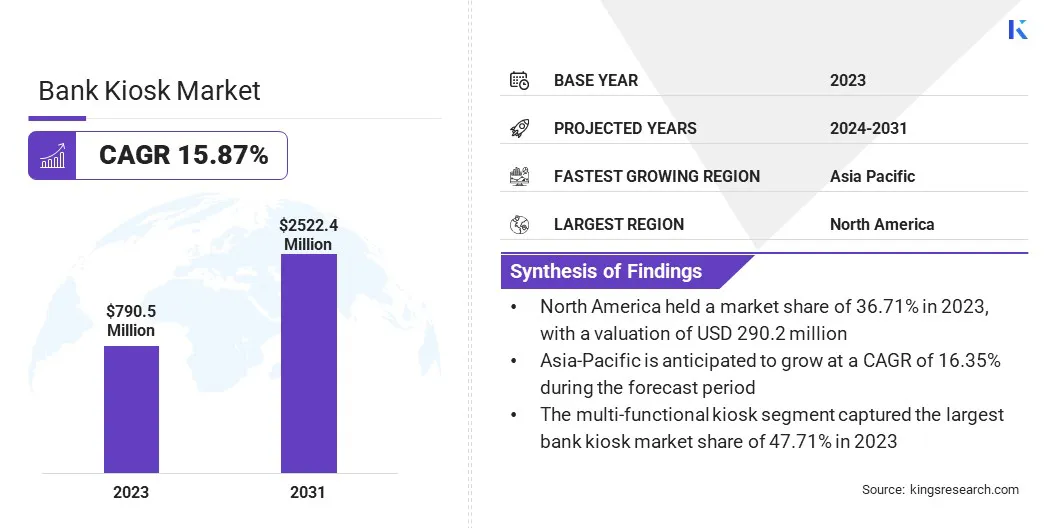

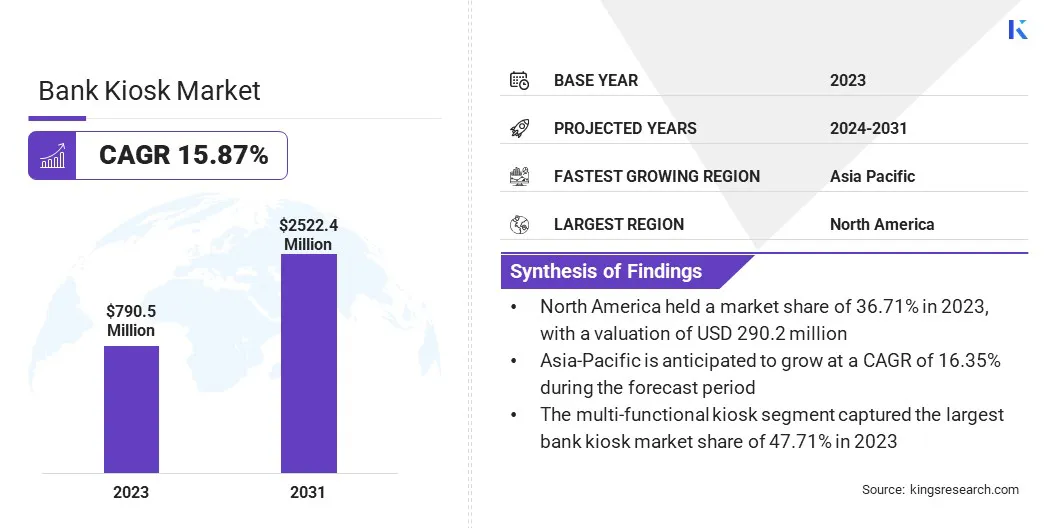

Bank Kiosk Market Size

The global Bank Kiosk Market size was valued at USD 790.5 million in 2023 and is projected to grow from USD 899.7 million in 2024 to USD 2,522.4 million by 2031, exhibiting a CAGR of 15.87% during the forecast period. Modernized payment processing platforms and growing demand for contactless transactions is driving the market.

In the scope of work, the report includes services offered by companies such as Bank Muscat SAOG, Diebold Nixdorf, Incorporated, Fiserv, Inc., GLORY LTD., Brink’s Incorporated, Hitachi Payment Services Pvt. Ltd., VeriFone, Inc., Auriga Spa, KAL ATM Software GmbH, NCR Atleos, and others.

