Market Definition

Automotive radar is a sensor technology used in vehicles to detect and track objects in their surroundings by emitting radio waves and analyzing their reflections. It is used in advanced driver assistance systems (ADAS) to help improve safety features.

Automotive Radar Market Overview

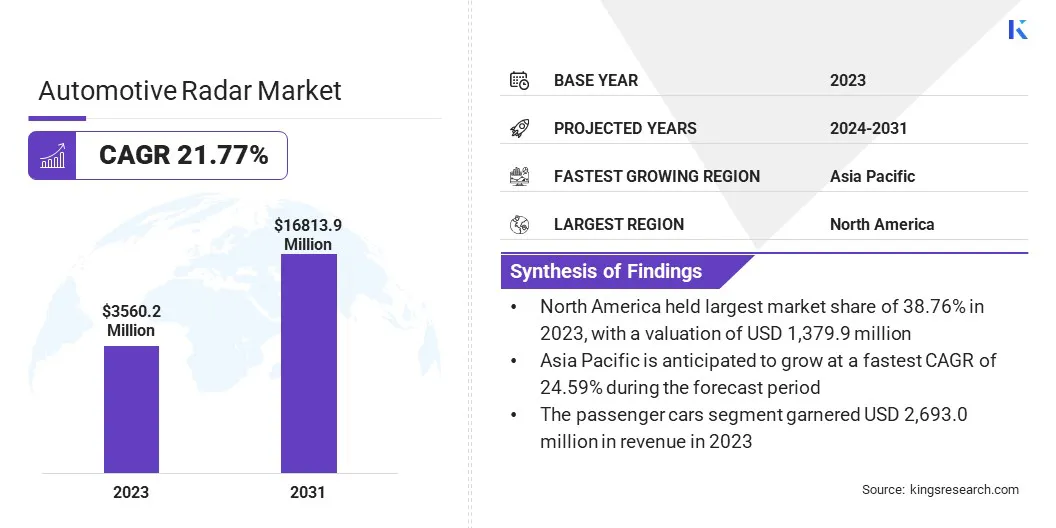

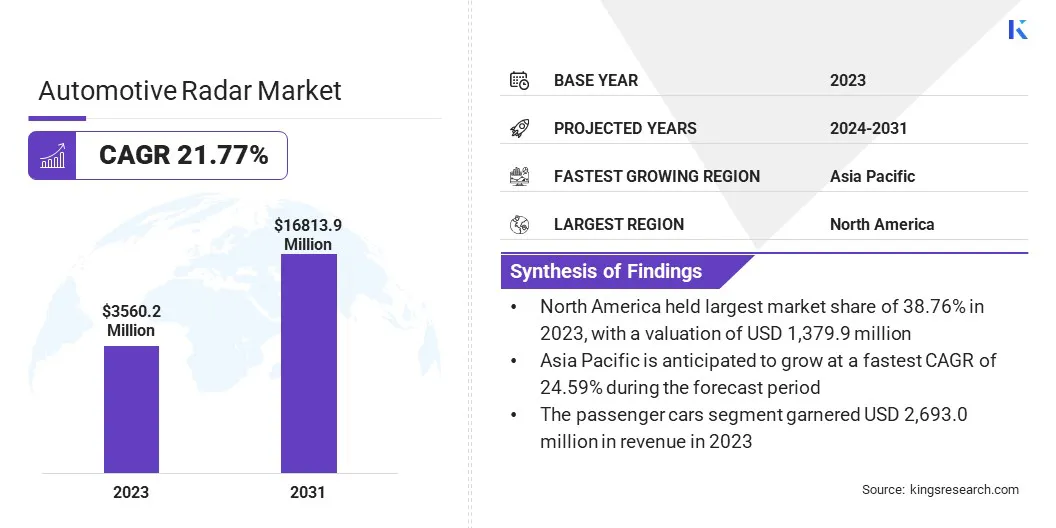

The global automotive radar market size was valued at USD 3,560.2 million in 2023 and is projected to grow from USD 4,234.5 million in 2024 to USD 16,813.9 million by 2031, exhibiting a CAGR of 21.77% during the forecast period.

