Market Definition

Automotive tires are vehicle components that provide traction, absorb shocks, and support the vehicle’s load while ensuring road safety and fuel efficiency. These products are designed using various materials and structures to match different driving conditions, performance standards, and durability requirements.

The market includes radial, bias, and non-pneumatic tires manufactured for passenger cars, commercial vehicles, two-wheelers, and off-road equipment. The market serves on-road and off-road usage across OEM and aftermarket channels, with demand influenced by rim size and propulsion type such as internal-combustion, electric, and hybrid vehicles.

Automotive Tires Market Overview

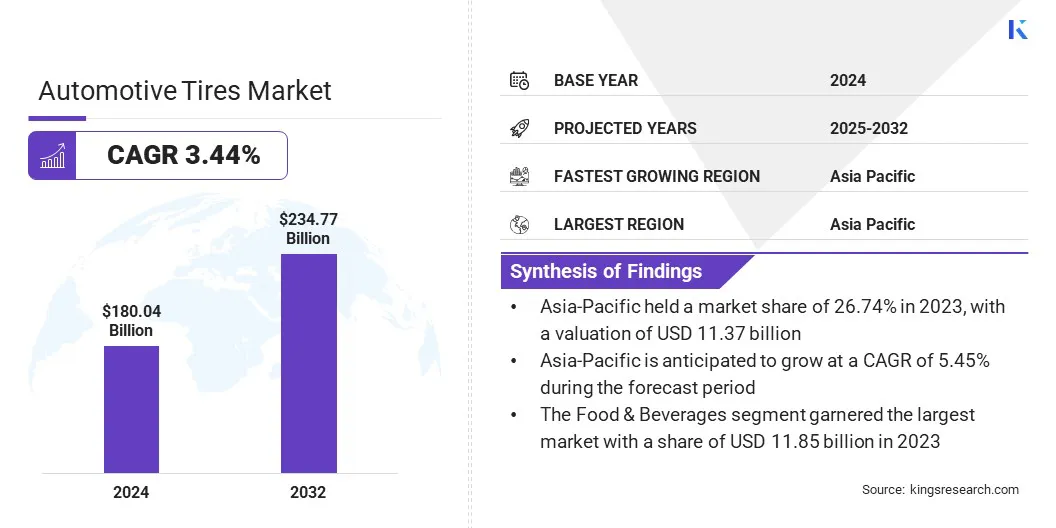

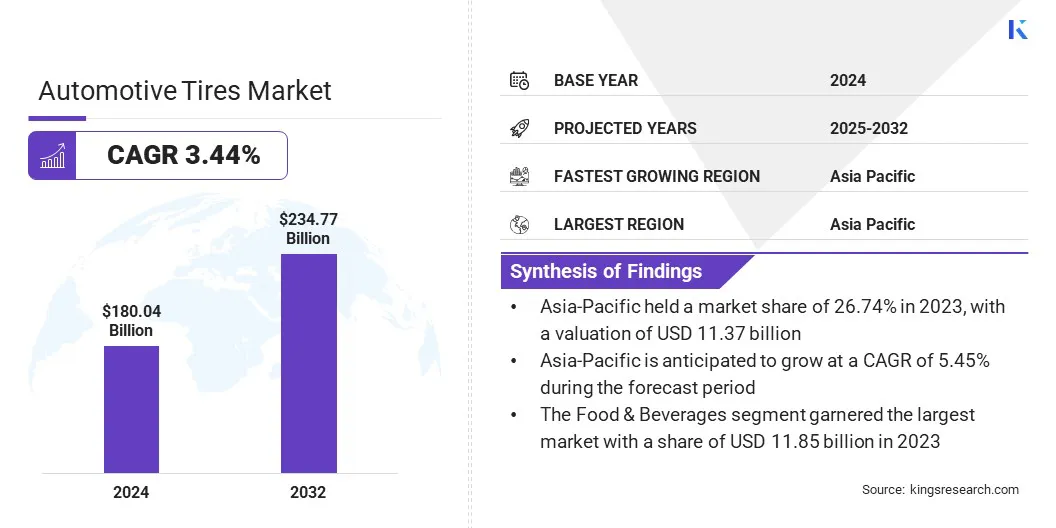

The global automotive tires market size was valued at USD 180.04 billion in 2024 and is projected to grow from USD 185.34 billion in 2025 to USD 234.77 billion by 2032, exhibiting a CAGR of 3.44% during the forecast period.

The growth is driven by rising vehicle production, increasing demand for replacement tires, and advancements in tire technology that improve durability, fuel efficiency, and safety. Expanding electric vehicle adoption and greater focus on performance and sustainability are further accelerating product innovation and market expansion across regions.

Key Highlights:

- The automotive tires industry size was recorded at USD 180.04 billion in 2024.

- The market is projected to grow at a CAGR of 3.44% from 2025 to 2032.

- North America held a market share of 54.30% in 2024, with a valuation of USD 97.76 billion.