The introduction of UPI-ATM has significantly transformed the banking and financial services sector, blending the convenience of Unified Payment Interface (UPI) with traditional Automated Teller Machines (ATMs). UPI-ATM allows users to withdraw cash by simply scanning a QR code displayed on the ATM screen using their UPI-enabled mobile app.

This eliminates the need for physical debit or credit cards and enhances security by reducing the risk of card skimming and fraud, while also catering to the increasing demand for contactless transactions.

- In September 2023, Hitachi Payment Services launched India's first UPI ATM, as a White Label ATM, in partnership with NPCI. This innovative ATM enhances customer security by enabling card-less cash withdrawals, underscoring the company’s commitment to advancing secure and efficient payment solutions.

The opportunity presented by UPI-ATMs lies in their potential to further democratize banking services, particularly in emerging markets where smartphone penetration is high, however, access to traditional banking infrastructure remains limited.

As of August 2024, NCBI reports that India has 24 banks operating as issuers and 16 banks functioning as acquirers for UPI-ATM withdrawals. Furthermore, there are 5 cooperative banks and 13 regional rural banks actively issuing UPI-ATM cash withdrawals.

Financial institutions can leverage UPI-ATM technology to reach a broader customer base, offering a seamless and secure banking experience. This technology can further reduce the operational costs associated with card issuance and maintenance, driving efficiency and profitability for banks.

A bank kiosk is a self-service terminal that allows customers to perform a variety of banking transactions without the need for direct interaction with a bank teller.

These kiosks are equipped with a user-friendly interface and are often strategically placed in high-traffic areas such as shopping malls, airports, and bank branches to provide convenient access to banking services. Bank kiosks come in various types, such as cash dispensers, cash deposit machines, multi-function kiosks, and interactive teller machines (ITMs).

Cash dispensers primarily allow customers to withdraw cash, while cash deposit machines are used to deposit cash directly into the accounts. Multi-function kiosks combine these services with additional features like bill payments, fund transfers, and account inquiries.

Interactive Teller Machines (ITMs) also provide advanced offering, enabling live video interaction with a remote teller for more complex transactions. These kiosks offer a wide range of services, including balance inquiries, check deposits, loan applications, and even financial advice, enhancing customer convenience and improving operational efficiency for banks.

Analyst’s Review

The current growth rate of the bank kiosk market indicates the strategic importance of self-service banking technologies in the digital transformation of financial institutions. Companies operating in this space are increasingly focused on innovation, developing advanced kiosks that integrate AI, biometrics, and other cutting-edge technologies to enhance security and user experience.

The key players are adopting strategies that emphasize scalability to expand their kiosk networks across urban and rural areas to maximize market penetration.

- Brink’s Netherlands commenced full in-house maintenance services for Geldmaat’s 1,700 self-service cash devices, starting January 2024. Geldmaat, operated by a joint venture of ABN AMRO, ING, and Rabobank, oversees 85% of all ATMs in the Netherlands.

Additionally, there is a strong emphasis on partnerships with FinTech companies and technology providers to co-develop next-generation kiosks that offer a seamless blend of digital and physical banking experiences. These companies are also investing in R&D to create customizable solutions to cater to the specific needs of different demographics, driving customer engagement and retention.

As the market evolves, these companies should focus on staying ahead of regulatory changes, ensuring data security, and continually adapting to shifting consumer preferences toward contactless and mobile-first banking solutions. The emphasis on sustainability and cost efficiency in kiosk operations is also becoming increasingly critical as companies look to optimize their value proposition in a competitive market.

Bank Kiosk Market Growth Factors

Modernizing payment processing platforms is a critical driver in the banking and financial services industry, reflecting the need for faster, more secure, and scalable solutions to meet evolving consumer expectations. As digital transactions proliferate, the demand for robust and agile payment processing systems will intensify.

Traditional payment infrastructure, often burdened by legacy technology, struggle to keep up with the volume and complexity of modern transactions.

By modernizing these platforms, financial institutions can significantly enhance their processing speed, reduce transaction costs, and improve overall customer satisfaction. This shift would typically involve the adoption of cloud-based architecture, the integration of real-time processing capabilities, and the deployment of advanced analytics to detect and prevent fraud.

- In May 2024, Diebold Nixdorf announced that Bankart, Slovenia's leading payment processor, is transitioning its services to Diebold’s Vynamic Transaction Middleware. This cloud-native solution will modernize payment capabilities across ATMs, POS terminals, and e-commerce for 20 banks in southeast Europe.

