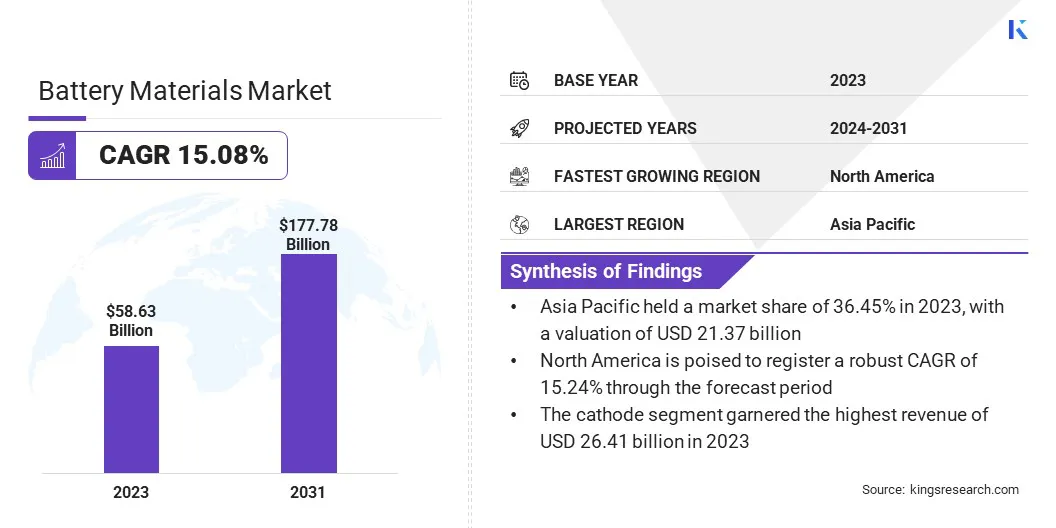

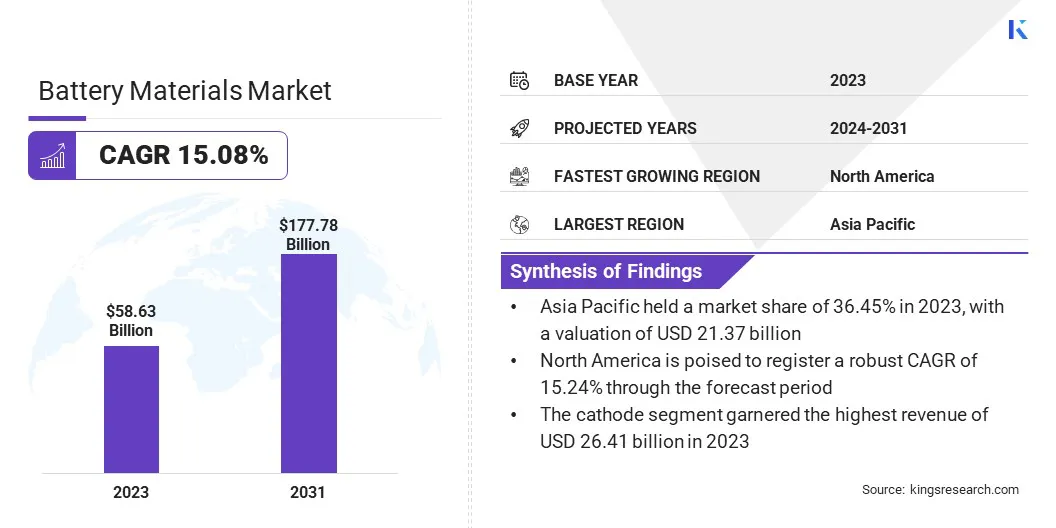

Battery Materials Market Size

The global Battery Materials Market size was valued at USD 58.63 billion in 2023 and is projected to grow from USD 66.52 billion in 2024 to USD 177.78 billion by 2031, exhibiting a CAGR of 15.08% during the forecast period. Increasing demand for consumer electronics and favorable government incentives and policies are contributing significantly to the growth of the global market.