The growing demand for ADAS and the progression toward autonomous vehicles are anticipated to boost the market. The expansion is fueled by heightened safety concerns, stringent government regulations mandating vehicle safety features, and technological advancements that have improved radar accuracy, range, and resolution.

Major companies operating in the automotive radar market are Robert Bosch GmbH, Continental AG, DENSO CORPORATION, VALEO, NXP Semiconductors, Texas Instruments Incorporated., ZF Friedrichshafen AG, Infineon Technologies AG, HELLA GmbH & Co. KGaA, Autoliv Inc., Magna International Inc., Analog Devices, Inc., Renesas Electronics Corporation, and Aptiv, BorgWarner Inc.

Automotive radar systems are integral to functions such as adaptive cruise control, collision avoidance, and parking assistance, making them essential components in modern vehicles.

Moreover, partnerships between technology companies and automakers are driving the advancement of advanced radar solutions, contributing to the market's continued expansion.

- In January 2025, Rohde & Schwarz unveiled the R&S RadEsT automotive radar tester at CES 2025, a compact solution for ADAS calibration and OEM production lines. The company also showcased advancements in in-vehicle network testing, electric drivetrain efficiency, ADAS sensor fusion, secure digital key systems, electrification, and connectivity.

Key Highlights:

- The global automotive radar market size was valued at USD 3,560.2 million in 2023.

- The market is projected to grow at a CAGR of 21.77% from 2024 to 2031.

- North America held a market share of 38.76% in 2023, with a valuation of USD 1,379.9 million.

- The passenger cars segment garnered USD 2,693.0 million in revenue in 2023.

- The long range radar segment is expected to reach USD 8,812.4 million by 2031.

- The adaptive cruise control (ACC) segment is expected to reach USD 5,558.8 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 24.59% during the forecast period.

Market Driver

"Increasing Demand for ADAS and Rapid Advancement of Autonomous Vehicles"

The rising demand for ADAS, driven by increasing safety concerns and regulatory mandates, is fueling the adoption of radar technology in modern vehicles. Features such as adaptive cruise control and emergency brake assist rely on radar sensors to enhance automation and prevent collisions, improving overall road safety.

- In December 2024, Bosch announced the launch of six new radar-based motorcycle assistance systems, including five world-firsts, aimed at enhancing rider safety and comfort, with features such as Adaptive Cruise Control – Stop & Go (ACC S&G) and Emergency Brake Assist set to debut in a KTM model in 2024 and enter production in 2025.

Additionally, the growing consumer preference for enhanced driving comfort and safety is pushing automakers to integrate radar-based systems, making them a standard feature in many mid-range and premium vehicles.

The rapid advancement of autonomous and connected vehicles further accelerates the need for high-frequency, enabling precise object detection and environmental mapping.

Market Challenge

"High Cost of Radar Sensors and Signal Congestion"

The high cost of radar sensors limits their adoption in entry-level and mid-range vehicles; however, advancements in semiconductor technology and system-on-chip integration are helping reduce costs, making radar more accessible.

Interference and signal congestion from multiple radar-equipped vehicles can affect detection accuracy; however, the development of advanced algorithms and dynamic frequency allocation is improving radar performance in dense traffic conditions.

The complexity of processing large volumes of radar data for real-time decision-making in ADAS and autonomous vehicles poses another challenge, which is being addressed by AI-driven sensor fusion that integrates radar data with inputs from cameras, LiDAR, and ultrasonic sensors to enhance detection accuracy and response times.

Market Trend

"Emergence of 4D and HD Imaging and Integration of AI"

The emergence of 4D and HD imaging radar is transforming vehicle perception by providing enhanced depth perception, object classification, and precise environmental mapping.