Moreover, modern platforms are designed to be more flexible, allowing for the seamless integration of new payment methods, such as digital wallets and cryptocurrencies. This not only caters to the current demand but also future-proofs the institution’s payment processing capabilities.

Financial institutions that invest in modernizing their payment processing platforms are better positioned to deliver a superior customer experience, maintain competitive advantage, and navigate the increasingly complex regulatory landscape.

Concerns regarding security and privacy are the most significant challenges faced by the bank kiosk market. As these self-service terminals handle sensitive financial transactions, they are prime targets for cyberattacks, fraud, and data breaches.

The proliferation of advanced technologies in kiosks, such as biometric authentication and AI-driven analytics, while enhancing convenience and efficiency, also introduces new vulnerabilities.

Data protection laws and regulations across various regions have become increasingly stringent, placing additional pressure on banks to ensure that their kiosks are secure. Failure to adequately safeguard customer data can result in severe financial penalties, reputational damage, and loss of customer trust.

To mitigate these risks, banks and kiosk manufacturers must implement robust security protocols, including end-to-end encryption, multi-factor authentication, and regular security audits.

Additionally, leveraging artificial intelligence and machine learning to detect and respond to potential threats in real-time is critical. Educating customers on safe usage practices also plays a crucial role in minimizing the risk of security breaches. By proactively addressing security and privacy concerns, banks can enhance customer confidence and ensure the long-term viability of self-service kiosks.

Bank Kiosk Market Trends

The expansion of self-service capabilities in the banking sector is a key trend shaping the future of customer interactions with financial institutions. As consumers shift their preference toward convenience and autonomy, banks are increasingly investing in technologies that allow them to perform a wide range of transactions without direct human assistance.

Self-service kiosks, once limited to basic functions like cash withdrawals and deposits, have now evolved to offer a comprehensive suite of services, including account management, loan applications, bill payments, and even financial planning advice. This trend is driven by the need to enhance customer experience, reduce operational costs, and streamline banking operations.

By expanding self-service capabilities, banks can serve a larger number of customers more efficiently, particularly in high-traffic areas where traditional teller services may be limited.

Furthermore, advanced self-service kiosks are being integrated with mobile banking platforms, allowing seamless transition between digital and physical banking channels. This convergence improves accessibility as well as strengthens customer engagement by providing a consistent and user-friendly experience across all touchpoints.

As the demand for personalized, on-demand banking services continues to grow, the expansion of self-service capabilities will remain a critical focus for financial institutions.

Segmentation Analysis

The global market has been segmented on the basis of type, offering, end user, and geography.

By Type

Based on type, the market has been categorized into single-functional kiosk, multi-functional kiosk, and video teller machine. The multi-functional kiosk segment captured the largest bank kiosk market share of 47.71% in 2023, largely due to their versatility and ability to meet diverse customer needs with a single platform.

Unlike single-function kiosks that are limited to cash withdrawals or deposits, multi-functional kiosks offer a comprehensive range of services, including account inquiries, bill payments, fund transfers, check deposits, and even loan applications. This broad functionality makes them highly attractive to both banks and customers, as they streamline operations and reduce the need for multiple machines.

These kiosks enhance customer satisfaction by providing a one-stop solution for various banking services, thus reducing the time spent in queues and the need for multiple visits to different service points.

Additionally, the adoption of advanced technologies, such as biometric authentication and touchscreen interfaces in multi-functional kiosks, has further driven their popularity in offering a secure, user-friendly experience.

The growing demand for self-service solutions, coupled with the ability of multi-functional kiosks to integrate with mobile banking and other digital platforms, has cemented their dominance in the market.

By Offering

Based on offering, the market has been classified into hardware, software, and services. The software segment is expected to record a staggering CAGR of 17.08% over the forecast period, due to the increasing demand for sophisticated, flexible, and secure solutions that power modern bank kiosks.

As financial institutions continue to expand their self-service offerings, the need for advanced software that can support a wide range of functionalities, from basic transactions to complex financial services, is also growing.

This includes software that enables seamless integration with core banking systems, supports multi-language interfaces, and incorporates robust security features such as encryption and real-time fraud detection.

Additionally, the trend of cloud-based software solutions is gaining momentum, offering banks the scalability and flexibility needed to quickly adapt to changing customer demands and regulatory requirements.

The rise of AI and machine learning in the banking sector is also contributing to the growth of the software segment, as these technologies are increasingly being embedded in kiosk software to enhance customer interactions, personalize services, and automate routine tasks.

