Market Definition

Autonomous tractors are advanced agricultural vehicles integrated with technologies such as GPS, cameras, LiDAR, artificial intelligence, and sensor systems that enable operation without direct human control. They are engineered to execute field tasks such as plowing, planting, harvesting, and field monitoring with high precision and efficiency.

Their application spans a wide range of farming environments, from large-scale commercial fields to orchards, vineyards, and smallholder plots across regions. By enabling continuous operations, optimizing resource use, improving crop productivity, and promoting sustainable farming practices, autonomous tractors are transforming modern agriculture.

Autonomous Tractors Market Overview

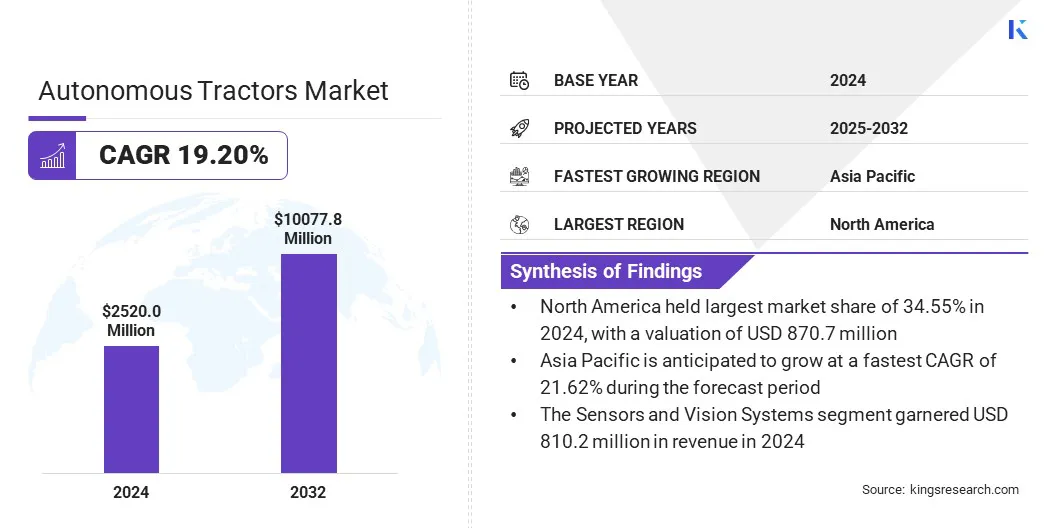

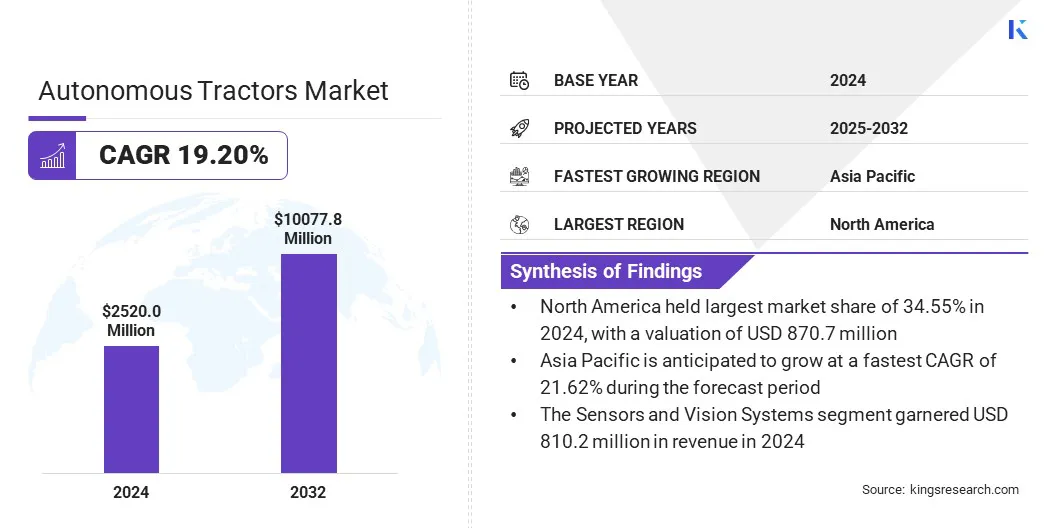

The global autonomous tractors market size was valued at USD 2,520,0 million in 2024 and is projected to grow from USD 2,946.6 million in 2025 to USD 10,077.8 million by 2032, exhibiting a CAGR of 19.20% during the forecast period.

