Market Definition

Automotive wrap film is a vinyl graphic applied directly over a vehicle's original paint. These films serve two primary purposes, protecting the original paint from dust and corrosion, and enhancing or altering the vehicle's appearance.

The application of an automotive wrap enables a quick transformation of the vehicle's look while allowing the wrap to be easily removed, restoring the vehicle to its original condition if required.

Automotive Wrap Films Market Overview

The global automotive wrap films market size was valued at USD 7.13 billion in 2023 and is projected to grow from USD 8.33 billion in 2024 to USD 28.73 billion by 2031, exhibiting a CAGR of 19.35% during the forecast period. The market is expanding, due to the rising demand for light-duty vehicles and increasing sales of luxury vehicles.

The growing racing and motorsport culture, expanding digital printing sector, focus on hydrophobic and self-healing films, color-shifting films, and rising adoption of commercial fleets has propelled the demand for automotive wrap films.

Major companies operating in the global automotive wrap films market are 3M, Avery Dennison Corporation, Arlon Graphics LLC, Fedrigoni S.P.A., HEXIS S.A.S., KPMF, ORAFOL Europe GmbH, VViViD Vinyl, Garware Hi-Tech Films, Eastman Chemical Company, Madico, Inc., AXEVINYL, WrapStyle, Saint-Gobain, and RENOLIT SE.

Automotive wrap films have become a popular solution for businesses and individuals seeking to enhance the esthetics, protect, or advertise on their vehicles. These high-performance vinyl films are applied to the exterior surfaces of automobiles, offering a cost-effective alternative to traditional paint jobs.

Automotive wraps are available in a wide range of colors, finishes (such as matte, gloss, and satin), and designs, allowing for full or partial vehicle coverage. They are particularly favored in the advertising industry, where they are used as mobile billboards to showcase brand logos and messages.

Additionally, wrap films provide a protective layer that shields the underlying paint from scratches, UV rays, and other environmental elements, thereby maintaining the vehicle's resale value. The growing demand for customization and brand visibility, coupled with the increasing adoption of eco-friendly materials in manufacturing, is contributing to the expansion of the automotive wrap films industry.

Key Highlights:

- The automotive wrap films market size was valued at USD 7.13 billion in 2023.

- The market is projected to grow at a CAGR of 19.35% from 2024 to 2031.

