Market Definition

The market encompasses the global industry dedicated to the production and supply of chemical materials used in the manufacturing of various batteries, including lithium-ion, lead-acid, and nickel-metal hydride batteries. The market includes key components such as electrolytes, cathode and anode materials, separators, and additives that enhance battery performance and lifespan.

The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Battery Chemicals Market Overview

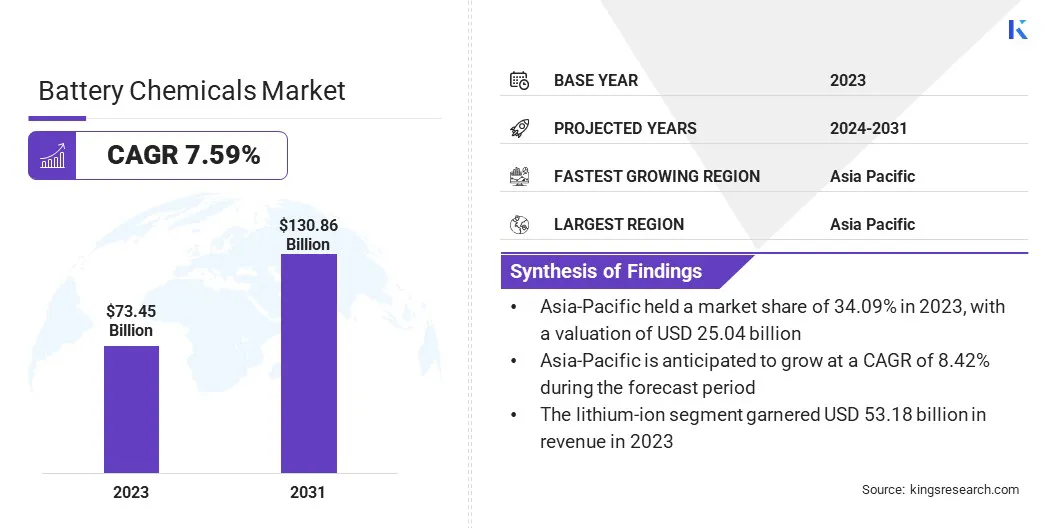

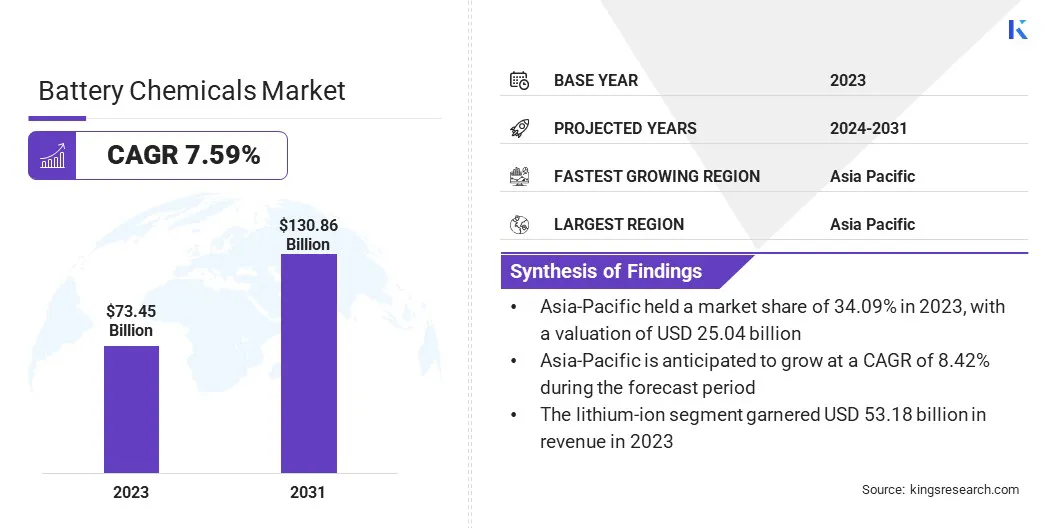

The global battery chemicals market size was valued at USD 73.45 billion in 2023 and is projected to grow from USD 78.42 billion in 2024 to USD 130.86 billion by 2031, exhibiting a CAGR of 7.59% during the forecast period.

