Market Definition

The market refers to the industry that develops technologies, systems, and solutions designed to regulate and control the temperature within automotive vehicles. It ensures the optimal operation of components such as the engine, battery, exhaust, HVAC (heating, ventilation, and air conditioning), and other electronic systems.

This improves performance, safety, energy efficiency, and longevity of vehicles. This report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks that are expected to impact market dynamics over the forecast period.

Automotive Thermal Management Market Overview

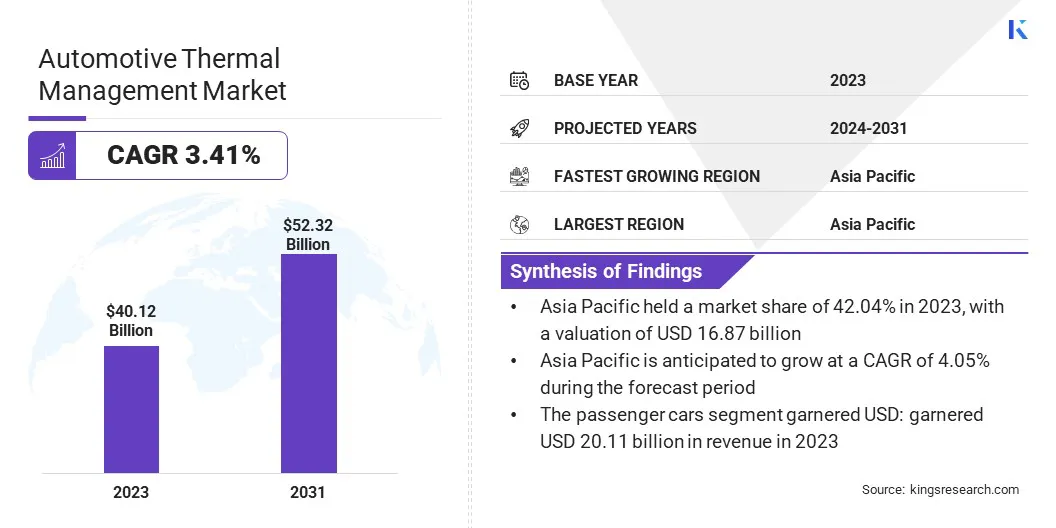

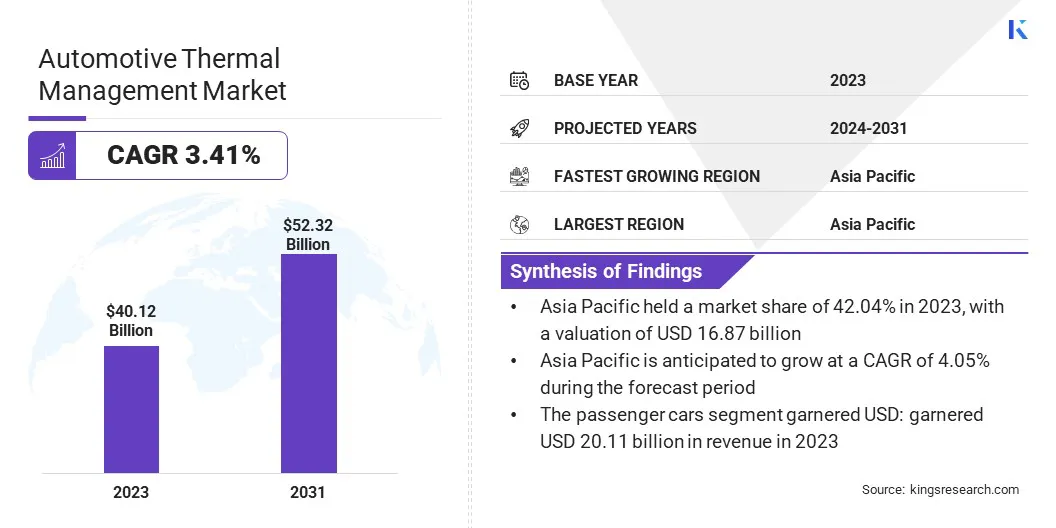

Global automotive thermal management market size was valued at USD 40.12 billion in 2023, which is estimated to be valued at USD 41.36 billion in 2024 and reach USD 52.32 billion by 2031, growing at a CAGR of 3.41% from 2024 to 2031.

The increasing adoption of electric and hybrid vehicles (EVs and HEVs) is driving the demand for advanced thermal management solutions. These systems are used to ensure optimal battery life, performance, and overall efficiency of EVs and HEVs.

