Market Definition

Biofabrication combines biology and engineering to produce functional biological products using living cells, biomaterials, and bioactive molecules. Techniques such as 3D bioprinting, electrospinning, and microfluidics enable the creation of complex tissue structures for medical applications.

The scope of this market covers tissue engineering, drug testing, regenerative medicine, and organ transplants, addressing the need for advanced therapeutic solutions. These technologies are utilized to develop personalized treatments, reduce reliance on animal models, and accelerate the development of functional tissues and organs for clinical use.

Biofabrication Market Overview

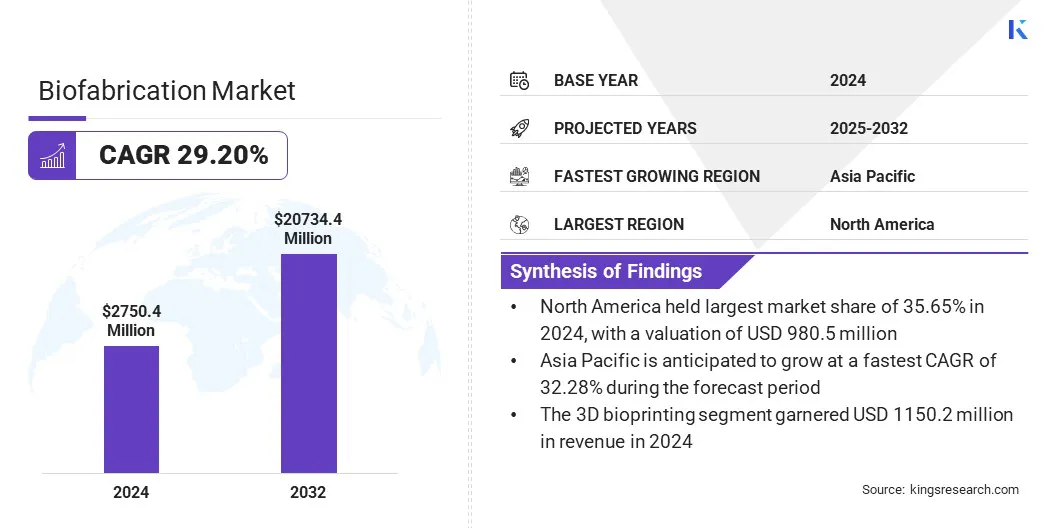

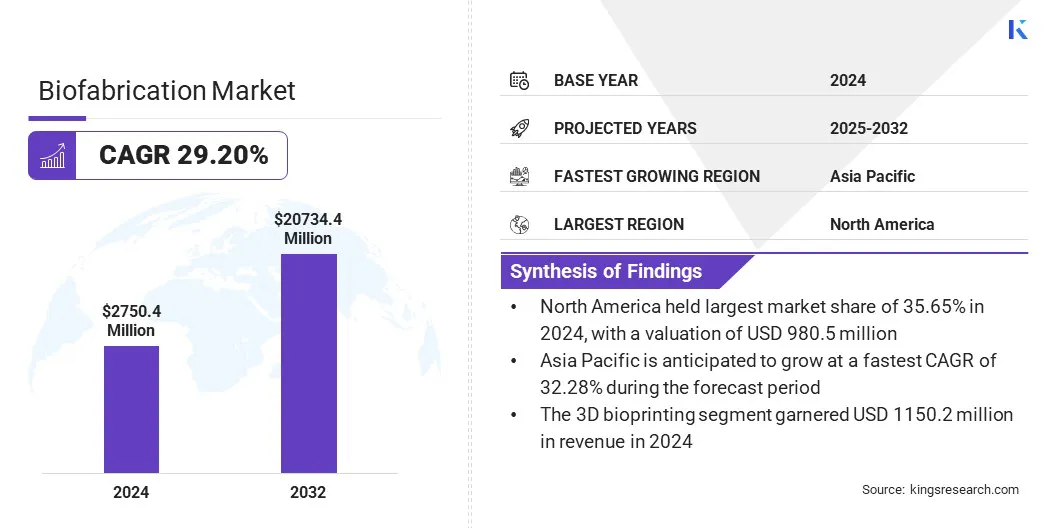

The global biofabrication market size was valued at USD 2,750.4 million in 2024 and is projected to grow from USD 3,450.7 million in 2025 to USD 20,734.4 million by 2032, exhibiting a staggering CAGR of 29.20% during the forecast period.