Unlike traditional radar, 4D imaging radar can detect an object's height, distance, speed, and angle, improving performance in complex driving conditions and enabling higher levels of autonomous driving.

- For instance, in December 2024, Infineon Technologies AG announced the release of final samples of its RASIC CTRX8191F, state-of-the-art radar MMIC designed to meet the requirements of automated and autonomous driving, enabling the development of next-generation 4D and HD imaging radar modules for enhanced object detection and environmental perception.

Additionally, the integration of AI-driven algorithms and sensor fusion with radar technology is enhancing object detection accuracy by combining data from LiDAR, cameras, and ultrasonic sensors. This synergy reduces false positives and improves real-time decision-making for ADAS and self-driving applications.

Furthermore, ongoing advancements in semiconductor technology and system-on-chip integration are leading to the miniaturization and cost reduction of radar sensors.

Automotive Radar Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vehicle Type

|

Passenger Cars, Commercial Vehicles

|

|

By Range

|

Long Range Radar, Medium & Short Range Radar

|

|

By Application

|

Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD, Forward Collision Warning System, Intelligent Park Assist, Other ADAS Systems

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Vehicle Type (Passenger Cars, Commercial Vehicles): The passenger cars segment earned USD 2,693.0 million in 2023, due to the increasing adoption of ADAS and rising consumer demand for enhanced vehicle safety features.

- By Range (Long Range Radar, Medium & Short Range Radar): The medium & short range radar segment held 51.79% share of the market in 2023, due to its widespread use in blind-spot detection, parking assistance, and collision avoidance systems in modern vehicles.

- By Application (Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD, and Forward Collision Warning System, Intelligent Park Assist, and Other ADAS Systems): The adaptive cruise control (ACC) segment is projected to reach USD 5,558.8 million by 2031, owing to the increasing integration of ACC in modern vehicles for enhanced driving comfort and the growing demand for semi-autonomous driving features.

Automotive Radar Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 38.76% share of the automotive radar market in 2023, with a valuation of USD 1,379.9 million. This strong market position is attributed to the early adoption of ADAS, stringent government safety regulations, and the presence of key automotive manufacturers and technology firms in the region.

The market is driven by the rising consumer awareness of vehicle safety, increased deployment of radar-based solutions in premium and mid-range vehicles, and regulatory mandates from agencies like the National Highway Traffic Safety Administration.

Additionally, the growing trend of autonomous driving and electric vehicles (EVs) is further propelling the demand for automotive radar systems.

The automotive radar industry in Asia Pacific is poised for significant growth at a robust CAGR of 24.59% over the forecast period. This rapid expansion is fueled by increasing vehicle production and rising adoption of ADAS technologies.

China, being the world’s largest automobile market, is registering substantial demand for radar-based safety features, due to regulatory pushes for intelligent transportation systems and autonomous mobility. Additionally, the rise of domestic automotive manufacturers and collaborations with global technology firms are accelerating the deployment of advanced radar solutions. The growing middle-class population, increasing disposable income, and expanding EV market in Asia Pacific further contribute to the growth of this market.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In U.S., the National Highway Traffic Safety Administration (NHTSA) and the Federal Communications Commission (FCC) are the primary regulatory bodies for automotive radar. The NHTSA is responsible for writing and enforcing Federal Motor Vehicle Safety Standards.

- In Europe, the primary regulatory authority overseeing automotive radar technology is the European Commission, which sets standards and regulations for vehicle safety features including radar systems through the type-approval process, primarily managed under the Economic Commission for Europe directives.

- In China, the Ministry of Industry and Information Technology (MIIT) oversees automotive radar regulations, including type approval procedures. Manufacturers must obtain SRRC certification before selling radar systems in the Chinese market.