In the scope of work, the report includes services offered by companies such as Stratus Materials Inc., Mitsubishi Chemical Group, Asahi Kasei Corporation, Nippon Carbon Co Ltd., Sumitomo Metal Mining Co., Ltd., Kureha Corporation, NEU Battery Materials, POSCO, 3M, BASF SE, and others.

The development of next-generation batteries represents a pivotal opportunity in the global battery materials market, driven by the pressing need for higher energy densities, faster charging capabilities, and improved safety features. Innovations such as solid-state batteries, lithium-sulfur batteries, and silicon anode technologies are at the forefront of this development.

Solid-state batteries, for instance, deliver higher energy densities and enhanced safety by replacing liquid electrolytes with solid ones, thus reducing the risk of leaks and fires. Lithium-sulfur batteries offer the potential for greater energy storage capacity due to the high theoretical energy density of sulfur.

Additionally, the integration of silicon anodes significantly increases the energy capacity of lithium-ion batteries. These advancements are crucial for meeting the growing demands of electric vehicles (EVs) and renewable energy storage systems, where efficiency and safety are paramount.

By investing in next-generation battery technologies, companies are addressing the challenges posed by ongoing limitations. This strategic focus allows them to position themselves at the forefront of a rapidly evolving market, tap into new revenue streams and gain a competitive edge.

Battery materials are essential components used in the production of batteries, encompassing a variety of substances that contribute to the overall functionality, efficiency, and longevity of these energy storage devices. These materials typically include cathodes, anodes, electrolytes, and separators. Cathodes, often made from lithium cobalt oxide, lithium iron phosphate, or nickel-cobalt-manganese, are crucial for storing and releasing electrical energy.

Anodes, commonly composed of graphite, store lithium ions during the charging process. Electrolytes, which are liquid, gel, or solid-state, facilitate the movement of ions between the cathode and anode. Separators, usually made from polymer films, prevent short circuits by keeping the cathode and anode apart.

The applications of these materials extend across various types of batteries, including lithium-ion, lead-acid, nickel-metal hydride, and solid-state batteries. These batteries power a wide range of applications, including portable consumer electronics, electric vehicles, grid energy storage systems, and medical devices, highlighting the critical role of battery materials in modern technology.

Analyst’s Review

The battery materials market is characterized by dynamic growth and strategic initiatives from key players aiming to secure their positions in an increasingly competitive landscape. Companies are actively focusing on a range of strategies to enhance their market share and foster innovation.

Significant investments in research and development are being made to develop next-generation battery technologies that offer higher energy densities, faster charging times, and improved safety features. Additionally, companies are forging strategic partnerships and collaborations with automotive manufacturers, technology firms, and research institutions to accelerate the development and commercialization of advanced battery materials.

- For instance, in June 2024, NEO Battery Materials Ltd, a developer of cost-effective silicon anode materials for advanced lithium-ion batteries, announced collaboration with INNOX eco-M. This partnership aims to develop silicon anode products using INNOX eco-M’s high-purity recycled silicon, thereby enhancing both battery performance and sustainability.

Expansion into emerging markets is another key strategy, as rapid industrialization and urbanization in these regions present substantial growth opportunities. Furthermore, sustainable sourcing and recycling initiatives are becoming imperatives, as companies seek to address environmental concerns and adhere to stringent regulatory standards.

These strategies are crucial for maintaining competitiveness and ensuring long-term growth in the evolving market. Emerging growth trends indicate robust demand fueled by the proliferation of electric vehicles, consumer electronics, and renewable energy storage solutions.

Battery Materials Market Growth Factors

The increasing demand for consumer electronics is contributing significantly to the expansion of the battery materials market. The proliferation of smartphones, laptops, tablets, wearable devices, and other portable gadgets has led to a substantial rise in the need for efficient and high-capacity batteries. These electronic devices rely heavily on lithium-ion batteries due to their superior energy density, lightweight properties, and longer life cycles.

As consumers seek more powerful and longer-lasting devices, manufacturers are continuously innovating to enhance battery performance, leading to increased consumption of advanced battery materials such as lithium, cobalt, nickel, and graphite.