Major companies operating in the automotive thermal management industry are DENSO CORPORATION, MAHLE GmbH, Hanon Systems, VALEO, BorgWarner Inc., GENTHERM, Schaeffler AG, Johnson Electric Holdings Limited., Dana Limited., Robert Bosch GmbH, Modine, Industrie Saleri Italo S.p.A., Thermal Management Solutions Group, Delta Electronics, Inc., and Vikas Group.

The market is evolving rapidly, driven by the increasing complexity of modern vehicles, particularly electric vehicles. As EVs incorporate advanced sensors, chips, and batteries, the need for efficient thermal management solutions has become critical.

These systems ensure the optimal performance and longevity of electronic components by regulating temperatures. With the rise of electric and hybrid vehicles, as well as stricter environmental regulations, the market is experiencing a significant growth.

- In October 2024, Honda unveiled next-generation technologies for its upcoming Honda 0 Series EVs, emphasizing energy efficiency, advanced thermal management, and automation. These innovations highlight the growing need for effective thermal management solutions in electric and autonomous vehicles, driving market growth.

Key Highlights:

- The automotive thermal management industry size was recorded at USD 40.12 billion in 2023.

- The market is projected to grow at a CAGR of 3.41% from 2024 to 2031.

- Asia Pacific held a market share of 42.04% in 2023, with a valuation of USD 16.87 billion.

- The passenger cars segment garnered USD 20.11 billion in revenue in 2023.

- The HVAC segment is expected to reach USD 19.82 billion by 2031.

- The thermoelectric generators segment is anticipated to witness the fastest CAGR of 4.33% during the forecast period

- Europe is anticipated to grow at a CAGR of 3.64% during the forecast period.

Market Driver

"Increasing Adoption of Electric and Hybrid Vehicles"

The growing adoption of electric and hybrid vehicles (EVs and HEVs) is driving demand for advanced thermal management systems. These vehicles rely on efficient cooling solutions to maintain battery temperature, prevent overheating, and ensure optimal energy efficiency.

Effective thermal management supports longer battery life, stable performance, and improved vehicle safety. As manufacturers focus on developing sustainable and high-performance EVs, investment in thermal technologies continues to increase, supporting overall market growth.

- In October 2024, Hyundai Mobis unveiled its 'Pulsating Heat Pipe' for EV battery cooling, demonstrating a nearly 20-degree temperature difference compared to standard aluminum cooling plates. This innovative material enhances thermal management during ultra-fast charging, reducing overheating and charging times.

Market Challenge

"Space and Weight Constraints in Vehicles"

Space and weight constraints in modern vehicles pose significant challenges to integrating advanced thermal management systems without affecting overall performance. As vehicles become more compact and energy-efficient, the need for lightweight, space-efficient cooling solutions intensifies.

To address this, manufacturers and researchers are developing innovative technologies such as microchannel heat exchangers, phase-change materials, and two-phase cooling systems that maximize thermal performance while minimizing bulk and mass.

These advanced solutions ensure effective cooling without compromising vehicle design or efficiency, enabling the seamless integration of high-performance systems in space-limited environments.

Market Trend

"Integration of Advanced Thermal Solutions in Electrified Vehicle"

The automotive thermal management market is witnessing a shift driven by the rising adoption of electric and hybrid vehicles. Automakers are integrating advanced thermal solutions to regulate battery temperature, improve component efficiency, and ensure system reliability.

Technologies such as integrated coolant modules, compact heat exchangers, and active thermal management systems are being developed to meet the unique cooling and heating requirements of electrified powertrains.

This trend supports longer battery life, better performance, and reduced energy consumption, aligning with broader goals for energy efficiency and vehicle sustainability.

- In July 2024, Cooper Standard introduced its eCoFlow Switch Pump, a fluid control technology for electrified and hybrid vehicles. This integrated solution combines an electric water pump and valve to simplify thermal management to improve efficiency, reduce system complexity, and minimize packaging space.

Automotive Thermal Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vehicle Type

|

Passenger Cars, Commercial Vehicles, Electric Vehicles

|

|

By System

|

HVAC, Powertrain Cooling, Battery Thermal Management, Waste Heat Recovery

|

|

By Technology

|

Active Transmission Warmers, Exhaust Gas Recirculation (EGR), Engine Thermal Mass Reduction, Thermoelectric Generators

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles): The passenger cars segment earned USD 20.11 billion in 2023 due to increasing demand for electric vehicles and the need for advanced thermal management solutions to optimize battery performance and energy efficiency.

- By System (HVAC, Powertrain Cooling, Battery Thermal Management, Waste Heat Recovery): The HVAC segment held 38.12% of the market in 2023, due to rising consumer demand for energy-efficient climate control systems and the integration of advanced thermal solutions in modern vehicle designs.

