Market Definition

Base oil is a fundamental component in the formulation of lubricants, including both automotive and industrial oils. Serving as the primary foundation, it provides critical properties such as viscosity, lubricity, and stability, ensuring optimal performance across a wide range of applications.

Base Oil Market Overview

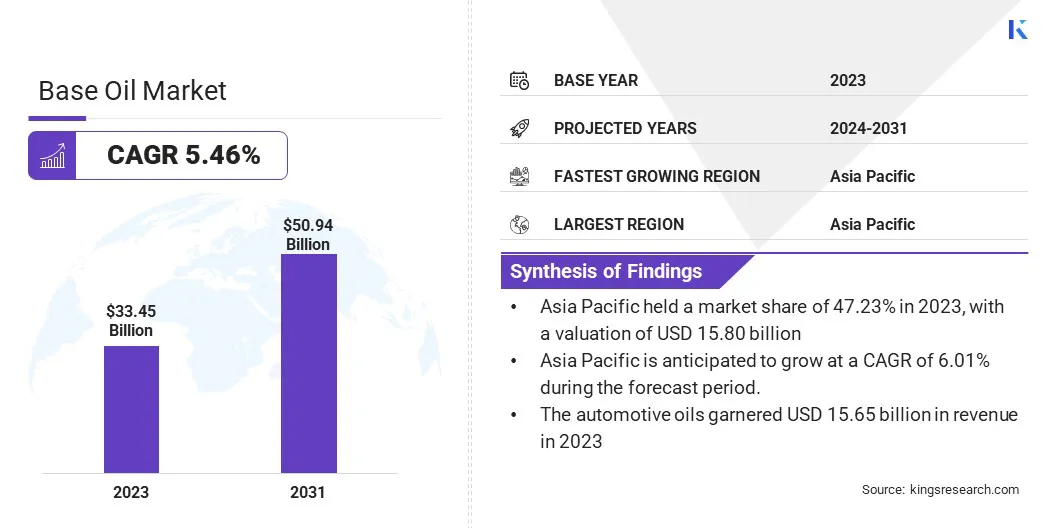

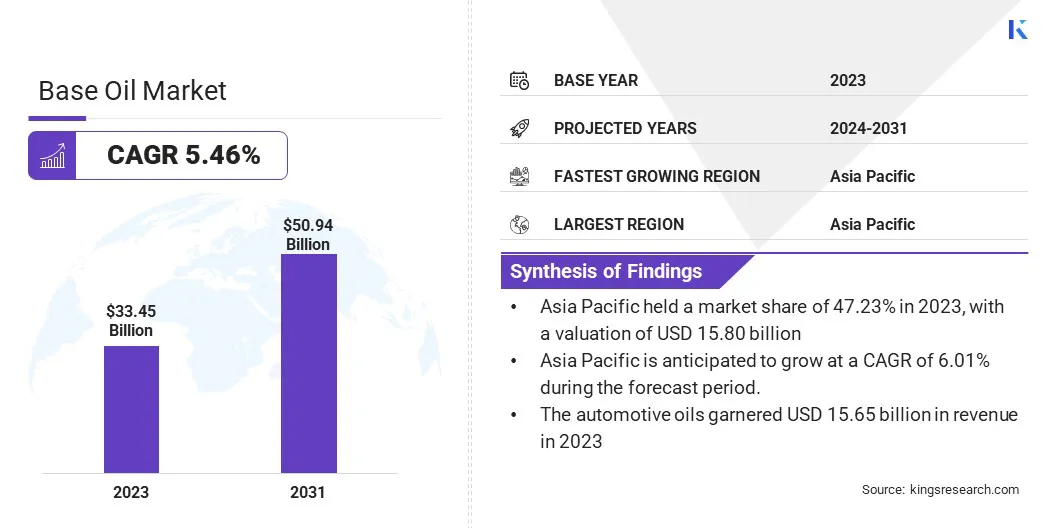

The global base oil market size was valued at USD 33.45 billion in 2023, which is estimated to be valued at USD 35.12 billion in 2024 and reach USD 50.94 billion by 2031, growing at a CAGR of 5.46% from 2024 to 2031.