This is attributed to the rising demand for energy storage solutions due to the widespread adoption of Electric Vehicles (EVs), renewable energy systems, and portable electronic devices. The global shift toward clean energy and the heightened focus on reducing carbon emissions are major factors supporting the market.

Major companies operating in the battery chemicals industry are LG Chem, Albemarle Corporation, Mitsubishi Chemical Group Corporation, Panasonic Corporation, Umicore, Himadri Speciality Chemical Ltd, Sumitomo Metal Mining Co., Ltd., Ganfeng Lithium Group Co., Ltd, Vale, A123 Systems Corp, CMOC, Gujarat Fluorochemicals Limited, Tianqi Lithium, Sherritt International Corporation, and Norilsk Nickel.

Continuous advancements in battery technologies, coupled with significant investments in high-performance chemistries and large-scale energy storage infrastructure, are further accelerating the market growth. Additionally, supportive government policies, incentives for electric mobility, innovation, and growing research into sustainable battery materials are expected to reinforce the long-term market growth.

- In September 2024, LANXESS won the ICIS Innovation Award for its high-quality iron oxides used in lithium iron phosphate (LFP) battery cathodes. The award highlights the company’s role in supporting sustainable, Western-based LFP supply chains and advancing domestic battery material production.

Key Highlights

- The battery chemicals market size was valued at USD 73.45 billion in 2023.

- The market is projected to grow at a CAGR of 7.59% from 2024 to 2031.

- Asia-Pacific held a market share of 34.09% in 2023, with a valuation of USD 25.04 billion.

- The lithium segment garnered USD 23.14 billion in revenue in 2023.

- The lithium-ion segment is expected to reach USD 93.81 billion by 2031.

- The automotive segment is anticipated to register the fastest CAGR of 8.14% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 7.35% during the forecast period.

Market Driver

Increased Electrification of the Transportation Sector

The increased electrification of the transportation sector is fueling the market. EVs are gaining momentum globally, boosting the need for high-performance batteries that rely on critical chemicals such as lithium, nickel, cobalt, and electrolytes to deliver energy efficiency, durability, and safety.

This shift is driven by growing environmental concerns, stricter emissions regulations, and government incentives aimed at promoting clean mobility and reducing dependence on fossil fuels. Battery chemicals play a crucial role in supporting the EV ecosystem, offering the necessary material foundation for advanced energy storage solutions that align with global sustainability and decarbonization goals.

- In January 2023, Stellantis N.V. and Terrafame Ltd. announced a five-year agreement for the supply of low-carbon nickel sulphate for EV batteries. Starting in 2025, Terrafame will provide Stellantis with this key material, supporting its electrification strategy and carbon neutrality goals by 2038.

Market Challenge

Safety Risks Due to Chemical Instability

A significant challenge hindering the growth of the battery chemicals market is the safety risks associated with the chemical instability of critical raw materials. Many battery chemicals, such as lithium, cobalt, and certain electrolytes, are highly reactive and pose significant hazards if not stored and handled properly.

Ensuring the safe storage of these materials requires advanced infrastructure, strict safety protocols, and highly trained personnel to prevent risks such as chemical degradation, leakage, or fires.

The complexity of these safety measures is further exacerbated by the need for temperature-controlled environments, specialized packaging, and real-time monitoring systems to maintain optimal conditions. Additionally, the transport of these materials introduces further challenges related to containment and regulatory compliance.

Market players are investing in enhanced safety infrastructure and technologies to improve chemical stability. Companies are also working closely with regulatory bodies to ensure compliance with safety standards and minimize risks associated with the storage and transportation of battery chemicals.

Advancements in alternative battery chemistries, such as solid-state batteries, are also being explored to reduce the inherent volatility of current materials and enhance overall safety.