Moreover, the advent of smart homes and the Internet of Things (IoT) is further boosting the demand for various consumer electronics, resulting in the rising need for reliable and high-performing battery solutions. This growing consumer electronics market fosters the demand for battery materials and spurs technological advancements in battery production, thereby creating a robust ecosystem that supports sustained growth and innovation in the battery materials industry.

High production costs present a significant challenge to the development of the battery materials market. The extraction and processing of raw materials such as lithium, cobalt, and nickel are capital-intensive and often involve complex, energy-intensive procedures.

Additionally, the costs associated with ensuring the purity and quality of these materials further increases production expenses. These high costs affect the overall pricing of batteries, making them less competitive, especially in markets where price sensitivity is a significant factor. Furthermore, the volatility of raw material prices due to geopolitical tensions and supply chain disruptions exacerbate the cost challenges.

Mitigating this challenge requires strategic initiatives such as investing in advanced manufacturing technologies that improve production efficiency and reduce energy consumption.

Furthermore, companies are exploring alternative materials that are more abundant and cost-effective, thus lowering reliance on high-cost materials. Developing robust recycling programs to recover valuable materials from used batteries help offset production costs and ensure a sustainable supply chain. These strategies are essential for maintaining profitability and competitiveness in the evolving market.

Battery Materials Market Trends

The increasing adoption of electric vehicles (EVs) is a prominent trend boosting the growth of the global battery materials market. As governments worldwide implement stringent emission regulations and promote sustainable transportation solutions, the demand for EVs is soaring. This shift is primarily fueled by the need to reduce greenhouse gas emissions and combat climate change.

Additionally, the automotive industry is investing heavily in the development and production of EVs, leading to a surge in the demand for advanced battery materials such as lithium, cobalt, nickel, and manganese. These materials are crucial for manufacturing high-performance batteries that offer greater energy density, longer driving ranges, and faster charging capabilities.

Furthermore, technological advancements in battery technology, such as solid-state batteries and lithium-sulfur batteries, are enhancing the efficiency and safety of EV batteries, thereby making them more appealing to consumers. The growing consumer preference for EVs, coupled with favorable government policies and incentives, is expected to augment the growth of the market.

Segmentation Analysis

The global market is segmented based on battery type, material, application, and geography.

By Battery Type

Based on battery type, the market is categorized into lithium-ion, lead acid, and others. The lithium-ion segment captured the largest battery materials market share of 46.32% in 2023, largely attributed to its widespread adoption across various applications and superior performance characteristics.

Lithium-ion batteries offer high energy density, long cycle life, and relatively low self-discharge rates, making them ideal for a broad range of applications, including consumer electronics, electric vehicles (EVs), and renewable energy storage systems. The burgeoning demand for portable electronics, such as smartphones, laptops, and wearable devices, has significantly boosted the need for lithium-ion batteries due to their efficiency and lightweight properties.

Additionally, the rapid growth of the electric vehicle market has fueled the demand for lithium-ion batteries, as they provide the necessary energy capacity and longevity to support longer driving ranges and faster charging times. Technological advancements and continuous innovation in lithium-ion battery technology have further enhanced their safety and performance, making them the preferred choice for several industries.

By Material

Based on material, the market is classified into cathode, anode, electrolyte, and separator. The cathode segment garnered the highest revenue of USD 26.41 billion in 2023, propelled by its critical role in determining the performance and efficiency of batteries. Cathode materials, such as lithium cobalt oxide, nickel-cobalt-manganese (NCM), and lithium iron phosphate, are essential for the storage and release of electrical energy within batteries.

The increasing demand for high-performance batteries across various applications, including electric vehicles (EVs), consumer electronics, and energy storage systems, has significantly supported segmental growth. In EVs, the cathode's ability to enhance energy density and driving range is crucial, making it a key component in the development of advanced battery technologies.

Additionally, the rising adoption of renewable energy solutions has increased the need for efficient energy storage systems, thereby boosting the demand for high-quality cathode materials. Continuous research and development efforts aimed at improving the performance, safety, and cost-effectiveness of cathode materials have further contributed to the growth of the segment.

