Market Definition

The automotive wiring harness industry involves the manufacturing and supply of organized electrical wiring systems for vehicles. These harnesses transmit power and signals, enhancing functionality, safety, and connectivity.

Automotive Wiring Harness Market Overview

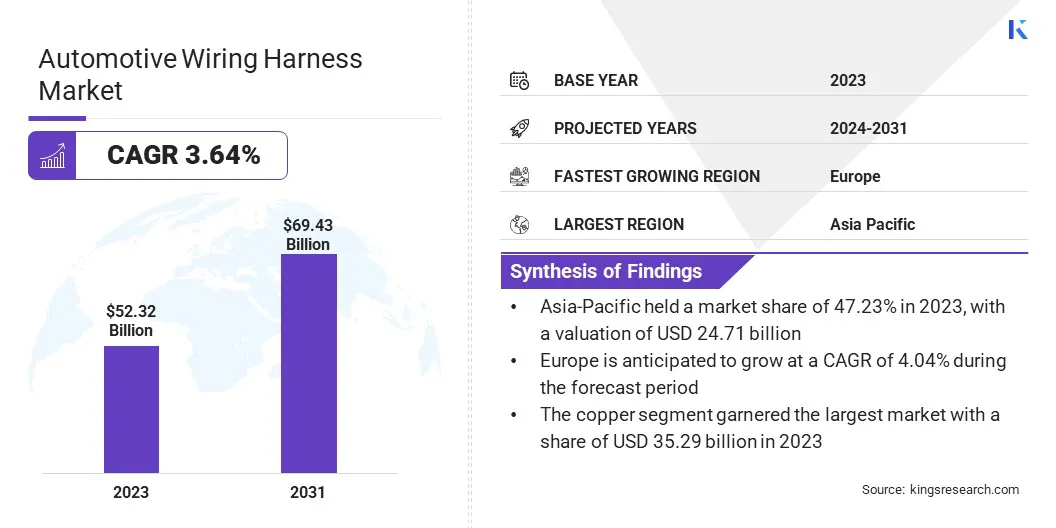

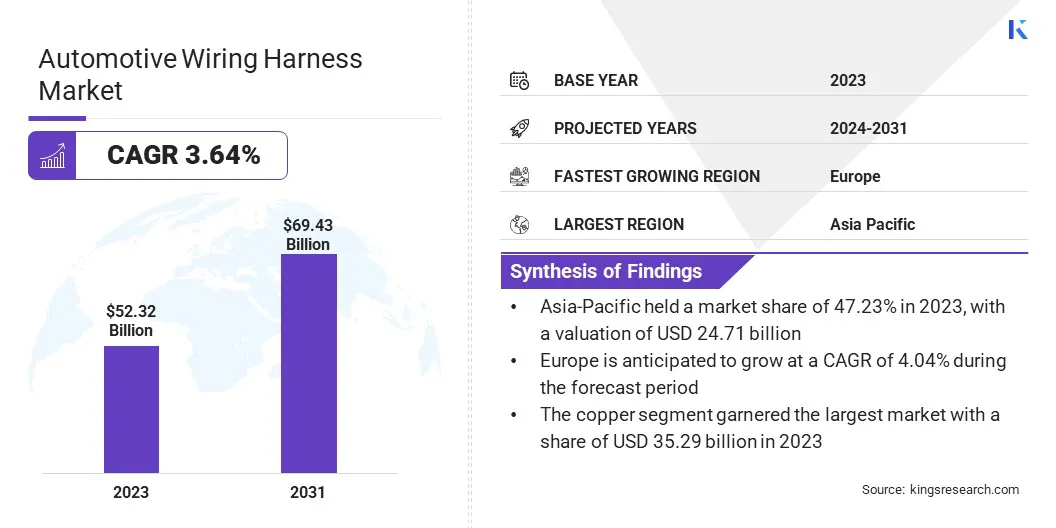

The global automotive wiring harness market size was valued at USD 52.32 billion in 2023 and is projected to grow from USD 54.04 billion in 2024 to USD 69.43 billion by 2031, exhibiting a CAGR of 3.64% during the forecast period.

Some factors aiding the market growth are increasing global vehicle production, growing adoption of electric and hybrid vehicles, and the rising demand for advanced driver-assistance systems (ADAS).