The growth of the market is driven by advancements in tissue engineering that are enabling the creation of functional tissues for regenerative medicine and research purposes. In addition, the adoption of 3D bioprinting with advanced bioinks is accelerating the development of complex, customizable biological structures, supporting wider clinical and industrial use.

Key Highlights

- The biofabrication industry size was valued at USD 2,750.4 million in 2024.

- The market is projected to grow at a CAGR of 29.20% from 2025 to 2032.

- North America held a market share of 35.65% in 2024, with a valuation of USD 980.5 million.

- The 3D bioprinting segment garnered USD 1,150.2 million in revenue in 2024.

- The natural polymers segment is expected to reach USD 6,639.2 million by 2032.

- The bioprinters segment secured the largest revenue share of 33.55% in 2024.

- The regenerative medicine segment is poised for a robust CAGR of 30.39% through the forecast period.

- The academic and research institutes segment secured the largest revenue share of 48.38% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 32.28% during the forecast period.

Major companies operating in the biofabrication market are BICO, Organovo Holdings Inc., Aspect Biosystems Ltd., Allevi, Inc., Stratasys, Nanoscribe GmbH & Co. KG, Prellis Biologics, Tissue Regenix, Poietis, Merck KGaA, 3D Systems Corporation, CollPlant Biotechnologies Ltd., ROKIT HEALTHCARE, INC., Advanced Solutions Life Sciences, LLC, and IamFluidics B.V.

Growth in pharmaceutical and cosmetic testing is significantly boosting the adoption of biofabrication solutions. Pharmaceutical companies are using engineered tissues to screen drug candidates more efficiently and predict human responses with higher accuracy.

Cosmetic manufacturers are also employing biofabricated skin models to comply with regulations that restrict animal testing while ensuring product safety. This technology enables high-throughput testing and personalized assessments, improving research speed and reliability. As a result, research institutions are collaborating with biofabrication providers to develop advanced tissue models for complex disease studies.

- In May 2024, L'Oréal, in collaboration with the University of Oregon, unveiled a bioprinted skin model capable of sensory feedback. This model replicates human skin's structure and function, and enables ethical testing of cosmetic products without animal involvement. The synthetic skin is produced using melt electro writing (MEW) technology. It can simulate various skin conditions such as eczema, acne, tanning, and wound healing, providing a humane alternative for product safety assessments.

Market Driver

Advancements in Tissue Engineering

The expansion of the biofabrication market is driven by the increasing research efforts in organ and tissue regeneration that require precise and reproducible fabrication methods. Scientists and medical researchers are developing complex 3D tissues for applications in regenerative medicine, disease modeling, and transplantation studies.

- In June 2025, researchers at Stony Brook University introduced a novel bioprinting method called TRACE (Tunable Rapid Assembly of Collagenous Elements), to enhance the functionality of natural materials in tissue engineering. This approach addresses previous challenges in bioprinting by enabling the creation of physiologically relevant tissue structures with improved viability and functionality. TRACE holds potential for advancing applications in regenerative medicine and disease modeling.

Biofabrication technologies are enabling the creation of functional tissues with controlled architecture, mechanical properties, and cellular composition. Academic and industrial collaborations are expanding the development of bioengineered organs, accelerating clinical translation. Growing investment in advanced bioprinting and scaffold technologies is further enhancing the capabilities of biofabrication platforms.

