpedance analyzers market size was valued at USD 642.8 million in 2024 and is projected to grow from USD 696.3 million in 2025 to USD 1,311.2 million by 2032, exhibiting a CAGR of 9.46% during the forecast period.

The market is witnessing consistent growth, mainly due to the rising focus on preventive healthcare and the increasing demand for body composition analysis in clinical and wellness settings. Growing adoption of fitness and nutrition monitoring devices, along with the integration of wireless and portable technologies, is expanding accessibility across hospitals, fitness centers, and home environments.

Key Highlights

- The bioimpedance analyzers industry size was USD 642.8 million in 2024.

- The market is projected to grow at a CAGR of 9.46% from 2025 to 2032.

- North America held a share of 35.82% in 2024, valued at USD 230.3 million.

- The stand-on device segment garnered USD 251.8 million in revenue in 2024.

- The wireless segment is expected to reach USD 769.7 million by 2032.

- The fitness & wellness centers segment is projected to reach USD 587.9 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 10.57% over the forecast period.

Major companies operating in the bioimpedance analyzers market are TANITA Health Equipment H.K. Limited, InBody Co.,Ltd., OMRON Healthcare, Inc., RJL SYSTEMS, Bodystat Limited, Company, Maltron International Ltd, Seca, Akern s.r.l., Withings, SELVAS Healthcare, Inc., Bioparhom, Charder Electronic Co., Ltd., Marsden Group, VacuMed, and VISBODY VIMBOD, INC.

Continuous technological innovations are driving improvements in bioimpedance analysis. Advanced multi-frequency and segmental analyzers provide more accurate body composition assessments for clinical and wellness applications.

Integration of bioimpedance sensors into wearable devices and connected health platforms allows real-time monitoring and seamless data sharing. These developments enhance user convenience and engagement, supporting wider adoption across healthcare, fitness, and home-based care, and expanding applications beyond traditional diagnostic settings.

Market Driver

Growing Consumer Focus on Preventive Health and Wellness

The bioimpedance analyzers market is experiencing strong growth, largely due to increasing consumer preference for preventive healthcare and personalized wellness solutions. Individuals actively monitor body composition, including fat, muscle mass, and hydration levels, to achieve fitness goals and maintain overall health.

This growth is further supported by the expansion of health clubs, home fitness solutions, and connected wellness platforms. Alongside clinical applications for managing chronic conditions, this emphasis on proactive health monitoring significantly boosts demand for bioimpedance analyzers across healthcare, sports, and fitness segments.

Market Challenge

Accuracy and Standardization Challenges

A major challenge in the bioimpedance analyzers market is the variability of measurements caused by factors such as hydration, food intake, posture, and electrode placement, combined with the absence of standardized protocols across manufacturers. These inconsistencies reduce accuracy, create skepticism among healthcare professionals, and limit adoption in clinical settings.

To mitigate these risks, industry players are developing global standardization for measurement conditions, integrating advanced technologies such as multi-frequency and segmental analysis, and incorporating AI-based algorithms to adjust for physiological variations.

Additionally, manufacturers are conducting clinical validation against gold-standard methods and providing user training to ensure appropriate device operation, improving reliability and accelerating regulatory acceptance.

Market Trend

Wearable Bioimpedance Monitoring

The global bioimpedance analyzers market is witnessing a notable shift toward the integration of bioimpedance sensors into wearable devices such as smartwatches and fitness bands. This trend enables continuous, real-time tracking of body composition, hydration, and other physiological metrics.

Wearable bioimpedance technology offers convenient, non-invasive health tracking, supporting personalized wellness and proactive health management. By integrating body composition analysis into everyday wearable devices, the market is experiencing growth and providing opportunities for more frequent and accessible health monitoring.

- In July 2025, Samsung Electronics introduced the Galaxy Watch8 and Galaxy Watch8 Classic, featuring the BioActive Sensor with bioelectrical impedance analysis for personalized health tracking and advanced wellness insights.

Bioimpedance Analyzers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Stand-On Device, Portable / Handheld Device, Segmental Analyzer

|

|

By Modality

|

Wired, Wireless

|

|

By End User

|

Fitness & Wellness Centers, Hospitals & Clinics, Home Users, Research Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Stand-On Device, Portable / Handheld Device, and Segmental Analyzer): The stand-on device segment earned USD 251.8 million in 2024, mainly due to its ease of use and widespread adoption in fitness and clinical settings.