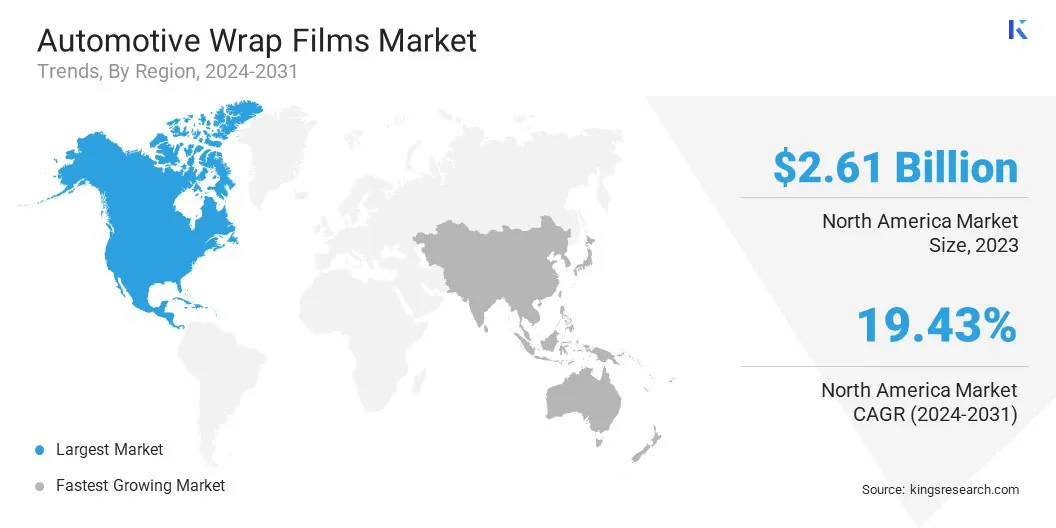

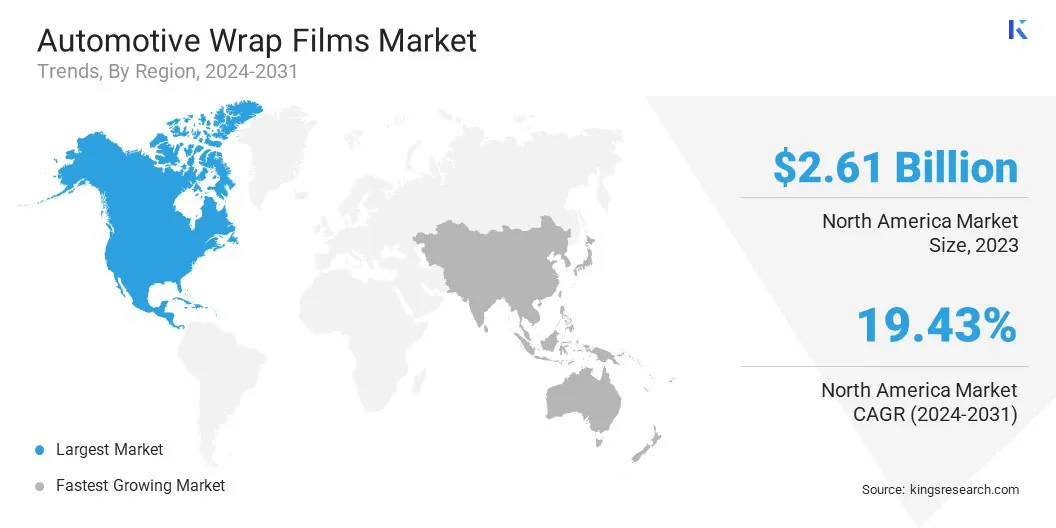

- North America held a market share of 36.65% in 2023, with a valuation of USD 2.61 billion.

- The wrap films segment garnered USD 3.32 billion in revenue in 2023.

- The passenger cars segment is expected to reach USD 13.46 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.36% during the forecast period.

Market Driver

"Increasing Trend of Vehicle Customization"

The increasing trend of vehicle customization is fostering the growth of the automotive wrap films market. Consumers and businesses increasingly seek personalized and cost-effective solutions to enhance the esthetic appeal, branding, and functionality of their vehicles.

Automotive wrap films offer versatility, enabling quick modifications such as color changes, unique designs, or brand-specific graphics without the permanence or expense of traditional paint jobs. Additionally, these films provide protective benefits, safeguarding vehicles from scratches, UV damage, and wear.

- In June 2024, 3M offered advanced automotive wrap film solutions, enabling businesses to enhance vehicle aesthetics and protection. These include customizable 3M Window Films for UV and heat rejection, 3M Paint Protection Films for durable surface defense, and 3M Wrap Films for striking designs with diverse textures and finishes, delivering elevated quality, personalization, and functional benefits for consumers and businesses.

The rise of e-commerce platforms and digital printing technologies has further streamlined the availability and customization of wrap films, contributing to robust market growth.

Market Challenge

"Fluctuating Raw Material Prices"

Fluctuating prices of raw materials can pose a challenge for the market growth, as these variations directly impact production costs, pricing strategies, and profit margins. Key raw materials, such as vinyl and adhesives, are subject to price volatility, due to factors like supply chain disruptions, geopolitical tensions, and fluctuations in demand across various industries.

This unpredictability can lead to inconsistent product pricing, making it difficult for manufacturers to maintain competitive advantage while ensuring profitability.

Companies can adopt strategic measures such as diversifying their supplier base to reduce dependency on a single source, implementing long-term procurement contracts to stabilize costs, and investing in innovative production techniques that minimize material waste.

Additionally, leveraging predictive analytics and market intelligence can help anticipate price trends, enabling proactive adjustments to procurement and pricing strategies.

Market Trend

"Increasing Adoption of Mobile Advertising"

Mobile advertising encompasses all forms of advertisements displayed on smartphones and other mobile devices. It leverages various interactive channels to enable advertisers to communicate and promote news, offers, and products through mobile platforms or networks. Automotive wrap films are a critical component of mobile advertising, especially within the heavy-duty vehicle segment.

These vehicles, including buses and large vans, are frequently utilized for tourism and promotional activities. Wrap films are applied to these vehicles to serve as dynamic tools for advertising and brand marketing initiatives.

Automotive Wrap Films Market Report Snapshot

| Segmentation |

Details |

| By Film Type |

Windows Films, Wrap Films, Paint Protection Films |

| By Vehicle Type |

Passenger Cars, Commercial Cars, Heavy Commercial Vehicles |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Film Type (Windows Films, Wrap Films, Paint Protection Films): The wrap films segment earned USD 3.32 billion in 2023. Wrap films offer a flexible solution for personalizing vehicle exteriors, enabling the application of distinctive designs, advertising graphics, and color modifications without causing permanent changes to the original paintwork.

- By Vehicle Type (Passenger Cars, Commercial Cars, Heavy Commercial Vehicles): The passenger cars segment held 48.43% share of the market in 2023, due to the declining costs of car wraps, increasing demand for personalized vehicles from clients, and significant rise in the need for vehicle modifications, particularly in terms of colors and textures. Drivers are increasingly opting to customize their vehicles with spot graphics and calligraphy, both for advertising purposes and personal expression.