This growth is driven by rising global food demand, which is pressuring farmers to improve efficiency and productivity across large-scale operations. Integration of AI-enabled vision and sensor systems is accelerating adoption, as these technologies enhance precision, safety, and reliability in complex agricultural environments.

Key Market Highlights:

- The autonomous tractors industry size was valued at USD 2,520.0 million in 2024

- The market is projected to grow at a CAGR of 19.20% from 2025 to 2032

- North America held a share of 34.55% in 2024, valued at USD 870.7 million.

- The 31–100 HP segment garnered USD 1,291.5 million in revenue in 2024.

- The sensor and vision systems segment is expected to reach USD 3,491.1 million by 2032.

- The diesel ICE segment secured the largest revenue share of 61.24% in 2024.

- The fully autonomous is poised to grow at a robust CAGR of 22.32% through the forecast period.

- The harvesting & transport segment is expected to secure the largest revenue share of 43.76% by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 21.62% over the forecast period.

Major companies operating in the autonomous tractors market are Deere & Company, Kubota Corporation, Monarch Tractor, AGCO, Mahindra & Mahindra Ltd., YANMAR HOLDINGS CO., LTD., AgXeed B. V., iTARRA Tractor Company, CNH Industrial, Sabanto Inc., SDF S.p.A., Escorts Limited, Autonomous Solutions, Inc., Autonomous-AG PTY LTD, and Raven Industries, Inc.

Adoption of precision agriculture is significantly boosting the demand for autonomous tractors. These tractors enhance farming operations such as seeding, fertilizer application, and crop protection with higher accuracy, reducing input waste. Integration of advanced GPS and sensor-based systems enables real-time monitoring of field conditions and crop requirements.

- In January 2025, FarmX Autonomy announced a milestone with OrchardPilot, a GPS-independent autonomy retrofit kit for orchards. The system offers one-day installation on existing tractors, including John Deere, CNH, and Kubota models and enables autonomous operations using vision-based technology.

Farmers are improving yield outcomes by ensuring uniform planting and optimal nutrient distribution through autonomous machinery. These machines are also reducing dependency on manual labor and ensuring the timely execution of critical farming tasks.

Market Driver

Rising Global Food Demand

The growth of the market is fueled by the increasing pressure on agriculture to meet the food requirements of a growing global population. Farmers are turning to automation solutions such as autonomous tractors to improve productivity and ensure efficient use of resources.

These tractors enhance productivity, optimize resource use, and ensure timely soil preparation, planting, and harvesting. Advanced systems in these tractors reduce errors and maintain consistent crop output, while also helping address labor shortages that limit large-scale farming operations.

- In February 2024, Agtonomy, a provider of autonomous and AI-powered agricultural solutions, expanded its paid on-farm pilot program in California. The program utilizes Agtonomy-equipped tractors for autonomous vineyard vine mowing and supports remote multi-fleet management via a tele-guidance platform.

Market Challenge

Connectivity Limitations in Rural Areas

A key challenge hampering the expansion of the autonomous tractors market is the lack of reliable connectivity in remote farming areas. Dependence on GPS and IoT-based communication systems makes consistent operation difficult where rural broadband and cellular networks are weak.

This creates operational inefficiencies and restricts the large-scale deployment of autonomous tractors in regions where they are most needed.

To address this challenge, market players are investing in enhanced satellite-based navigation, developing offline-capable systems, and partnering with telecom providers to expand rural network coverage. These initiatives are enabling more reliable operation and improving accessibility for farmers in underserved areas.