- By Modality (Wired and Wireless): The wireless segment held a share of 56.88% in 2024, propelled by growing preference for connected devices that enable real-time data transfer and remote monitoring.

- By End User (Fitness & Wellness Centers, Hospitals & Clinics, Home Users, Research Laboratories): The fitness & wellness centers segment is projected to reach USD 587.9 million by 2032, owing to the rising emphasis on personalized fitness programs and body composition tracking.

Bioimpedance Analyzers Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America bioimpedance analyzers market share stood at around 35.82% in 2024, valued at USD 230.3 million. This dominance is reinforced by the high prevalence of obesity, particularly in the U.S., where adult obesity reached 40.3% between August 2021 and August 2023, as reported by the Centers for Disease Control and Prevention (CDC).

The rising incidence of obesity has led to increased awareness of health and fitness, highlighting the need for precise body composition monitoring in clinical and fitness settings. Healthcare providers and fitness centers are increasingly adopting advanced analyzers to assess body fat, muscle mass, and metabolic health, supporting personalized health management and intervention strategies.

The Asia-Pacific bioimpedance analyzers industry is expected to register the fastest CAGR of 10.57% over the forecast period. This growth is bolstered by the expanding fitness and wellness sector and increasing health awareness among consumers.

Rising disposable incomes and lifestyle changes in countries such as China, India, and Japan are fueling demand for advanced body composition monitoring devices in gyms, fitness centers, and wellness clinics. Additionally, government initiatives promoting preventive healthcare and corporate wellness programs are supporting the adoption of these devices, enabling accurate assessment of body fat, muscle mass, and overall health in clinical and fitness settings.

Regulatory Frameworks

- In the U.S., bioimpedance analyzers are regulated as medical devices by the Food and Drug Administration (FDA).

- In Europe, bioimpedance analyzers must comply with the Medical Device Regulation (MDR) to obtain the CE mark, indicating conformity with health, safety, and environmental protection standards. Manufacturers are required to conduct a conformity assessment, which may involve an audit of the manufacturer's quality system and a review of technical documentation.

- In China, the National Medical Products Administration (NMPA) oversees the regulation of medical devices, including bioimpedance analyzers. These devices are subject to classification based on risk, with Class III devices requiring clinical trials and approval from the NMPA.

Competitive Landscape

Key players in the bioimpedance analyzers industry are focusing on product innovation and partnerships to gain substantial market share. They are adopting bioimpedance analyzers that offer multi-frequency measurement, segmental body composition analysis, and intuitive touch-screen interfaces to deliver precise and actionable health insights.

Companies incorporate cloud-based platforms, mobile connectivity, and customized reporting to enhance functionality for clinical and wellness applications. They are adopting strategic partnerships with healthcare providers, fitness chains, and digital health platforms to expand adoption.

Companies also collaborate with research institutions and technology developers to validate performance, strengthen distribution networks, and integrate analyzers into broader health management systems.

- In January 2025, seca introduced the upgraded seca mBCA Go, combining the proven technology of the seca mBCA 525 with the cloud-based seca analytics 125. The device offers mobile access, secure patient management, and advanced analytics. Designed for dietitians and nutritional therapists, it provides portable, clinically validated body composition analysis with intuitive patient engagement through the seca myAnalytics app.

Key Companies in Bioimpedance Analyzers Market:

- TANITA Health Equipment H.K. Limited

- InBody Co.,Ltd.

- OMRON Healthcare, Inc.

- RJL SYSTEMS

- Bodystat Limited, Company

- Maltron International Ltd

- seca

- Akern s.r.l.

- Withings

- SELVAS Healthcare, Inc.

- Bioparhom

- Charder Electronic Co., Ltd.

- Marsden Group

- VacuMed

- VISBODY VIMBOD, INC.

Recent Developments (Product Launch)

- In March 2024, InBody Co., Ltd. launched the InBody 580, a premium body composition analyzer for health professionals. The device provides advanced assessments, including Segmental ECW Ratio, Phase Angle, and Visceral Fat Area, supported by Bioelectrical Impedance Vector Analysis (BIVA) graphs for hydration and cellular health, enabling precise and efficient health evaluations.