Market Definition

The market encompasses cloud computing services that provide dedicated physical servers, known as bare metal servers . Unlike traditional virtualized cloud servers that share hardware, bare metal servers offer exclusive access yo an entirely physical server, ensuring full control over resources.

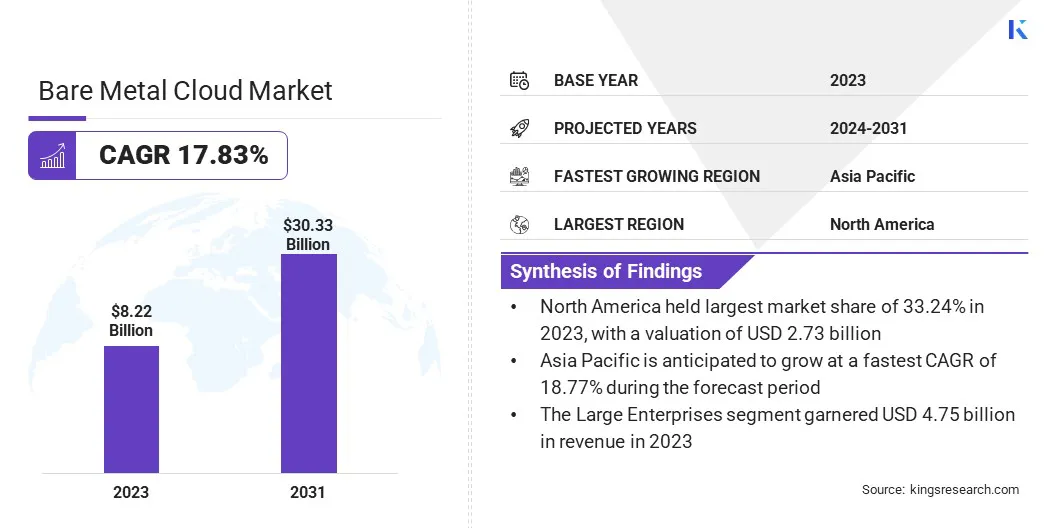

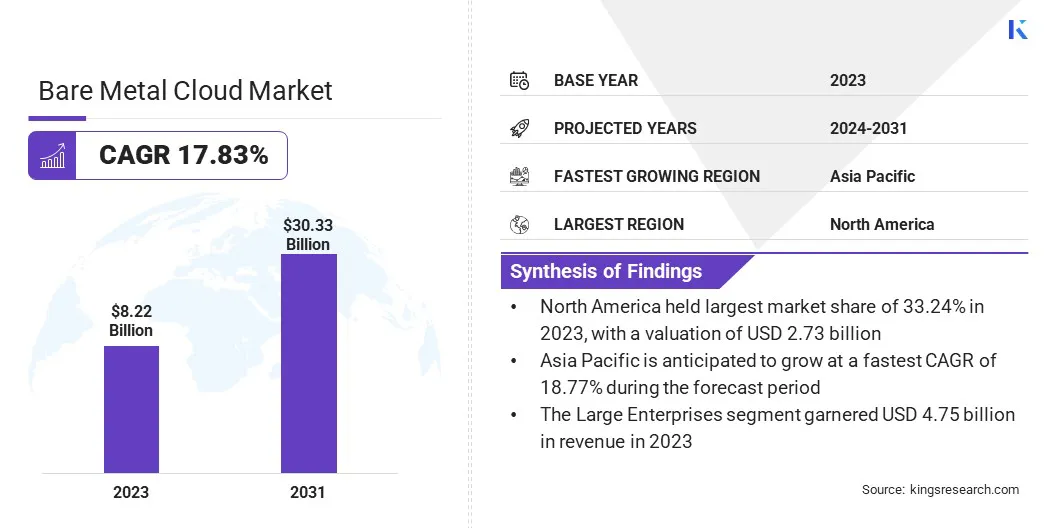

Global bare metal cloud market size was valued at USD 8.22 billion in 2023, which is estimated to be valued at USD 9.61 billion in 2024 and reach USD 30.33 billion by 2031, growing at a CAGR of 17.83% from 2024 to 2031.

The growing preference for dedicated, non-virtualized resources is bolstering this growth. Organizations are adopting bare metal solutions for superior performance, enhanced security, and greater control over virtualized environments.