Automotive Wrap Films Market Regional Analysis

North America accounted for a significant automotive wrap films market share of around 36.65% in 2023, valued at USD 2.61 billion. Increasing consumer demand for vehicle customization and cost-effective advertising solutions are propelling the market.

Growing automotive industry, coupled with a high rate of vehicle ownership, provides a robust foundation for market expansion. Furthermore, advancements in wrap film technologies, such as improved durability, vibrant color options, and ease of application, are enhancing product appeal among individual vehicle owners and commercial fleets.

The growing adoption of electric vehicles (EVs) is anticipated to bolster demand, as manufacturers and fleet operators leverage wraps for branding and protective purposes.

However, the automotive wrap films market in Asia Pacific is anticipated to register the fastest growth at a projected CAGR of 20.36%. The growing urbanization, increasing disposable income of consumers, and strong manufacturing infrastructure are fostering the growth of the market. The region's strong manufacturing base enhances accessibility to high-quality wrap materials for automotive applications.

Furthermore, the rising interest in branding and vehicle personalization among businesses is increasing the demand for wrap films. Additionally, the growing middle-class population in India and China, with significant disposable income and an interest in esthetics, is contributing to market growth in the region.

Governments in the region are taking various initiatives for the manufacturing of vehicles to reduce dependence on imports.

- The Government of India approved the Production Linked Incentive (PLI) Scheme for the Automobile and Auto Components Industry to boost domestic production of Advanced Automotive Technology products and attract investments throughout the automotive manufacturing value chain. The scheme is supported by a budget allocation of USD 3.01 million over five years.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. Federal Motor Carrier Safety Administration (FMCSA) regulated guidelines for vehicle advertising, which must adhere to specific safety regulations while on the road. The vehicle wrap must not obscure critical driver or vehicle identification details. Reflective materials should be positioned for visibility from designated distances to maintain roadway safety. Additionally, local regulations may impose restrictions on advertising in residentially zoned areas, which could include limitations on the size, color, or the presence of commercial vehicle wraps.

- The EU's Packaging and Packaging Waste Regulation (PPWR) aims to reduce packaging waste and promote recycling. While primarily focused on packaging, this regulation influences the automotive wrap films companies by encouraging the use of recyclable and environmentally friendly materials. Manufacturers are encouraged to minimize the weight and volume of packaging and to use materials that are recyclable according to strict criteria.

- In India, the use of automotive wrap films is regulated to ensure compliance with the vehicle's original color as stated in the Registration Certificate (RC). Changing the vehicle's color through wrapping without updating the RC is deemed illegal and may lead to penalties or even the seizure of the vehicle. To avoid such consequences, it is essential to notify the Regional Transport Office (RTO) and update the RC to reflect any color changes made through wrapping.

Competitive Landscape:

The automotive wrap films market is characterised by a number of participants, including both established corporations and rising organisations. Companies in the market are investing in research and development (R&D) to expand their production capacity.

Companies aggressively pursue a variety of strategic initiatives to achieve a competitive advantage in this continuously changing industry. Major strategies include new product launches, collaborations and alliances, corporate expansions, and mergers and acquisitions.

Companies in the market are focusing on niche products or cater to the market in a specific region with a customized solution. Key players are also leveraging advancements in film technology, sustainable materials, and digital printing capabilities to differentiate their offerings. Companies are manufacturing and selling various types of specialty papers for fine printing and self-adhesive products for labeling.

- For instance, in January 2024, Eastman Performance Films, LLC launched LLumar Protective Wrap Film, representing a significant advancement for the company in the automotive film industry.

List of Key Companies in Automotive Wrap Films Market:

- 3M

- Avery Dennison Corporation

- Arlon Graphics, LLC

- Fedrigoni S.P.A.

- HEXIS S.A.S.

- KPMF

- ORAFOL Europe GmbH

- VViViD Vinyl

- Garware Hi-Tech Films

- Eastman Chemical Company

- Madico, Inc.

- AXEVINYL

- WrapStyle

- Saint-Gobain

- RENOLIT SE, and

- Others

Recent Developments (Launch/Acquisition)

- In March 2024, Tesla launched wraps for the Cybertruck, Model Y, and Model 3 at a new location, the Collision Austin South body shop in Texas, complementing its existing operations in California.

- In May 2023, PPG unveiled its advanced paint and clear film solutions for the automotive and industrial sectors in collaboration with Entrotech, enhancing both vehicle protection and esthetics.

- In February 2023, Fedrigoni S.P.A. acquired an R&D center in Grenoble, France, as part of its strategic initiative to enhance innovation in production processes and address the growing consumer demand for advanced automotive films and wraps.