Market Definition

Automotive sensors are devices that detect physical parameters such as temperature, pressure, speed, and position and convert them into signals for electronic control units. These sensors enable accurate monitoring and control across various automotive systems to ensure optimal performance and safety.

They are integrated into vehicle functions, including powertrain, chassis, body electronics, and advanced driver assistance systems. The market includes a broad range of sensor technologies that support conventional and next-generation vehicles.

Automotive Sensors Market Overview

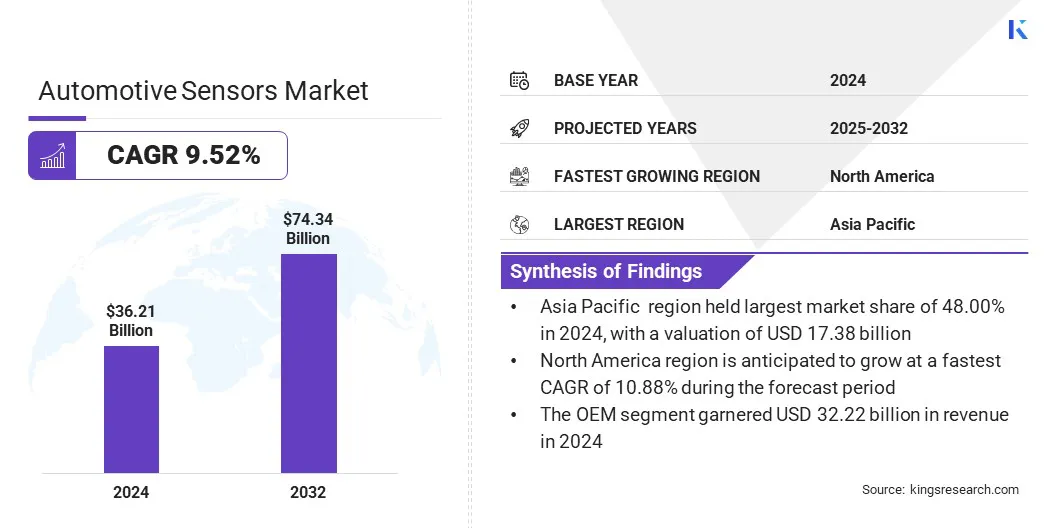

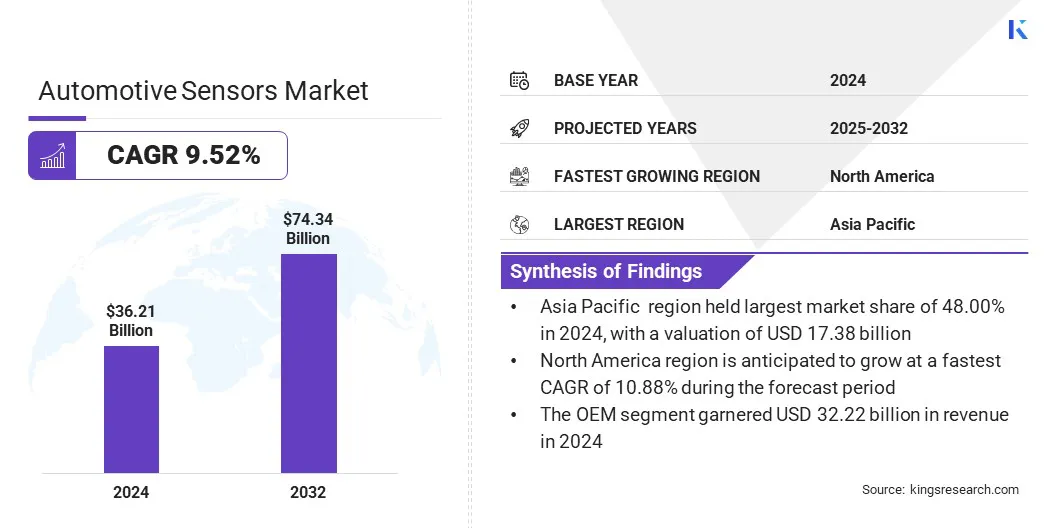

The global automotive sensors market size was valued at USD 36.21 billion in 2024 and is projected to grow from USD 39.33 billion in 2025 to USD 74.34 billion by 2032, exhibiting a CAGR of 9.52% over the forecast period. This growth is attributed to the growing demand for ultra-low power sensors, enhancing energy efficiency, particularly in electric and hybrid vehicles.

Additionally, there is a clear shift toward sensors with extended operating temperatures to ensure reliability across varying thermal conditions. Rising vehicle electrification, increasing integration of ADAS, and advancements in vehicle electronics are contributing to the broader adoption of high-performance sensors.

Key Highlights

- The automotive sensors industry was valued at USD 36.21 billion in 2024.

- The market is projected to grow at a CAGR of 9.52% from 2025 to 2032.