Market Trend

Shift Toward Lithium Iron Phosphate (LFP) Batteries

Lithium Iron Phosphate (LFP) batteries are increasingly being adopted in EVs, due to their cost-effectiveness, enhanced safety features, and environmental benefits. These batteries are used in a wide range of EV models, particularly in entry-level and mid-range vehicles, where affordability and safety are critical.

LFP batteries are gaining popularity, due to their ability to offer a balanced performance while minimizing the reliance on expensive raw materials like cobalt and nickel. Additionally, their inherent thermal stability reduces the risk of overheating or fires, making them a safer alternative to traditional lithium-ion batteries.

This trend is driven by the growing demand for affordable, sustainable, and safe electric mobility solutions, positioning LFP batteries as a key technology in the future of electric transportation.

- In October 2024, American Battery Factory Inc. (ABF) signed a seven-year memorandum of understanding (MOU) with Tinci Materials Texas LLC to secure a supply of essential materials for LFP battery chemistry. This collaboration will enhance ABF's battery cell production capabilities, complementing the development of its first gigafactory in Tucson, Arizona.

Battery Chemicals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Chemical Type

|

Lithium, Cobalt, Nickel, Manganese, Electrolyte Compounds, and Others

|

|

By Battery Type

|

Lithium-ion, Lead-acid, Nickel-based (NiMH, NiCd), and Others

|

|

By End-use Industry

|

Automotive, Electronics & Appliances, Utilities & Power, Aerospace & Defense, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Chemical Type (Lithium, Cobalt, Nickel, Manganese, Electrolyte Compounds, and Others): The lithium segment earned USD 23.14 billion in 2023, due to its critical role in powering high-performance batteries for EVs and energy storage systems.

- By Battery Type (Lithium-ion, Lead-acid, Nickel-based (NiMH, NiCd), and Others): The lithium-ion segment held 72.40% share of the market in 2023, due to its superior energy density, long lifespan, and widespread adoption in EVs, consumer electronics, and renewable energy storage systems.

- By End-use Industry (Automotive, Electronics & Appliances, Utilities & Power, Aerospace & Defense, and Others): The automotive segment is projected to reach USD 70.75 billion by 2031, owing to the increasing demand for EVs and the growing emphasis on sustainable transportation solutions.

Battery Chemicals Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 34.09% share of the battery chemicals market in 2023, with a valuation of USD 25.04 billion. This dominant position is attributed to the region's strong manufacturing capabilities, leading position in the EV market, and extensive investments in energy storage technologies, particularly in countries like China, Japan, and South Korea.

Furthermore, ongoing government initiatives and policies that promote green energy solutions, coupled with the region’s focus on expanding EV adoption and battery production, are fostering the market growth. The region’s commitment to innovation in battery technologies, along with the increasing integration of renewable energy sources, further strengthens Asia Pacific's dominant position in the global market.

- In September 2024, Panasonic Energy announced plans to begin the mass production of 4680-format lithium-ion batteries for EVs. The company has also upgraded its Wakayama factory in Western Japan, which will act as the main production facility for the new cells. This initiative aims to enhance EV performance and meet the growing demand for high-capacity batteries.

The battery chemicals industry in North America is poised for significant growth at a robust CAGR of 7.35% over the forecast period. This growth is attributed to the increasing adoption of EVs, advancements in energy storage solutions, and a growing emphasis on reducing carbon emissions and reliance on fossil fuels.

The region is also registering rising investments in battery manufacturing, research and development of next-generation chemistries, and a strong push for energy storage infrastructure to support renewable energy integration. Moreover, government policies promoting clean energy technologies and electric mobility are further driving the demand for battery chemicals, fostering the growth of the market in North America.

- In January 2024, First Phosphate Corp., American Battery Factory Inc. (ABF), and Integrals Power Limited (IPL) announced a strategic partnership to create a fully localized LFP battery supply chain in North America. This collaboration, called LFP Project America, aims to produce up to 40,000 tons of LFP cathode active material (CAM) annually by 2028, supporting ABF's battery manufacturing operations, including its planned gigafactory in Tucson, Arizona.

