Market Definition

B2B SaaS (Business-to-business software-as-a-service) delivers subscription-based cloud applications that enables companies to manage subscription-based cloud applications. These solutions reduce the need for on-premise systems by delivering secure, scalable, and continuously updated software through the internet.

The market’s scope includes functions such as customer relationship management, enterprise resource planning, human capital management, and supply chain management. Enterprises across industries including banking, healthcare, manufacturing, and information technology adopt B2B SaaS to lower costs, streamline operations, and improve digital agility.

B2B SaaS Market Overview

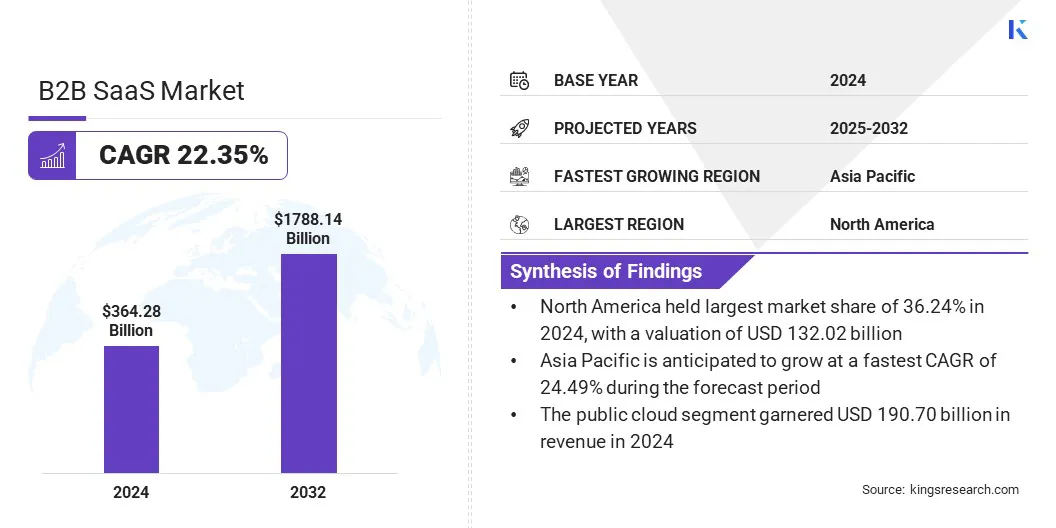

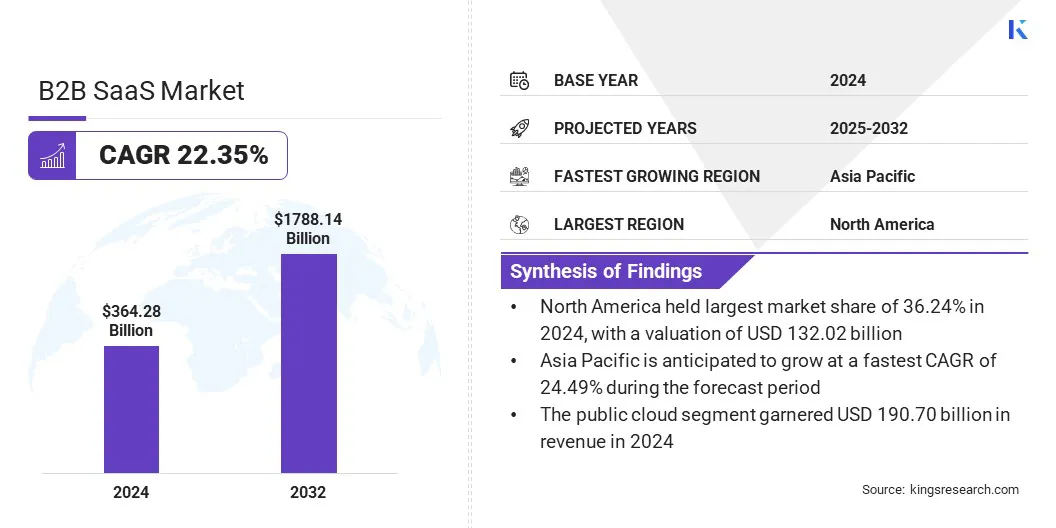

The global B2B SaaS market size was valued at USD 364.28 billion in 2024 and is projected to grow from USD 435.66 billion in 2025 to USD 1,788.14 billion by 2032, exhibiting a CAGR of 22.35% over the forecast period.

The market is expanding due to the rising need for digital collaboration tools that enable teams within and across organizations to communicate, share files, and coordinate workflows in real time. Moreover, growing adoption of low-code and no-code platforms is enabling faster business application development by allowing non-technical staff to design and deploy software, thereby reducing technical barriers for enterprises.

Increasing adoption of cloud infrastructure in enterprises and public organizations improves the operational efficiency of IT systems and business processes by providing scalable resources and automated services, further supporting the expansion of digital products and services.