Major companies operating in the automotive wiring harness market are Aptiv PLC, Furukawa Electric Co., Ltd., Kromberg & Schubert GmbH Cable & Wire, Lear, LEONI AG, PKC Group Ltd, Spark Minda, Sumitomo Electric Industries, Ltd., YAZAKI Corporation, Motherson, YURA Corp., Nexans autoelectric GmbH, COFICAB Group, Coroplast Fritz Müller GmbH & Co. KG, and DRÄXLMAIER Group.

Automotive companies are focusing more on cost-effective, light, and high-performance wiring solutions through the implementation of optical fiber and artificial intelligence-based manufacturing technologies. These technologies not only help to reduce manufacturing costs but also support the creation of more precise, reliable, and flexible wiring systems.

Key Highlights:

- The automotive wiring harness market size was valued at USD 52.32 billion in 2023.

- The market is projected to grow at a CAGR of 3.64% from 2024 to 2031.

- Asia Pacific held a market share of 47.23% in 2023, with a valuation of USD 24.71 billion.

- The engine segment garnered USD 14.65 billion in revenue in 2023.

- The electric wires segment is expected to reach USD 27.94 billion by 2031.

- The copper segment is expected to reach USD 46.13 billion by 2031.

- The passenger cars segment is expected to reach USD 43.05 billion by 2031.

- The market in Europe is anticipated to grow at a CAGR of 4.04% during the forecast period.

Market Driver

"Electric Vehicles, ADAS, and Smart Wiring"

The automotive wiring harness market is significantly driven by the rise in electric vehicles (EVs) and hybrid vehicle production, requiring advanced wiring systems for power management and signal transmission. The increasing integration of ADAS and vehicle connectivity is fueling the demand for more sophisticated harnesses to support features like automated driving.

Additionally, advancements in smart wiring technologies, including optical fiber and AI-based manufacturing, are driving innovation while increasing global vehicle production further accelerates the market growth.

- In 2023, according to the International Energy Agency (IEA), nearly 14 million new EVs were registered globally, increasing the total number of EVs on the road to 40 million. This represents a 35% year-over-year growth, with sales surpassing 2022 figures by 3.5 million units. Notably, EV sales in 2023 were more than six times higher than in 2018, reflecting the sector's rapid expansion over the past five years.

Market Challenge

"Complex Wiring Systems, Material Price Fluctuations, and High-Voltage"

The market faces challenges, such as the increasing complexity of wire harness designs due to the growing integration of electronic systems in modern vehicles. This complexity leads to higher production costs and extended lead times.

Furthermore, volatility in the supply chain for critical materials like copper and aluminum impacts pricing and availability, creating uncertainties for manufacturers. The industry also faces pressure to balance cost-effectiveness with the demand for high-performance, durable wiring solutions.

To address these challenges, manufacturers can adopt modular wiring systems, diversify material sourcing, leverage AI-driven production technologies, and invest in advanced insulation materials and safety innovations for high-voltage systems.

Market Trend

"Lightweight Materials, Modular Designs, and AI Boost"

The market is significantly accelerated by trends such as the shift toward lightweight and sustainable materials such as aluminum and optical fiber. These materials help reduce vehicle weight, improving overall fuel efficiency and performance. Modular harness designs are increasingly popular, due to their flexibility, allowing for easier customization and scalability in manufacturing.

The demand for high-voltage wiring systems is rising, due to the growing adoption of electrified powertrains and eco-friendly vehicle technologies in the industry.

In addition, the integration of AI and automation in manufacturing processes is significantly enhancing production efficiency, reducing operational costs, and improving precision, which is crucial for meeting the complex demands of modern vehicle wiring systems.

- In May 2024, Yazaki and Toray collaborated to develop a recycled PBT resin for automotive wiring harness connectors, reducing carbon emissions in the manufacturing process while maintaining the same performance as virgin materials, supporting sustainability in the industry.

Automotive Wiring Harness Market Report Snapshot

| Segmentation |

Details |

| By Application |

Engine, Chassis, Cabin, Body & Lightning, HVAC, Battery, Seat, Sunroof, Door |

| By Component |

Electric Wires, Connectors, Terminals, Others |

| By Material |

Copper, Aluminum, Optical Fiber |

| By Vehicle Type |

Passenger Cars, Commercial Vehicles |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Application (Engine, Chassis, Cabin, Body & Lightning, HVAC, Battery, Seat, Sunroof, and Door): The engine segment earned USD 14.65 billion in 2023, driven by the need for advanced powertrain systems and efficient connectivity for modern engines.