- In Japan, the regulatory authority overseeing automotive radar is the Ministry of Internal Affairs and Communications (MIC), which manages radio frequencies according to the Radio Law, ensuring the efficient use of radio waves within the country

- In India, the regulatory authority overseeing automotive radar technology is the Telecom Regulatory Authority of India (TRAI), which has recommended the de-licensing of the 77-81 GHz frequency band specifically for short-range automotive radar applications, allowing manufacturers to utilize this band without needing additional authorization for their radar systems.

Competitive Landscape:

The automotive radar industry is characterized by a large number of participants, including both established corporations and rising organizations. Market players are focusing on the development of next-generation radar sensors with improved resolution, multi-mode operation, and AI-powered data processing capabilities to meet the evolving demands of ADAS and autonomous driving.

Companies are investing heavily in research and development to improve radar sensing capabilities, particularly in areas such as 4D imaging radar, multi-sensor fusion, and high-frequency millimetre-wave technology.

Strategic collaborations between automotive manufacturers, semiconductor firms, and software providers are becoming increasingly common to accelerate product development and ensure seamless integration of radar sensors into modern vehicles.

- In September 2024, Rohde & Schwarz and NOFFZ announced their collaboration to enhance automotive radar production with the introduction of the R&S AREG-P, a solution designed to streamline the transition of radar sensors from R&D to production by increasing efficiency, reducing test time, and optimizing costs for Tier 1 suppliers.

List of Key Companies in Automotive Radar Market:

- Robert Bosch GmbH

- Continental AG

- DENSO CORPORATION

- VALEO

- NXP Semiconductors

- Texas Instruments Incorporated.

- ZF Friedrichshafen AG

- Infineon Technologies AG

- HELLA GmbH & Co. KGaA

- Autoliv Inc.

- Magna International Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Aptiv

- BorgWarner Inc.

Recent Developments (M&A/Partnerships /New Product Launch)

- In January 2025, Texas Instruments introduced the AWRL6844 60GHz mm wave radar sensor and next-generation automotive audio processors to enhance vehicle safety and in-cabin experiences. The edge AI-enabled radar sensor integrates three in-cabin sensing features, improving detection accuracy for seat belt reminders, child presence detection, and intrusion monitoring.

- In January 2025, Anduril Industries acquired the Radar and Command and Control businesses of Numerica Corporation, enhancing its air and missile defence capabilities. The acquisition integrates Numerica’s Spyglass and Spark radars into Anduril’s Lattice AI-powered platform, strengthening situational awareness, decision-making, and fire control solutions for war fighters.

- In December 2024, Gapwaves secured a project order from a new North American Tier 1 supplier, a global leader in the automotive sector. The order entails the initial design and development of a Gapwaves MLW waveguide antenna for automotive radar sensors, supporting ADAS applications. Valued at approximately MSEK 1.6, delivery is scheduled for Q4 2024 and Q1 2025.

- In December 2024, Neural Propulsion Systems launched the world’s first AI-powered Hyper-Definition Radar Operating System (HROS) for advanced driver assistance systems. Using advanced mathematics, AI, and patented algorithms, HROS delivers Crystal-Clear Visibility, enabling vehicles to detect hazards with LiDAR-like resolution in all conditions.

- In September 2024, Omni Design Technologies partnered with Aura Intelligent Systems to develop next-generation digital radar for ADAS and autonomous vehicles. Omni Design will provide its Swift data converters, analog front-end, and supporting IP solutions to enhance Aura’s MultiRay platform, improving radar performance in urban environments.

- In April 2024, Microchip Technology Inc. acquired VSI Co. Ltd., a pioneer in high-speed camera, sensor, and display connectivity technologies based on the Automotive SerDes Alliance (ASA) standard. This acquisition strengthens Microchip’s position in ADAS and digital cockpit solutions, supporting next-generation software-defined vehicles.

- In February 2024, Pana-Pacific partnered with Spartan Radar to introduce Hoplo, an advanced collision warning radar for commercial vehicles. With seamless integration into the Controller Area Network and Spartan’s innovative software, Hoplo enhances situational awareness while minimizing false alerts.