Key Highlights

- The B2B SaaS industry size was valued at USD 364.28 billion in 2024.

- The market is projected to grow at a CAGR of 22.35% from 2025 to 2032.

- North America held a market share of 36.24% in 2024, with a valuation of USD 132.02 billion.

- The customer relationship management (CRM) segment garnered USD 99.99 billion in revenue in 2024.

- The public cloud segment is expected to reach USD 946.94 billion by 2032.

- The large enterprises segment secured the largest revenue share of 57.63% in 2024.

- The healthcare segment is poised for a robust CAGR of 23.78% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 24.49% over the forecast period.

Major companies operating in the B2B SaaS market are Salesforce, Inc., Microsoft, Oracle, SAP SE, Workday, Inc., ServiceNow, Adobe, HubSpot, Inc., Atlassian, Coupa, Freshworks Inc., Zendesk, Snowflake Inc., Smartsheet Inc., and Asana, Inc.

Enterprises are increasingly adopting SaaS platforms to replace on-premise software to reduce infrastructure costs and improve IT efficiency, thereby driving market growth. Cloud-based platforms are able to provide remote accessibility, allowing teams to collaborate across multiple locations seamlessly. This accessibility is supporting faster decision-making and smoother workflow integration across departments.

Moreover, frequent updates and rapid deployment of SaaS applications are enhancing productivity and system reliability. Growing demand for scalable, flexible, and accessible business solutions is further accelerating the adoption of B2B SaaS platforms.

- In May 2024, the World Bank's ‘Advancing Cloud and Data Infrastructure Markets’ report highlighted that the global cloud computing industry is projected to grow at 20% annually until 2025, driven by increasing demand for scalable and flexible digital solutions in low- and middle-income economies.

Market Driver

Rising Need for Collaboration Tools

Expansion of distributed and hybrid workforces is driving growth in the B2B SaaS market. Organizations across IT, finance, healthcare, and professional services are adopting SaaS platforms to support remote collaborations. Increasing reliance on digital communication tools is enabling workforces across departments to collaborate and exchange information efficiently.

SaaS-based project management solutions are helping companies track tasks, deadlines, and resource allocation in real time. Enhanced collaboration capabilities are improving productivity, reducing delays, and maintaining operational continuity. Growing demand for efficient, cloud-based teamwork solutions is significantly accelerating the adoption of B2B SaaS platforms.

- In March 2024, Zoom Video Communications launched Zoom Workplace, an AI-powered collaboration platform designed to unify communication tools such as chat, video conferencing, email, and telephony into a single interface. This platform aims to enhance team collaboration by integrating various communication channels and incorporating AI features like the "Ask AI Companion," which allows users to perform natural language queries across its services and third-party applications.

Market Challenge

Data Security and Privacy Risks

A key challenge in the B2B SaaS market is protecting sensitive client data in multi-tenant cloud environments. Shared infrastructure increases the risk of unauthorized access, data breaches, and cross-tenant vulnerabilities. Regulatory compliance is increasingly intricate, requiring organizations to adhere to comprehensive data-protection frameworks such as the GDPR and CCPA, as well as a wide range of sector-specific regulations.

To address this challenge, market players are implementing advanced encryption, multi-factor authentication, and continuous monitoring solutions. In July 2024, the Thales Cloud Security Study reported that 65% of enterprises use multi-factor authentication (MFA) to secure cloud access, while 63% employ encryption to protect sensitive data in the cloud. These measures are strengthening security frameworks and ensuring compliance across diverse enterprise clients.

Market Trend

Expanding Accessibility through Low-Code and No-Code Platforms

A key trend in the B2B SaaS market is the rising adoption of low-code and no-code platforms. These platforms are enabling non-technical users to build business applications using visual, drag-and-drop interfaces efficiently.

Configurable modules allow teams to customize workflows and processes without requiring deep programming knowledge. Organizations are improving operational agility by reducing dependency on IT departments for routine application development. Rapid prototyping and deployment are shortening time-to-market for business solutions across industries.

- In August 2025, Hexaware partnered with Replit, a natural language-based AI software development platform, to introduce secure 'vibe coding' to enterprises. This collaboration enables both technical and non-technical users, including those in sales, marketing, and operations, to rapidly create secure, production-grade applications using a no-code interface, bypassing traditional IT bottlenecks.

B2B SaaS Market Report Snapshot

|

Segmentation

|

Details

|

|

By Software Type

|

Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Capital Management (HCM), Supply Chain Management (SCM), Others

|

|

By Deployment Model

|

Public Cloud, Private Cloud, Hybrid Cloud

|

|

By Enterprise Size

|

Large Enterprises, Small & Medium-sized Enterprises (SMEs)

|

|

By End-use Industry

|

Banking, Financial Services & Insurance (BFSI), IT & Telecom, Healthcare, Retail & E-commerce, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Software Type (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Capital Management (HCM), Supply Chain Management (SCM), and Others): The CRM segment earned USD 99.99 billion in 2024 due to rising enterprise demand for scalable solutions that enhance customer engagement and streamline sales processes.