- Asia Pacific held a market share of 48.00% in 2024, with a valuation of USD 17.38 billion.

- The temperature sensors segment garnered USD 5.07 billion in revenue in 2024.

- The passenger cars segment is projected to generate a valuation of USD 50.75 billion by 2032.

- The powertrain segment is estimated to reach USD 19.92 billion by 2032.

- The OEM segment is expected to reach USD 64.70 billion by 2032.

- North America is anticipated to grow at a CAGR of 10.88% during the forecast period.

Major companies operating in the automotive sensors market are Robert Bosch GmbH, Continental AG, DENSO CORPORATION, STMicroelectronics, Infineon Technologies AG, BorgWarner Inc., NXP Semiconductors, Renesas Electronics Corporation, Analog Devices, Inc., Amphenol Advanced Sensors, Semiconductor Components Industries, LLC, CTS Corporation, TE Connectivity, VALEO, and Sensata Technologies, Inc.

Market growth is propelled by advancements in sensor technologies that enable direct temperature measurement on the rotor of permanently excited synchronous motors in electric vehicles. This enables precise thermal monitoring of the motor’s rotating components, which was previously difficult due to limited sensor access and high-speed operation.

Accurate rotor temperature data improves thermal management, enhances motor efficiency, and protects against overheating. These sensors support the performance and safety demands of high-efficiency electric drivetrains, reinforcing their value in next-generation EV platforms.

- In June 2025, Continental introduced its e-Motor Rotor Temperature Sensor (eRTS) technology, becoming the first to enable direct temperature measurement on the rotor of permanently excited synchronous motors in electric vehicles. The innovation offers a more precise alternative to algorithm-based temperature simulations, reducing the tolerance range from 15°C to 3°C. This allows manufacturers to lower the use of rare earth elements required for heat-resistant magnets, while improving motor performance and sustainability.

Market Driver

Growing Demand for Ultra-Low Power Sensors

The growth of the automotive sensors market is driven by the rising demand for sensors with ultra-low power consumption. Automakers are focusing on improving energy efficiency across electric and hybrid vehicles, where each electronic component must reduce battery load without compromising functionality.

Low-power sensors support an extended driving range, lower heat generation, and optimized energy use across key vehicle systems. These sensors are widely used in battery management, thermal control, and tire pressure monitoring, where continuous operation with minimal energy draw is essential.

Manufacturers are designing advanced sensor ICs that deliver precise signal processing, while operating on extremely low current, helping automakers meet performance standards and energy efficiency targets in modern vehicle platforms.

- In June 2025, Bosch launched the SMP290, a compact MEMS-based tire pressure sensor, featuring an integrated Bluetooth Low Energy interface. The sensor combines multiple components, including a microcontroller, a 2-axis acceleration sensor, and temperature and pressure sensors, into a fully integrated and ultra-low power solution. SMP290 enables wireless communication, smartphone interaction, and over-the-air updates, simplifying vehicle architecture and extending sensor lifespan up to ten years.

Market Challenge

Increasing Sensor Complexity Creating Integration and Cost Challenges

A major challenge in the automotive sensors market is the rising complexity of sensor systems for advanced vehicle functions. Modern vehicles demand high-precision and multi-functional sensors that can support systems like ADAS and electric powertrains. This makes it difficult to manage integration complexities, control rising development costs, and balance performance and reliability.

To overcome this challenge, companies are adopting modular sensor designs and system-on-chip solutions that reduce design time and simplify installation. Manufacturers are also working closely with OEMs during early development stages to align performance requirements and streamline integration.

Market Trend

Shift Toward Sensors with Extended Temperature Range

The automotive sensors market is experiencing a shift toward developing sensors with extended operating temperature ranges. This shift supports consistent performance in harsh thermal conditions, mainly found in engine compartments and external environments. Vehicles now integrate more electronics near heat-generating components, making it essential for sensors to function accurately in high and low temperatures.

Extended temperature tolerance ensures reliable data transmission and system response in safety features, powertrain controls, and battery monitoring. This shift is especially important for electric and hybrid vehicles, where thermal management is critical to maintain overall system efficiency and durability.

- In June 2025, TDK Corporation announced the global distribution of its InvenSense SmartAutomotive IAM-20680HV, a high-value 6-axis IMU designed for in-cabin automotive applications. The sensor operates in harsh conditions up to +125 °C, with guaranteed performance up to +105 °C, offering low-noise operation and precise motion tracking. It integrates a 3-axis gyroscope and a 3-axis accelerometer in a compact package, featuring a ±125 dps full-scale gyroscope for enhanced navigation.