By Application

Based on application, the battery materials market is divided into consumer electronics, automotive, power storage, and others. The automotive segment is poised to record a staggering CAGR of 17.47% through the forecast period, driven by the rapid transition toward electric vehicles (EVs) and the growing emphasis on sustainable transportation solutions.

The global shift toward reducing carbon emissions and mitigating climate change has led governments and regulatory bodies to implement stringent emission norms and incentivize the adoption of EVs. This has spurred significant investments from automakers in developing and commercializing EVs, thereby fueling the demand for high-performance batteries.

- For instance, in June 2024, Stratus Materials, a company specializing in advanced cathode active materials (CAMs) for lithium-ion batteries, announced that its first-generation LXMO CAM material has reached a significant milestone in cycling durability for electric vehicle applications.

The advancements in battery technology, such as improved energy densities, faster charging capabilities, and enhanced safety features, are making EVs more viable and appealing to consumers. Furthermore, increasing consumer awareness and growing preference for eco-friendly vehicles are contributing to the development of the automotive segment. The expansion of charging infrastructure and the reduction in battery costs are further propelling the adoption of EVs.

Battery Materials Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific battery materials market share stood around 36.45% in 2023 in the global market, with a valuation of USD 21.37 billion. This dominance is primarily reinforced by the region's rapid industrialization and urbanization, particularly in countries such as China, Japan, and South Korea, which are major hubs for battery manufacturing and technology development.

The extensive presence of key battery manufacturers and suppliers, coupled with significant investments in research and development, has bolstered the region's leading position in the market. Furthermore, Asia-Pacific is at the forefront of the electric vehicle (EV) revolution, bolstered by substantial government support through subsidies and incentives aimed at promoting sustainable transportation.

The growing adoption of consumer electronics and the increasing demand for renewable energy storage solutions further contribute to domestic market growth. Additionally, the region's strong supply chain infrastructure and access to raw materials essential for battery production further enhance its competitive advantage.

North America is projected to grow at a significant CAGR of 15.24% in the forthcoming years, reflecting the region's dynamic market expansion and increasing investments in battery technology. The rapid growth of the electric vehicle (EV) market in the United States and Canada is playing a pivotal role in this expansion, supported by favorable government policies, tax incentives, and initiatives to reduce greenhouse gas emissions.

- For instance, in April 2024, Electra Battery Materials Corporation and Eurasian Resources Group, a leading diversified natural resources group headquartered in Luxembourg, announced the signing of a binding letter of intent for the long-term supply of ERG’s cobalt hydroxide to North America’s first battery grade cobalt sulfate refinery. The agreement, effective April 1, 2024, aims to support efforts to onshore the battery supply chain and reduce reliance on foreign refiners.

The presence of major automotive manufacturers and technology companies investing heavily in EV development and battery innovation is boosting domestic market growth. Moreover, the increasing focus on renewable energy and energy storage systems is leading to increased demand for advanced battery materials, as the region seeks to enhance grid stability and integrate more renewable energy sources.

North America's strong research and development infrastructure and collaborations between universities, research institutions, and industry players are fostering technological advancements in battery materials. Additionally, the rise of consumer electronics and the shift toward energy-efficient devices are propelling regional market expansion.

Competitive Landscape

The global battery materials market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Battery Materials Market

Key Industry Developments

- June 2024 (Launch): LANXESS highlighted its diverse product portfolio for lithium-ion battery production and electro mobility applications at Battery Show Europe. The specialty chemicals company offers raw materials for cathode materials, electrolyte components, ion exchange resins, coolants, colorants, and casting compounds to protect electronic battery components.

- November 2023 (Launch): Stratus Materials announced significant updates on the performance and value of its next-generation LXMOTM cathode active materials (CAMs). The company detailed its sampling efforts with EV supply chain customers and partners and outlined future scaling plans for commercializing these advanced CAMs.

The global battery materials market is segmented as:

By Battery Type

- Lithium-ion

- Lead Acid

- Others

By Material

- Cathode

- Anode

- Electrolyte

- Separator

By Application

- Consumer Electronics

- Automotive

- Power Storage

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America