- By Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud): The public cloud segment held 52.35% of the market in 2024, on account of its cost efficiency, scalability, and ease of deployment for businesses of all sizes.

- By Enterprise Size (Large Enterprises and Small & Medium-sized Enterprises (SMEs)): The large enterprises segment is projected to reach USD 942.94 billion by 2032, owing to their higher technology budgets, need for scalable solutions, and adoption of advanced digital platforms to manage complex global operations.

- By End-use Industry (Banking, Financial Services & Insurance (BFSI), IT & Telecom, Healthcare, Retail & E-commerce, Manufacturing, and Others): The healthcare segment is poised for significant growth at a CAGR of 23.78% through the forecast period, attributed to the increasing demand for cloud-based solutions that enhance patient data management, telemedicine services, and regulatory compliance.

B2B SaaS Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America B2B SaaS market share stood at 36.24% in 2024 in the global market, with a valuation of USD 132.02 billion. This dominance is due to the region's advanced digital infrastructure, which supports high-speed internet and reliable cloud services.

The presence of major data centers and cloud providers enables seamless SaaS delivery, which helps businesses to benefit from reduced latency and enhanced service reliability. This infrastructure attracts startups and established enterprises to adopt SaaS solutions.

According to the U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA), there are more than 5,000 data centers in the U.S. in 2024, with demand projected to grow by 9% annually through 2030, driven by the rise of artificial intelligence and other emerging technologies. The region's tech ecosystem boosts innovation and scalability, strengthening the adoption of the B2B SaaS platforms.

The Asia-Pacific B2B SaaS industry is expected to grow at a significant CAGR of 24.49% over the forecast period. This growth is due to the establishment of regional data centers and cloud development facilities by major technology providers across the region.

These hubs provide businesses with access to resources for developing and deploying SaaS solutions efficiently. They also provide structured environments where organizations can test cloud and AI technologies under guidance and with adequate support.

- In June 2025, Amazon Web Services (AWS) launched its first 8,000-square-foot AWS Innovation Hub in Singapore. This hub is designed to empower cloud and AI innovation, providing businesses with the resources to develop and deploy SaaS solutions efficiently.

The availability of training, mentorship, and reliable infrastructure is accelerating the adoption of enterprise software and cloud-based applications. Regional enterprises benefit from reduced time-to-market for new digital services and platforms, that support accelerated adoption of SaaS in region.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) enforces regulations impacting B2B SaaS providers, including the "Click-to-Cancel" rule, which mandates that businesses make it as easy for consumers to cancel their subscriptions as it is to sign up. The California Consumer Privacy Act (CCPA), along with the California Privacy Rights Act (CPRA), grants California residents rights over their personal information, affecting SaaS companies that collect such data.

- Japan's Act on the Protection of Personal Information (APPI) regulates the handling of personal data, requiring SaaS providers to obtain consent before collecting personal information and to implement necessary safeguards.

- In the European Union, B2B SaaS is regulated by the General Data Protection Regulation (GDPR). It mandates strict guidelines on data collection, processing, and storage, emphasizing user consent and data minimization.

Competitive Landscape

Major players in the B2B SaaS industry are adopting strategies such as strategic acquisitions, research and development, technological innovation, and partnerships to remain competitive in the market. These strategies help companies expand their product offerings, integrate advanced features like artificial intelligence, and enhance user experience.

Firms also leverage collaborations to accelerate innovation and access new customer segments. Continuous investment in R&D enables the development of tools that streamline enterprise workflows and improve operational efficiency.

- In September 2025, Atlassian announced the acquisition of The Browser Company, creators of the Arc and Dia browsers. This strategic move aims to enhance Atlassian's suite of productivity tools by integrating AI-powered browser capabilities tailored for knowledge workers. Atlassian plans to promote Dia as its primary work browser, aiming to unify web tasks and tools in enterprise settings.

Key Companies in B2B SaaS Market:

- Salesforce, Inc.

- Microsoft

- Oracle

- SAP SE

- Workday, Inc.

- ServiceNow

- Adobe

- HubSpot, Inc.

- Atlassian

- Coupa

- Freshworks Inc.

- Zendesk

- Snowflake Inc.

- Smartsheet Inc.

- Asana, Inc.

Recent Developments (M&A/Product Launch)

- In June 2025, Freshworks introduced the next evolution of its Freddy AI platform, now rebranded as the Freddy Agentic AI Platform. This platform enables customer support teams to manage and resolve service requests autonomously, deliver real-time insights, and simplify the deployment of AI agents.

- In September 2024, SAP completed its acquisition of WalkMe, a digital adoption platform company, for approximately USD 1.5 billion. This acquisition enhances SAP's Business Transformation Management portfolio, integrating WalkMe's solutions to help customers accelerate user adoption and productivity.