Market Definition

Automotive silicone is a high-performance synthetic material that constitutes silicon, oxygen, carbon, and hydrogen. It offers superior thermal stability, flexibility, durability, and resistance to weathering, moisture, and chemicals. As a result, it is widely used in sealing, gasketing, bonding, vibration damping, insulation, thermal management, coatings, lubricants, and protective films.

The market encompasses the production, development, and commercialization of silicone-based materials, components, and solutions specifically for automotive applications.

Automotive Silicone Market Overview

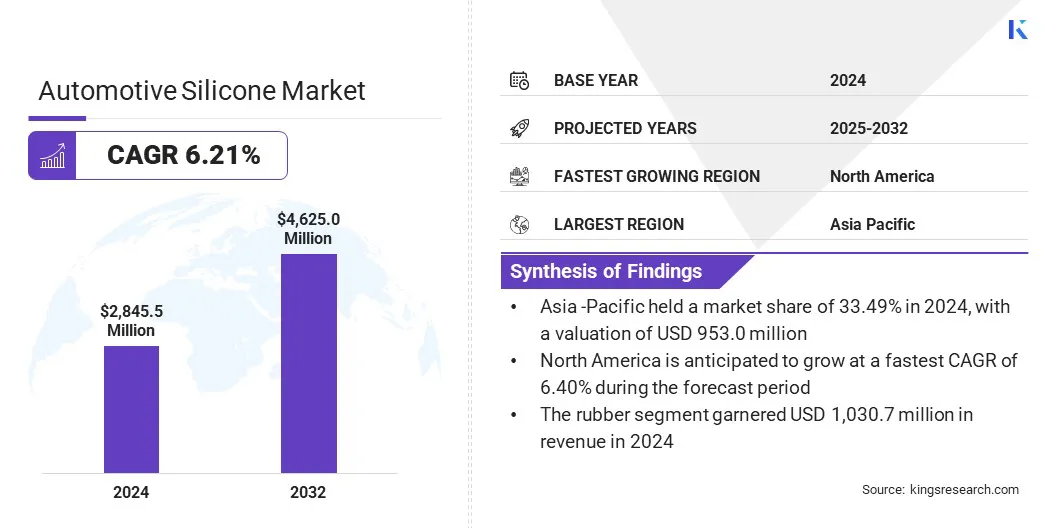

According to Kings Research, the global automotive silicone market size was valued at USD 2,845.5 million in 2024 and is projected to grow from USD 3,015.7 million in 2025 to USD 4,625.0 million by 2032, exhibiting a CAGR of 6.21% over the forecast period.

Rising demand for lightweight vehicle components, such as silicone-based gaskets, seals, engine parts, and other interior parts, is primarily driving the growth of this market. Additionally, increasing focus on vehicle safety and durability is driving the adoption of high-performance silicone solutions in engines, protective coatings, and critical sealing.

Key Market Highlights:

- The automotive silicone industry size was recorded at USD 2,845.5 million in 2024.

- The market is projected to grow at a CAGR of 6.21% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 953.0 million.

- The rubber segment garnered USD 1,030.7 million in revenue in 2024.

- The interior and exterior parts segment is expected to reach USD 1,300.1 million by 2032.

- North America is anticipated to grow at a CAGR of 6.40% over the forecast period.

Major companies operating in the automotive silicone market are Henkel Centroamericana, S.A., Dow Inc, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd, Elkem ASA, Evonik Industries AG, KCC SILICONE CORPORATION, 3M Company, CHT Germany GmbH, Primasil Silicones Ltd, Siltech Corporation, Mitsubishi Shoji Chemical Corporation, Rogers Corporation, Zhejiang Xin'an Chemical Industry Group Co., Ltd, and BRB International B.V.

A major trend operating in the market is the rising demand for silicone-based components in EVs (electric vehicles). Silicone is being used in EVs for enhancing battery safety, managing heat, and providing effective sealing solutions. Its superior thermal stability and electrical insulation make it indispensable for EV systems, which is fueling its adoption in the automotive industry.

- The International Energy Agency (IEA) reported that global electric car sales surpassed 17 million units in 2024, registering a 25% increase from 2023.

Market Driver

Rising Demand for Lightweight Materials

The growth of the market is propelled by the rising demand for lightweight materials to improve fuel efficiency and reduce emissions in the automotive industry. Silicone-based components, such as gaskets, seals, engine parts, and interior elements, offer high durability, flexibility, and thermal stability while reducing vehicle weight.

The U.S. Department of Energy (DOE) reports that a 10% reduction in vehicle weight can result in a 6–8% improvement in fuel economy. Regulatory authorities worldwide are also shifting their focus toward vehicle efficiency and compliance, which is prompting investments in silicone-based components.

Market Challenge

High Production Cost

The market faces a major challenge in the automotive silicone market in the form of high production cost of silicone-based materials, including elastomers, adhesives, sealants, and coatings.

The manufacturing process requires advanced equipment, energy-intensive operations, and costly raw materials such as siloxanes, which substantially increase expenses. Additionally, costs associated with quality control, specialized processing, and regulatory compliance add to the financial burden.

As a result, market players are adopting process optimization and automation to cut energy use and boost the yield of high-performance silicone. Companies are also expanding research into cost-effective formulations and hybrid materials that retain silicone’s performance while lowering raw material expenses.

Market Trend

Growing Integration of Silicone in EV Battery Packs and Power Electronics

A key trend influencing the market is the growing integration of silicone in electric vehicle (EV) battery packs and power electronics. Manufacturers are incorporating silicone gels, adhesives, and encapsulants in high-voltage components such as inverters, IGBT modules, and battery systems for thermal management, electrical insulation, and vibration damping.