- By Component (Electric Wires, Connectors, Terminals, and Others): The electric wires segment held 40.23% share of the market in 2023, due to their essential role in power and signal transmission across vehicle systems, particularly in electrified and feature-rich vehicles.

- By Material (Copper, Aluminum, and Optical Fiber): The copper segment is projected to reach USD 46.13 billion by 2031, owing to its superior conductivity and critical use in high-power and high-voltage applications, especially in electric and hybrid vehicles.

- By Vehicle Type (Passenger Cars and Commercial Vehicles): The passenger cars segment is projected to reach USD 43.05 billion by 2031, owing to the growing demand for EVs and innovations in lightweight, fuel-efficient designs.

Automotive Wiring Harness Market Regional Analysis

Based on region, the automotive wiring harness market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 47.23% share of the automotive wiring harness market in 2023, with a valuation of USD 24.71 billion. This growth is driven by increasing vehicle production and the rising adoption of EVs and advanced technologies. The region's robust automotive manufacturing infrastructure and growing demand for connected vehicles further bolster market expansion.

- For instance, in 2023, China represented nearly 60% of all global electric car registrations, showcasing its dominant role in the transition to electric mobility. The share of EVs in total domestic car sales in China surpassed 35% in 2023, a significant increase from 29% in 2022.

The market in Europe is poised for significant growth at a robust CAGR of 4.04% over the forecast period. This expansion is driven by several factors, including the rising demand for EVs, which require more complex wiring systems to manage their advanced electrical needs.

The market is also influenced by stringent safety regulations and consumer preferences for enhanced safety features, leading to greater integration of electronic components in vehicles. Moreover, the region's focus on sustainability and innovation, alongside significant investments in research and development (R&D), aids the market growth.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the national highway traffic safety administration (NHTSA) sets safety standards for automotive wiring harnesses under the Federal Motor Vehicle Safety Standards (FMVSS), while the Society of Automotive Engineers (SAE) develops technical standards for their design, testing, and performance.

- In Europe, the European Union (EU) and European Committee for Standardization (CEN) regulate automotive wiring harnesses. The EU sets safety and environmental standards through regulations like vehicle type approval, while CEN develops European standards to ensure quality and performance consistency in wiring harnesses.

- In India, automotive wiring harnesses are regulated by the Ministry of Heavy Industries and Public Enterprises (MHI), and Automotive Research Association of India (ARAI). These organizations ensure compliance with safety, performance, and environmental standards for automotive components.

Competitive Landscape:

The automotive wiring harness industry is characterized by a large number of participants, including both established corporations and rising organizations. Leading companies are focusing on technological innovation, strategic collaborations, and product differentiation to stay ahead in the market.

Investment in AI-driven manufacturing, lightweight materials, and high-voltage wiring systems is increasing, driven by the rising demand for electric and connected vehicles. Additionally, market participants are expanding their market share through mergers, acquisitions, and strategic partnerships, enhancing supply chain capabilities and reinforcing their position in a competitive global market.

- For instance, in January 2023, LEONI expanded its presence in Mexico with a new facility, reinforcing its commitment to innovative wiring solutions for the growing demand in EVs, enhancing supply chain capabilities, and strengthening its competitive market position.

List of Key Companies in Automotive Wiring Harness Market:

- Aptiv PLC

- Furukawa Electric Co., Ltd.

- Kromberg & Schubert GmbH Cable & Wire

- Lear

- LEONI AG

- PKC Group Ltd

- Spark Minda

- Sumitomo Electric Industries, Ltd.

- YAZAKI Corporation

- Motherson

- YURA Corp.

- Nexans autoelectric GmbH

- COFICAB Group

- Coroplast Fritz Müller GmbH & Co. KG

- DRÄXLMAIER Group

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In July 2023, Leoni, a leading global provider of energy and data management solutions for the automotive industry, expanded its production capacities in Morocco. As part of this initiative, the company established a new wiring systems plant in Agadir, dedicated to the commercial vehicles segment, creating 3,000 new jobs. To facilitate these investments, Leoni recently formalized agreements with a delegation led by the Head of the Moroccan Government, Aziz Akhannouch, to implement multiple strategic projects.