Enquire Now

Basalt Fiber Market Size, Share, Growth & Industry Analysis, By Product Form (Roving, Yarn, Fabric, Reinforcement, Others), By Form (Continuous Fiber, Chopped Fiber), By Fiber Specification (Continuous Basalt Fibers, Super Thin Basalt Fibers), By Application, By End Use Industry and Regional Analysis, 2025-2032

Pages: 230 | Base Year: 2024 | Release: August 2025 | Author: Versha V.

Key strategic points

Basalt fiber is a high-performance material produced by melting natural basalt rock and extruding it into fine filaments. It provides high mechanical strength, thermal resistance, and chemical stability.

The market includes products such as roving, yarn, fabric, and reinforcement available in continuous and chopped forms. These fibers are used in composite and non-composite applications across construction, automotive, aerospace, and electronics to enhance durability, reduce weight, and improve thermal and structural performance.

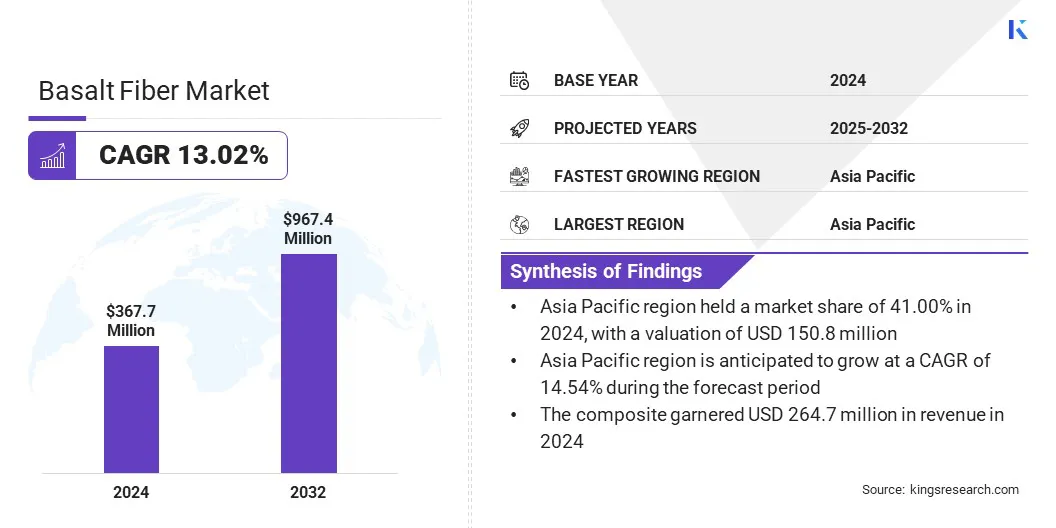

The global basalt fiber market size was valued at USD 367.7 million in 2024 and is projected to grow from USD 410.7 million in 2025 to USD 967.4 million by 2032, exhibiting a CAGR of 13.02% over the forecast period.

This growth is attributed to the growing demand for lightweight and conductive materials across the automotive, aerospace, and electrical sectors. The rising adoption of basalt fiber in advanced composite systems is expanding its application in high-strength, corrosion-resistant, and thermally stable components.

Major companies operating in the global basalt fiber market are Kamenny Vek, ARMBASALT, Hengdian Group Holdings Limited, Polotsk-Steklovolokno, Technobasalt-Invest LLC, Arab Basalt Fiber, Basalt Fiber Tech, CARBON Group, Sudaglass Fiber Technology, Basalt Engineering, LLC, INCOTELOGY GmbH, Final Advanced Materials, Deutsche Basalt Faser GmbH, LAVAintel, and Basaltex.

The market growth is propelled by advancements in hybrid fiber technologies that combine basalt with carbon or glass fibers to enhance mechanical performance and cost efficiency. Hybrid solutions deliver improved strength-to-weight ratios, thermal stability, and durability, while lowering overall material costs.

Industries such as aerospace, automotive, and industrial manufacturing are increasingly adopting hybrid composites for structural applications that demand optimal performance along with economic viability. This shift is encouraging product innovation and expanding the functional scope of basalt fiber in high-performance environments.

Growing Demand for Lightweight & Conductive Materials

Growth in the basalt fiber market is attributed to the increasing demand for lightweight, conductive materials across automotive, aerospace, and electrical sectors. Basalt fiber offers a high strength-to-weight ratio and stable thermal performance, which supports weight reduction in structural components without compromising durability.

The material is gaining in applications requiring electromagnetic interference (EMI) and radio-frequency interference (RFI) shielding, where its conductivity and thermal stability are critical. It is also used in thermal management systems for electric vehicles, consumer electronics, and energy storage, where efficient heat dissipation and structural integrity are essential.

High Production Costs Limiting Basalt Fiber Adoption

A major challenge in the basalt fiber market is the high production cost associated with energy-intensive manufacturing and specialized equipment. These costs make basalt fiber less competitive compared to conventional materials like glass fiber. This limits its adoption in large-volume applications, despite superior performance characteristics.

To address this challenge, manufacturers are investing in process optimization and energy-efficient technologies to reduce operational expenses. Market players are also establishing production facilities closer to basalt rock reserves to cut logistics and raw material handling costs.

Rising Adoption of Basalt Fiber in Advanced Composite Systems

The basalt fiber market is witnessing increased integration of basalt fiber into thermoplastic and thermoset composite systems. This trend is driven by the rising demand for durable and lightweight materials that deliver high thermal and chemical resistance across industrial applications.

Manufacturers are adopting basalt fiber to enhance the structural performance of composite components used in automotive, aerospace, and equipment manufacturing. The material’s compatibility with multiple resin types supports its broader use in engineered composite solutions.

|

Segmentation |

Details |

|

By Product Form |

Roving, Yarn, Fabric, Reinforcement, Others |

|

By Form |

Continuous Fiber, Chopped Fiber |

|

By Fiber Specification |

Continuous Basalt Fibers, Super Thin Basalt Fibers, Staple Thin Basalt Fibers |

|

By Application |

Composite, Non-Composite |

|

By End Use Industry |

Construction & Infrastructure, Automotive & Transportation, Aerospace & Defense, Electrical & Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific basalt fiber market share stood at 41.00% in 2024, with a valuation of USD 150.8 million. This dominance is attributed to the rising demand from the construction and infrastructure sector, particularly in China and India, where large-scale urban development and transportation projects are under development.

The availability of raw basalt, low production costs, and expanding domestic manufacturing is driving the steady growth of basalt fiber production in the region. Additionally, the increasing use of lightweight and corrosion-resistant materials in automotive and industrial applications continues to strengthen regional demand.

Europe is poised to grow at a significant CAGR of 11.75% over the forecast period. The growth is reflected by the rising investment in advanced material research and funding initiatives that promote the use of sustainable fiber solutions.

Governments and industry players are actively supporting the replacement of traditional reinforcement materials with basalt fiber to meet environmental regulations and improve performance. The region is witnessing increased adoption in automotive and aerospace industries, where lightweight and durable materials are prioritized for fuel efficiency and design innovation.

Key players in the global basalt fiber market are actively focusing on product launches and geographic expansion to strengthen their market position. Companies are introducing advanced basalt fiber products with enhanced thermal resistance, tensile strength, and compatibility with polymer matrices to meet the specific demands of construction, automotive, and aerospace industries. Several players are also expanding production facilities and establishing distribution networks in high-growth regions such as Asia Pacific and Eastern Europe. These strategies aim to increase product availability, reduce lead times, and cater to the growing demand from local end-use industries.

Frequently Asked Questions