- The radial segment garnered USD 157.00 billion in revenue in 2024.

- The passenger cars segment is expected to reach USD 131.62 billion by 2032.

- The on-road segment garnered USD 149.62 billion in revenue in 2024.

- The 15–20 Inches segment is expected to reach USD 120.84 billion by 2032.

- The internal-combustion vehicles segment is expected to reach USD 204.93 billion by 2032.

- The aftermarket segment is expected to reach USD 158.47 billion by 2032.

- Europe is anticipated to grow at a CAGR of 2.66% during the forecast period.

Major companies operating in the automotive tires market are Bridgestone, Michelin, The Goodyear Tire & Rubber Company, Continental Reifen Deutschland GmbH, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Ltd., Hankook Tire & Technology, THE YOKOHAMA RUBBER CO., LTD., TOYO TIRE CORPORATION, Giti Tire, NANKANG RUBBER TIRE CORP., LTD., Balkrishna Industries Limited, Deestone-Tires, DOUBLE STAR TIRE, and Triangle Tire Co., Ltd.

The market is driven by the increasing demand for all-season tires across passenger and commercial vehicles. These tires provide consistent performance in varying weather conditions, reducing the need for seasonal changeovers. Advancements in material engineering and tread design are improving durability, fuel efficiency, and driving comfort.

OEMs and fleet operators are adopting all-season tires to streamline inventory and maintenance costs. Companies are expanding all-season offerings to align with diverse market demands and deliver greater year-round value to consumers.

- In March 2025, Nokian Tyres launched its Seasonproof 2 all-season tire range for the Central European market. The new product line contains up to 38% renewable, recycled, and ISCC PLUS certified materials and is the first to be produced at the company’s zero CO₂ emission factory in Oradea, Romania.

Market Driver

Growing Demand for High-Performance Tires

Rising preference for enhanced vehicle handling and speed stability has driven the demand for high-performance tires. These tires deliver superior grip, braking accuracy, and responsiveness, making them essential for sports and performance vehicles. Standard tires often lack the precision and control required in high-speed or aggressive driving conditions.

High-performance tires address this need through specialized tread patterns, advanced rubber compounds, and reinforced internal structures that improve traction and durability.

- In March 2025, Pirelli launched the fifth generation of its P Zero tire, developed using artificial intelligence and virtual prototyping. The new ultra-high-performance (UHP) tire offers improved handling and shorter braking distances, with an “A” rating for wet grip on the European label. The tire features an optimized tread design and structure to support electric vehicles and enhance performance consistency throughout its lifecycle.

Market Challenge

Fluctuating Raw Material Costs Impacting Tire Production

The automotive tires market faces a significant challenge due to fluctuating raw material costs. Prices of key inputs such as natural rubber, synthetic rubber, and carbon black remain unstable, leading to unpredictable production expenses and margin pressures.

To mitigate this, manufacturers are adopting strategic sourcing agreements, exploring alternative materials, and leveraging advanced manufacturing technologies to improve cost efficiency and reduce dependency on volatile raw inputs.

Market Trend

Specialized Tires for Electric Vehicles

The automotive tires market is undergoing a significant transformation due to the rising adoption of electric vehicles (EVs). EV-specific tires are engineered with features such as low rolling resistance, reinforced structures for heavier battery loads, and optimized tread patterns to reduce road noise. These design elements enhance driving efficiency and align with the performance demands of electric drivetrains.

- According to the Global EV Outlook 2025 by the International Energy Agency (IEA), global electric car production reached 17.3 million units in 2024, marking an increase of nearly 25% compared to 2023. This surge in EV output is accelerating demand for specialized tire solutions, prompting tire manufacturers to realign their product strategies and invest in EV-focused innovation.

- In May 2023, Bridgestone Americas debuted its Turanza EV grand touring tire at Electrify Expo, marking the company’s first dedicated replacement tire for premium electric vehicles. The tire features ENLITEN technology to optimize all-season performance, extend tread life, and incorporate renewable and recycled materials, including recycled carbon black and rice husk silica.

Automotive Tires Market Report Snapshot

|

Segmentation

|

Details

|

|

By Tire Design

|

Radial, Bias, Non-pneumatic/ Airless

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers, Off-the-Road & Specialty (OTR, Agriculture, Mining, Racing)

|

|

By Application

|

On-Road, and Off-Road (Construction, Mining, Agriculture)

|

|

By Rim Size

|

15–20 Inches, Below 15 Inches, Above 20 Inches

|

|

By Propulsion

|

Internal-Combustion Vehicles, Electric Vehicles, Hybrid Vehicles

|

|

By End User

|

Aftermarket (Replacement, Retread), OEM

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Tire Design (Radial, Bias, and Non-pneumatic/ Airless): The radial segment earned USD 157.00 billion in 2024 due to higher durability, improved fuel efficiency, and widespread adoption in passenger and commercial vehicles.