- In January 2024, John Deere partnered with SpaceX’s Starlink satellite network to provide continuous Internet connectivity to its agricultural machinery, including in remote areas. The collaboration aims to support precision farming applications such as real-time crop monitoring and autonomous operations.

Market Trend

Integration of AI-Enabled Vision and Sensor Systems

The market is witnessing a notable trend toward the integration of AI-driven vision and sensor technologies. The combination of LiDAR, radar, and advanced computer vision enables tractors to detect obstacles, identify crop rows, and navigate varied field conditions with greater precision.

These systems enhance safety and efficiency by reducing human error and ensuring accurate operations in complex agricultural environments. Improved perception and navigation capabilities are boosting the adoption of semi- and fully autonomous tractors, supporting large-scale farming and precision agriculture applications.

- At CES 2025, John Deere introduced its second-generation autonomy kit, featuring LiDAR sensors, multiple cameras, and AI-driven vision systems. These technologies allow tractors to navigate dense orchard environments and detect obstacles in real time. The Autonomous 5ML Orchard Tractor notably includes pods with both LiDAR and cameras, allowing dynamic micro-adjustments while spraying along tree rows.

Autonomous Tractors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Power Output

|

Up to 30 HP, 31–100 HP, Above 100 HP

|

|

By Component

|

LiDAR, Radar, GPS Systems, Sensor and Vision Systems, Others

|

|

By Propulsion

|

Diesel ICE, Battery-electric, Hybrid, Alternative Fuels

|

|

By Automation Level

|

Semi-autonomous, Fully autonomous

|

|

By Farm Applications

|

Tillage & Soil Prep, Planting & Seeding, Harvesting & Transport, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Power Output (Up to 30 HP, 31–100 HP, and Above 100 HP): The 31–100 HP segment earned USD 1,291.5 million in 2024, fueled by its suitability for medium- to large-scale farming operations that require versatility across tasks such as tilling, planting, and spraying at a cost-effective level.

- By Component (LiDAR, Radar, GPS Systems, Sensor and Vision Systems, and Others): The sensor and vision systems segment held a share of 32.15% in 2024, propelled by their critical role in enabling real-time obstacle detection, precise navigation, and safe operation in diverse and complex field environments.

- By Propulsion (Diesel ICE, Battery-electric, Hybrid, and Alternative Fuels): The diesel ICE segment is projected to reach USD 4,577.4 million by 2032, owing to its established infrastructure, high power efficiency, and widespread availability for large-scale farming operations.

- By Automation Level (Semi-autonomous and Fully autonomous): The fully autonomous segment is estimated to grow at a significant CAGR of 22.32% through the forecast period, attributed to its ability to operate without human intervention, enabling higher productivity and cost efficiency for large-scale farming operations.

Autonomous Tractors Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America autonomous tractors market share stood at 34.55% in 2024, valued at USD 870.7 million. This dominance is reinforced by large-scale farming operations that require consistent efficiency in planting, spraying, and harvesting. Autonomous tractors enable farms to cover extensive areas in shorter timeframes, improving output.

The region's agribusiness structure supports investment in advanced machinery. Moreover, the presence of leading agricultural equipment manufacturers and technology startups, including John Deere, CNH Industrial, and AGCO, is accelerating product launches and pilot projects, further propelling regional market expansion.

- At AGCO Tech Days in June 2024, AGCO showcased its autonomous offerings, including a tractor-pulled autonomous grain cart capable of independently off-loading from combines, improving harvest efficiency and reducing operator fatigue. The company emphasized its retrofit-first approach, enabling autonomy across mixed fleets, and outlined plans for the commercial availability of these systems.

The Asia-Pacific autonomous tractors industry is estimated to grow at a significant CAGR of 21.62% over the forecast period. This growth is fostered by policy initiatives promoting digital agriculture and automation. Regional governments are supporting pilot projects, subsidies, and training programs, which enhance awareness and mitigate adoption risks for farmers.