These solutions enhance reliability, improve energy efficiency, and protect against moisture and chemical exposure. It also supports the performance, safety, and longevity of next-generation EV powertrains.

- Dow launched DOWSIL EG-4175 Silicone Gel, a high-performance material for next-generation IGBT modules in electric vehicles and renewable energy applications. This product enhances thermal stability, reliability, and power efficiency in high-voltage power electronics.

Automotive Silicone Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Rubber, Adhesives & Sealants, Coatings, Others

|

|

By Application

|

Interior and Exterior Parts, Engine & Drive Train System, Electrical System, Suspension Systems, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Rubber, Adhesives & Sealants, Coatings, and Others): The rubber segment earned USD 1,030.7 million in 2024 due to its extensive use in gaskets, seals, hoses, and vibration-damping components within automotive systems.

- By Application (Interior and Exterior Parts, Engine & Drive Train System, Electrical System, Suspension Systems, and Others): The interior and exterior parts segment held 28.08% of the market in 2024, due to a high demand for durable, flexible silicone components for dashboards, panels, trims, and sealing.

Automotive Silicone Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific automotive silicone market share stood at 33.49% in 2024, valued at USD 953.0 million in the global market. This is primarily driven by the rapidly expanding automotive sector, which has fueled the demand for high-performance silicone components in various automotive systems.

Government policies promoting EV adoption, such as tax rebates, direct subsidies, and exemptions from road taxes are further boosting the need for automotive silicone. Advances in automotive manufacturing, including automation, additive manufacturing, and precision molding, are making durable, efficient materials available.

Additionally, regional market players are focusing on enhancing their manufacturing capabilities and distribution networks to meet the growing demand for automotive silicone solutions.

- In February 2025, Biesterfeld Group acquired Tat Lee’s silicone distribution business in Singapore. This acquisition was done to strengthen Biesterfeld’s regional distribution network and enhance the availability of high-performance silicone materials for automotive sector.

North America is set to grow at a CAGR of 6.40% over the forecast period. This growth is attributed to the increasing adoption of electric vehicles, which drives the demand for silicone in battery insulation, thermal management, and high-voltage system protection.

Stringent vehicle safety and emission regulations, such as fuel economy standards requires durable, high-performance silicone components in engines, gaskets, and seals. Rising integration of advanced electronics and infotainment systems in vehicles further fuels the need for silicone-based insulation and encapsulation for wiring, sensors, and electronic modules.

Additionally, strategic expansions and capacity enhancements by regional market players improves the supply and accessibility of silicone solutions, supporting broader adoption of automotive silicone across the region.

- In April 2025, Kodiak LLC acquired Sunocs LLC, the largest grease and silicone manufacturing facility in North America. This acquisition expands Kodiak’s manufacturing capabilities and customer base and also enhances the supply and availability of high-performance silicones for the automotive sector.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the market by overseeing emissions, chemical safety, and material compliance. The agency enforces limits on volatile organic compounds (VOCs) in silicone-based coatings and adhesives.

- In the UK, the Health and Safety Executive (HSE) regulates the automotive silicone market by overseeing workplace safety, chemical compliance, and environmental protection. HSE enforces REACH regulations and ensures silicone-based adhesives, sealants, and coatings meet environmental standards in automotive production and usage.

- In China, the Ministry of Ecology and Environment (MEE) regulates the market through emissions control, chemical safety, and environmental standards. It enforces VOC limits, hazardous substance controls, and green manufacturing practices to ensure silicones in coatings, adhesives, and rubber components align with dual-carbon and sustainability goals.

- In India, the Bureau of Indian Standards (BIS) regulates the market by setting quality and safety standards for silicone-based rubbers, adhesives, and coatings. BIS ensures that silicone use in automotive parts aligns with emission norms and sustainability goals.

Competitive Landscape

Major players in the automotive silicone market are actively strengthening their competitive position through technological innovation and strategic expansions. Key players are investing in the development of high-performance silicone materials for electric vehicle batteries, and lightweight automotive components.

They are also focusing on expanding their portfolios with specialty coatings, and 3D-printable silicone solutions to meet the growing demand for advanced electronics, and efficient powertrain systems. Additionally, players are enhancing manufacturing capabilities and optimizing distribution networks to improve supply reliability and market reach for automotive silicone solutions.

- In May 2025, Trelleborg acquired European silicone specialist Sico, strengthening its silicone capabilities in Europe. This expansion allows Trelleborg to offer a broader range of high-quality silicone solutions for automotive sector.

Key Companies in Automotive Silicone Market:

- Henkel Centroamericana, S.A.

- Dow Inc

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd

- Elkem ASA

- Evonik Industries AG

- KCC SILICONE CORPORATION

- 3M Company

- CHT Germany GmbH

- Primasil Silicones Ltd

- Siltech Corporation

- Mitsubishi Shoji Chemical Corporation

- Rogers Corporation

- Zhejiang Xin'an Chemical Industry Group Co., Ltd

- BRB International B.V.

Recent Developments

- In January 2025, KCC Silicone merged with Momentive Performance Materials Korea, combining domestic operations with global expertise. This strategic merger strengthens KCC Silicone’s capabilities in the automotive sector.

- In July 2024, BRB Silicones launched BRB SF 1802, an aminoalkyl functional silicone for automotive car care. The product provides improved surface protection, reduces dirt adherence, and allows easy cleaning of treated surfaces.

- In July 2025, Stratasys and Shin-Etsu launched P3 Silicone 25A, a high-performance silicone material for additive manufacturing. This material enables the production of flexible, automotive-grade parts with precision 3D printing.