The market is expanding, due to rapid industrialization in emerging economies and the growing adoption of synthetic and bio-based oils driven by environmental regulations.

The increasing utilization of these oils across industries such as chemicals, metallurgy, and heavy equipment has spurred market growth. Companies are implementing strategies to enhance their productivity by offering high-quality products to their consumers.

Major companies operating in the base oil market are Abu Dhabi National Oil Company, Arabo Impex Pvt. Ltd., Aramco, Chevron Corporation., Exxon Mobil Corporation., GS Caltex Corporation., NYNAS AB, Petro‐Canada Lubricants LLC., PETRONAS Lubricants International, Repsol, Shell Plc, Calumet, Inc., Motiva Enterprises LLC, SK Enmove Co., Ltd., and Phillips 66 Company.

The market is registering robust growth, due to the growing demand for synthetic lubricants. Synthetic lubricants deliver enhanced performance, especially in extreme temperatures and high-pressure conditions, which makes them well-suited for automotive and industrial sectors.

The adoption of synthetic lubricants is on the rise as industries prioritize durability and efficiency to improve machinery performance and reduce maintenance expenses. Increased awareness of their benefits, such as improved fuel efficiency and reduced emissions, is fostering the demand for higher-quality base oils in their formulation.

- In 2024, AMSOIL unveiled its new Synthetic-Blend Motor Oil series, available in 0W-20, 5W-20, and 5W-30 viscosities, specifically designed for mechanics. This advanced product contains over 50% synthetic base oils, offering superior protection and performance compared to conventional motor oils. It is engineered to fulfil the demands of modern engines, including those with direct injection and turbocharging technologies.

Key Highlights:

- The global base oil market size was valued at USD 33.45 billion in 2023.

- The market is projected to grow at a CAGR of 5.46% from 2024 to 2031.

- Asia Pacific held a market share of 47.23% in 2023, with a valuation of USD 15.80 billion.

- The group I segment garnered USD 13.69 billion in revenue in 2023.

- The automotive oils segment is expected to reach USD 26.11 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.01% during the forecast period.

Market Driver

"Rising Demand Across Automotive Sector"

The rising demand for base oils and high-performance lubricants across the automotive sector is fostering the base oil market growth, owing to a rise in vehicle production, particularly in developing economies.

These oils, as a key component in the formulation of automotive lubricants, play a crucial role in enhancing engine efficiency, reducing friction, and ensuring smooth operation. Furthermore, advancements in lubricant technology and a shift toward premium-grade oils with improved viscosity and oxidation stability are further driving the market.

The growing emphasis on fuel efficiency, emissions control, and sustainability is also prompting manufacturers to develop innovative, high-quality base oils.

- For instance, in September 2022, OQ Chemicals launched its latest ester base oil, Oxlube L7-NPG, developed to enhance the performance and efficiency of electric vehicles (EVs). This innovative product allows lubricant manufacturers to create optimized e-driveline lubricants that feature low viscosity, a high flash point, and excellent biodegradability. Due to its low friction properties, lubricants formulated with Oxlube L7-NPG can significantly improve energy efficiency while reducing wear and maintenance requirements.

Market Challenge

"Variations in Crude Oil Prices"

The variations in crude oil prices can pose a significant challenge for the market, as crude oil is the main source for base oil production. Variations in crude prices impact refining costs, supply chain stability, and market pricing, which, in turn, create uncertainty for manufacturers and end users.

Price volatility can result from geopolitical tensions, changes in production quotas, global economic conditions, and shifts in demand dynamics.

Key market players adopt strategies such as long-term supply agreements, hedging mechanisms, diversification of feedstock sources, and investment in technology to enhance refining efficiency. Moreover, businesses can explore alternative base oil production methods, such as bio-based or synthetic base oils, to reduce dependency on crude oil price movements.

Implementing robust risk management frameworks and maintaining flexible pricing strategies assist companies in tackling price fluctuations while ensuring profitability and supply chain resilience.

Market Trend

"Surging Industrial Activities to Develop New Technologies"

The surging industrial activities to develop new technologies is propelling the market. As industries expand and new manufacturing facilities are established, the demand for lubricants and oils rises, driving product demand. This growth spans across multiple sectors, including manufacturing, automotive, and construction.