Market Challenge

High Cost of Equipment and Materials

A major challenge in the biofabrication market is the substantial investment required for advanced bioprinters, specialized bioinks, and custom scaffolds. High-cost components limit adoption, particularly among smaller research institutions and startups with constrained budgets. Additionally, the complexity of handling biological materials and maintaining sterile environments further increases operational expenses.

To address this challenge, market players are developing more affordable, modular bioprinting systems, offering shared facility models, and optimizing bioink formulations to reduce material costs . These approaches are helping expand access to biofabrication technologies while maintaining precision and quality in research and development.

Market Trend

Adoption of 3D Bioprinting with Advanced Bioinks

The biofabrication market is advancing through the use of 3D bioprinting technologies combined with sophisticated bioinks. Cell-laden and composite bioinks are enabling the creation of tissue structures that mimic the architecture and function of native biological tissues. These bioinks support precise placement of multiple cell types and extracellular matrix components, improving structural integrity and biological performance.

Enhanced bioink formulations are facilitating applications in tissue engineering, regenerative medicine, and drug testing. By increasing reproducibility and functional fidelity, 3D bioprinting with advanced bioinks is expanding the capabilities and adoption of biofabrication technologies.

- In July 2024, BIO INX and Readily3D announced a collaboration to advance volumetric bioprinting with a cutting-edge GelMA-based bioink, READYGEL INX. This ready-to-use, sterile bioink is designed for high reproducibility and performance in volumetric 3D bioprinting applications. The partnership aims to streamline the bioprinting process, making it more accessible for researchers and clinicians.

Biofabrication Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

3D bioprinting, Tissue Engineering, Scaffold-free Fabrication, Others

|

|

By Material Type

|

Natural Polymers, Synthetic Polymers, Ceramics & Glass, Composite Materials

|

|

By Product

|

Bioprinters, Bioinks, Bioreactors & Post-Processing Systems, Others

|

|

By Application

|

Regenerative Medicine, Drug Testing, Cosmetic Treatment

|

|

By End User

|

Academic and Research Institutes, Biotechnology and Pharmaceutical Companies, Hospitals and Specialty Clinics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (3D bioprinting, Tissue Engineering, Scaffold-free Fabrication, and Others): The 3D bioprinting segment earned USD 1,150.2 million in 2024 due to its ability to produce complex, scalable, and patient-specific biological structures with high precision and efficiency.

- By Material Type (Natural Polymers, Synthetic Polymers, Ceramics & Glass, and Composite Materials): The natural polymers segment held 32.40% of the market in 2024, due to their superior biocompatibility and ability to closely mimic the native extracellular matrix.

- By Product (Bioprinters, Bioinks, Bioreactors & Post-Processing Systems, and Others): The bioprinters segment is projected to reach USD 7,882.6 million by 2032, owing to their critical role in enabling precise, scalable, and customizable 3D construction of tissues and organs for research and clinical applications.

- By Application (Regenerative Medicine, Drug Testing, and Cosmetic Treatment): The regenerative medicine segment is poised for significant growth at a CAGR of 30.39% over the forecast period, attributed to the rising demand for engineered tissues and organs to address chronic diseases, organ shortages, and advanced therapeutic needs.

Biofabrication Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America biofabrication market share stood at 35.65% in 2024, with a valuation of USD 980.5 million in the global market. This dominance is driven by well-established biotechnology clusters that integrate universities, hospitals, and industry players.

These clusters provide easy access to specialized talent, research collaborations, and shared infrastructure. The proximity of stakeholders enhances knowledge exchange, speeds innovation, and strengthens the commercial potential of biofabrication products.

- In July 2024, the ReGen Valley Tech Hub in New Hampshire received USD 44 million in federal funding for biofabrication. This initiative aims to develop cost-effective regenerative therapies addressing chronic diseases and organ failure. The project leverages existing infrastructure, including the Advanced Regenerative Manufacturing Institute (ARMI), the historic Amoskeag Millyard, and institutions of higher education, to create a collaborative ecosystem for biofabrication innovation.