Regulatory Frameworks

- In the European Union (EU), the EU Batteries Regulation (EU) 2023/1542 governs the entire life cycle of batteries, from production to recycling. It mandates sustainability requirements, including recycled content targets, recycling efficiency standards, and due diligence for the sourcing of critical raw materials like lithium and cobalt.

- In Canada, the Canadian Environmental Protection Act, 1999 (CEPA) regulates toxic substances used in battery manufacturing. It allows the government to assess, restrict, or ban chemicals that pose environmental or health risks.

- In the U.S., the Resource Conservation and Recovery Act (RCRA), administered by the Environmental Protection Agency (EPA), governs the management and disposal of hazardous waste, including battery chemicals. It sets guidelines for the proper treatment, storage, and disposal of battery components to prevent environmental contamination.

Competitive Landscape

The battery chemicals market is characterized by a competitive landscape, featuring a mix of established global chemical companies, battery manufacturers, and emerging players in energy storage technologies. Companies are prioritizing innovation, sustainability, and strategic partnerships to advance battery performance and meet the growing demand for EVs and renewable energy storage.

Leading players are heavily investing in R&D to improve battery chemistries, enhance energy density, and develop safer, more efficient materials. Strategic collaborations with automotive manufacturers, energy providers, and research institutions are enabling companies to expand their market reach and technological capabilities.

The increasing demand for eco-friendly and high-performance batteries is intensifying competition, with market participants focusing on the development of next-generation materials and recycling technologies to meet the evolving needs of industries such as automotive, energy, and consumer electronics.

- In January 2024, RecycLiCo Battery Materials Inc. announced that its recycled lithium carbonate, sourced from battery waste, passed testing for LFP batteries, meeting battery-grade standards. This achievement supports the growing demand for sustainable solutions in the EV market, as RecycLiCo recycles materials like lithium, cobalt, and nickel for reuse in new batteries.

List of Key Companies in Battery Chemicals Market:

- LG Chem

- Albemarle Corporation

- Mitsubishi Chemical Group Corporation

- Panasonic Corporation

- Umicore

- Himadri Speciality Chemical Ltd

- Sumitomo Metal Mining Co., Ltd.

- Ganfeng Lithium Group Co., Ltd

- Vale

- A123 Systems Corp

- CMOC

- Gujarat Fluorochemicals Limited

- Tianqi Lithium

- Sherritt International Corporation

- Norilsk Nickel

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In April 2025, Lyten announced that it began producing battery-grade lithium-metal foil in the U.S., marking a key milestone in expanding domestic battery manufacturing. By using U.S.-sourced lithium materials, the company aims to reduce dependency on foreign critical minerals and bolster the national battery supply chain.

- In January 2025, Amprius Technologies launched its SiCore cell, a breakthrough in battery chemistry that enhances performance for electric mobility. With an energy density of 370 Wh/kg and discharge rates over 3000 W/kg, it is ideal for aviation, drones, and EVs.

- In December 2024, Stellantis and Zeta Energy entered a joint development agreement to advance lithium-sulfur battery technology for EVs. The partnership focuses on creating lighter, more affordable batteries that match the energy density of lithium-ion cells, aiming to improve EV range and performance.

- In December 2023, POSCO Future M began the mass production of high-nickel NCMA single-crystal cathode materials at its Pohang plant in South Korea. This expansion aims to meet the growing demand for EV batteries, with shipments to Ultium Cells starting in late November. The plant's capacity will increase to 106,000 tons by 2026.

- In October 2023, Birla Carbon announced the acquisition of Nanocyl SA, a Belgian manufacturer of multi-wall carbon nanotubes (MWCNTs). The deal strengthens Birla Carbon’s capabilities in advanced materials for lithium-ion batteries and other high-performance conductive applications.

- In June 2023, RecycLiCo Battery Materials and Zenith Chemical Corporation announced a $25 million joint venture to establish a lithium-ion battery recycling plant in Taiwan. The facility was planned to process 2,000 metric tons of battery waste annually into valuable materials like lithium hydroxide and lithium carbonate.