The expansion of these sectors leads to higher utilization of machinery and equipment, all of which require regular lubrication to ensure efficiency and extend their operational lifespan. Companies in the market are focusing on manufacturing sustainable and eco-friendly lubricants with high-quality performance while reducing environmental impact.

- For instance, in February 2023, Neste, a Finland-based company in oil refining and marketing, launched a new line of sustainable lubricants made from renewable or re-refined base oils. These innovative lubricants are designed to enhance environmental sustainability and support the reduction of carbon emissions. They are produced using renewable and sustainable feedstocks, such as vegetable oils and animal fats, as an alternative to traditional petroleum-based sources.

With emerging economies accelerating industrial development and developed nations prioritizing the maintenance of manufacturing growth, global demand for lubricants and base stock is anticipated to continue its upward trend.

Base Oil Market Report Snapshot

| Segmentation |

Details |

| By Product |

Group I, Group II, Group III, Group IV, Group V |

| By Application |

Automotive Oils, Process Oils, Metalworking Fluids, Hydraulic Oils, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Group I, Group II, Group III, Group IV, Group V): The group I segment earned USD 13.69 billion in 2023, as they are heavily used in lubricants and automotive, owing to its lubrication properties, low volatility, high viscosity index, and affordability and simple processing.

- By Application (Automotive Oils, Process Oils, Metalworking Fluids, Hydraulic Oils, Others): The automotive oils segment held 46.78% share of the market in 2023, due to the surging demand for gear oil, engine oil, and greases for oiling automobile components.

Base Oil Market Regional Analysis

Asia Pacific accounted for a significant base oil market share of around 47.23% in 2023, valued at USD 15.80 billion. Growing urbanization and the expanding manufacturing and automotive sectors are driving the market in the region.

The increasing demand for base oils is fueled by the expanding need for lubricants across multiple industries, as well as infrastructure development and higher vehicle production rates. This robust demand, combined with continuous investments in refining capacity, is fostering market growth.

The presence of major refineries and base oil production facilities ensures a reliable supply of products to meet the rising demand across diverse sectors in the region, which is driving the adoption of these oils. Governments in the region are offering incentives and funding to boost production capacity.

- For instance, in September 2023, Bharat Petroleum Corporation Limited (BPCL) approved an investment of USD 6 billion from the Government of India to enhance petrochemical production capacity, which will include the installation of an ethylene cracker at its Bina refinery in Madhya Pradesh. Furthermore, BPCL plans to invest in the development of storage facilities and pipelines for petroleum oil lubricants (POL) and lube base oil stocks (LOBS) at Rasayani, Maharashtra. These initiatives are designed to expand the company's petrochemical capacity while integrating sustainable energy solutions, such as wind power, into their refinery operations.

However, the base oil market in Europe is anticipated to register the fastest growth, at a projected CAGR of 5.85%. The expanding automotive industry and robust industrial activities are fostering the growth of the market in the region.

Countries such as France, Germany, and the UK are home to some of the largest manufacturing and automotive hubs globally, driving substantial demand for high-quality base oils.

The growing need for sustainable, energy-efficient lubricants, coupled with stricter environmental regulations, is accelerating the demand for premium base oils, particularly those derived from Group II and Group III base stocks. Furthermore, the expansion of the renewable energy and EV sectors has prompted a shift in lubricant formulations, further fueling the demand for specialized base oils.

- In August 2024, the European Automobile Manufacturers' Association (EAMA), a Belgium-based organization, reported a 3.9% increase in new car registrations for the first seven months of the year, surpassing 6.5 million units. The largest markets within the bloc showed positive but moderate growth, with Spain (+5.6%), Italy (+5.2%), Germany (+4.3%), and France (+2.2%) all experiencing increases.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. government regulates base oils through a combination of federal and state laws, including the National Environmental Policy Act (NEPA) and the Clean Water Act. These laws are intended to protect the environment and ensure the responsible development of oil & gas resources.

- The U.S. Federal Government regulates the transportation of oil & natural gas under two different regimes both administered by the Federal Energy Regulatory Commission (FERC). The price of oil transportation is based on an index that FERC sets and revises from time to time.