- By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers, Off-the-Road & Specialty): The passenger cars segment held 56.80% of the market in 2024, due to increasing global vehicle ownership and regular tire replacement cycles.

- By Application (On-Road and Off-Road): The on-road segment is projected to reach USD 191.17 billion by 2032, owing to the expanding fleet of urban and highway vehicles and rising demand for long-lasting, high-performance tires.

- By Rim Size (15–20 Inches, Below 15 Inches, and Above 20 Inches): The 15–20 Inches segment is projected to reach USD 120.84 billion by 2032, owing to the growing production of mid-size and premium vehicles that commonly use this rim size.

- By Propulsion (Internal-Combustion Vehicles, Electric Vehicles, and Hybrid Vehicles): The internal-combustion vehicles segment is projected to reach USD 204.93 billion by 2032, owing to the large global base of ICE-powered vehicles and steady replacement demand.

- By End User (Aftermarket and OEM): The aftermarket segment is projected to reach USD 158.47 billion by 2032, owing to rising vehicle miles traveled and increased consumer preference for timely tire replacements and retreading services.

Automotive Tires Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America automotive tires market share stood at 54.30% in 2024 in the global market, with a valuation of USD 97.76 billion. The dominance is due to the region’s high vehicle ownership rate and strong automotive production base, which drives consistent demand across OEM and aftermarket channels.

Major tire manufacturers operate extensive production and distribution facilities across the U.S., supporting large-scale supply to meet demand from passenger cars, light trucks, and commercial vehicles. Moreover, continuous investments in manufacturing technology and product innovation by the key market players is driving market growth across the region.

Europe automotive tires industry is poised to grow at a CAGR of 2.66% over the forecast period. The growth is driven by tire manufacturers expanding production facilities and R&D capabilities across key European countries to strengthen regional supply. Moreover, the presence of leading tire manufacturers that are actively investing in advanced manufacturing plants, automation, and localized R&D centers is further driving the growth of the market.

These investments are targeted towards reducing lead times and respond faster to evolving vehicle standards. These expansions are enabling manufacturers to serve OEM contracts more efficiently while addressing region-specific requirements such as winter tire performance and sustainability targets.

- In January 2025, Hankook Tire launched its new Optimo sub-brand in Europe to expand market share and meet rising demand for reliable, all-season passenger car and SUV tires. The Optimo line includes summer, winter, and all-season products across a range of sizes.

Regulatory Frameworks

- In Europe, tire manufacturers must comply with Regulation (EC) No. 661/2009, which mandates requirements for tire safety, rolling resistance, and external rolling noise. Additionally, the EU Tire Labelling Regulation (EU) 2020/740 requires standardized labeling on parameters such as fuel efficiency, wet grip, and noise levels to help consumers make informed choices.

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) enforces performance standards under the Federal Motor Vehicle Safety Standards (FMVSS No. 109 and No. 139), covering tire strength, endurance, and high-speed performance.

Competitive Landscape

Key players in the automotive tires industry are focusing on product innovation and regional expansion to strengthen their market position. Companies are developing high-performance sporty tires designed for enhanced grip, speed stability, and cornering control to meet the rising demand from performance vehicles and premium passenger cars.

Manufacturers are expanding production facilities in regions with growing automotive assembly operations to reduce delivery times and improve supply chain efficiency.

Strategic investments in localized R&D centers are helping companies tailor tire designs to regional road conditions, vehicle types, and regulatory standards. In addition, partnerships with local distributors and OEMs are enabling faster market access and stronger brand presence across competitive regions.

- In April 2024, Continental Tyres launched the MaxContact MC7, a high-performance sporty tire designed for Asia Pacific. The product offers high control, shorter braking distances, and reduced noise, making it well-suited for urban driving conditions in the region.

Key Companies in Automotive Tires Market:

- Bridgestone

- Michelin

- The Goodyear Tire & Rubber Company

- Continental Reifen Deutschland GmbH

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- Hankook Tire & Technology

- THE YOKOHAMA RUBBER CO., LTD.

- TOYO TIRE CORPORATION

- Giti Tire

- NANKANG RUBBER TIRE CORP., LTD.

- Balkrishna Industries Limited

- Deestone-Tires

- DOUBLE STAR TIRE

- Triangle Tire Co., Ltd.

Recent Developments (Product Launch)

- In June 2025, Hankook Tire & Technology launched the iON HT, its first highway-terrain tire designed for electric light-duty trucks and full-size SUVs. The tire features high-load support, ultra-low rolling resistance, and an 80,000-mile limited treadwear warranty.

- In March 2025, Bridgestone Americas unveiled the Bridgestone R273 Ecopia and Duravis M705 tires featuring ENLITEN technology at the TMC Annual Meeting & Transportation Technology Exhibition. The R273 Ecopia is designed for the steer position in regional trucks and offers improved fuel efficiency and tread wear. The Duravis M705 targets pickup and last-mile delivery fleets, providing enhanced durability, winter performance, and retreading potential.