Major companies operating in the bare metal cloud industry are IBM, Oracle, Amazon Web Services, Inc, Lumen Technologies, Rackspace Technology, HorizonIQ, Gcore, Alibaba Cloud, Scaleway SAS, Hewlett Packard Enterprise Development LP, OVH SAS, Limestone Networks, Inc., Huawei Cloud Computing Technologies Co., Ltd., DartPoints, BIGSTEP, and others.

The market is evolving with a growing focus on high-performance computing for data-intensive applications. Enterprises are increasingly adopting these services to run workloads that require greater processing power and customization, such as AI and big data analytics.

With low latency and direct access to hardware, bare metal cloud solutions are essential for industries demanding precision and reliability in their operations. As cloud technologies advance, these offerings are becoming integral to businesses seeking advanced infrastructure.

- In October 2023, Amazon EC2 launched new bare metal instances (C7i, M7i, R7i, R7iz) powered by custom 4th generation Intel Xeon processors. These instances enhance performance for specialized workloads, legacy applications, and licensing-restricted business-critical systems.

Key Highlights:

- The bare metal cloud industry size was recorded at USD 22 billion in 2023.

- The market is projected to grow at a CAGR of 17.83% from 2024 to 2031.

- North America held a share of 33.24% in 2023, USD 2.73 billion.

- The networking services segment garnered USD 2.48 billion in revenue in 2023.

- The large enterprises segment is expected to reach USD 17.51 billion by 2031.

- The healthcare segment is anticipated to witness the fastest CAGR of 17.99% through the projection period

- Asia Pacific is anticipated to grow at a CAGR of 18.77% over the forecast period.

Market Driver

"Surging Demand for Dedicated Resources"

As businesses increasingly prioritize performance, security, and control, the demand for dedicated, non-virtualized resources in the cloud is growing. Unlike virtualized solutions, which share hardware resources among multiple customers, a bare metal cloud offers physical servers exclusively for one user, eliminating the risks associated with resource contention.

This enhances performance, reduces latency, and strengthens security. Industries such as finance, healthcare, and gaming are fueling the growth of the bare metal cloud market.

- In November 2024, DigitalOcean introduced Bare Metal GPUs, offering dedicated infrastructure designed for AI/ML workloads. These GPUs provide customers with full access to the hardware, ideal for large-scale model training, real-time inference, and complex setups.

Market Challenge

"Security Risks"

A significant challenge hampering the expansion of the bare metal cloud market is managing security, as these environments require meticulous configuration and continuous monitoring to prevent vulnerabilities.

Unlike virtualized environments, where security is often handled at multiple layers, bare metal setups require users to secure hardware, software, and network configurations.

To address this challenge, organizations can leverage automated security tools, implement strict access controls, and partner with providers offering enhanced security features such as hardware-based encryption and regular vulnerability assessments.

Market Trend

"Growing Use in Gaming"

Rising use in the gaming industry is emerging as a notable trend in the bare metal cloud server market , supported by the need for low latency and high-performance computing. These servers offer dedicated resources, reducing delays and enhancing server reliability.

These servers provide better control over hardware, enabling game developers to optimize performance for real-time multiplayer experiences, large-scale events, and global player bases, making them a preferred choice for game hosting and online gaming platforms.

- In December 2024, OVHcloud launched its third generation of dedicated Bare Metal game servers powered by AMD EPYC 4004 processors. These servers offer high performance, low latency, and optimized DDoS protection tailored to gaming workloads. With rapid deployment and global coverage, they ensure smooth, reliable gaming experiences.

|

Segmentation

|

Details

|

|

By Service Type

|

Compute Services, Networking Services, Database Services, Security Services, Storage Services, Others

|

|

By Organization Size

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

BFSI, IT & Telecommunications, Healthcare, Manufacturing, Media & Entertainment, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Compute Services, Networking Services, Database Services, Security Services, Storage Services, and Others): The networking services segment earned USD 2.48 billion in 2023, fueled by demand for secure, high-performance cloud networking solutions.

- By Organization Size (Large Enterprises and Small & Medium Enterprises): The large enterprises segment held a share of 57.77% in 2023, as large-scale operations require dedicated bare metal infrastructure for optimized performance.

- By Vertical (BFSI, IT & Telecommunications, Healthcare, Manufacturing, Media & Entertainment, Government, and Others): The BFSI segment is projected to reach USD 7.45 billion by 2031, largely attributed to increasing security and performance requirements in financial services.