Furthermore, the shift toward digital banking and the increasing emphasis on customer experience are driving investments in user-friendly interfaces and mobile integration, which are key factors capable pf driving the growth of the software segment.

By End User

Based on end user, the market has been divided into BFSI and government. The BFSI segment led the bank kiosk market in 2023, reaching a valuation of USD 456.2 million, which was attributed to the sector’s rapid digital transformation and the growing adoption of self-service technologies.

The increasing demand for enhanced customer experience, combined with the need for cost-efficient operations, has led banks and financial institutions to invest heavily in bank kiosks and other self-service solutions. These investments are aimed at reducing the operational costs, streamlining processes, and improving accessibility for customers across both urban and rural areas.

Additionally, the BFSI sector has been at the forefront of integrating advanced technologies, such as biometric authentication, AI-driven analytics, and contactless payment systems, into its service offerings, further driving revenue growth. The rise in mobile and internet banking is also supporting the deployment of bank kiosks, creating a seamless omni-channel experience for customers.

Moreover, the sector’s focus on financial inclusion has led to the deployment of kiosks in underserved regions, expanding their reach and driving revenue. The regulatory push for digital banking and the increasing consumer preference for self-service options have further solidified the BFSI sector’s position as a major revenue generator in the market.

Bank Kiosk Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America bank kiosk market held 36.71% of the global market share, accounting for USD 290.2 million in 2023, reflecting the region's leading position. This dominance can be attributed to the advanced banking infrastructure, high adoption of technology, and strong focus on enhancing customer experience across the banking, financial services, and insurance (BFSI) sector.

In North America, particularly in the U.S. and Canada, banks have been early adopters of self-service technologies, deploying a wide range of multi-functional kiosks in both urban and suburban areas to cater to the diverse needs of their customers. The region’s high level of digital literacy and better smartphone penetration has further driven the integration of kiosks with mobile banking platforms, offering a seamless, omni-channel banking experience.

Additionally, the emphasis on financial inclusion and the need to serve underbanked populations in rural areas have led to the widespread deployment of kiosks, making banking services more accessible. Furthermore, the region’s regulatory environment, which supports technological innovation in banking, has encouraged continuous investment in advanced kiosk solutions, including those with biometric authentication and AI-driven features.

Asia-Pacific is expected to grow at the highest CAGR of 16.35% over the forecast period, driven by the rapid economic development, increasing urbanization, and rising demand for advanced banking services across the region.

Countries like China, India, and Southeast Asian nations are witnessing significant investments in banking infrastructure, as financial institutions seek to expand their reach and improve service delivery in both urban and rural areas.

The region's large unbanked and underbanked population presents a substantial opportunity for the deployment of bank kiosks to provide accessible and convenient banking services. The growing adoption of digital technologies, coupled with the rising penetration of smartphones, is further fueling the demand for self-service kiosks integrated with mobile banking platforms.

Additionally, government initiatives aimed at promoting financial inclusion and digital banking are expected to accelerate the deployment of bank kiosks, particularly in rural and semi-urban areas.

The increasing focus on enhancing customer experience, along with the need to reduce operational costs, is leading banks in Asia-Pacific to adopt multi-functional kiosks equipped with advanced features such as biometric and AI-driven service features.

Competitive Landscape

The global bank kiosk market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Bank Kiosk Market

- Bank Muscat SAOG

- Diebold Nixdorf, Incorporated

- Fiserv, Inc.

- GLORY LTD.

- Brink's Incorporated

- Hitachi Payment Services Private Limited

- VeriFone, Inc.

- Auriga Spa

- KAL ATM Software GmbH

- NCR Atleos Corporation

Key Industry Developments

- December 2023 (Acquisition): Glory expanded its stake in OneBanx, a provider of fully managed shared banking solutions, by acquiring additional shares. This acquisition increased Glory's ownership to 91.99% of OneBanx's outstanding shares, further strengthening its control and influence over the company.

- March 2023 (Launch): Bank Muscat SAOG introduced self-service kiosks at key business hubs across Oman. This strategic move aligns with the bank’s customer-centric approach and ongoing efforts to enhance its Phygital network, improving customer access to services and reinforcing its digital transformation initiatives.

The global bank kiosk market has been segmented:

By Type

- Single-functional Kiosk

- Multi-functional Kiosk

- Video Teller Machine

By Offering

- Hardware

- Software

- Services

By End User

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America