- In October 2024, the Ministry of Agriculture and Rural Affairs of China published the National Smart Agriculture Action Plan (2024–2028). The plan calls for the development of national agricultural and rural big data platforms. It also introduces demonstration programs for precision planting, smart farms, and automation technologies to facilitate the implementation of innovations in real-world farming.

Regulatory Frameworks

- In the European Union, autonomous tractors must comply with Regulation (EU) 167/2013, which governs type-approval and surveillance of agricultural vehicles. They are also subject to the Machinery Directive 2006/42/EC, which ensures the safe design and operation of automated equipment. Additionally, United Nations Economic Commission for Europe (UNECE) rules, including Regulation 155 on cybersecurity and Regulation 156 on software updates, are mandatory for autonomous and connected farm equipment. Compliance is mandatory prior to market entry.

- In China, autonomous tractors are monitored under the Ministry of Agriculture and Rural Affairs (MARA), which issued Guidelines for Intelligent Agricultural Machinery in 2021. These tractors must also obtain approval under the Compulsory Product Certification (CCC) scheme. Pilot programs in provinces such as Heilongjiang and Jiangsu set operational standards and safety protocols.

- In Japan, regulations for autonomous tractors fall under the Ministry of Agriculture, Forestry and Fisheries (MAFF) Smart Agriculture Implementation Strategy. Tractors operating on public roads must comply with the Road Transport Vehicle Act, while on-farm use is subject to the Agricultural Machinery Safety Standards. Government-backed demonstration zones allow supervised testing of fully autonomous tractors.

- In South Korea, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) oversees autonomous tractors under the Agricultural Machinery Management Act. Safety testing is conducted by the Korea Agricultural Machinery Industry Cooperative (KAMICO), and designated smart farming pilot zones allow supervised operation.

Competitive Landscape

Major players operating in the autonomous tractors market are expanding research and development activities to improve autonomous retrofit solutions and integrate advanced navigation technologies. Several firms are focusing on technological advancements such as high-precision GPS, sensor fusion, and remote operations platforms to enhance safety and efficiency.

Investments in cloud-based monitoring services that provide real-time data are enabling farmers to manage operations more effectively. Numerous companies are emphasizing pilot programs and customer trials to build trust and demonstrate reliability in large-scale farming conditions.

- In April 2025, Carbon Robotics introduced the Carbon AutoTractor, an autonomous retrofit solution for John Deere 6R and 8R models. The kit enables overnight autonomous operations, including tilling, mowing, and planting. It features RTK-accurate GPS, 360° cameras, radar-based safety sensors, and cloud-linked remote monitoring and control through the Remote Operations Control Center (ROCC).

Top Companies in Autonomous Tractors Market:

- Deere & Company

- Kubota Corporation

- Monarch Tractor

- AGCO

- Mahindra & Mahindra Ltd.

- YANMAR HOLDINGS CO., LTD.

- AgXeed B. V.

- iTARRA Tractor Company

- CNH Industrial

- Sabanto Inc.

- SDF S.p.A.

- Escorts Limited

- Autonomous Solutions, Inc.

- Autonomous-AG PTY LTD

- Raven Industries, Inc.

Recent Developments (Funding/Product Launches)

- In August 2025, AGCO exhibited retrofit solutions, autonomous technology, and precision agriculture offerings at the Farm Progress Show in Illinois. Highlights included the OutRun autonomous grain cart, smart planting and spraying systems, and retrofit options for legacy equipment.

- In January 2025, Deere & Company introduced a new lineup of autonomous tractors and industrial equipment at CES 2025. The range covers soil tilling, orchard spraying, commercial landscaping, and quarry operations, featuring advanced computer vision, artificial intelligence, multiple cameras, and -powered autonomy retrofit kits based on Nvidia Jetson processor, addressing labor shortages in the sector.

- In July 2024, Monarch Tractor raised USD 133 million in a Series C round to accelerate the development and deployment of its all-electric, driver-optional tractors, specifically the MK-V model. These tractors are integrated with the WingspanAI platform, enabling automated operations planning, remote fleet management, performance reporting, and maintenance diagnostics.