Automotive Sensors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Temperature Sensors, Pressure Sensors, Speed Sensors, LiDAR Sensors, Radar Sensors, Position Sensors, Image Sensors, Oxygen Sensors, NOx Sensors, Others

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two Wheelers

|

|

By Application

|

Powertrain, Safety & Security, Body Electronics, Chassis, Telematics, ADAS, Others

|

|

By Distribution Channel

|

OEM, Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Temperature Sensors, Pressure Sensors, Speed Sensors, LiDAR Sensors, Radar Sensors, Position Sensors, Image Sensors, Oxygen Sensors, NOx Sensors, and Others): The temperature sensors segment earned USD 5.07 billion in 2024, due to increasing integration in engine and battery thermal management systems across modern vehicles.

- By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Two Wheelers): The passenger cars segment held 66.00% of the market in 2024, due to the growing deployment of advanced electronics and safety technologies in this vehicle category.

- By Application (Powertrain, Safety & Security, Body Electronics, Chassis, Telamatics, ADAS, and others): The powertrain segment is projected to reach USD 19.92 billion by 2032, owing to the rising adoption of engine control and emission monitoring systems.

- By Distribution Channel (OEM and Aftermarket): The OEM segment is projected to reach USD 64.70 billion by 2032, owing to the growing preference for factory-installed sensor systems that meet regulatory and performance standards.

Automotive Sensors Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific automotive sensors market share stood at 48.00% in 2024, with a valuation of USD 17.38 billion. The dominance is attributed to the expanding production facilities for automotive sensors across China, Japan, and South Korea, where global and regional suppliers are investing in large-scale manufacturing to support rising automotive output.

This regional concentration of sensor manufacturing has improved supply chain efficiency and enabled the faster integration of advanced sensor technologies in vehicles produced locally.

- In March 2024, Valeo inaugurated a new manufacturing facility in Daegu, South Korea, for producing advanced driver assistance system (ADAS) sensors. The facility began with the production of parking assistant sensors and will expand to manufacture key components like ultrasound sensors, radars, cameras, and LiDARs. The facility is positioned to become a major production hub in Asia, serving domestic and export markets.

automotive sensors industry in North America is set to grow at a significant CAGR of 10.88% over the forecast period. This growth is propelled by the rapid adoption of advanced driver assistance systems (ADAS), which require a wide array of high-performance sensors for functionalities such as blind spot detection, adaptive cruise control, and lane-keeping assistance.

Regulatory mandates supporting vehicle safety and including requirements by the National Highway Traffic Safety Administration (NHTSA), have accelerated sensor deployment across new vehicle models.

Moreover, the region's strong presence of technology-driven automotive manufacturers and sensor innovators continues to support the development of next-generation sensor platforms. North America remains a high-growth region due to its focus on safety innovation and the early adoption of autonomous driving technologies.

Regulatory Frameworks

- In the U.S., automotive sensors must comply with regulations set by the National Highway Traffic Safety Administration (NHTSA) under the Federal Motor Vehicle Safety Standards (FMVSS), which mandate sensor performance for airbags, electronic stability control, and tire pressure monitoring.

- In India, the Automotive Industry Standards Committee (AISC) under the Ministry of Road Transport and Highways enforces AIS-145, which mandates sensors in safety features such as seat belt reminders and reverse parking assistance.

Competitive Landscape

Key players in the global automotive sensors industry are focusing on advancing sensor IC technologies that deliver high precision and reliable performance across critical vehicle systems. Leading manufacturers are developing sensor ICs with low internal conductor resistance to minimize power losses and enhance efficiency in powertrain and safety applications.

Companies are also prioritizing high operating bandwidth to support fast signal transmission required for advanced driver-assistance systems and real-time monitoring. Strategic efforts include the integration of robust packaging solutions to ensure sensor durability in harsh automotive environments and expanding product lines to meet evolving design requirements across electric and autonomous vehicle platforms.

- In January 2025, Allegro MicroSystems, Inc. launched two new current sensor ICs, the ACS37030MY and ACS37220MZ, featuring compact packages with 40% smaller footprints and higher isolation. The ACS37030MY offers fast response time for wide bandgap GaN device protection, while the ACS37220MZ is tailored for value-line current sensing with low power dissipation.

Key Companies in Automotive Sensors Market:

- Robert Bosch GmbH

- Continental AG

- DENSO CORPORATION

- STMicroelectronics

- Infineon Technologies AG

- BorgWarner Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- Analog Devices, Inc.

- Amphenol Advanced Sensors

- Semiconductor Components Industries, LLC

- CTS Corporation

- TE Connectivity

- VALEO

- Sensata Technologies, Inc.

Recent Developments (Product Launch)

- In April 2025, OMNIVISION launched its new OX01N1B 1.5-megapixel global shutter image sensor for automotive driver monitoring systems (DMS). The sensor features Nyxel NIR technology, low power consumption, and industry-leading quantum efficiency, offering a compact and cost-effective solution for in-cabin applications with enhanced image quality and design flexibility.

- In September 2024, Continental announced a major aftermarket product range expansion initiative, introducing new product groups including sensors for driver assistance systems, chassis and steering components, and high-pressure fuel pumps, along with digital services like remote repair support to meet rising technical demands in workshops.