The biofabrication industry in Asia Pacific is poised for a significant CAGR of 32.28% over the forecast period. This notable growth is a result of the increasing number of biotechnology research centers and biofabrication labs in the region. These centers are equipped with modern infrastructure and skilled personnel undertaking advanced tissue engineering projects.

Investments in research allow the region to explore innovative bioinks and printing technologies. Collaborative studies among institutions improve efficiency and speed up the development of functional tissues. The expansion of research capabilities also attracts global partnerships and knowledge exchange.

- In November 2024, the International Society for Biofabrication (ISBF) hosted the Biofabrication 2024 conference in Fukuoka, Japan. The event attracted global experts to discuss advancements in tissue engineering, regenerative medicine, and bioprinting technologies.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates human cells, tissues, and cellular and tissue-based products (HCT/Ps) under 21 CFR Part 1271. Establishments must register and list their HCT/Ps within 5 days of beginning operations and update their registration annually in December. These regulations include requirements for donor screening, testing, and current good tissue practices to prevent the transmission of communicable diseases.

- In the European Union, the European Medicines Agency (EMA) oversees the regulation of advanced therapy medicinal products (ATMPs), which include gene therapies, somatic-cell therapies, and tissue-engineered medicines. The EU Regulation (EC) No 1394/2007 establishes a centralized authorization procedure for ATMPs, requiring a marketing authorization from the EMA before these products can be marketed in the EU.

- In China, the National Medical Products Administration (NMPA) regulates tissue-engineered products under the Regulations for the Supervision and Administration of Medical Devices. The NMPA requires that these products undergo clinical trials and obtain a medical device registration certificate before being marketed.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates tissue-engineered products under the Pharmaceuticals and Medical Devices Act. The PMDA requires that these products undergo clinical trials and obtain marketing authorization before being sold.

Competitive Landscape

Major players in the biofabrication industry are investing in research and development, strengthening partnerships with academic and clinical institutions, and advancing their technological capabilities to remain competitive. They are focusing on creating more efficient and customizable tools that improve scalability and functionality in tissue engineering.

In addition, collaborations with universities, hospitals, and research organizations are helping them test and validate new solutions in real-world applications. Several firms are also expanding their portfolios with advanced bioreactors, bioinks, and 3D bioprinting platforms to address the growing demand in regenerative medicine. These approaches are enabling companies to differentiate themselves in a rapidly evolving market while ensuring long-term growth.

- In November 2024, REGEMAT 3D developed novel bioreactors for advancing the next generation of biofabrication technologies for regenerative medicine and tissue engineering. These new bioreactors are part of REGEMAT 3D’s robust R&D strategy, aimed at delivering innovative and customizable tools that enable researchers and clinicians to push the boundaries of tissue engineering.

Key Companies in Biofabrication Market:

- BICO

- Organovo Holdings Inc.

- Aspect Biosystems Ltd.

- Allevi, Inc.

- Stratasys

- Nanoscribe GmbH & Co. KG

- Prellis Biologics.

- Tissue Regenix

- Poietis

- Merck KGaA

- 3D Systems Corporation

- CollPlant Biotechnologies Ltd.

- ROKIT HEALTHCARE, INC.

- Advanced Solutions Life Sciences, LLC

- IamFluidics B.V.

Recent Developments (Partnerships/Product Launch)

- In July 2024, Debut Biotech announced an expanded partnership with L'Oréal to develop and scale bio-identical ingredients crucial for sustainable beauty. This long-term agreement aims to accelerate the shift to using bio-identical ingredients across numerous L'Oréal product formulations and brands. The collaboration focuses on replacing conventionally sourced ingredients with bio-identical, fermentation-based alternatives.

- In May 2024, Redwire announced the successful 3D bioprinting of the first live human heart tissue sample through its 3D BioFabrication facility onboard the International Space Station. This achievement marks a significant milestone in the field of biofabrication, showcasing the potential of 3D bioprinting in creating functional human tissues.