- In Europe, the primary government regulation governing base oils is the REACH regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals), which requires all base oils produced or imported into the EU to be registered, ensuring safety and proper handling of chemicals throughout the supply chain, including detailed safety data sheets for each substance; essentially meaning that any company importing or manufacturing base oils in Europe must comply with REACH regulations regarding chemical safety and registration.

- The Government of India has regulated the Hazardous and Other Wastes (Management and Transboundary Movement) Second Amendment Rules, 2023, which introduces Chapter VII, "Extended Producer Responsibility for Used Oil," through MoEF&CC Notification No. G.S.R 677(E) dated September 18, 2023. These rules come into effect on April 1, 2024. According to the rules, producers of base oil or lubricating oil, as well as importers of used oil, are required to fulfill their Extended Producer Responsibility (EPR) obligations. This includes meeting specific recycling targets for used oil within the country by purchasing EPR certificates from registered recyclers to ensure the environmentally sound management of used oil.

- In China, the government regulates base oils through a series of laws and policies, which include price caps, import quotas, and tax exemptions. These measures are designed to ensure a stable oil supply and mitigate the effects of fluctuations in oil prices.

- In Japan, the Ministry of Economy, Trade, and Industry (METI) regulates base oils. The METI regulates the production and exploration of oil & gas in Japan. Oil importers, oil refiners and specified oil distributors must prepare oil production plans and submit them to the METI.

Competitive Landscape:

The base oil market is characterized by a number of participants, including both established corporations and rising organisations. Key market players are focusing on the expansion of their production capacities and investing in advanced refining technologies to improve product quality and meet the increasing demand for high-performance oils.

They are focusing on the development of eco-friendly and synthetic base oils to comply with stricter environmental regulations and sustainability objectives. Companies are pursuing strategic collaborations and mergers to enhance their market position and expand their geographic reach.

As the market evolves toward sustainability and performance innovation, organizations are leveraging cutting-edge technologies to maintain a competitive edge and meet emerging industry standards.

- For instance, in March 2024, Cerilon entered into technology licensing agreements with Chevron to utilize Chevron’s hydroprocessing technologies at its gas-to-liquids (GTL) facility in North Dakota. This facility offers ultra-low sulfur diesel and Group III+ base oils, which are high-quality lubricants known for their superior performance. The project represents a significant advancement in the conversion of natural gas into premium synthetic products.

List of Key Companies in Base Oil Market:

- Abu Dhabi National Oil Company

- Arabo Impex Pvt. Ltd.

- Aramco

- Chevron Corporation.

- Exxon Mobil Corporation.

- GS Caltex Corporation.

- NYNAS AB

- Petro‐Canada Lubricants LLC.

- PETRONAS Lubricants International

- Repsol

- Shell Plc

- Calumet, Inc.

- Motiva Enterprises LLC

- SK Enmove Co., Ltd.

- Phillips 66 Company

Recent Developments (Agreement/Partnership)

- In October 2023, Idemitsu Kosan Co., Ltd. entered into a Memorandum of Understanding (MOU) with Saudi Aramco Base Oil Company - Luberef to establish a partnership for the supply of high-quality refined lubricant base oil, specifically Grade III. The agreement outlines plan to construct a new Grade III manufacturing facility in Saudi Arabia, ensuring a long-term, stable supply of Grade III base oil for both companies.

- In October 2023, Gulf Oil Lubricants India, a subsidiary of the Hinduja Group, launched the S-OIL SEVEN range through a partnership with S-Oil to bring High Technology Korean products to India. This extensive product portfolio includes various variants of passenger car gasoline engine oils and passenger car diesel engine oil. The S-OIL SEVEN range offers a selection of fully synthetic, semi-synthetic, and premium lubricants, utilizing high-viscosity index attributes within Group II/III class base stocks.

- In September 2023, PETRONAS Lubricants International, in partnership with PT Kilang Pertamina Internasional, entered into a Joint Study Agreement (JSA) to assess the potential for developing a new greenfield lube base oil facility at Refinery Unit (RU) IV Cilacap, Central Java. This collaboration is expected to deliver a comprehensive technical and feasibility study. Moreover, it aims to address the growing demand in the Indonesian market, as well as the expanding regional markets, including China and Southeast Asia.