Bare Metal Cloud Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America bare metal cloud market share stood at around 33.24% in 2023, valued at USD 2.73 billion. This dominance is reinforced by the presence of leading cloud service providers and advanced technological infrastructure.

The regional market benefits from a high demand for high-performance computing, data security, and low-latency services, particularly in sectors such as finance, gaming, and healthcare.

A well-established network of data centers in the region is further boosting the adoption of bare metal cloud services among businesses seeking reliability, scalability, and performance.

- In July 2024, OVHcloud launched its advanced Bare Metal Advances servers powered by AMD EPYC 4004 processors, offering enhanced performance and network capabilities. Available in the U.S. and globally, these servers provide unmetered bandwidth, improved private network speeds, and robust data protection for businesses.

Asia Pacific bare metal cloud industry is likely to grow at a robust CAGR of 18.77% over the forecast period. This growth is bolstered by rapid digital transformation across emerging economies.

Countries such as China, India, and Japan are adopting bare metal solutions to support growing industries such as e-commerce, gaming, and manufacturing. The region's increasing demand for high-performance computing, data privacy, and customized infrastructure solutions is contributing to this growth.

- In February 2025, Liquid Web expanded its presence in Asia Pacific by launching new bare metal server locations in Sydney. This initiative enhances global reach, improves speed, reduces latency, and delivers high-performance hosting solutions for businesses.

Regulatory Frameworks

- In the U.S., compliance with the National Institute of Standards and Technology (NIST) guidelines is essential for ensuring security, as NIST promotes innovation, enhances economic security, and establishes industry standards.

- In the U.S., the Clarifying Lawful Overseas Use of Data (CLOUD) Act enables foreign partners to directly access electronic evidence held by U.S. providers, enhancing global law enforcement collaboration while maintaining privacy and civil liberties in criminal investigations.

- In the EU, the General Data Protection Regulation (GDPR) outlines strict data privacy laws, requiring companies to manage personal data carefully, either storing it within the EU or providing mechanisms for secure cross-border data transfers.

Competitive Landscape

Companies in the bare metal cloud industry are providing high-performance, energy-efficient infrastructure to meet the growing demand for AI, cloud-native applications, and data-intensive workloads.

They are adopting energy-efficient processors, offering scalable computing solutions, and enhancing network performance to deliver faster, more reliable services. These innovations are crucial for businesses seeking optimal performance, lower latency, and reduced total cost of ownership in their cloud environments.

- In August 2023, phoenixNAP expanded its Bare Metal Cloud platform by deploying HPE ProLiant RL300 Gen11 servers powered by energy-efficient Ampere processors. This enhancement improves performance and energy efficiency for AI, cloud gaming, and cloud-native workloads across 18 data centers worldwide.

List of Key Companies in Bare Metal Cloud Market:

- IBM

- Oracle

- Amazon Web Services, Inc

- Lumen Technologies

- Rackspace Technology

- HorizonIQ

- Gcore

- Alibaba Cloud

- Scaleway SAS

- Hewlett Packard Enterprise Development LP

- OVH SAS

- Limestone Networks, Inc.

- Huawei Cloud Computing Technologies Co., Ltd.

- DartPoints

- BIGSTEP

Recent Developments (Partnerships/New Product Launch)

- In Sept 2024, Oracle introduced the first zettascale cloud computing clusters, featuring bare metal instances with NVIDIA GPUs. This initiative aims to address the growing demand for high-performance, dedicated resources in the cloud, particularly for AI and compute-intensive workloads.

- In March 2023, Oracle expanded its collaboration with NVIDIA to launch OCI Supercluster with support for 4,096 bare metal instances and 32,768 GPUs. This development enhances AI-driven workloads, showcasing significant growth in the market through scalable, high-performance solutions.

- In June 2024, Oracle, Microsoft, and OpenAI partnered to extend the Microsoft Azure AI platform to Oracle Cloud Infrastructure (OCI), enhancing OpenAI’s capacity. This collaboration aims to offer scalable, high-performance AI infrastructure for generative models and workloads.

- In September 2023, IBM introduced the latest SmartNIC update for IBM Cloud Bare Metal Servers for VPC, enhancing networking, storage, and security across various workloads. This innovation improves performance and connectivity, supporting scalable file storage and private connectivity.