- By Technology [Active Transmission Warmers, Exhaust Gas Recirculation (EGR), Engine Thermal Mass Reduction, and Thermoelectric Generators]: The thermoelectric generators segment is projected to reach USD 18.39 billion by 2031, owing to the growing focus on regenerative energy systems and the increasing adoption of sustainable technologies in automotive applications.

Automotive Thermal Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific automotive thermal management market share stood around 42.04% in 2023 in the global market, with a valuation of USD 16.87 billion. This dominance is attributed to its strong automotive manufacturing base and increasing demand for electric vehicles (EVs).

As countries in this region focus on advancing EV technology, there is a growing emphasis on developing efficient thermal management solutions to enhance vehicle performance, energy efficiency, and range.

Government policies supporting electric mobility, coupled with the expansion of manufacturing capabilities and investment in research, are driving the region’s leadership in thermal management innovations, making it a key player in the global market.

- In June 2023, TI Fluid Systems opened new e-Mobility Innovation Centers (eMICs) in Japan and South Korea to accelerate the development of thermal management solutions for electric vehicles. These centers foster collaboration, enabling faster innovation and enhancing vehicle performance through advanced engineering, testing, and prototyping.

Europe automotive thermal management industry is poised for significant growth at a robust CAGR of 3.64% over the forecast period. Europe is emerging as a rapidly growing region for the market, driven by increasing demand for electric vehicles (EVs) and stringent environmental regulations.

The region's focus on sustainability and innovation is leading to advancements in thermal management technologies, optimizing battery performance and energy efficiency.

Additionally, key automotive manufacturers and suppliers in Europe are investing heavily in research and development to integrate advanced thermal solutions, further fueling the growth of the market in this region.

Regulatory Frameworks

- In June 2023, the U.S. proposed new Federal Motor Vehicle Safety Standards for electric-powered vehicles, focusing on the electric powertrain integrity. This regulation aims to enhance safety and performance standards for electric vehicles, especially addressing safety concerns associated with electric powertrains and contributing to the advancement of electric mobility.

- In India, the introduction of updated automotive safety standards, including the AIS-156 amendment, emphasizes stringent thermal safety measures for electric vehicles. This includes thermal propagation testing and enhanced battery management system requirements, driving the growth of electric vehicle safety and sustainability within the region's automotive industry.

- The Commission Regulation (EU) 2023/2485 establishes new requirements for the design and performance of electric vehicle thermal management systems. This regulation aims to improve safety, efficiency, and environmental sustainability in the European automotive market.

Competitive Landscape

In the automotive thermal management industry, companies are increasingly focusing on developing innovative solutions to support the growing demand for electric vehicles.

Manufacturers are investing in advanced technologies like modular thermal management systems, which integrate multiple components to improve energy efficiency. These solutions aim to enhance battery performance, optimize vehicle cabin temperatures, and reduce charging times.

- In April 2024, MAHLE secured major orders for thermal management modules, with a combined order volume nearing USD 1.6 billion. These modules enhance electric vehicle performance by improving battery range and charging speed. This strategic focus on electrification strengthens MAHLE’s position in the growing e-mobility industry.

List of Key Companies in Automotive Thermal Management Market:

- DENSO CORPORATION

- MAHLE GmbH

- Hanon Systems

- VALEO

- BorgWarner Inc.

- GENTHERM

- Schaeffler AG

- Johnson Electric Holdings Limited.

- Dana Limited.

- Robert Bosch GmbH

- Modine

- Industrie Saleri Italo S.p.A.

- Thermal Management Solutions Group

- Delta Electronics, Inc.

- Vikas Group

Recent Developments (Partnerships/ Product Launch)

- In August 2024, Hanon Systems introduced the world’s first 4th generation heat pump system for electric vehicles (EVs). This innovative system features a parallel heat source recovery method, utilizing both battery waste heat and external air to optimize energy efficiency, enhance heating and cooling, and improve battery temperature management. The system’s modular design incorporates integrated refrigerant and coolant components, reducing size and boosting performance.

- In April 2024, Vitesco Technologies and Sanden International partnered to develop an integrated thermal management system for battery electric vehicles. This collaboration focuses on reducing complexity, improving energy efficiency, and supporting the transition to natural refrigerants like propane, enhancing both vehicle performance and sustainability.

- In December 2023, TI Fluid Systems partnered with Sanden to advance next-generation thermal refrigerant modules for electric vehicles. This collaboration combines their expertise in thermal management and e-compressors, accelerating the development of highly efficient, integrated thermal solutions.